Deferred tax assets are a valuable tool for managing your company’s finances. They reduce future tax bills, improve cash flow, and make a big difference in long-term planning. But many companies don’t fully understand how they work or how to use them effectively.

Read: A Complete Guide to Financial Statement Analysis for Strategy Makers

In this blog, we’ll cover everything you need to know about deferred tax assets: how they’re created, how they show up on financial statements, and how to manage them. We’ll also explain deferred tax liabilities to give you a complete understanding.

What Are Deferred Tax Assets?

Deferred tax assets are future tax savings a company can use to lower its taxes in upcoming years. They happen when a company has paid more taxes upfront than required or has recorded expenses in its financial statements that can only be deducted for tax purposes in the future.

These assets are valuable because they reduce a company’s future tax bills, improving cash flow and financial stability. Deferred tax assets often appear on a company’s balance sheet as a non-current asset and are key for financial reporting and analysis.

What Are Deferred Tax Liabilities?

Deferred tax liabilities (DTLs) are taxes a company will owe in the future because of differences between how income or expenses are handled in financial statements and tax filings. These happen when taxable income is higher than the income reported in the financials for the same period.

Common Causes of Deferred Tax Liabilities

- Deferred Revenue: A company might get paid upfront for a product or service but only count the revenue in its financial statements later. For taxes, the payment is taxed immediately, creating a liability for the future.

- Accelerated Depreciation: Some companies deduct more of an asset’s cost upfront for tax purposes while spreading the expense over several years in their financials. This creates a short-term tax break but results in higher taxes later.

Example: A manufacturing company gets paid before delivering a product. It records this as deferred revenue in its financials but pays taxes on the income right away. This difference creates a deferred tax liability, reflecting taxes owed later when the revenue is officially recognized.

How Deferred Tax Assets Are Created

Deferred tax assets happen when there’s a difference between how income or expenses are treated in financial statements and how they’re handled for tax purposes. These differences reduce tax payments in future years. Here are the main causes:

Net Operating Loss Carryforwards (NOLs)

When a company’s expenses are higher than its income, it creates a loss that can offset taxable income in future years.

Example: A startup with a $10 million loss in its first year creates a $2.1 million deferred tax asset at a 21% tax rate. This DTA can be used to reduce taxes in profitable years ahead.

Temporary Timing Differences

These occur when income or expenses are reported in different periods for accounting and tax purposes.

Example: A manufacturing company records warranty expenses upfront in its financial statements, but for tax, the deduction only happens when claims are paid. This timing difference creates a deferred tax asset.

Overpaid Taxes

If a company pays more taxes than required, it can carry the excess forward to reduce future taxes.

Example: A business overpays $100,000 in estimated taxes. This amount becomes a deferred tax asset for the next year.

Tax Credits

Unused tax credits, like those for research and development (R&D), can be carried forward as deferred tax assets.

Example: A tech company earns $500,000 in R&D tax credits but only uses $300,000 this year. The remaining $200,000 is carried forward as a deferred tax asset.

To make the most of deferred tax assets, companies need reliable forecasts of future taxable income. Learn more about forecasting in our blog on Budget Forecasting Methods.

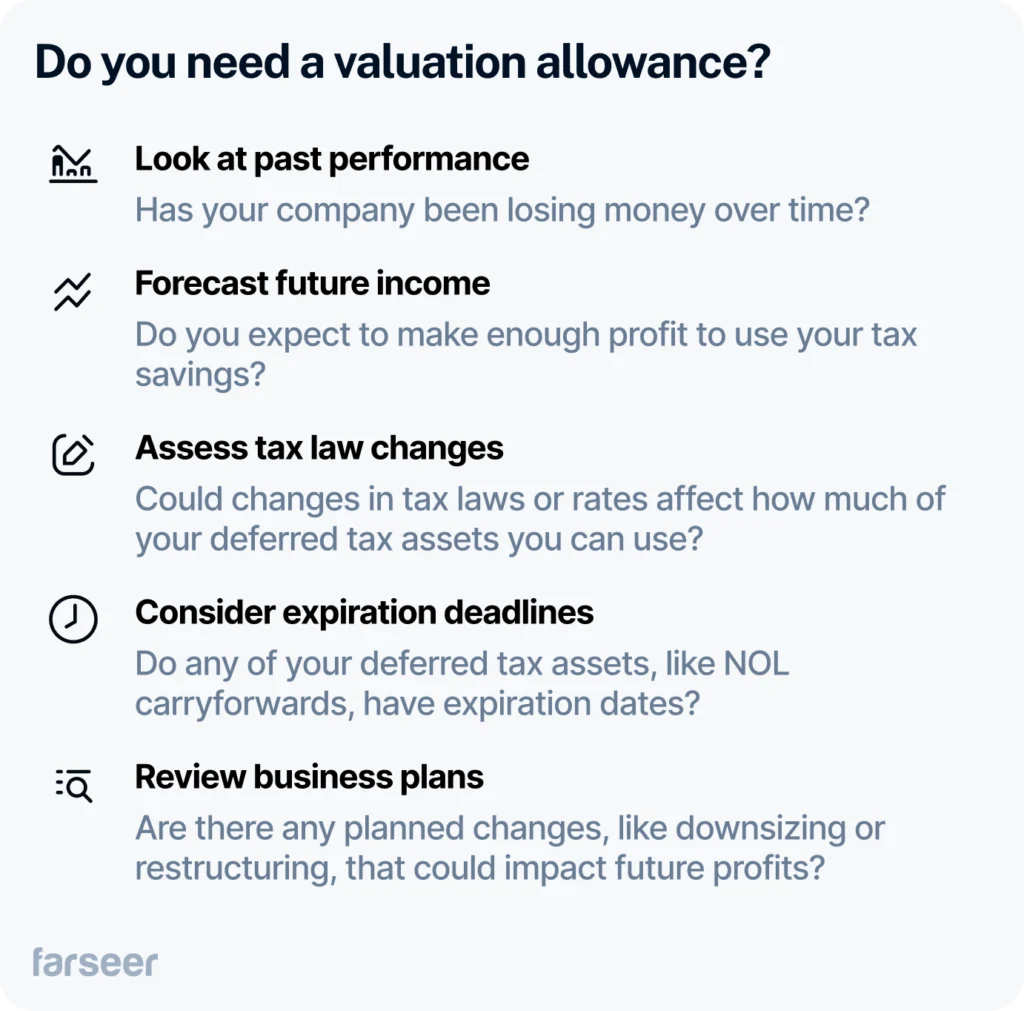

Evaluating Deferred Tax Assets with a Valuation Allowance

Deferred tax assets reduce future taxes, but companies might not always use them fully. If there’s a chance future taxable income won’t be enough to offset these assets, a valuation allowance adjusts its value to reflect what the company can realistically use.

What Is a Valuation Allowance?

A valuation allowance reduces the value of deferred tax assets if a company doesn’t expect to use all of them. This adjustment ensures the financial statements show a realistic picture of how much tax the company can actually save in the future.

Example: A tech startup has $5 million in tax savings from past losses. If the startup expects to make a profit in five years, it can count all $5 million as a future tax benefit. But if it doesn’t think it will make a profit, it might lower that amount to $2 million. The company is saying, “We don’t think we’ll make enough money to use all $5 million, so let’s only count the $2 million we think we can use.”

How Deferred Tax Assets Impact Financial Statements

Deferred tax assets (DTAs) affect two key financial statements: the balance sheet and the income statement.

Deferred Tax Assets On the Balance Sheet

Companies record DTAs as non-current assets because they expect to save on taxes in the future. Deferred tax liabilities (DTLs), which represent future tax payments, show up as non-current liabilities. Many companies combine DTAs and DTLs into one net number to keep things simple.

Deferred Tax Assets On the Income Statement

DTAs and DTLs directly affect tax expenses:

- When DTAs increase, tax expenses go down, and net income goes up.

- When DTLs increase, tax expenses go up, and net income goes down.

What Large DTAs and DTLs Mean

- Large DTAs often mean the company has past losses or expenses that will lower future taxes.

- Large DTLs usually mean the company uses strategies like accelerated depreciation or deferred revenue to manage its taxes.

Example: Tesla’s early financials showed deferred tax assets from heavy losses during its R&D and factory expansion phases. These losses helped reduce future taxes as the company moved toward profitability. At the same time, Tesla reported deferred tax liabilities from customer prepayments for its vehicles and energy products. While the revenue was taxed upfront, Tesla delayed recognizing it in its financial statements.

DTAs and DTLs show how financial statements connect. To see how these pieces fit into planning, read our guide on the 3-Statement Financial Model.

Challenges and Solutions for Deferred Tax Assets

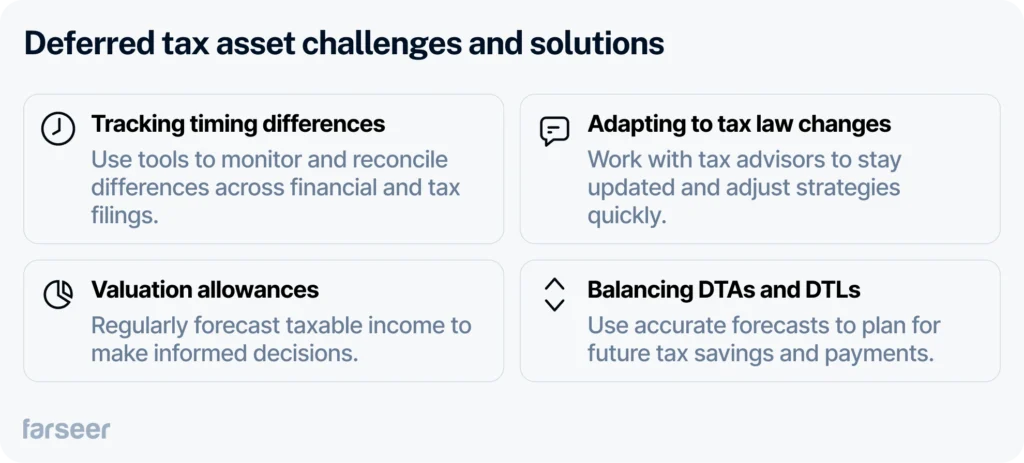

Managing deferred tax assets (DTAs) isn’t always easy. Timing differences, tax law changes, and valuation allowances can make it complicated. Knowing the common challenges can help you stay on top of things.

Key Challenges

- Tracking timing differences: It’s hard to keep up when financial reporting and tax filings don’t match, especially for companies working in multiple countries.

- Tax law changes: Shifts in tax rates or laws can change the value of your DTAs, forcing you to adjust your plans.

- Valuation allowances: Deciding if you need a valuation allowance can be tricky, especially if future taxable income is uncertain.

- Balancing DTAs and DTLs: To manage deferred tax liabilities alongside DTAs, you need accurate forecasts of future tax savings and payments.

How to Solve These Issues

- Use accounting tools to track timing differences and stay organized.

- Work with tax advisors to keep up with tax law changes and adjust quickly.

- Update taxable income forecasts regularly to make informed decisions about valuation allowances.

- Schedule periodic reviews with your finance team to stay accurate and compliant.

For help addressing these challenges, explore our blogs on rolling forecasts for dynamic planning, short-term forecasting for immediate needs, and account analysis for reconciling deferred taxes.

Best Ways to Manage Deferred Tax Assets

Managing deferred tax assets (DTAs) well means staying organized and proactive. These practices can help you get the most out of them:

1. Keep your records up to date

Review your DTAs regularly to make sure they match your current financial position. Check for changes in timing differences, overpayments, or unused tax credits.

2. Sync accounting and tax plans

Make sure your accounting and tax teams are on the same page. Aligning their work helps avoid errors and keeps things running smoothly.

3. Plan for what’s ahead

Run different scenarios to see how changes in income, tax laws, or rates could affect your DTAs. This helps you prepare for unexpected changes.

4. Watch for expiration dates

Some DTAs, like carryforward losses, don’t last forever. Track their deadlines and use them before they expire.

5. Do regular check-ins

Work with your team and tax advisors to review DTAs on a regular basis. These reviews help you spot opportunities and ensure compliance.

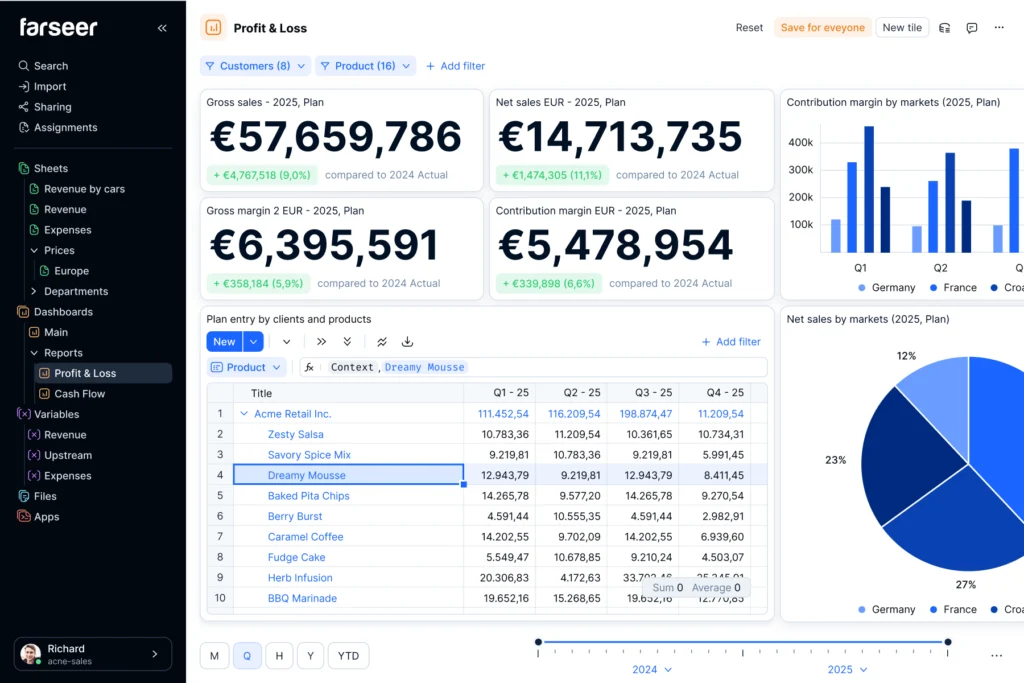

Managing DTAs is easier with the right tools and strategies. Farseer simplifies forecasting, data tracking, and reporting, helping you stay ahead.

Learn more about financial strategy in our blog on budgeting vs. forecasting.

Conclusion

By understanding what deferred tax assets are, how they are created, how they affect your financials, and how to manage them effectively, you can unlock their full potential.

To stay ahead, keep your records accurate, plan for changes, and review regularly. Tools like Farseer can simplify forecasting and tracking, helping you manage DTAs with confidence.