Profitability planning is an important process of estimating and optimizing a company’s expected profit based on revenue projections, cost structures, and operational drivers. A good profitability plan goes beyond budgeting expenses or forecasting sales, giving finance leaders the visibility and control they need to lead the business.

It connects the dots between different departments helping you understand where your business really makes money.

Profitability planning is a continuous process that helps answer questions like:

- Which products are dragging down margins?

- Are we profitable across all sales channels?

- What happens to profitability if raw material prices increase by 10%?

In this blog, we’ll explain why it matters, the common pitfalls to avoid, and the four key things to focus on if you want to get it right.

Read more: Strategic Financial Planning That Actually Drives Results

Why Profitability Planning Is A Must

Your business can grow while you are losing money.

Yes, you read that correctly.

Revenue alone doesn’t tell a lot.

What matters is how revenue, costs, and operational decisions come together to produce real profit, and that’s where profitability planning helps.

A good profitability plan enables finance teams to:

- Track profit by product, customer, region, or channel, not just at the top-line level.

- Simulate different scenarios (e.g., price increases, cost inflation, sales volume drops) and understand their impact on the bottom line.

- Align departments – (sales, operations, production) around the same financial targets, reducing internal friction.

- Make faster, fact-based decisions – especially when the business is under pressure or uncertain.

But, knowing all this sometimes just isn’t enough.

Common Challenges and Pitfalls in Profitability Planning

Here are some of the most common problems that even experienced finance teams run into when building profitability plans:

Siloed and Fragmented Data

Sales has one version of the truth, production another, and finance is stuck in the middle trying to make sense of both.

Without a centralized planning model, it’s nearly impossible to get an accurate view of what’s actually driving profit. According to the State of Finance 2026 report by Farseer, 38% of finance leaders cite data quality and disconnected processes as their top FP&A challenge — proving that profitability planning often breaks down long before the numbers even reach the P&L.

For example, if discounts applied by sales teams aren’t reflected in the financial plan, gross margin projections will be off, often by a lot.

Overreliance on Spreadsheets

Most SMB’s and even large businesses still do profitability planning in Excel. When a finance team is handling hundreds of SKUs, multiple regions, and variable cost structures, spreadsheets become a pain and difficult to scale. A lot of manual inputs, disconnected sheets and entire process can lead to delays and inaccuracies.

Read more: Why AI in Forecasting Beats Spreadsheets

Static Planning

Markets change, so do input costs, FX rates, and customer behavior. Yet many companies still build one static annual plan and hope for the best. Without the ability to run quick “what-if” scenarios or adjust plans mid-year, you risk flying blind when something unexpected happens, like a supplier price hike or regulatory shift. Static approaches often confuse profitability planning with capital budgeting.

Read more: Best Capital Budgeting Software: Tools That Go Beyond Approvals

Planning at the Wrong Level

Profitability planning that only happens at the department or cost-center level misses the details that actually matter. You need to plan by product line, customer segment, region, or sales channel, depending on your business model. If you don’t, it’s easy to miss unprofitable pockets or cross-subsidization between units.

So how do you avoid these issues and build a profitability plan that actually works?

Let’s break it down into four key actions that keep planning efforts on track.

Read more: The CFO’s Guide to Profitability Analysis Software (+Tool Recommendations)

4 Critical Actions for Effective Profitability Planning

Getting profitability planning right requires a few bulletproof actions. These four actions are what separate high-performing finance teams from those stuck in reactive mode.

Link Planning to Operational Drivers

Profitability planning doesn’t start in the general ledger. It starts in operations and with the actual business drivers that impact margins daily:

- Units sold

- Channel-level pricing

- Discount strategies

- Material and production costs

- Supply chain lead times

These are the inputs that will help you shape your financial outcomes. Too often, they’re disconnected from the planning model, and this disconnect leads to planning in a vacuum, and inaccurate forecasts.

Why it matters

You can’t model profitability realistically without incorporating operational logic. For example:

- If your sales team adjusts pricing by region but finance uses an average price per unit, margin forecasts will be off.

- If production capacity or lead times aren’t factored in, planned volumes may be impossible to meet, leading to stockouts or overproduction.

- If procurement negotiates a 3% reduction in raw material costs, but it’s not reflected in the plan, you miss opportunities to improve EBITDA.

Driver-based planning solves this by tying financial projections to operational assumptions, making your forecast dynamic, not static.

Keep in mind that the finance must own the model, but it must be built on operational inputs. You don’t need to model every cost per screw or SKU, but you do need to reflect how value is created and cost is incurred in your business.

Start by identifying the top 5 to 10 drivers that influence margin in your business model. Then build your financial plan around them, not the other way around.

Centralize Your Data

Profitability planning falls apart when every department runs its own version of the truth.

Sales has one forecast. Operations have a different production plan. Finance is left cleaning up the inconsistencies, and usually in spreadsheets.

If planning data isn’t centralized in a single, shared model, you’ll waste time reconciling inputs instead of analyzing outcomes. Worse, strategic decisions will be based on mismatched assumptions.

Why it matters

Without centralized planning data:

- Gross margin forecasts become unreliable

- Scenario planning takes days instead of minutes

- Inter-departmental trust breaks down, and finance gets stuck mediating

According to FSN’s Global Survey, 69% of finance professionals report that their data is not fully aligned across departments, making it one of the top barriers to effective decision-making.

A shared planning model doesn’t mean everyone uses the same tool. It means all inputs flow into one version of the plan, a dynamic, living model that reflects current assumptions.

Start by integrating data sources:

- Sales pipeline (CRM)

- ERP (actuals and production data)

- Marketing spend

- Supply chain forecasts

Then align business owners to feed updates into a single platform, not across 15 spreadsheets and email threads.

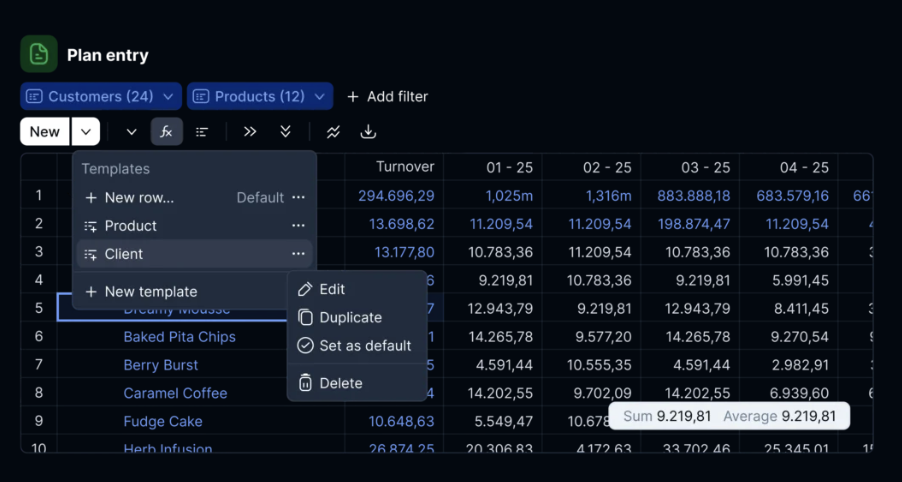

Plan at the Right Level of Detail

Department-level planning gives you a budget. But if you want to understand profitability, you need to go deeper, by product line, customer segment, sales channel, or even SKU.

You can hit your department’s budget target while still leaking profit from unprofitable products or customers. Without detailed planning, you’re not optimizing – you’re averaging.

Why it matters

Profitability planning requires visibility into how and where value is created, and where it’s lost. Aggregated views hide margin dilution, price erosion, and operational inefficiencies.

According to PwC, 71% of CFOs believe that better granularity in planning would improve their ability to identify underperforming areas and optimize resource allocation.

The “right” level of detail depends on your business model, but a good rule of thumb is this: Plan and analyze profit wherever cost or revenue materially differs.

Focus on:

- Product categories with varying production or shipping costs

- Channels with different discount structures

- Customer groups with distinct service levels or payment terms

- Geographies with local taxes, logistics costs, or FX exposure

You don’t need to model everything, just the parts that change your margin story.

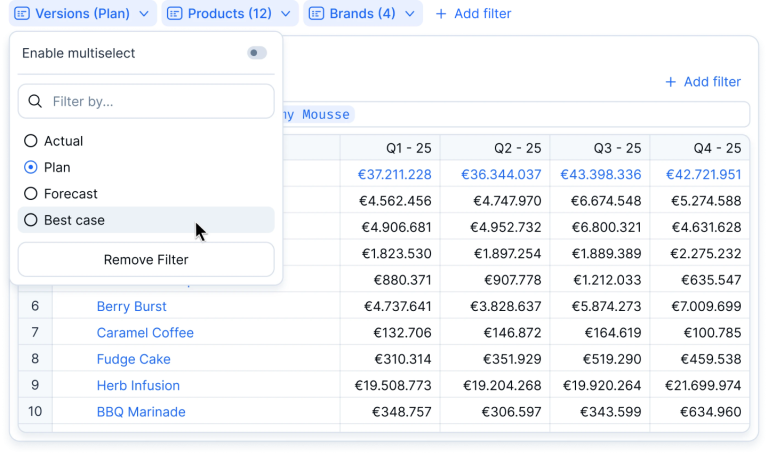

Run Scenarios, Don't Just Stick to One Plan

Markets shift fast: raw material prices increase, FX rates fluctuate, customer orders slow down. If your profitability plan relies on a single forecast, you’re not planning, you are reacting.

Scenario planning gives you options. It allows you to simulate changes in key drivers and see how they affect gross margin, EBITDA, or cash flow, before they hit the P&L.

Why It Matters

When Shell’s upstream business faced economic uncertainty in 2020, they didn’t just revise the budget. They modeled multiple profitability scenarios. These included:

- A “Short & Sharp” V-shaped recovery

- A “Deeper & Longer” U-shaped downturn

- Multiple stress-tested cases with oil price and demand shocks

By tying capital allocation, margin, and free cash flow to operational triggers, they defined clear actions to take under each condition, not weeks later, but immediately.

For high-performing teams scenario planning isn’t about predicting the future it’s about preparing for it:

- Build three versions of the profitability plan: base, best, and worst

- Tie assumptions to operational drivers, not just percentages

- Set triggers for each scenario, e.g. +10% material cost or -5% sales volume

- Use shared models, so changes cascade automatically across P&L and cash flow

- Review scenarios regularly: not just at year-end

When scenario planning is integrated into profitability planning, you’re not reacting to change, you’re managing it.

Plan for Profit, Not Just for The Planning Sake

At the end of the day profitability planning isn’t just another finance exercise but a business-critical process connecting strategy with execution. But it only works if:

- Operational drivers are linked to the plan

- Data is centralized and current

- Plans are detailed and scenario-based

- The process is built for collaboration, not just compliance

So, if you still rely on fragmented spreadsheets or static budgets, it is time to rethink them. The faster you and your team can move from reporting the past to planning the future, the stronger your business position will be.

Đurđica Polimac is a former marketer turned product manager, passionate about building impactful SaaS products and fostering connections through compelling content.