The balance sheet is one of the pillars of financial planning, there’s no doubt on that one. It shows assets, liabilities, and equities – a true snapshot of what a company owns and owes. Therefore, it’s no wonder that investors, creditors, and managers take it as the starting point when making decisions. It displays the overall financial health of a company, but it’s also important to understand the primary limitations of the balance sheet – what it doesn’t show can be just as important as what it does.

Read: A Complete Guide to Financial Statement Analysis for Strategy Makers

Still, it can’t be taken as the only source of truth.

So, what are the primary limitations of the balance sheet?

Well, it often reflects historical costs rather than current market values. This affects the perception we have of a company’s worth. And that’s not the only one.

Read on to find out what you should be careful about if you were making your financial plans based solely on the balance sheet.

Learn about how deferred tax assets can adress timing differences in financial reporting.

5 Limitations of the Balance Sheet

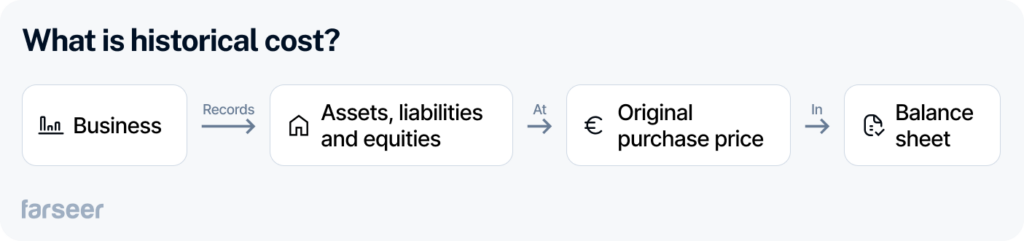

Historical cost principle

One primary limitation of the balance sheet is the fact that it relies on the historical cost principle. This means that assets listed on the balance sheet show their original purchase price, and don’t take changes in market value into account. Why is that a problem?

Let’s say your company bought an office building 20 years ago for $500,000. Over the years, this area of the city increased in value and demand for real estate rose. The building’s market price rose to $2 million. However, because of the historical cost principle, the balance sheet will still show this asset at its original purchase price of $500,000.

If a potential investor checks the balance sheet only, they might see that the assets don’t have much value and they might assume that the company has limited financial resources. Additionally, creditors might underestimate the company’s creditworthiness if they only consider the historical cost, which could affect the terms of a loan or credit line.

Intangible assets are usually omitted

Certain intangible assets, such as brand reputation, intellectual property, or employee expertise, have immense value but they are often left out of the balance sheet since they are very difficult to measure. So when an investor is interested in a company’s financial health, they may not understand its full value. And this can lead to underestimating its potential.

For example, a tech company that develops software, like Google, relies very much on employee expertise and its intellectual property and it all contributes heavily to its market position. Still, these assets are usually not listed in the balance sheet, unless they are acquired through acquisitions. This creates a gap in understanding Google’s true value.

It offers a point-in-time snapshot of the finances

A point-in-time snapshot refers to the fact that the balance sheet shows the company’s finances only at a specific date. This usually refers to the end of a fiscal year or the end of a quarter. This can be misleading for stakeholders checking a company’s performance because it lacks context on financial trends or cash flow patterns over time. This can be particularly problematic in industries where there are seasonal fluctuations or rapid market shifts. For instance, a retail company may have a very strong balance sheet right after the holiday season because of a huge increase in sales, but this doesn’t reflect its typical financial health throughout the year.

It relies heavily on estimates and assumptions

Not all assets and liabilities on the balance sheet are based on clear, objective parameters. Some require subjective evaluation which leaves room for different methods of calculation. Ultimately, this may result in different images of a company’s financial health and stability.

Imagine two companies, Company A and Company B, with the same type of machinery. Company A uses the straight-line depreciation method, while Company B uses the double-declining balance method. After five years, Company A’s balance sheet shows a higher book value for the machinery. Whereas, Company B’s shows a significantly lower book value due to more aggressive depreciation. Although both companies have similar machinery, their balance sheets reflect different values due to subjective depreciation choices. An investor might see Company B as having lower asset value, even though both companies have identical machinery with the same market worth.

Lack of cash flow information

Cash flow information is essential when assessing a company’s liquidity, stability, and operational health. So, even though the balance sheet lists assets, liabilities, and equity, it doesn’t show how cash is generated over time. This makes it difficult to determine whether a company has enough liquid assets to cover its short-term liabilities, support growth, or respond to unforeseen expenses (if you’re observing from an investor’s point of view, that may be a real problem).

Despite all these limitations, the balance sheet remains an essential part of every company’s financial analysis. But still, it needs to be used smartly, to get the most out of it. Here are several ways to overcome its limitations.

How to Mitigate Balance Sheet Limitations

Combine the balance sheet with cash flow and income statements

The cash flow statement provides insights into liquidity, showing how cash moves in and out of the business. This complements the balance sheet since it shows whether a company can meet its short-term obligations. On the other hand, the income statement offers information on revenue and expenses over a period, giving a broader context to the assets and liabilities on the balance sheet. Together, these statements give a more complete view of a company’s operational efficiency and financial resilience.

You should be aware that there are limitations to all financial statements. If you want to learn more about them, read: 4 Critical Financial Statement Limitations and How to Overcome Them.

Use fair value adjustments and revaluation

Fair value adjustments are used to bring assets on the balance sheet closer to their current market worth, a technique used to set the historical cost principle right. When you’re adjusting asset values periodically based on their real market value, you easily get a more accurate and updated picture of a company’s financial position.

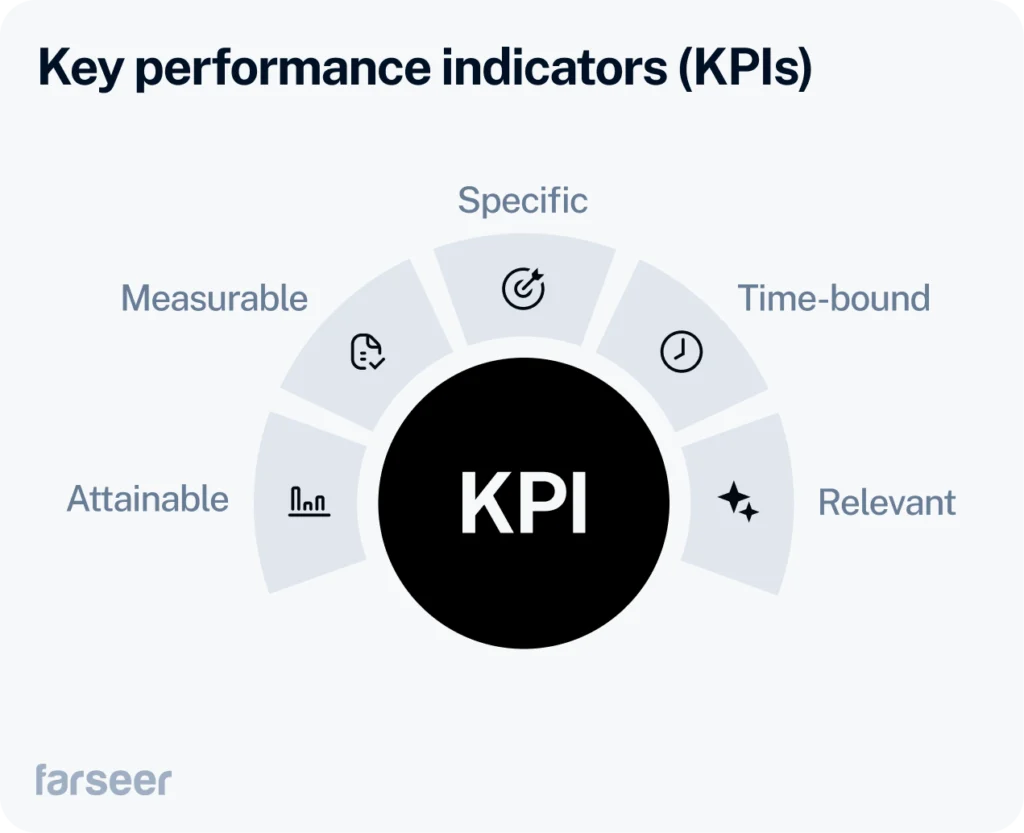

Incorporate Key Performance Indicators (KPIs)

If you’re looking for ways to present and include the value of intangible assets, then tracking KPIs related to brand strength, customer loyalty, or intellectual property value could be the way to go. Make sure to include metrics like customer acquisition cost, brand equity, or patent valuation – they complement the tangible assets listed on the balance sheet, giving a fuller understanding of a company’s competitive positioning. This will ultimately give stakeholders a more complete image of a company’s position and potential.

Integrate forward-looking analysis

To have a full overview of a company’s financial position, it’s not enough to only look into the past and present. You need to include a forward-looking analysis, like forecasts and trend projections. This is particularly important for understanding growth potential and financial stability over time. Financial professionals might use methods like discounted cash flow (DCF) analysis or rolling forecasts to create a perspective focused on the future that the balance sheet alone can’t provide.

Regular financial health check-ups

Conducting periodic reviews of financial health using a range of tools – including the balance sheet, cash flow analysis, market valuations, and projections – helps ensure that stakeholders have an accurate, up-to-date understanding of the company’s position. If you review the company’s finances regularly, you’ll easily identify early signs of financial stress or new growth opportunities.

Conclusion

In conclusion, while the balance sheet is a valuable tool for understanding a company’s financial position, it comes with primary limitations that can impact its effectiveness when used independently. Issues like reliance on historical cost, omission of intangible assets, and limited cash flow information are some of the primary limitations of the balance sheet, and they can lead to an incomplete picture of a company’s true financial health. But these limitations are not a reason to neglect it.

Combining the balance sheet with other financial statements, finding other ways of including intangible assets, and integrating forecasting and revaluations is the way to get a complete and correct image of your company’s financial health.