When we talk about balance sheets, we’re actually referring to the core financial statements that describe a company’s financial health at a specific moment.

A balance sheet outlines a business’s assets, liabilities, and shareholder equity. This makes it easier for stakeholders to understand a business’s financial standing. However, when it comes to making in-depth assessments and analyses, a standard (or let’s call it traditional) balance sheet is sometimes not enough. This is where a classified balance sheet comes into play.

Read: A Complete Guide to Financial Statement Analysis for Strategy Makers

In what way is a classified balance sheet different from a regular one, what are its components, and how does it actually look – read on to find out.

What’s a Classified Balance Sheet?

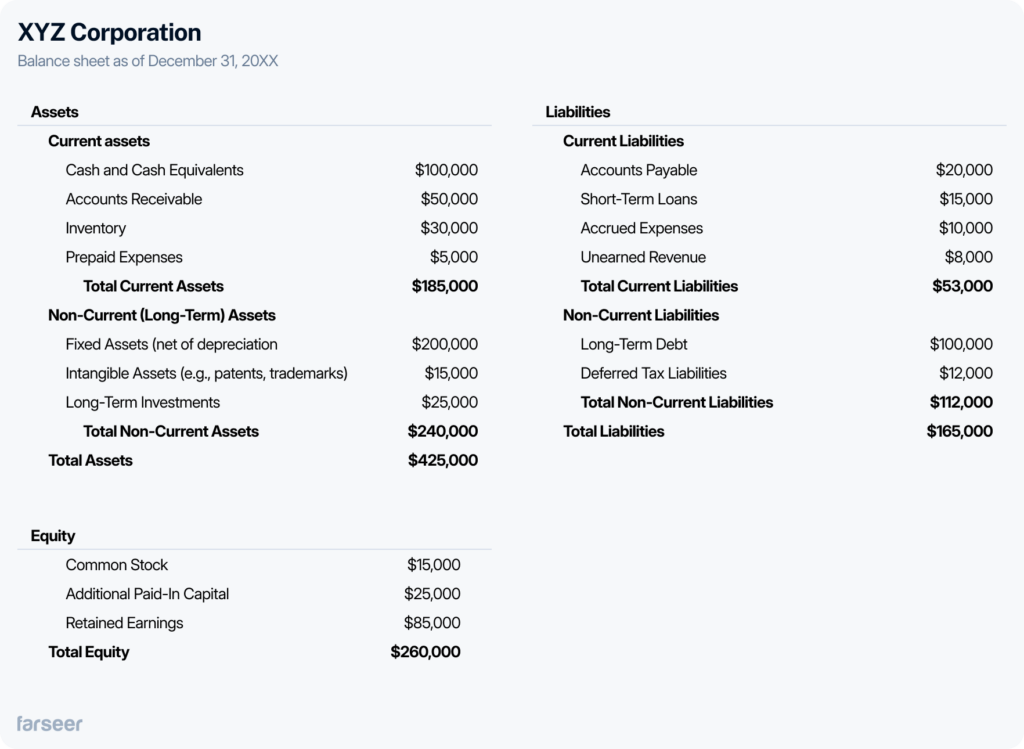

A classified balance sheet is actually a standard balance sheet – but with much more detail. It organizes information about assets, liabilities, and equity into specific, meaningful subcategories. These are for example current vs. non-current assets and current vs. non-current liabilities, based on their characteristics and time frames.

Why the extra division and what does it bring to the table?

Well, since it’s divided into more details, a classified balance sheet allows financial professionals to dig deeper into the reasoning behind a company’s financial state. For example, when you separate assets into current (those that are expected to be converted to cash or used up within a year) and non-current (long-term investments or resources), you can easily assess a company’s liquidity. Meaning, if a company has enough current assets, this tells you that it can cover day-to-day operational costs without any problems, which is crucial for its stability. It is possible to draw similar conclusions from any of the mentioned subcategories. This is, in fact, the main value of a classified balance sheet.

Components of a Classified Balance Sheet

As mentioned, the main components of a classified balance sheet are the same as in the standard one – Assets, Liabilities, and Equity. But in this case, each section is further organized into more categories. Here’s how:

Assets

Assets refer to the resources a company owns and they can be used to generate value. In a classified balance sheet, they are divided into:

- Current Assets: These are assets that can be converted to cash or used up within a year. They include:

- Cash and Cash Equivalents: Cash reserves and other assets that you can easily convert to cash

- Accounts Receivable: Money your customers owe to you for your products or services

- Inventory: Raw materials, work-in-progress, and finished goods available for sale. For example, Amazon’s inventory includes books, electronics, groceries, etc. All of this is potential revenue, ready for sale to customers.

- Prepaid Expenses: Payments made in advance, such as insurance or rent, which will provide future benefits.

- Non-Current (Long-Term) Assets: The assets that are expected to provide value over a period longer than one year. For example:

- Fixed Assets: These are assets that you use in operations – like buildings, machinery, and equipment.

- Intangible Assets: Non-physical assets like patents, trademarks, and goodwill that add long-term value to the business.

- Investments: Long-term financial investments, such as stocks or bonds held over time.

Each asset type plays a unique role – current assets ensure liquidity (as mentioned in the example above) and non-current assets support operations and market position over time.

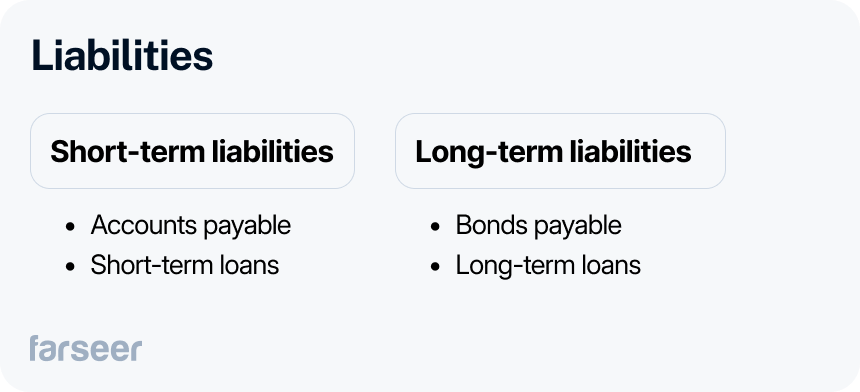

Liabilities

Liabilities represent obligations a company owes to others. These are also divided into short- and long-term categories:

- Current Liabilities: These are obligations due within a year, such as:

- Accounts Payable: Money owed to suppliers or vendors for goods and services.

- Short-Term Loans: Debts and lines of credit due within the current period.

- Accrued Expenses: Expenses incurred but not yet paid, like wages or utilities.

- Unearned Revenue: Payments received in advance for services yet to be provided.

- Non-Current Liabilities: These are long-term obligations due beyond one year. They include:

- Long-Term Debt: Loans or bonds payable over an extended period.

- Deferred Tax Liabilities: Taxes owed in the future due to timing differences between accounting and tax reporting.

- Pension Obligations: These are, for example, commitments for employee retirement benefits that people pay over time.

Overall, these liabilities categories show how a certain business manages both immediate and future financial obligations.

Equity

Equity is in fact what is left of a company’s assets once all liabilities (meaning debts and obligations) have been paid off. In other words, it’s the net worth of the company. It typically includes:

Shareholder’s Equity: The owners’ stake in the company, which can be broken down into:

- Common Stock: The par value of shares issued to investors.

- Retained Earnings: Accumulated profits retained in the business for growth rather than distributed as dividends.

- Additional Paid-In Capital: Extra capital contributed by shareholders over and above the par value of the stock.

So if a company has $1 million in assets, and $400,000 in liabilities, the remaining $600,000 is equity.

To put all of this in simpler terms, a classified balance sheet gives an overview of a company’s:

- Resources

- Obligations

- Ownership

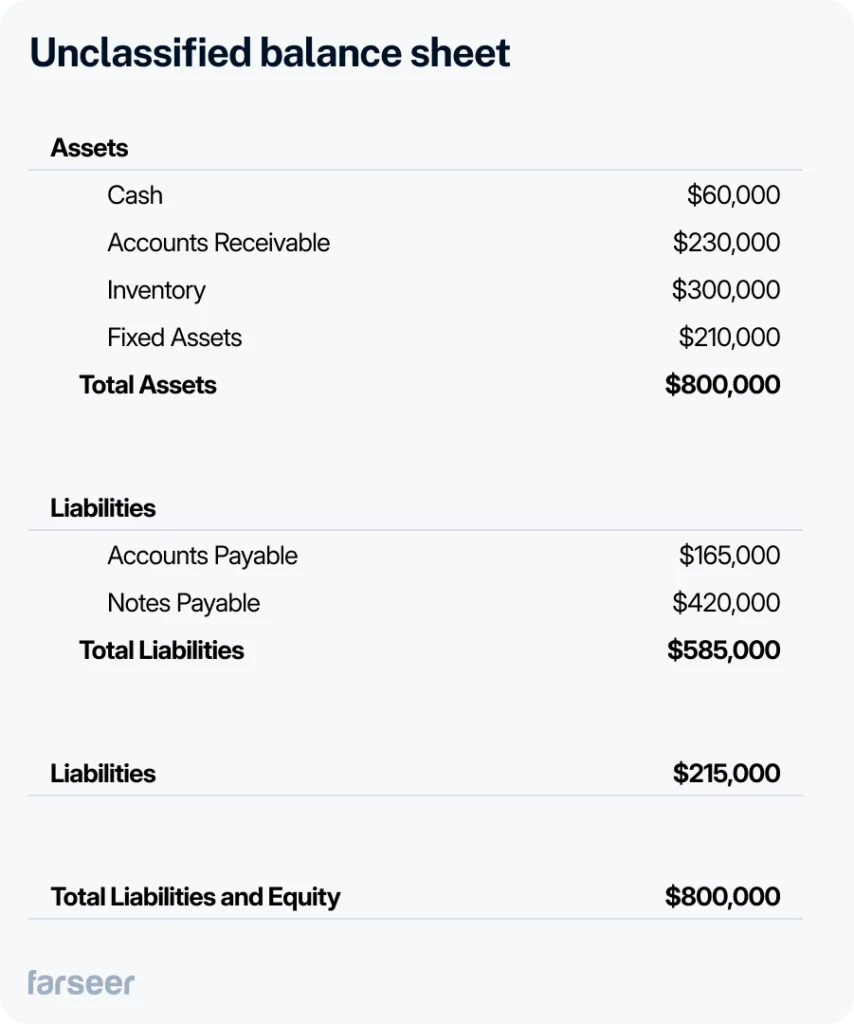

Classified vs Unclassified Balance Sheet

A classified balance sheet and an unclassified balance sheet present a company’s financial position differently. Here’s how they’re different:

- Structure and organization: A classified balance sheet organizes assets and liabilities into subcategories, such as current and non-current, to provide a clearer, more detailed view of a company’s financial status. An unclassified balance sheet, however, doesn’t break assets, liabilities, and equity into subcategories. It lists them as single totals.

- Readability and analysis: When you have everything divided into categories like on a classified balance sheet, it’s much easier to analyze liquidity, solvency, and financial structure. An unclassified balance sheet is simpler, but offers much less insight and is, therefore, more difficult to use for an analysis.

When to use each format

- Classified Balance Sheet: This format appears commonly in formal financial reporting, where it’s extremely important to be as transparent as it gets for investors, analysts, and lenders who need to assess a company’s operational health.

- Unclassified Balance Sheet: An unclassified balance sheet offers a quicker overview with little detail and is usually used by smaller businesses or for internal use. This format may work better when the focus is on simple record-keeping or when detailed financial analysis isn’t necessary, such as in informal reports or small business settings.

Conclusion

If we have to choose between a classified and an unclassified balance sheet – the classified one will be more useful in almost any scenario. When you have a categorized overview of your business assets, liabilities, and equity, it’s much easier to get a picture of a company’s financial state, you can find specific info in a matter of minutes and potential problems are easy to spot. On the other hand, if you’re looking for just a quick report about your business performance, an unclassified variant can also do since it’s easily digestible.

Whichever the case – a correct balance sheet is a must, and what can help you in maintaining accuracy are tools like Farseer. It helps you track assets, liabilities, and equity without hustle, removing the need for manual entries. If you’d like to give it a try, feel free to book a demo with our experts, we’d be happy to provide more info on how to track your financial health better.