You can have a rock-solid finance team and strong leadership – cash flow forecasts still find a way to go off track. It’s more common than you’d think – and it’s not just about getting a number or two wrong. A bad forecast can mean:

- missed growth opportunities

- late payments

- or betting on the wrong priorities because the data wasn’t there when you needed it.

When your forecast is off, the whole business feels it.

Read: Rolling Forecast – 101 Guide For Smarter Planning

In this post, we’ll look at why this keeps happening, what a reliable forecast actually looks like, and what you can do right now to start getting it right – without going back to square one and starting from scratch.

4 Real Reasons Cash Flow Forecasts Fail

Fragmented data

Forecasting is often based on inputs from various systems – ERP, Excel, business intelligence tools, maybe even emails and shared drives. The problem is, these systems rarely speak the same language. Data comes in different formats, at different times, and the worst part – it’s questionable how accurate they are.

This makes it hard to get a clear, up-to-date picture of the state of your cash. To add up, teams waste a ton of time figuring out ways to reconcile these numbers instead of analyzing them. Without a single source of truth, it’s almost impossible to run accurate cash flow forecasts as fast as a business might need.

Manual processes

When forecasts are built and updated manually, and it usually happens in spreadsheets, the risk of errors and outdated numbers grows with every new cycle. Small mistakes, like a copied formula or a delayed input, can turn into major issues in the end. More importantly, the time spent updating and double-checking numbers is time not spent analyzing or scenario planning.

Manual workflows also make it really hard to react fast. If something changes in the middle of the month – a delivery gets delayed or a big client doesn’t pay on time – adjusting the forecast quickly becomes a logistical headache. Sometimes, just pulling a quick ad hoc report is the fastest way to get clarity and keep things moving. Finance ends up reacting to problems instead of staying ahead of them.

Read 7 Reasons Why Forecasting is Important For Your Business

No operational input

A cash flow forecast is only as accurate as the data behind it. But in many cases, finance is working in a vacuum, without input from key departments like sales, procurement, and production. Either the data isn’t shared at all, or it’s shared in a format that doesn’t fit the model.

That gap creates a disconnect between what the forecast says and what’s actually happening on the ground. For example, if sales adjusts their targets or procurement delays a large order, and finance doesn’t hear about it in time, the forecast instantly becomes outdated. Without input from other teams, forecasts are based on guesses, not real data.

Static forecasting models

Traditional forecasting models are built for stable conditions. But a business rarely stays still. Markets shift, costs change, and unexpected events can disrupt even the most well-prepared plan. Monthly or quarterly forecasts, especially when kept in spreadsheets, can’t keep up with that pace. They become outdated fast, often before the month is over.

When your model can’t adjust quickly, it’s hard to spot risks or respond to changes. You end up reacting too late, which can lead to cash flow problems – especially when things are moving fast.

How to Start Improving Your Cash Flow Forecast Today

Change doesn’t always include big, monumental things. Start small with steps like:

Audit your data

Start by auditing your data. Take a step back and look at what’s fragmented or siloed, and see where the bottlenecks are. It’s easy to overlook where things are getting stuck, but if your data’s incomplete or hard to access, you’re definitely going to get inaccurate forecasts down the line. Cleaning up and organizing this data is critical. Think of it as laying a solid foundation – without it, any forecasting model you build will likely be shaky, even if the rest of the process is flawless

Build a lean forecasting model

Don’t overcomplicate things with variables that don’t mean anything for your business, prioritize real operational drivers – and make sure your forecasting tool supports them without extra noise or complexity. For example, track metrics like units sold, collection delays, supplier payment terms – or even validate pricing logic with a quick profit margin calculator. McKinsey has shown that companies that focus on a small number of core drivers in their forecasting models see significantly better accuracy and faster response times during volatile periods.

Still working in spreadsheets? Try our free monthly cash flow template in Excel. It’s structured for versioning, actuals vs. forecast comparisons, and monthly planning – a solid base before moving to more advanced forecasting tools.

Engage operational teams

It’s also important to engage your operational teams early and often. An easy way to keep things consistent is to use simple templates and just check in with the team once a month. Operational teams, such as sales or procurement, often have valuable insights that can have a huge impact on your forecast accuracy. If you involve them regularly, you not only get more reliable data but also foster a collaborative environment where everyone feels invested in the forecasting process.

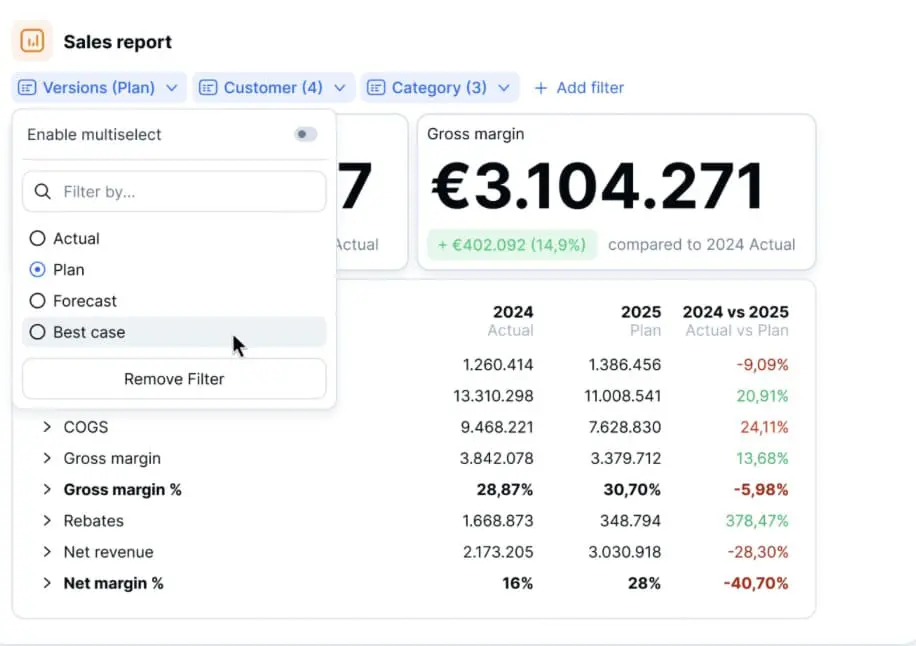

Add scenarios

Lastly, consider adding different scenarios to your forecasts – best-case, worst-case, and something in between. This helps stakeholders clearly see the range of possible outcomes and better understand the risks and opportunities ahead. It’s not just about planning for what you think will happen, but being ready for what could happen.

This is also where AI really shines. Modern forecasting tools powered by AI can quickly generate multiple scenarios based on real-time data and evolving trends, making it easier to stress-test your assumptions and spot issues early. And not just that – according to research, AI-driven models reduce forecast error rates by up to 50% over traditional methods.

Quick win: Automate your AP/AR cash inflows and outflows. These typically cover the majority of short-term liquidity. Automating just a part of the process can take a lot of the manual work off your plate and give you a much clearer view of your cash flow.

Key takeaways

- Forecasts fail due to: fragmented data, manual processes, lack of operational input, and static models.

- Reliable forecasts include: real-time data, rolling updates, cross-team input, and scenario planning.

- Fix it by:

- Auditing and cleaning data

- Building a lean model with key drivers

- Involving ops teams

- Adding scenarios with AI