If you want to keep your business running smoothly, knowing how to improve your current ratio is key. It shows if your company has enough assets to pay its short-term bills, like supplier invoices or payroll.

A healthy current ratio is useful in multiple ways. It makes sure you have the cash to handle daily operations, reduces financial stress, and shows lenders and investors that your business is stable. It also keeps your business flexible to invest in growth opportunities without worrying about running out of money.

Read: A Complete Guide to Financial Statement Analysis for Strategy Makers

If your current ratio isn’t where you want it to be, there are practical steps you can take. In this blog, we’ll cover 5 ways to improve your current ratio with real-world examples to help you get started.

Let’s go.

What Is the Current Ratio and Why Does It Matter?

The current ratio is a quick way to check if your business can cover its short-term bills. It’s calculated by dividing your current assets (cash, receivables, and inventory) by your current liabilities (supplier payments or short-term loans).

Current ratio = Current assets ÷ Current liabilities

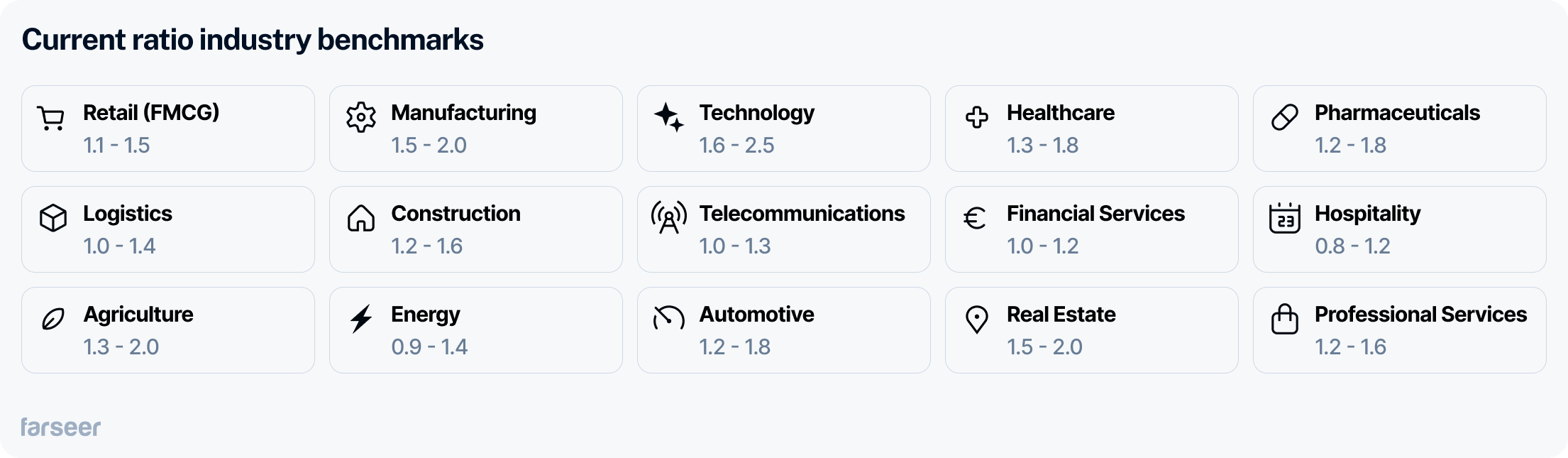

If your ratio is above 1, it means you have more assets than liabilities. A ratio of 1.5 means you have $1.50 in assets for every $1.00 of liabilities. But what counts as a “good” ratio depends on your industry. Retailers with fast-moving inventory might aim for a ratio between 1.1 and 1.5, while manufacturers may need higher ratios because of longer production cycles.

The current ratio is a great snapshot of your liquidity and it helps you make sure your operations are stable. To see how it fits with other metrics, check out our guide on balance sheet ratios.

Now, let’s explore practical strategies to improve your current ratio.

1. Pay Off Short-Term Debt or Refinance It

One of the easiest ways to improve your current ratio is to pay off short-term debt. Short-term liabilities (loans or supplier payments) directly impact the ratio because they’re included in the denominator. When you reduce the obligations it makes an instant difference to your liquidity.

Refinancing can also help. By turning short-term debt into long-term liabilities, you give yourself more time to pay it off without additional pressure on your current assets.

Example: In 2019, Tesla took a $1.4 billion loan from Chinese banks for its Shanghai Gigafactory. This restructured its short-term debt into long-term payments and improved its current ratio.

Reducing debt, when possible, is also a great signal for creditors and investors. For more about other similar ratios, read our guide on liquidity and solvency ratios.

2. Sell Unused Assets for Extra Cash

Selling unused assets, like equipment or property you can do without, is another great way to improve your current ratio and add more cash to your reserves. This turns idle resources into working capital, helping you cover short-term obligations without taking on more debt.

Example: In August 2023, IBM sold The Weather Company’s assets, including its digital services, to Francisco Partners. This allowed IBM to focus on its core operations while using the proceeds to support its financial stability.

By selling non-essential assets, you can free up cash and better manage your short-term financial needs.

3. Get rid of your excess inventory

Another way to improve your current ratio is to convert excess inventory into cash. Of course, first, you have to identify the slow-moving inventory. Once identified, you can liquidate the inventory and use the money to reduce your liabilities.

Example: Apple Inc. used different methods to get rid of their excess inventory. Besides closely monitoring the number of times their items were used or sold, adopting the Just-In-Time method, they also started selling their slow-moving inventory at discounted prices, which attracted buyers and freed up the inventory.

4. Save Cash by Outsourcing Non-Core Tasks

Another good way to improve the current ratio is to outsource. When you don’t have the expenses of hiring and maintaining in-house teams, you can keep more cash in your business, and pay only for what you need, when you need it. This leaves more money to handle short-term obligations. Also, turning fixed into variable costs makes the cash flow much easier to manage.

Example: Alibaba outsourced customer service to cut costs and focus on its main business, keeping more cash available and improving liquidity.

5. Use Dynamic Pricing to Increase Revenue

Adjusting your prices based on demand can increase your revenue and improve your current ratio. This strategy is known as dynamic pricing. It allows you to charge more during high-demand periods and less when demand is low.

Example: Uber uses surge pricing to balance supply and demand. During peak times, such as concerts or bad weather, Uber increases fares to encourage more drivers to offer rides, ensuring that riders can get a car when they need one.

With dynamic pricing, you can maximize revenue during busy periods, helping to cover short-term obligations and strengthen your financial position.

Take Charge of Your Current Ratio

Improving your current ratio doesn’t have to be complicated. Simple steps like managing inventory, negotiating payment terms, or outsourcing non-core tasks can make a big difference. These changes can help your business stay financially stable and ready to handle short-term obligations.

Real-world examples like Tesla’s debt restructuring and Uber’s dynamic pricing show how these strategies work in practice. The key is to take a close look at your financials, identify where you can improve, and act on it.