Accrued revenue can be confusing at first glance. Have you ever finished a job and wondered how to handle the money you haven’t been paid yet? If you handle this properly, it can make a huge difference and keep your finances in order. It’s especially important for businesses working on long-term projects or dealing with delayed payments.

Read: A Complete Guide to Financial Statement Analysis for Strategy Makers

But how do you account for it correctly? And how can it impact your financial decisions? This guide will walk you through everything you need to know, with clear examples and practical tips.

What is Accrued Revenue?

Accrued revenue is money you’ve earned but haven’t billed or received yet. It’s common in industries with longer payment cycles, like manufacturing or logistics. For example, a manufacturer delivering parts over several months might record accrued revenue for completed deliveries, even without sending an invoice.

To secure accurate financial reporting, it’s equally important to recognize expenses properly. Learn more by reading: What is Expense Recognition Principle.

It’s all about timing. Accounting standards like GAAP and IFRS require businesses to record revenue when the work is done, not when the payment arrives. It goes on the books if your customer has received the product or service, even if payment is late.

This keeps your financial records accurate and helps you see exactly how your business is doing, especially with big projects or long-term contracts.

Want to know more about how assets are organized? Check out our guide on classified balance sheets.

Clearing Up Common Confusions

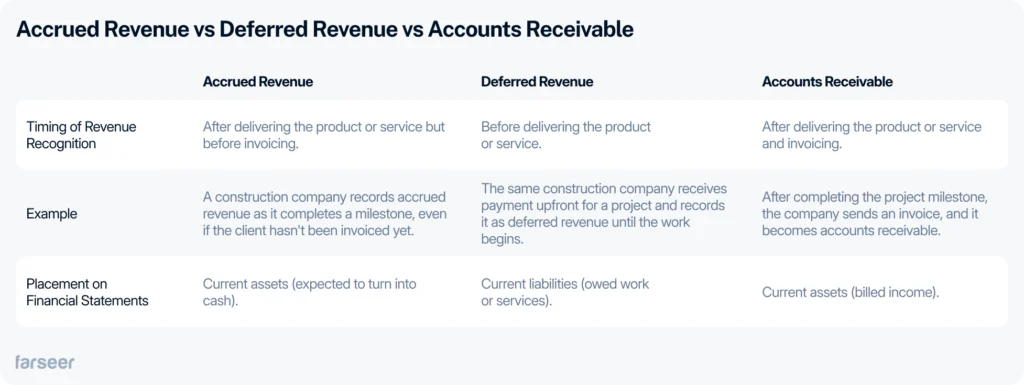

Accrued Revenue vs Deferred Revenue

These two terms are opposites. Deferred revenue is when you get paid before delivering a product or a service.

Example: A supplier might receive an upfront payment for raw materials they’ll deliver later. Until the materials are shipped, that payment is recorded as deferred revenue.

Accrued revenue is the reverse. It’s recorded after you’ve delivered a product or service, even if you haven’t been paid yet.

Example: A construction company might log accrued revenue as each stage of a building project is finished, even if the invoice hasn’t gone out yet.

Accrued Revenue vs Accounts Receivable

Accounts receivable and accrued revenue are easy to confuse, but the key difference is timing. It is recorded when you’ve delivered a product or service but haven’t invoiced the customer yet.

Accounts receivable comes next, after the invoice is sent. It represents money your customers owe you once they’ve been billed.

Example: A logistics company will record accrued revenue as they complete part of a shipment. Once they actually send the invoice for the completed miles, it becomes accounts receivable.

For more details on managing accounts receivable, check out our guide.

Is Accrued Revenue an Asset or Liability?

Accrued revenue is an asset because it reflects money owed to your business for work you’ve already completed. It’s recorded under “current assets” on the balance sheet, alongside items like cash and accounts receivable, because it’s expected to turn into cash within the near term (a year).

Unlike liabilities, which represent what your business owes, accrued revenue represents value your business has already earned and will collect soon. By including it as a current asset, your financial statements provide a complete picture of your short-term financial health.

Learn about what qualifies as a current asset here.

How to Record Accrued Revenue

Recording accrued revenue properly is key to keeping your financial statements accurate.

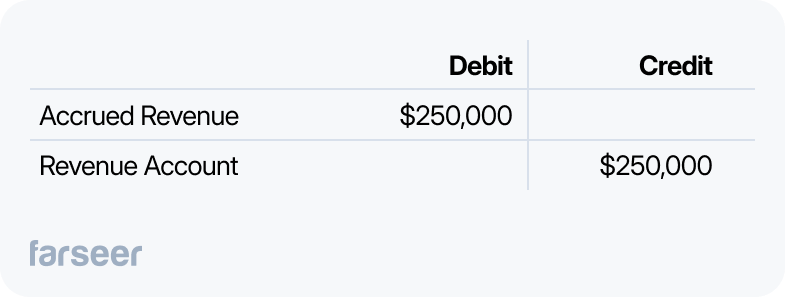

When you’ve delivered a product or service but haven’t sent an invoice, you record accrued revenue to reflect what you’ve earned. To do this, debit accrued revenue to increase your current assets and credit revenue to show the income you’ve earned.

For example, if a construction company completes 25% of a $1M project, they would record $250,000 as accrued revenue. The journal entry would look like this:

This way the value of the work done is reflected in your financial records, even if the client hasn’t been billed yet.

Reversing Entries and Why They Matter

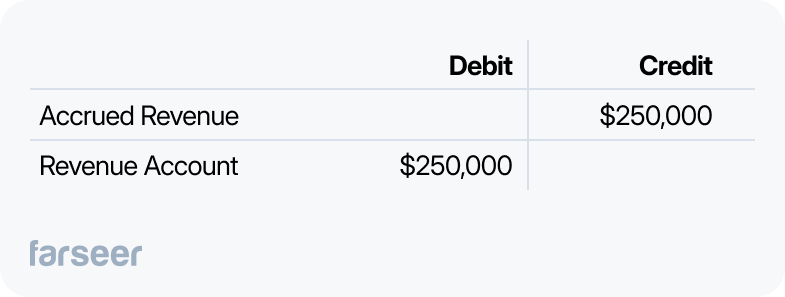

Once you send the invoice, you need to reverse the accrued revenue entry to avoid counting the income twice. To reverse it, credit accrued revenue to reduce the asset and debit revenue to remove the original entry.

Using the same construction company example, after invoicing the client for the $250,000 milestone, the reversing entry would look like this:

Reversing entries help keep your books clean and accurate, by only counting income once. This is especially important for businesses managing multiple projects or billing cycles, where financial reporting needs to stay organized.

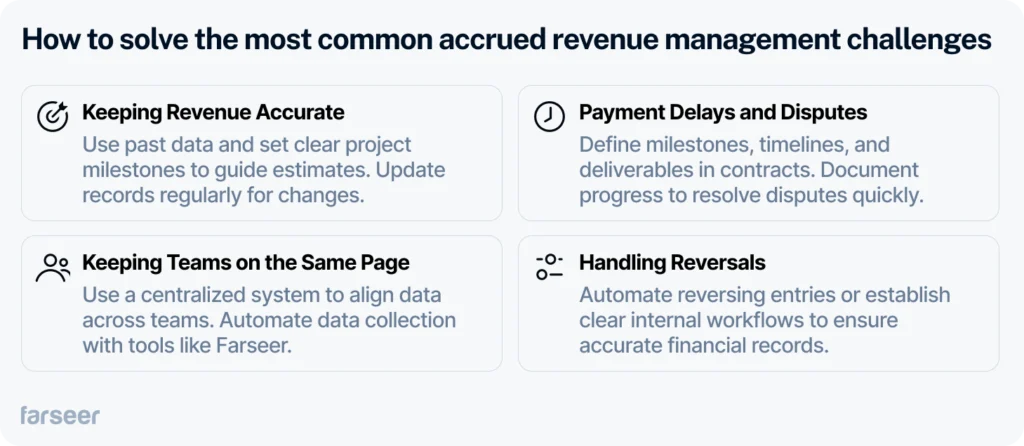

Challenges in Accrued Revenue Management (and How to Solve Them)

Managing accrued revenue isn’t always simple. Here are the most common issues businesses face and how to handle them.

Keeping Revenue Accurate

Getting your revenue numbers wrong can mess up your financial reports. If you overestimate, your income looks better than it is. If you underestimate, it hides your real performance. To stay accurate, use historical data and clear project milestones. When projects change, like extra work or delays, update your records to reflect the latest situation. Forecasting tools can make this process faster and more reliable.

Dealing with Payment Delays and Disputes

Late payments or disagreements over what’s been delivered can throw off your records. Clear contracts with well-defined milestones, timelines, and deliverables can prevent most issues. Keep detailed records of progress so you can quickly resolve disputes and keep your financials on track.

Keeping Everyone on the Same Page

When different teams, like finance, sales, and operations, work with disconnected data, mistakes can happen. A centralized system helps ensure everyone is using the same numbers. Tools like Farseer can automate this process, making data collection faster and more accurate while cutting down on manual work.

Getting Reversals Right

If you don’t reverse accrued revenue properly after sending an invoice, it can lead to double-counting. Automating this process or setting clear internal timelines makes transitions smooth and keeps your books clean.

Why Managing Accrued Revenue Matters

Accrued revenue plays a big role in maintaining financial health of the company. Here’s why you should manage it carefully:

Better Cash Flow Visibility

Knowing what’s owed to you gives a clearer picture of your short-term financial health. This helps you plan for expenses, avoid cash shortages, and make better business decisions. Managing accrued revenue properly also improves liquidity ratios, showing how well your business can meet short-term obligations. Learn more about liquidity ratios here.

Stronger Financial Forecasts

Accrued revenue shows the true value of the work you’ve done, even if the cash hasn’t come in yet. This is key for businesses with changing costs, like automotive or logistics. When you forecast accurately based on earned revenue you can make smarter decisions for the future.

Easier Compliance and Audit Preparation

Standards like IFRS 15 and ASC 606 require businesses to record revenue correctly. Good management keeps your books compliant and ready for audits. It also helps address the limitations of balance sheets in reflecting the real-time financial health of your business. Read more about these limitations here.

Conclusion

Accrued revenue is a key part of keeping your finances accurate and your business on solid ground. Tracking what you’ve earned but haven’t been paid for helps you stay on top of cash flow, plan better, and meet accounting standards without stress.

By understanding how to record accrued revenue, handle challenges, and avoid common mistakes, you can keep your financial records clean and make smarter decisions for the future. It’s not about making things complicated, but keeping your business on track.

If you’re ready to make managing accrued revenue easier, check out how Farseer can help.