The current assets formula helps you understand your business’s short-term financial health. It shows how well you can use resources like cash, receivables, and inventory to cover immediate needs.

Getting this formula right means better decisions, smoother cash flow, and fewer financial surprises. In this blog, we’ll explain the formula in simple terms, break down its parts, and show you how to use it. With clear tips and real-world examples, you’ll learn how to make it work for your business.

Let’s get started.

Read: A Complete Guide to Financial Statement Analysis for Strategy Makers

What Are Current Assets and Why Do They Matter?

Defining Current Assets

Current assets are resources your company can turn into cash within a year. You rely on them to pay bills, keep operations moving, and handle everyday expenses.

These include cash, money owed to you by customers (accounts receivable), and stock or materials you plan to sell.

Example: a manufacturer might use payments from customers to buy raw materials or depend on prepaid expenses like insurance to stay protected.

Want to know how current assets fit into the bigger financial picture? Take a look at the classified balance sheet blog.

Why Are Current Assets Important?

Current assets are crucial because they provide the liquidity to handle short-term obligations like salaries and vendor payments. They also have a key role in keeping operations running smoothly and planning.

Example:

A pharma distributor will depend on receivables from hospitals to pay its suppliers.

An FMCG company could use inventory turnover for marketing campaigns or product launches.

Good current asset management improves liquidity and helps you avoid cash flow problems. Learn more about liquidity in our liquidity and solvency ratios blog.

The Current Assets Formula and Its Components

The Formula Explained

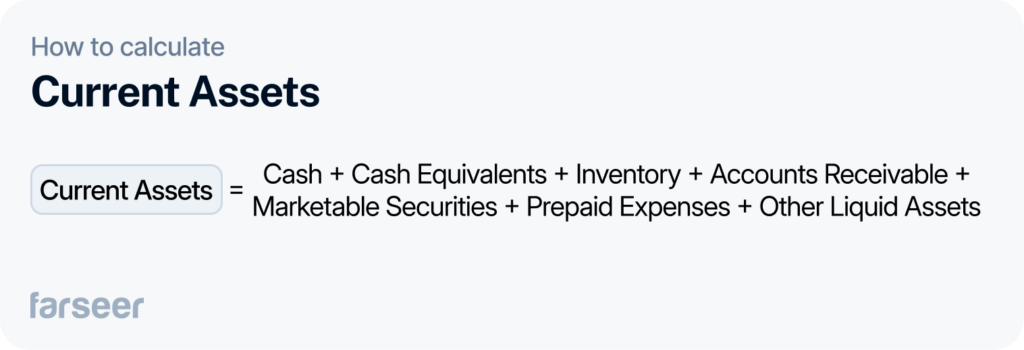

The current assets formula calculates the total resources your business can turn into cash within a year. These components—cash, receivables, inventory, and others—are all line items on your company’s balance sheet.

Here’s the formula:

Its purpose is simple: to measure liquidity and show how well your business is positioned to cover short-term needs.

Breaking Down the Formula

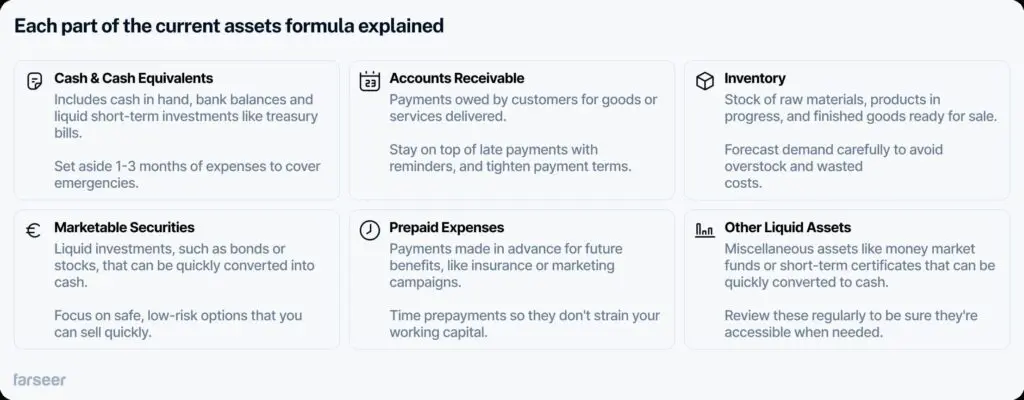

Here are the key components (balance sheet line items) that together measure your business’s short-term financial health. Here’s what each one means:

- Cash & Cash Equivalents:

This includes cash in hand, balances in your bank accounts, and liquid short-term investments like treasury bills. - Accounts Receivable:

Payments owed to your business by customers for goods or services you’ve already delivered. - Inventory:

Stock of raw materials, products in progress, and finished goods ready for sale. - Marketable Securities:

Liquid investments, like bonds or stocks, that can be sold quickly to generate cash. - Prepaid Expenses:

Payments made in advance for future benefits, such as insurance or marketing campaigns. - Other Liquid Assets:

Miscellaneous assets that can be easily converted to cash, like money market funds or short-term certificates.

Real-Life Examples of Making the Formula Work

To make all we talk about here less abstract, let’s have a look at a few examples of how this works in practice.

Pharma Distributor Example

Pharma companies often struggle with big receivables from hospitals and the need to keep just the right amount of medicine in stock. One Indian company had a problem with delayed payments. They had over $312 million stuck in receivables in 2022.

What They Did: They focused on improving receivables tracking and automated the process to collect payments faster. They also reviewed their inventory systems to avoid keeping too much stock, which tied up cash.

These changes helped free up money that was stuck, reduced warehousing costs and kept their operations running smoothly.

FMCG Company Example

Managing inventory is a constant challenge for FMCG companies like Procter & Gamble (P&G). They always need a better way to keep just the right amount of stock on hand without tying up too much cash. Excess inventory slows them down and eats into their working capital.

What They Did: P&G switched to a demand-driven supply chain. They used real-time data to better predict what customers would need and shared sales data with retailers. This helped them with restocking and avoiding overstocking.

This way, they freed up cash tied in stock. This goes to show how managing current assets can significantly improve liquidity.

Manufacturing Firm Example

Toyota, a global leader in the automotive industry, needed a better way to handle raw materials, work-in-progress items, and finished goods while keeping costs low.

What They Did: Toyota implemented a Just-In-Time (JIT) production system. They aligned production with real-time demand, reduced excess inventory, cut storage costs, and freed up cash for other priorities.

This helps Toyota run efficiently and make better use of its current assets.

How to Measure the Health of Your Current Assets

Understanding and managing your current assets is the first step. But how do you know if you’re doing it well? Financial metrics like the current ratio, quick ratio, net working capital, and cash ratio can help you measure success and guide your decisions.

The Current Ratio Formula and Why It Matters

The current ratio shows whether your current assets can cover your short-term liabilities. Here’s the formula:

Current Ratio = Current Assets ÷ Current Liabilities

An ideal ratio is usually between 1.5 and 2.0. A ratio below 1 might signal liquidity problems, while a much higher ratio could mean you’re not using your assets efficiently. To explore more about liquidity, check out our cash ratio definition blog.

Quick Ratio for a Sharper Look at Liquidity

The quick ratio excludes inventory from the calculation to give a more conservative view of liquidity. Here’s the formula:

Quick Ratio = (Current Assets – Inventory) ÷ Current Liabilities

This metric is particularly useful for businesses with slower-moving inventory, as it focuses on assets that can be quickly converted to cash.

Net Working Capital and Your Cash Flow

Net working capital shows how much liquidity you have left after accounting for liabilities. The formula is:

Net Working Capital = Current Assets – Current Liabilities

A positive NWC indicates your business has the flexibility to cover short-term obligations and invest in operations. If it’s negative, you might need to re-evaluate how your current assets and liabilities are managed. Keep in mind, that Net Working Capital is based on static balance sheet data. To understand its limitations, check out our blog on the primary limitations of the balance sheet.

Cash Ratio for Ultra-Conservative Liquidity Checks

The cash ratio focuses solely on cash and cash equivalents, giving the most conservative view of liquidity. Here’s the formula:

Cash Ratio = Cash and Cash Equivalents ÷ Current Liabilities

This ratio is especially helpful for businesses in volatile markets or those that need to maintain strong cash reserves.

How to Use the Formula to Improve Financial Health

Knowing the current assets formula is one thing, but putting it to work is where the real benefits come in. Here are some simple steps and tools to help you make the most of it.

Practical Steps to Optimize Current Assets

Start by automating how you track receivables. Use invoicing software to send reminders and speed up collections, so cash flows in faster. Next, streamline inventory by forecasting demand and keeping just what you need—this avoids tying up cash in slow-moving stock. If you’ve got excess liquidity, reinvest it into short-term investments like marketable securities to earn extra returns while staying flexible.

Use FP&A Software

FP&A software like Farseer helps you take control of your current assets. It centralizes tracking so you can see everything in one place, gives you real-time reports to check your liquidity instantly, and lets you test strategies with scenario planning to make smarter decisions.

Conclusion

The current assets formula is a tool that helps you see how well your business can handle short-term obligations. By understanding and managing components like receivables, inventory, and cash, you can improve liquidity, make smarter decisions, and keep your operations running smoothly.

Managing these areas doesn’t have to be complicated. Tools like Farseer simplify the process, giving you real-time insights and helping you plan more effectively. If you’re ready to take control of your finances, start by applying what you’ve learned here.

For even more on how to connect your financial planning, check out our blog on the 3-statement financial model.