Is unearned revenue an asset? It might look like one because the cash is in your account. But is it really yours yet?

Many businesses get this wrong and treat unearned revenue like extra money to spend. In reality, it’s a liability – a promise to deliver something in the future. Misclassifying it can mess up your financial reports, distort cash flow, and cause compliance issues.

Read: A Complete Guide to Financial Statement Analysis for Strategy Makers

Investors, CFOs, and auditors know the truth. If you don’t handle unearned revenue the right way, it can throw off your entire financial picture.

Let’s break it down.

Key Takeaways

- Unearned revenue is a liability, not an asset. You have the cash, but you still owe the customer.

- Recognizing revenue too early can mess up your financials. It must be recorded over time to stay compliant.

- Misclassifying unearned revenue can mislead investors. It can make your company look more profitable than it really is.

- Failing to track unearned revenue can cause cash flow problems. Spending it too soon can leave you short later.

- Using a revenue recognition schedule keeps things accurate. Automating the process helps avoid mistakes.

Managing unearned revenue the right way keeps your financials clean, your cash flow steady, and your business on solid ground.

What Is Unearned Revenue?

Unearned revenue, also called deferred revenue, is money received before delivering a product or service.

Why is Unearned Revenue a liability?

When a business gets paid upfront, it owes the customer something – a product, a service, or access to something over time. Until it delivers, that money isn’t truly earned and sits on the balance sheet as a liability.

Examples of Unearned Revenue

Here’s how unearned revenue looks in different industries:

- Manufacturing: A company gets a 50% deposit for a custom-built machine.

- Professional Services: A consulting firm collects $100,000 in retainers before starting work.

- Energy & Utilities: A business prepays for six months of electricity.

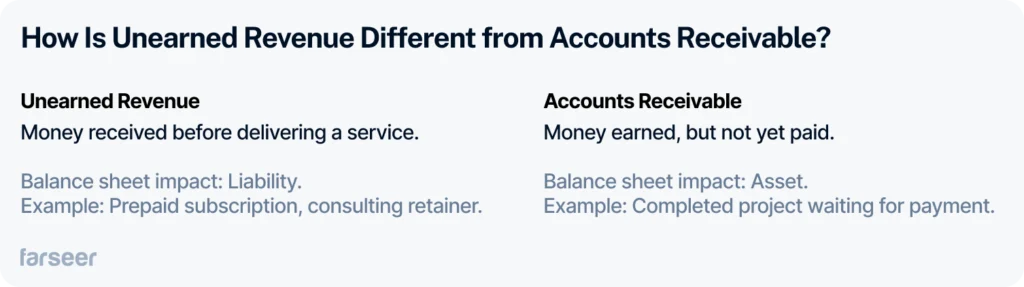

How Is Unearned Revenue Different from Accounts Receivable?

Many businesses confuse unearned revenue with accounts receivable, but they are opposites. Unearned revenue means you got paid before delivering, while accounts receivable means you delivered but haven’t been paid yet.

Is Unearned Revenue an Asset?

No – it’s a liability.

Some businesses think unearned revenue is an asset because they already have the cash. But an asset is something the company owns, while unearned revenue is money the company owes. Until it delivers the product or service, it stays on the balance sheet as a liability.

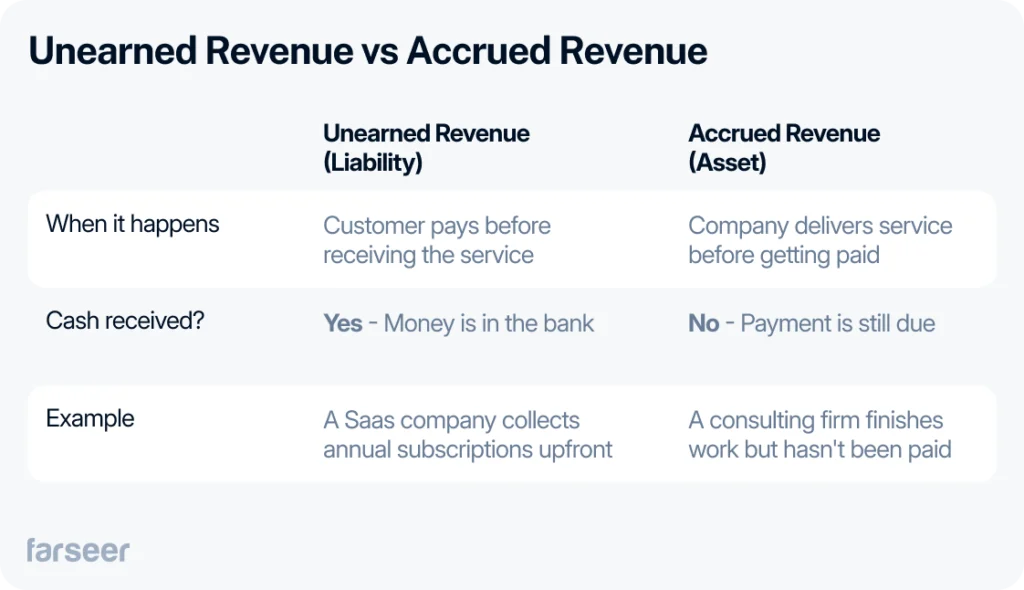

Unearned Revenue vs. Accrued Revenue

People often mix up unearned revenue and accrued revenue, but they work in opposite ways. Unearned revenue means you got paid before delivering. Accrued revenue means you delivered but haven’t been paid yet.

Example: A law firm collects $500,000 upfront for a 12-month contract. Since the firm hasn’t provided the service yet, it can’t count the full amount as revenue. Instead, it recognizes $41,667 per month ($500,000 ÷ 12) as it delivers the service.

Want to learn more? Read our guide on Accrued Revenue and how it differs from unearned revenue.

How to Record Unearned Revenue in Accounting

When a company gets paid before delivering a service, it can’t count that money as revenue yet. Instead, it records it as unearned revenue (a liability) and moves it to revenue over time as it fulfills its obligation. Here’s how that works:

Step-by-Step Journal Entry Example

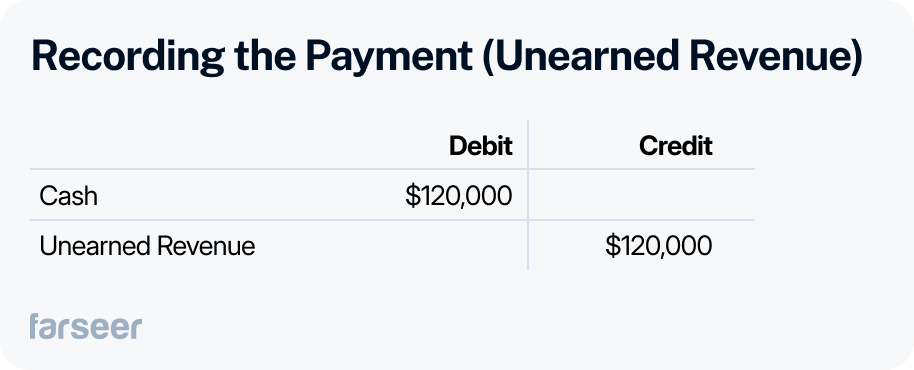

Here’s a scenario: A company signs a 12-month consulting contract and gets paid $120,000 upfront. Since it hasn’t done the work yet, it records the full amount as unearned revenue.

1. Recording the Payment (Unearned Revenue)

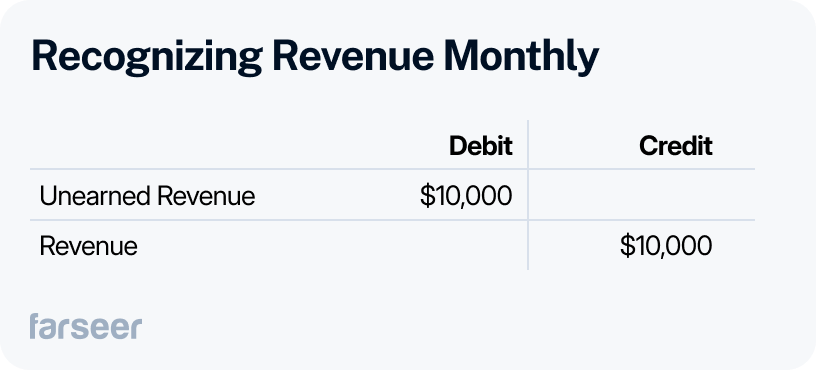

2. Recognizing Revenue Monthly

Each month, the company earns $10,000 ($120,000 ÷ 12) and moves that amount from unearned revenue to revenue.

This process repeats every month until the contract is complete.

Is Unearned Revenue a Debit or Credit?

- When recorded, it’s a credit because it’s a liability.

- As the company earns the revenue, it debits unearned revenue and credits revenue.

How This Affects Forecasting

Recognizing revenue over time affects cash flow and budgeting. If a company spends too aggressively after receiving upfront payments, it can run into trouble later.

How Unearned Revenue Affects Financial Statements

Unearned revenue doesn’t just sit on the balance sheet, it affects cash flow, profitability, and financial ratios. If you don’t track it correctly, it can make your company look more profitable or liquid than it really is.

Balance Sheet Impact

Unearned revenue is a liability because the company still owes a product or service.

- If the company will deliver within 12 months, it’s a current liability.

- If it takes longer than a year, it’s a long-term liability.

As the company delivers, unearned revenue moves from liabilities to revenue on the income statement.

Income Statement Impact

Revenue is recognized over time, not all at once. This prevents inflated earnings and keeps financial reports accurate under ASC 606 and IFRS 15.

Cash Flow Statement Impact

Unearned revenue increases cash flow when received, but that money isn’t free to spend. Businesses that don’t plan for this can run into liquidity problems later.

Example: How Unearned Revenue Moves Through Financial Statements

A software company sells a $240,000 annual subscription and collects full payment upfront. Here’s what happens:

When the Payment Is Received (January 1st):

- Balance Sheet: Cash increases by $240,000, and unearned revenue (liability) increases by $240,000.

- Income Statement: No revenue yet.

- Cash Flow Statement: The $240,000 appears in operating cash flow.

Each Month (February – December):

- Balance Sheet: Unearned revenue decreases by $20,000 per month ($240,000 ÷ 12).

- Income Statement: The company recognizes $20,000 in revenue.

- Cash Flow Statement: No change—cash was received upfront.

By year-end, all $240,000 has been recognized as revenue, and unearned revenue is zero.

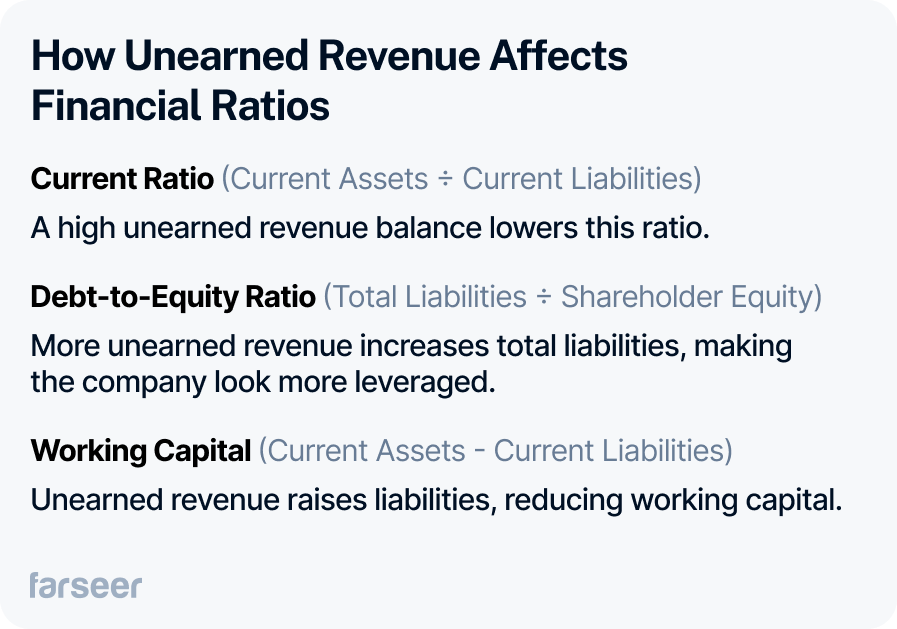

How Unearned Revenue Affects Financial Ratios

Since unearned revenue increases liabilities, it impacts liquidity and leverage ratios:

Common Accounting Mistakes & Best Practices

Handling unearned revenue incorrectly can lead to misleading financials, cash flow problems, and compliance risks. Here are the most common mistakes – and how to avoid them.

Common Mistakes

- Recognizing revenue too early – Violates IFRS 15 and ASC 606, leading to inaccurate financial statements. This also breaks the expense recognition principle, which requires matching revenue with related costs.

- Misclassifying unearned revenue as an asset – Creates overstated profitability and distorts balance sheets.

- Ignoring cash flow impact – High unearned revenue can inflate cash balances, making companies spend money they haven’t truly earned.

- Not separating short-term vs. long-term liabilities – Failing to classify unearned revenue correctly can mislead investors and stakeholders.

Best Practices

- Use a revenue recognition schedule – Track earned vs. unearned revenue to stay compliant and avoid misstatements.

- Separate short-term and long-term unearned revenue – This keeps financial reports clear and prevents liquidity surprises.

- Monitor cash flow impact – High unearned revenue can create false confidence in available cash – always forecast its effect.

- Automate tracking with FP&A software like Farseer – Helps reduce manual errors and provides better visibility into revenue timing.

Farseer helps finance teams track, forecast, and manage unearned revenue with ease. Book a demo to see how it works.