In finance, liquidity is everything. For companies, having enough cash to cover short-term debts is key for stability. Understanding the cash ratio definition is key—it’s a quick, reliable way to check if a company has enough cash on hand to meet immediate obligations.

In this guide, we’ll walk through what the cash ratio is, how to calculate it, and why it matters.

What Is Meant by Cash Ratio?

The cash ratio definition is straightforward: it’s a financial metric that shows if a company can cover its short-term liabilities using only its cash and cash equivalents. Officially, it’s defined as the ratio of a company’s cash and cash equivalents to its current liabilities. This makes it one of the strictest liquidity measures: it focuses only on cash that’s ready to use without converting other assets.

To keep things simple, in this blog, we’ll use the example company, Acme Inc.

Acme uses the cash ratio to check if they have enough cash to pay off their immediate debts. By calculating this ratio, the financial team can quickly assess the company’s liquidity without relying on inventory sales or waiting for receivables to come in.

For a better view of assets and liabilities, companies often use a classified balance sheet, which organizes these items in a way that makes liquidity easier to understand.

In short, the cash ratio provides a quick answer to whether the company can meet its short-term obligations with cash alone.

How to Calculate the Cash Ratio + Formula

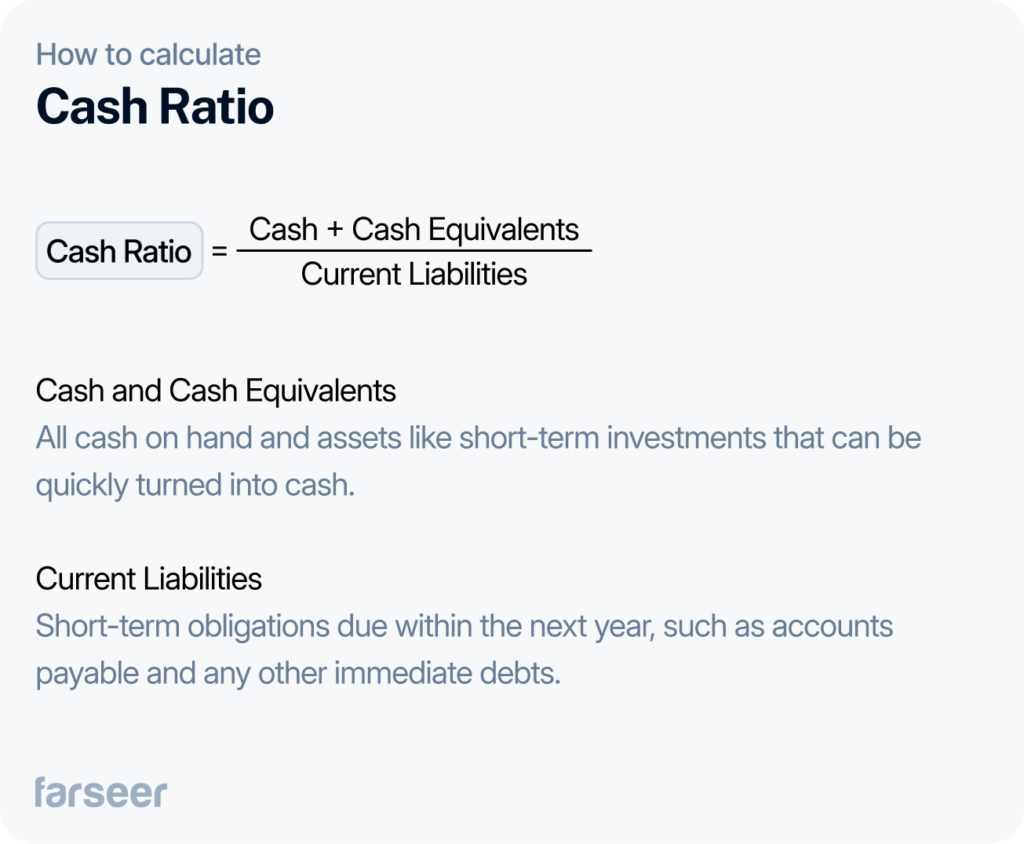

To calculate the cash ratio, we use this fairly simple formula:

Cash Ratio = (Cash + Cash Equivalents) / Current Liabilities

From Acme’s balance sheet, we can see their situation:

- Cash and Cash Equivalents: $2,000,000

- Current Liabilities (Accounts Payable): $3,000,000

When we plug these into the formula, here’s what we get:

Cash Ratio = $2,000,000 / $3,000,000 = 0.67

So, Acme has enough cash to cover 67% of its short-term debts. The team knows that while they have a solid cash position, they would need other assets or revenue to cover the rest.

For more on analyzing financial statements, check out our guide on Vertical Financial Analysis. To see how the cash ratio fits into a broader financial model, see our blog on the 3-Statement Financial Model.

What Is a Good Cash Ratio?

There’s no single “good” cash ratio that fits all companies. For many, a ratio close to 1.0 is ideal. They have enough cash to cover all short-term debts. But it rarely happens. Most companies don’t even want to keep it that high, because of the opportunity cost of not investing all the cash. Ratios in the 0.5 to 1.0 range are also considered healthy because they show how a company can cover a significant part of its obligations with cash alone.

For Acme Inc., with a cash ratio of 0.67, this means they’re well-positioned to cover 67% of their short-term debts. This level suggests that Acme is fairly secure but may still rely on other income or assets to be fully covered.

Lower ratios (below 0.5) could indicate liquidity risk, while high ratios (above 1.5) might suggest excess cash that could be reinvested for growth. Ultimately, what qualifies as a “good” cash ratio varies by industry, cash flow needs, and financial strategy.

Cash Ratio vs. Quick and Current Ratios

The cash ratio is helpful but doesn’t show everything on its own. Here’s how it compares to two other liquidity ratios: the quick ratio and the current ratio.

Quick Ratio

The quick ratio, or acid-test ratio, looks at cash, cash equivalents, and receivables, but excludes inventory. It’s useful for companies that need a broader view than the cash ratio gives. The quick ratio includes receivables and shows assets that could be quickly turned into cash.

For Acme Inc., the quick ratio is 2.0, which means excellent liquidity. This level is common in industries like consulting or tech, where firms don’t depend on inventory. However, in inventory-heavy sectors like manufacturing or retail, a quick ratio this high is less common, as these companies usually rely more on inventory to meet obligations.

Current Ratio

The current ratio is the broadest of the three, including all current assets—cash, receivables, and inventory. It’s a good measure for companies that rely on converting inventory to cover their debts over time.

Acme’s current ratio of 4.0 is on the high side. Typical companies fall between 1.5 and 2.5, which shows enough liquidity without tying up too many assets. A current ratio of 4.0 can indicate that Acme may have idle assets that aren’t being used for growth. High ratios like this are more typical for asset-light industries. Manufacturing and retail firms often operate closer to a 1.5–2.5 range.

Each ratio has a purpose. The cash ratio is the strictest, while the quick and current ratios add other layers to help companies understand their short-term finances. For more on these and other balance sheet metrics, check out our blog on balance sheet ratios.

Why the Cash Ratio Alone Isn’t Enough

The cash ratio is useful for checking if a company can cover its short-term debts with cash on hand. But relying on it alone can be too conservative, especially for companies with other assets that can quickly convert to cash, like receivables or inventory.

For companies like Acme, with significant receivables, the cash ratio alone might understate their actual liquidity, making them seem less prepared than they are. That’s why many companies also look at the quick and current ratios, which include receivables and inventory.

A high cash ratio can also mean missed opportunities if cash isn’t put to use. Instead of holding extra cash, companies often invest it to generate returns while still managing liquidity.

To track liquidity over time, many businesses use horizontal analysis to see how cash flow and other assets change over periods.

How Companies Use the Cash Ratio

Companies use the cash ratio every day to make better decisions. Here are the most common use cases:

Staying Ready for Unexpected Costs

At Acme Inc., the cash ratio is part of the regular financial checkup. When the cash ratio shows they can cover most of their short-term bills, they know that they’re in a good spot, and ready for any surprises the markets can bring.

Making Smart Investments

A healthy cash ratio also gives Acme confidence for growth. Knowing they have enough cash lets them make smart investments without the risk of overreaching. The cash ratio is a quick way to check if they’re ready to expand.

Comparing to Industry Standards

Companies also use the cash ratio to benchmark against others in their industry and understand if they’re more or less conservative with cash compared to competitors.

Managing Debt

The cash ratio is also great for managing debt. A strong cash position can help Acme negotiate better loan terms, and show lenders they have enough liquidity to pay up. It leads to lower interest rates, and that’s always great for cash flow.

For better decision making many companies use financial analysis tools that go beyond individual ratios. These tools help them align their cash ratio and similar indicators with long-term plans.

Key Takeaways on Cash Ratio

So, in this blog, you’ve not only learned about the cash ratio definition but also how it’s used in a broader context.

It is a quick way to check if a company has enough cash to cover short-term debts.

While it’s a useful measure, it doesn’t show the full picture. Companies often look at the quick and current ratios for a broader view and compare their cash levels to industry standards.

Acme, for example, uses it to make smart decisions about risk, debt, and growth.

In short, the cash ratio is a powerful tool, but combining it with other metrics makes for better financial planning.