What is FP&A Software

Financial Planning and Analysis (FP&A) software helps finance professionals streamline their budgeting, forecasting, and financial reporting processes. These tools provide a comprehensive platform for managing, monitoring, and analyzing an organization’s financial health. They do so by integrating data from various sources and providing advanced analytics capabilities.

Essential Considerations Before Purchasing FP&A Software

The history of FP&A software can be traced back to the early 1980s when the first spreadsheet applications were introduced. As the technology evolved, the 1990s saw the advent of specialized financial planning software, which focused on budgeting and forecasting. In the early 2000s, these tools started to integrate with other business applications, paving the way for modern FP&A software. Today, FP&A solutions have evolved into sophisticated platforms, offering advanced analytics, real-time data integration, and cloud-based access to cater to the ever-changing needs of modern finance departments.

The so-called third generation of FP&A software offers advanced analytics, real-time data integration, cloud-based access, and user-friendly interfaces. As a result, it is well-suited to meet the evolving needs of modern finance departments.

Here are the key differences of 3rd gen FP&A software compared to its older counterparts:

Better Design: Modern FP&A tools have simple and user-friendly interfaces, while older software is often confusing and hard to navigate.

Teamwork: They let users work together on financial plans and models in real-time, while older tools had limited teamwork options.

Smarter Analysis: They use advanced techniques like machine learning to give better insights, while older software has basic analysis features.

Easier Integrations: They can connect with many data sources and business applications easily, while older tools have limited options.

Cloud Access: These tools are usually cloud-based, making them easy to access from anywhere, while older ones are installed on-premise.

Better Visuals: 3rd gen FP&A tools have advanced ways to display data, such as interactive charts. In contrast, older software uses simpler visuals.

Real-time Data: Modern FP&A software shows real-time data, helping users make decisions based on the latest information. Meanwhile older tools might have had outdated data.

Do you even need FP&A Software?

Unfortunately, it’s not always clear for businesses when is the right time to start using dedicated FP&A software. Finance teams get stuck in their day-to-day operations in spreadsheets, and sometimes lose perspective of the broad picture. But, we can help you here. If you and your team check more than three boxes, you might want to take a better look at your FP&A software situation:

Yearly planning lasts > 1 month

Lots of people participate

Lots of spreadsheets used

Lots of versions

Data-heavy model(s)

Manual template management

Manual reports

The plan is not viable (departments not co-ordinated)

Boss wants rolling forecast

Boss wants what-if simulations

Boss wants driver-based planning

Boss wants to plan profitability on the product/person/atom level

What is the problem worth to you, and what is your company budget?

FP&A software can be on the expensive side of the business tools spectrum. Before starting to research vendors and do a deep dive into software features and various use cases, it is smart to start looking at the problem from a budget perspective. The most important question you must ask yourself is: how much does this problem cost the company? In other words, you need to perform an ROI analysis and determine if FP&A software is the answer to your problem. Also, does the solution cost more than the problem itself? If that is the case, you are better off sitting down with your team and optimizing your planning processes and operations. Consider other solutions first.

User Adoption to FP&A Software

Another critical factor you will want to be careful about when considering acquiring FP&A software is the ease of use of the software. The reason for this is simple – the tool’s ease of use will dictate the adoption rate throughout your company, and lower the TCO (Total Cost of Ownership). In other words, the more simple, intuitive, and flexible the tool is, the more resources your company will save in the onboarding phase.

Implementation Complexity

As an FP&A software buyer, you should be very careful about the implementation process. Many pitfalls hide here. A lack of clear communication between you and the vendor can lead to:

inadequate planning and testing,

poor data quality,

insufficient user training and support,

unrealistic expectations of what the software can deliver.

In this phase, your priority should be setting and following a clear implementation action plan with the vendor. You should include all major stakeholders in the implementation planning, not just the finance and IT departments. If you want Sales and Production teams to use the software (and you probably do), they should have a say in the planning phase and voice their priorities and concerns early on. Happy teams -> better adoption, remember?

Setting clear goals for the implementation, including all relevant stakeholders, preparing your data sources, mapping your data properly, and communicating tasks and responsibilities between your internal team and the vendor can save you from headaches and problems in the long run.

Scalability of FP&A Software

If an enterprise software system is scalable, it can accommodate growth and expansion as a company’s needs evolve over time. For example, if a company initially implements a software solution to support a small team of users but later needs to expand the user base or add new functionality, a scalable software solution should be able to accommodate those changes. It should do so without requiring significant upgrades or replacements. For FP&A software tools, you will want to ensure that your teams can edit the models in the software by themselves without the vendor’s assistance.

Autonomy

After scalability, the question of user autonomy arises organically. Autonomy means that a company can manage and customize the software solution to meet its unique business needs. And do that without relying on the vendor for every change or update.

Security

Security is crucial in cloud-based FP&A software implementations for several reasons. Firstly, this software typically deals with sensitive financial data, including budgeting and forecasting information that could be attractive to cybercriminals or malicious insiders. Ensuring the confidentiality, integrity, and availability of the data is essential to prevent data breaches, financial loss, and reputational damage.

at-rest and transit data encryption,

role-based access control (to restrict access to the FP&A software based on user roles and responsibilities),

security training for software users,

data backup and recovery measures (in case of accidental deletion, hardware failure, or a security breach),

regular software updates

Support

When considering FP&A tools, you should be mindful of the quality and availability of support provided by the software vendor. This includes everything from technical and implementation support across training and education to customer success management.

Does the vendor offer dedicated free support? What additional support fees are required, if any?

What is the background of their customer success team, and do they have relevant financial experience?

What to Look for in FP&A Software

In this section, we’ll focus on specific feature groups and use cases that organizations would (and should) expect from some of the more modern, flexible, and agile FP&A solutions.

Budgeting and Forecasting with FP&A Software Tools

Budgeting and forecasting are the essential financial planning processes. They help businesses allocate resources, set financial targets, and plan for future growth. Third-generation FP&A tools have advanced features and capabilities that improve accuracy, efficiency, and decision-making when performing these processes.

Reporting and Analytics

Quality-built reporting and analytics feature systems are a crucial part of FP&A software. They can be a dealbreaker if not implemented properly. Feature-wise, the FP&A tool can check all the boxes for your business, but if it is lacking in the reporting department, you should re-think the implementation.

Improving Collaboration and Workflow with FP&A Software

When talking about collaboration and workflow, we aim for all features designed to improve communication between team members and streamline processes. As you might have guessed already, 3rd gen FP&A software improved these features drastically compared to older gen software. Besides RBAC (role-based access control) we mentioned earlier, here are some other features you want to see in these types of tools:

Real-time collaboration – multiple users can work simultaneously on a centralized model and get real-time updates.

Version control & audit trails – tracking user actions, changes, and approvals, providing transparency and accountability within the financial planning process.

Task management – various features that help users assign tasks, set deadlines, and monitor progress, ensuring that all team members are aligned and working towards common goals.

Commenting and annotations: users can add comments and annotations directly within the tool, facilitating discussions and enabling clear communication on specific data points or assumptions.

Workflow Automation – users can automate repetitive tasks and processes, such as data input, report generation, and approvals, saving time and improving overall efficiency.

Approval Process: maintain control over budgets, forecasts, and financial models by requiring designated approvers to review and sign off on changes.

Different tools even have other advanced collaboration features, but the ones listed here are minimum in the 3rd gen FP&A software.

Integrations

Easier integrations are one of the most important aspects of 3rd gen FP&A software. When investigating a tool, you should check if it connects with various data sources like ERP, CRM, and HR systems. Pre-built connectors for common applications such as SAP, Oracle, Salesforce, and Microsoft Dynamics can save time and effort.

Design/UI

3rd gen FP&A software moves away from the standard spreadsheet UI approach. Many tools in this space significantly upgrade the spreadsheet user experience with specific FP&A workflows and UI patterns. When searching for the perfect FP&A software, pay close attention to the design and user interface (UI). This is critical in enhancing the user experience (and adoption rates). Modern FP&A tools prioritize intuitive, user-friendly interfaces that streamline navigation and make it easy for users to access features and functions, unlike some older tools (SAP, we’re looking at you).

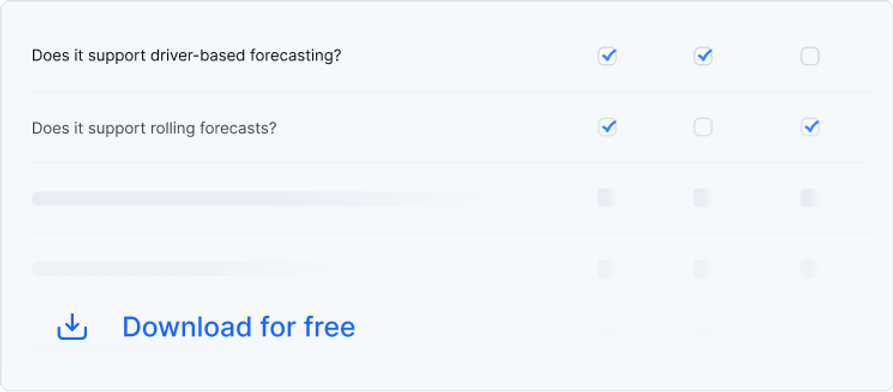

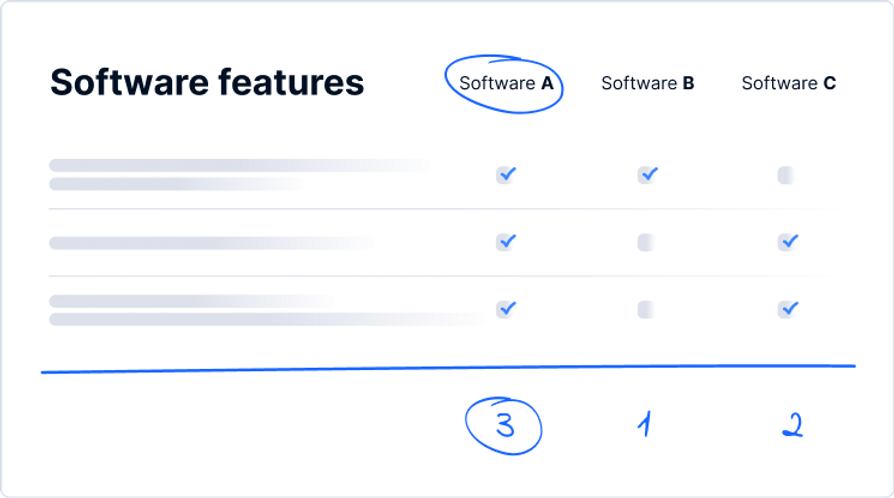

Free FP&A Software Comparison Checklist Download

If you are looking into FP&A software tools and don’t know where to start, our free FP&A Software Comparison Checklist can help you.

Conclusion

In conclusion, FP&A software is essential for managing financial health, and modern solutions offer advanced features like cloud-based analytics and user-friendly interfaces. Businesses should consider implementation complexity, scalability, autonomy, security, and support and involve all stakeholders in the planning. Buyers should look for vendors with advanced budgeting and forecasting, real-time reporting and analytics, robust collaboration and workflow, integration with data sources, and a modern UI. Additionally, buyers should prioritize vendors with quality support services and reputation, scalable services, and security measures to protect sensitive data.