CapEx software makes it easier to track capital expenditures, but many companies still rely on spreadsheets and email approvals. As a result, budgets keep going over the limit, approvals take forever, and no one knows exactly where the money is going. Manual processes slow everything down and create costly mistakes.

Read: FP&A Software – A Practical Guide for Finance Teams

CapEx software fixes this. It gives finance teams a clear view of spending, faster approvals, and better budget control. No more chasing emails or fixing errors in spreadsheets. Just accurate numbers, streamlined processes, and smarter decisions.

What is CapEx Software?

Every business spends money in two ways: to keep operations running and to grow. Specifically, these fall into operating expenses (OpEx) and capital expenditures (CapEx).

- OpEx covers daily costs like rent, wages, and software subscriptions. A retail chain paying for cloud-based accounting software is a typical example.

- CapEx funds major purchases like factories, equipment, or IT infrastructure. A telecom company building 5G towers or a manufacturer upgrading production lines falls into this category.

However, managing CapEx takes more effort than tracking OpEx. Budgets stretch across years, approvals involve multiple teams, and costs can easily get out of control. Without a structured system, finance teams waste time chasing approvals, fixing reporting errors, and trying to make sense of scattered data.

Thankfully, CapEx software fixes these issues by replacing manual work with automation, real-time tracking, and structured approvals. It helps finance teams with:

Ultimately, CapEx software is essential for businesses that rely on capital investments, like manufacturing, energy, retail, and financial services.

Read: Facing the CapEx vs. OpEx Dilemma? Here’s How Financial Tools Can Help

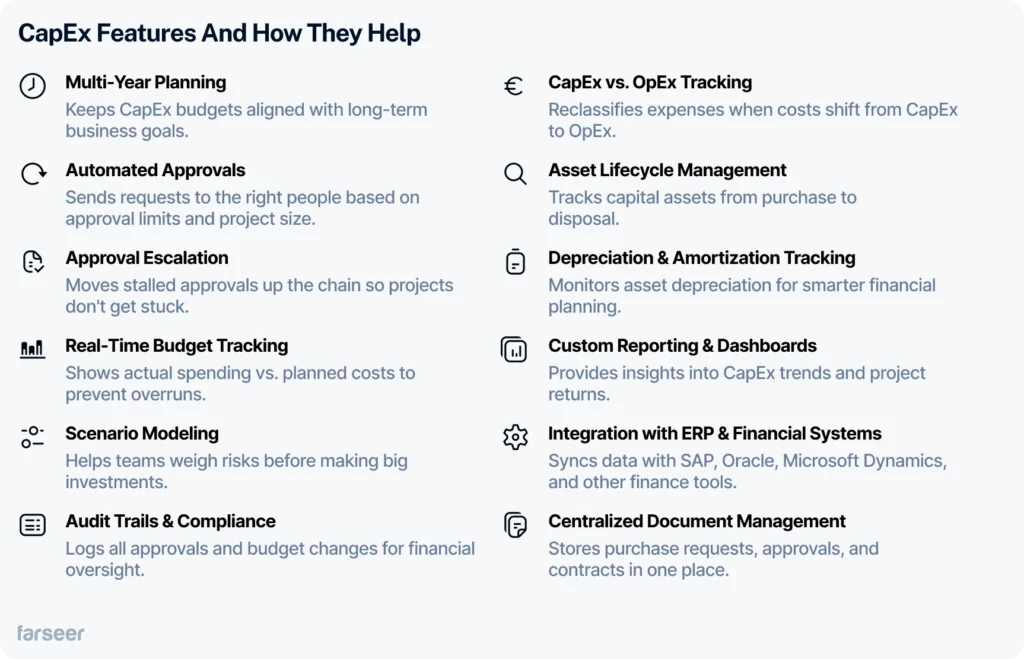

Must-Have Features of CapEx Software

Ideally, CapEx software should make approvals faster, budgets clearer, and decisions smarter. The best tools focus on what actually helps finance teams stay in control.

To begin with, Automated approvals keep requests moving instead of getting stuck in email chains. Otherwise, when approvals take too long, projects stall, and costs climb. A system that routes requests to the right people keeps everything on track.

Likewise, real-time budget tracking makes sure teams always know where the money is going. Without it, live updates, budgets run over before anyone catches it, leading to last-minute cuts and bad decisions.

Furthermore, ERP integration connects CapEx data with SAP, Oracle, and Microsoft Dynamics, so finance teams don’t waste time fixing numbers across different systems. As a result, this reduces errors and keeps everything aligned.

Additionally, scenario modeling helps teams weigh different investment options and avoid costly mistakes. Instead of guessing, they can test different financial outcomes before making big decisions.

For companies evaluating CapEx software, the FP&A Software Buyer’s Guide includes a vendor comparison checklist to help finance teams find a solution that fits their needs. Ultimately, a tool that connects CapEx with broader financial planning makes it easier to manage budgets and plan for the future.

How Farseer Solves the Biggest CapEx Planning Problems

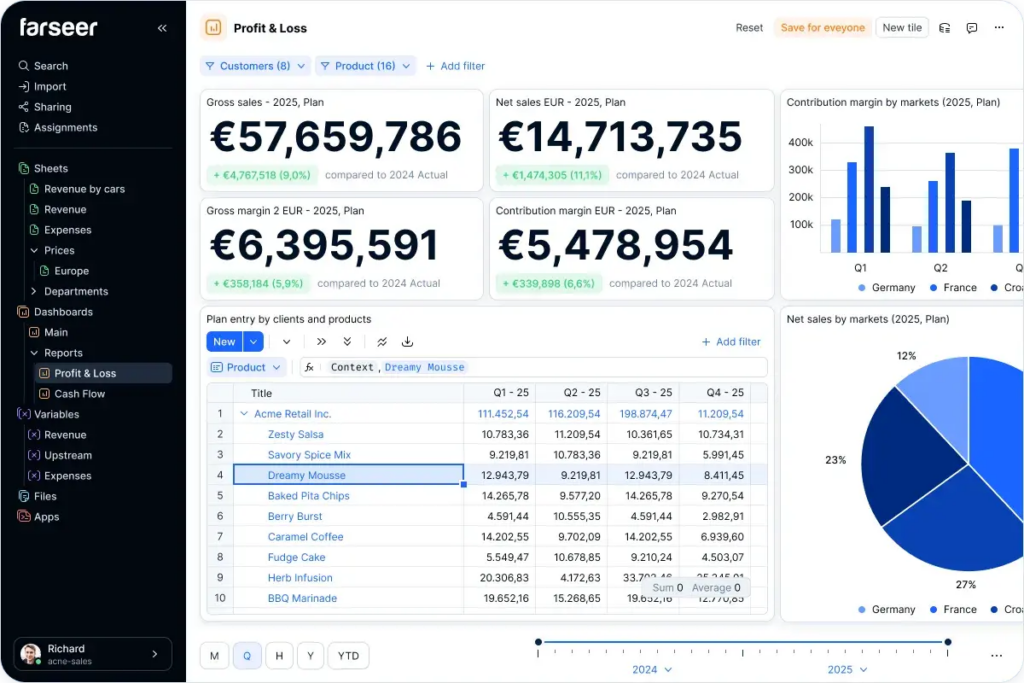

Farseer is built for finance teams who need a fast, flexible, and accurate way to manage CapEx.

Unlike rigid enterprise tools, Farseer is easy to use and eliminates spreadsheet chaos with automated workflows and real-time data. It integrates with ERP and all other relevant systems, so finance teams always work with the latest numbers, without manual updates.

With AI-driven forecasting and scenario modeling, Farseer helps companies plan smarter and adjust budgets instantly as conditions change. Built-in audit trails and approval workflows ensure compliance without slowing things down.

To see how Farseer transforms budgeting and forecasting, check out 10 Ways Farseer Simplifies Enterprise Budgeting.

How Plinacro Took Control of CapEx Planning with Farseer

Surprisingly, most companies don’t realize how much time they lose managing CapEx manually, until they switch to a system that actually works.

For example, Plinacro, Croatia’s largest gas transmission system operator, was stuck with outdated tools and spreadsheets that slowed down financial planning and made reporting a hassle. They needed a way to plan CapEx accurately, track spending in real-time, and get rid of unnecessary manual work.

Plinacro’s finance team struggled with:

- Complex gas transmission maintenance financial planning

- CapEx planning for investments and fixed assets

- Managing detailed revenue and cost planning

- Slow, manual reporting that made decision-making harder

A lack of centralized data, forcing planners to rely on scattered spreadsheets

The Solution

Farseer replaced their outdated system with a fast, automated CapEx planning platform that solved their biggest issues:

- ERP Integration: Two-way sync with Oracle EBS ensured actuals and planned figures always matched.

- Automated Reporting: Budget, P&L, and revenue reports were generated instantly – no more manual updates.

- Centralized Data: Planners finally had a single source of truth instead of chasing numbers across different files.

The Results

- Less manual work – automation freed up time for strategic planning.

- More accurate budgets – real-time data kept forecasts in check.

- Smoother workflows – finance teams always worked with up-to-date numbers

For a full breakdown, check out Plinacro’s case study to see how Farseer helps companies take control of CapEx planning.

Ready to Take Control of CapEx Planning?

Managing CapEx with spreadsheets is slow, error-prone, and full of blind spots. Run the numbers first. Use our Net Present Value Calculator to quickly check if your CapEx investment pays off.

Farseer helps finance teams get full visibility over spending, automate approvals, and plan investments with confidence.

Key Takeaways: Why CapEx Software is Essential

Manual CapEx processes create delays, errors, and budget overruns. Spreadsheets and email approvals slow everything down.

In contrast, CapEx software streamlines approvals, automates tracking, and integrates with ERP systems for accurate financial control.

More importantly, advanced forecasting and scenario modeling help finance teams make smarter investment decisions.

Ultimately, Farseer eliminates manual work, improves data accuracy, and gives full visibility over CapEx planning.

Companies like Plinacro have transformed their CapEx processes with Farseer. See how they did it in this case study.

If you want to simplify your CapEx planning, book a demo today.