FP&A software helps finance teams plan, budget, and forecast faster, but most companies are still stuck using spreadsheets. Budgets take too long to build, forecasts feel like educated guesses and financial data is scattered across different systems.

Fixing errors takes hours, sometimes days. By the time leadership gets the numbers, things have already changed.

The right FP&A software solves these problems. It gives finance teams real-time data, automation, and better forecasting tools, so they can focus on strategy instead of manual work. But not every tool is the same. Some are too rigid. Others take months to implement. Choosing the wrong one can slow you down instead of pushing you forward.

This guide breaks down what FP&A software does, how it helps, and how to choose the right one.

What is FP&A Software?

Most finance teams rely on spreadsheets to plan budgets, build forecasts, and track financial performance. But as businesses grow, spreadsheets become too slow, messy, and unreliable.

FP&A software fixes this. It pulls financial data from different systems into one place, automates calculations, and makes planning faster and more accurate. Instead of spending hours updating formulas and fixing errors, finance teams get real-time numbers they can trust.

Who Uses FP&A Software?

FP&A software isn’t just for finance teams – it’s for anyone involved in planning and decision-making. Specifically, the main users include:

- Finance teams – FP&A analysts, controllers, and finance managers who build forecasts, track budgets, and analyze financial data.

- Executives & business leaders – CFOs, CEOs, and department heads who use reports and scenario models to guide strategy.

- Budget owners – Sales, HR, and operations teams that plan expenses and need real-time financial visibility.

Typically, small businesses usually use FP&A software to replace spreadsheets and speed up budgeting, while larger companies rely on it for multi-entity planning, complex forecasting, and automation.

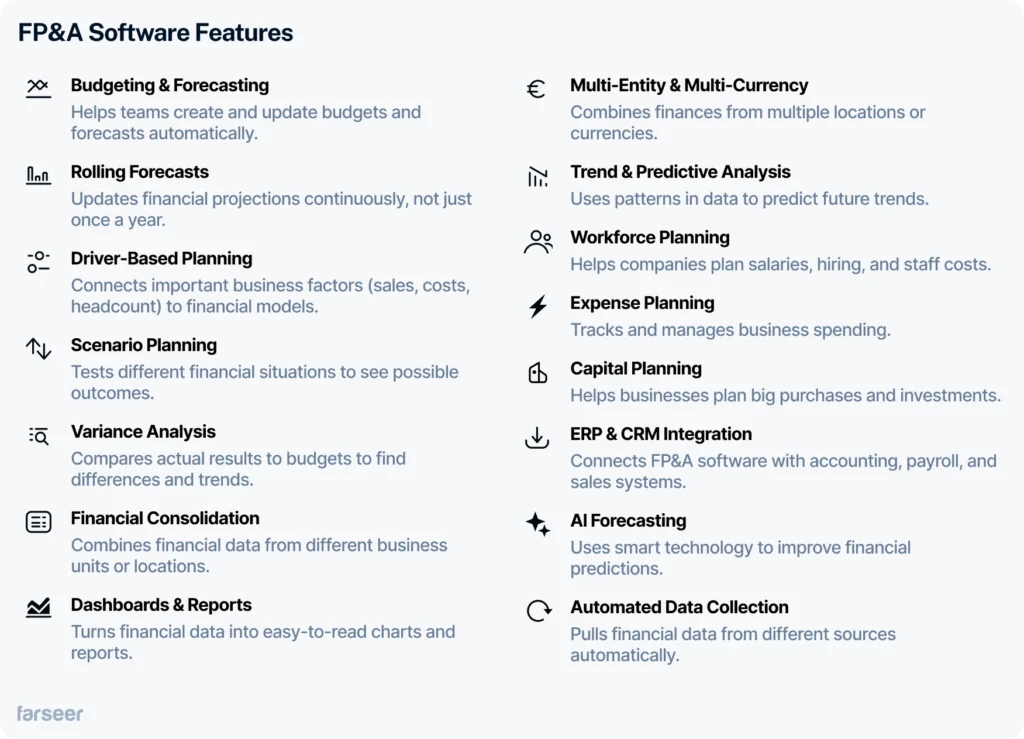

What FP&A Software Does

FP&A software helps manage budgets, forecasts, and financial data in one system. It often works hand-in-hand with balance sheet software tools to ensure reporting accuracy and full financial visibility. Instead of juggling spreadsheets, teams use it to analyze performance, test different scenarios, and make better financial decisions – faster.

FP&A Software vs. ERP

Many people mix up FP&A software and ERP systems, but they do different things. Let’s clear that up.

To start, ERP systems track past financial data – things like invoices, payroll, and expenses. They help businesses manage daily operations, however, they don’t offer tools for planning or forecasting. And even when they do, those tools are far from perfect.

In contrast, FP&A software focuses on the future. It takes financial data, analyzes trends, and helps teams build budgets, create forecasts, and test different scenarios. Moreover, for teams that need more detailed visibility into profit and costs, P&L software tools offer a clear view into margins and cost structures – without relying on static reports.

Ideally, most companies use both – the ERP stores financial records, while FP&A software turns that data into a plan for what’s next.

How FP&A Software Improves Forecasting and Decision-Making

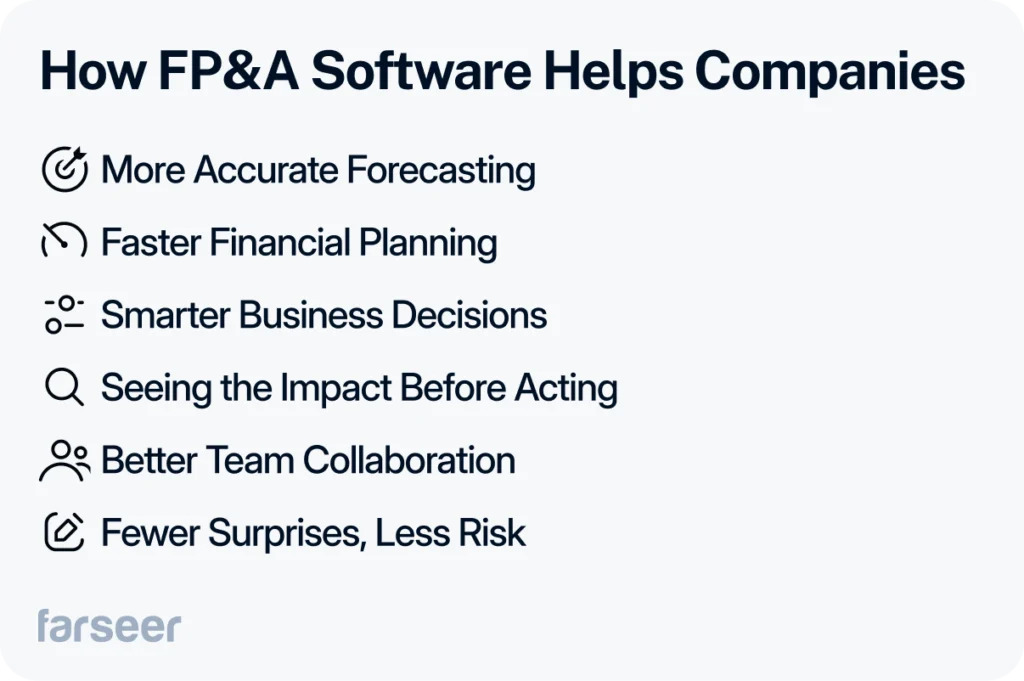

Bad forecasts lead to bad decisions. If financial data is outdated or full of errors, companies react too slowly, miss opportunities, or overspend. FP&A software fixes this by making forecasts more accurate, financial planning faster, and decisions smarter.

More Accurate Forecasting

One spreadsheet mistake can mess up an entire budget, and different versions make it hard to know which numbers are right. FP&A software pulls in real-time data from different sources, so teams always work with up-to-date numbers. Many tools also use AI to spot trends and improve revenue and cost predictions.

Want to go a step further? Variance analysis software helps pinpoint exactly why your actuals missed the budget – and how much that deviation really costs you. It’s one of the fastest ways to turn your FP&A system into a performance engine.

Faster Financial Planning

Manually updating budgets and forecasts takes too long. FP&A software automates data collection and speeds up planning cycles, so finance teams spend less time fixing numbers and more time making decisions.

Smarter Business Decisions

Old data leads to slow or bad decisions. FP&A software gives teams real-time insights, so they can react to market shifts, cost changes, and revenue trends right away. It also helps plan long-term investments, especially when combined with dedicated CapEx software tools that simplify capital planning and keeps major spending under control.

Seeing the Impact Before Acting

Markets change fast, and finance teams need to be ready. FP&A software lets businesses test different financial scenarios before making a move. Whether it’s preparing for a downturn, expanding into new markets, or adjusting pricing, teams can see the financial impact first.

Better Team Collaboration

When financial data is scattered across different teams and systems, it’s tough to stay aligned. FP&A software connects finance, sales, HR, and operations in one system, so everyone works with the same numbers – especially in planning processes like S&OP.

Fewer Surprises, Less Risk

Unexpected financial problems can wreck a company. FP&A software tracks trends, spots budget issues early, and helps businesses catch risks before they turn into big problems. Companies that focus on forecasting avoid last-minute scrambles and bad surprises.

Types of FP&A Software

The right FP&A software depends on company size, complexity, and growth plans. Most tools fit into one of three categories: Enterprise, Mid-Market, and SMB, each built for different needs.

Looking for the right corporate budgeting software? Here’s a list of 7 tools every CFO should know.

Enterprise FP&A Software

Large companies deal with complex finances, multiple locations, and massive data volumes. They need software that can consolidate financials, automate processes, and handle multi-currency operations.

- Best for: Large corporations, public companies, and businesses with multiple subsidiaries.

- Key features:

- AI-powered forecasting and scenario planning.

- Multi-currency and multi-entity financial management.

- Integrations with ERPs, CRMs, and HR systems.

- Examples: Farseer, OneStream, Oracle Hyperion, SAP Analytics Cloud, Anaplan.

Enterprise FP&A tools offer the most power but come with high costs, longer setup times, and the need for specialized staff.

Mid-Market FP&A Software

Growing businesses need flexibility and automation without the complexity of enterprise-grade systems. These tools streamline budgeting, forecasting, and reporting while staying easy to use.

- Best for: Mid-sized businesses, PE-backed firms, and companies outgrowing spreadsheets.

- Key features:

- Cloud-based planning with built-in automation.

- AI-assisted forecasting and workflow optimization.

- Easy integrations with mid-market ERP and CRM systems.

- Examples: Farseer, Vena Solutions, Prophix, Cube.

Mid-market FP&A software cuts down manual work and improves financial planning but may not be enough for businesses with complex, global operations.

SMB FP&A Software

Small businesses need simple, affordable tools to move beyond spreadsheets. These platforms help with budgeting, forecasting, and reporting without unnecessary features.

- Best for: Startups and small businesses switching from spreadsheets.

- Key features:

- Basic budgeting, forecasting, and reporting.

- Excel-friendly interface with simple automation.

- Integrations with QuickBooks, Xero, and other small-business tools.

- Examples: Jirav, Budgyt, Fathom.

SMB FP&A tools are cost-effective but have limited automation and scalability, so businesses may need to upgrade as they grow.

Which FP&A Software Is Right for You?

- Enterprise FP&A software has the most features and automation but requires higher costs and dedicated staff.

- Mid-market tools offer automation and scalability without enterprise-level costs.

- SMB solutions provide basic financial planning at a lower price but won’t scale with rapid growth.

If you’re comparing vendors, especially for enterprise or mid-market needs, it helps to see how they stack up side by side. Here’s a breakdown of 5 top Board competitors to guide your decision.

Read: FP&A Software: A Buyer’s Guide [Free Download – Vendor Comparison Checklist]

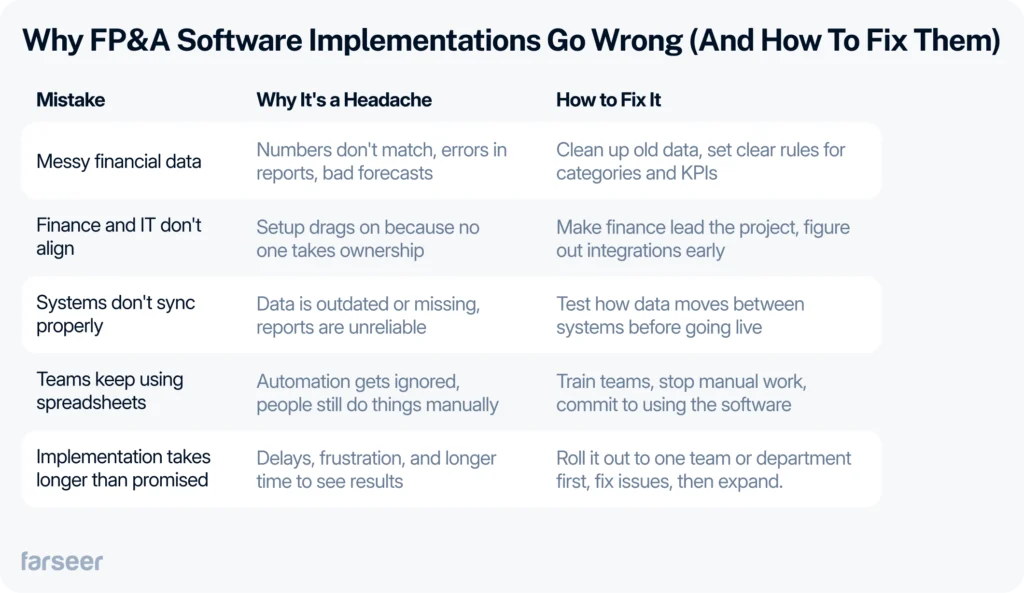

Implementation Challenges & What to Do About Them

Implementing FP&A software often isn’t just about installing a tool. More often than not, it’s about fixing broken processes – especially around how financial reporting and analytics are structured and managed. If that part isn’t working, the rest won’t either – and here’s why enterprise reporting fails and how to fix it.

Messy data, slow adoption, and teams stuck in old ways cause more problems than the software itself.

Most companies aren’t ready when they switch. Data is all over the place, systems don’t connect properly, and teams default back to spreadsheets. If you don’t plan for these issues, implementation drags on for months.

Here’s what goes wrong, and how to fix it.

Your Data Structure Might Not Be Ready

Most finance teams assume they can import spreadsheets and start forecasting—but the data is usually a mess.

- Different teams define revenue, costs, and KPIs differently – causing errors.

- Excel formulas and custom models don’t transfer easily into new systems.

- Historical data is incomplete, inconsistent, or full of duplicates.

Fix it before implementation:

- Standardize financial data – align revenue categories, cost structures, and reporting rules.

- Clean up historical data – remove duplicates, fill in missing values, and check formatting.

If your data isn’t ready, your FP&A tool won’t work the way you expect.

Finance and IT Don’t Speak the Same Language

Finance expects IT to handle setup. IT assumes finance knows what they need. Neither side takes full ownership, and implementation stalls.

- IT focuses on data security and system connections, not financial workflows.

- Finance assumes the tool will just work, without knowing what integrations or automation rules they need.

Fix it before implementation:

- Put a finance lead in charge. They should own the setup, not IT.

- Map out integrations early. Decide which data (ERP, CRM, HR) needs to connect and who manages it.

If finance and IT don’t align, expect delays and messy data.

Your Existing Systems Might Slow Everything Down

Even if FP&A software integrates with your ERP or CRM, that doesn’t mean data will sync correctly or in real-time.

- Some ERPs update data once a day or less, making real-time forecasting impossible.

- CRM data is often incomplete or outdated, throwing off revenue projections.

- HR systems may not sync workforce data properly, leading to payroll miscalculations.

Fix it before implementation:

- Test real-time data syncs – don’t assume integrations will work as expected.

- Check report formats – make sure your ERP, CRM, and FP&A tool pull data in a usable way.

If your systems aren’t feeding accurate data, your forecasts won’t be reliable.

Teams Keep Falling Back to Spreadsheets

Many FP&A tools fail not because they’re bad software, but because finance teams don’t adjust their workflows to take full advantage of automation. New software won’t help if teams keep using Excel as a crutch instead of fully switching over:

- inance still exports reports manually instead of using live dashboards.

- Analysts rebuild forecasts in Excel, treating FP&A software like a reporting tool.

- Leadership asks for static reports instead of using real-time scenario models.

Fix it before implementation:

- Redesign workflows – define what gets automated and what still needs manual input.

- Train leadership on live dashboards – eliminate static reports where possible.

- Stop duplicating work – once the system is live, commit to using it as the single source of truth.

If teams don’t fully switch, you’re just adding another tool instead of improving how finance works.

Vendors Often Underestimate Implementation Timelines

FP&A vendors promise fast setup, but rollouts almost always take longer than expected.

- Data migration takes twice as long when cleaning and validation are needed.

- Custom reporting requests add unexpected delays to the timeline.

- Teams aren’t fully ready to switch, dragging out the transition.

Fix it before implementation:

- Get a realistic timeline – ask vendors how long it took for companies with similar systems.

- Run a small-scale test first – pilot the tool with one team before rolling it out.

- Measure success by actual usage – the system isn’t fully implemented until finance stops using spreadsheets.

If you don’t plan for delays, expect frustration, missed deadlines, and slow adoption.

How Companies Actually Use FP&A Software - Farseer

Here’s how three companies in different industries made their finance operations faster and easier with FP&A software – Farseer.

Hrvatski Telekom cut forecasting time from ten days to two days

Hrvatski Telekom’s finance team managed budgeting and forecasting with 50+ spreadsheets across different departments. Consolidating financial data was slow, and updating forecasts took more than 10 days every quarter. The finance team spent more time fixing numbers than planning for the future.

FP&A software replaced spreadsheets with automated forecasting and budgeting, giving teams a single system where they could plan, update numbers, and adjust forecasts instantly.

Results:

- Quarterly forecasting time reduced from 10 days to 2.

- 50+ spreadsheets eliminated.

- Finance teams now spend time analyzing numbers, not fixing them.

Altium standardized reporting across nine countries

Altium operates in nine countries, and every region had its own way of handling budgets and forecasts. Finance teams had to manually consolidate numbers from different formats and systems, which slowed down reporting and created inconsistencies.

FP&A software helped Altium standardize financial reporting and automate forecasting, so finance teams could work with one set of numbers instead of constantly adjusting data from different sources.

Results:

- 30% faster reporting by eliminating manual data consolidation.

- 25% shorter planning cycles, making forecasting quicker and easier.

- Finance teams across all regions now work in one system instead of juggling spreadsheets.

LELO automated demand forecasting for B2B and B2C sales

LELO’s demand planning team used spreadsheets and BI tools that weren’t built for forecasting. It was hard to separate B2B and B2C sales, and finance teams spent too much time adjusting forecasts manually.

FP&A software introduced automated demand forecasting, a centralized planning model, and a top-down forecasting tool that let finance teams set high-level targets and distribute them across all business units automatically.

Results:

- Faster, more accurate demand forecasts, helping production teams plan better.

- Less time wasted fixing spreadsheets, allowing finance teams to focus on strategy.

- B2B and B2C planning fully separated, improving forecasting accuracy.

What These Companies Learned About FP&A Software

Finance teams at Hrvatski Telekom, Altium, and LELO had different challenges, but they all ran into the same core problems: spreadsheets slowed them down, forecasting took too long, and budgeting was full of manual steps.

FP&A software helped them:

- Get rid of spreadsheets and bring all planning into one system.

- Make forecasting faster so finance teams could plan ahead instead of playing catch-up.

- Automate budgeting and demand planning, reducing manual work and improving accuracy.

For any company still relying on spreadsheets for budgeting and forecasting, the biggest lesson is this: manual processes only get worse as a business grows. FP&A software isn’t just a faster way to do the same work – it changes how finance teams operate, helping them plan more efficiently and make better decisions.

Key Takeaways

- FP&A software replaces spreadsheets for budgeting, forecasting, and financial planning, making processes faster and more accurate.

- ERP systems track financial history, while FP&A software plans for the future – most companies need both to run efficiently.

- Better forecasting leads to better decisions – automation reduces errors, speeds up planning, and helps businesses test different financial scenarios.

- The right FP&A software depends on company size and complexity – enterprise tools offer deep automation, mid-market solutions balance flexibility and cost, and SMB tools help small businesses move beyond spreadsheets.

- Implementation often fails due to messy data, IT misalignment, and slow adoption – cleaning data, setting clear workflows, and phasing the rollout prevent delays.

- Real companies see real improvements – Hrvatski Telekom, Altium, and LELO all reduced forecasting time, improved reporting, and made financial planning easier with Farseer FP&A software.

- Manual processes only get worse as a business grows – FP&A software isn’t just about speed; it makes financial planning smarter, more scalable, and more strategic.