Pigment competitors are becoming an attractive option in the FP&A space, as Pigment – while popular – often isn’t the right fit for finance teams that need speed, flexibility, and a reasonable price tag.

Many mid-market companies share the same feedback:

- It’s pricey – often out of reach for mid-market companies.

- Takes time to learn – business users need a lot of training or outside help to get the most out of it.

- AI feels more hype than help – features look good on paper but aren’t delivering real day-to-day impact yet.

- You’ll need partners to set it up – which means higher costs and longer timelines.

- Built for bigger, slower teams – not exactly a natural fit for lean, agile finance departments.

Read FP&A Software for Modern Finance Teams: Compare the Best Tools in 2026

For manufacturing, pharma, FMCG, and other complex industries, Pigment often ends up being more software than they actually need, and at a price that’s hard to justify.

If you’ve recognized yourself in one of these points and are looking for an alternative, here’s a list of 6 Pigment competitors that may do the job better or in a way that actually fits how your team works.

Anaplan - Powerful but Complex

Anaplan, one of Pigment competitors, remains one of the most recognized heavyweights in enterprise planning, with the scale and flexibility to handle some of the world’s most complex financial and operational models. It’s a go-to for large, global organizations that require deep, multi-scenario planning, real-time collaboration across hundreds of planners, and sophisticated data modeling across multiple entities and geographies.

Anaplan strengths

- Highly customizable: Can be adapted to almost any business process or planning scenario, from sales to supply chain to finance.

- Excellent for multi-entity consolidation: Handles intercompany eliminations, currency conversions, and cross-border reporting with ease.

- Massive partner ecosystem: A large network of consultants and implementation partners to support global rollouts.

Anaplan limitations

- High implementation costs: Significant investment in both software and external consulting.

- Long timelines: Large, complex deployments can take many months or even years to fully implement.

- Specialized expertise required: Building and maintaining models often needs dedicated Anaplan-trained staff or long-term consultant support.

- Overkill for mid-market: The scale and complexity can be far more than mid-sized finance teams actually need, leading to underused features and higher-than-necessary costs.

Pricing

Starts at around $200,000 per year. The final cost depends on company size, model complexity, and support needs.

Read Anaplan Competitors – The 6 Best Alternatives for Enterprise FP&A

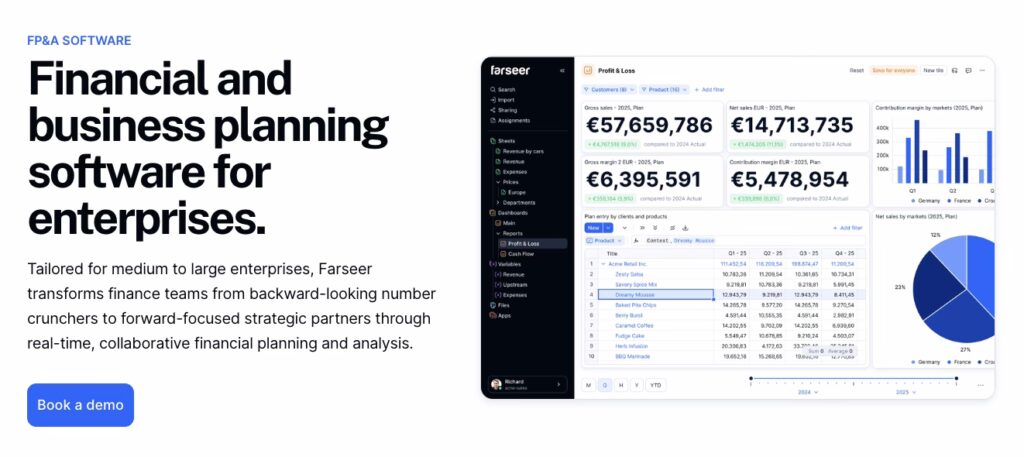

Farseer - Enterprise-Grade Modeling Without the Overhead

Farseer delivers enterprise-level planning power in a package built for speed, flexibility, and control. Furthermore, with a superior calculation engine for ML forecasting, top-down and bottom-up planning, and instant what-if simulations, finance teams can model anything from operational plans to consolidated P&Ls, balance sheets, and cash flows – all without IT dependence.

The spreadsheet-native interface makes it intuitive from day one, while the robust modeling capabilities mean you never outgrow the platform.

Farseer strengths

Everything Pigment makes harder, Farseer makes easier, and it goes beyond that with features purpose-built for agile finance teams.

First, price that makes sense: Designed for mid-to-large companies, Farseer delivers enterprise-level planning power without enterprise-level pricing.

Second, it’s easy to pick up: Spreadsheet-native modeling means finance teams already know how to use it. No new syntax, no steep learning curve.

In addition, a superior calculation engine supports ML forecasting, top-down and bottom-up planning, and instant what-if simulations so you can test scenarios in seconds.

Moreover, it covers the full planning spectrum: From operational planning to all three major financial reports (P&L, balance sheet, cash flow), even in a consolidated form, so you can manage the entire planning cycle in one platform.

Instead of hype, Farseer stays practical: Every feature is designed to solve day-to-day planning problems, from speeding up forecasts to centralizing data, rather than chasing trends.

On top of that, setup is fast and in-house: We get customers live in weeks, without heavy reliance on external partners. That means less cost and more control.

Finally, it’s built for agile finance teams: Farseer is light, flexible, and designed for teams that need to move quickly without IT bottlenecks.

Farseer limitations

- Primarily focused on mid-to-large companies: May not be ideal for very small teams with simple planning needs.

- Best fit for spreadsheet-comfortable users: Teams wanting a completely different, non-spreadsheet interface might prefer other tools.

Pricing

Starts at $20,000 per year, based on team size and features.

Workday Adaptive Planning - Strong HR + Finance Alignment

Workday Adaptive Planning, one of Pigment competitors, is a natural fit for organizations that already run on the Workday ecosystem, particularly those that want to align workforce planning closely with financial planning. Its cloud-native architecture makes it accessible anywhere, and it’s well-suited for companies that value smooth integration between HR data, headcount planning, and broader financial models.

Workday Adaptive strengths

- Seamless integration with Workday HCM and Financial Management: Ideal for aligning people plans and budgets in one environment.

- Cloud-native platform: Accessible from anywhere, without the need for complex on-premise infrastructure.

- Good for workforce-heavy industries: Particularly relevant for service-based organizations or large HR teams that need to model headcount changes quickly.

Workday Adaptive limitations

- Less flexible for unique processes: While strong in standard planning scenarios, it can be restrictive for companies with highly specific or non-standard workflows.

- Medium implementation speed: Faster than heavy enterprise tools like Anaplan, but not as quick as lighter, more agile solutions such as Farseer.

- Best suited for existing Workday customers: Integration advantages drop significantly if you’re not already on Workday HCM or Finance.

Pricing

Starts at around $50,000 per year, depending on user count and feature set.

Board - Unified BI and FP&A in a Single Platform

Board, one of Pigment competitors, combines business intelligence, performance management, and FP&A in one platform. This “all-in-one” approach appeals to companies that want to analyze, plan, and report without juggling multiple tools. It’s especially popular in retail, manufacturing, and distribution, where combining operational metrics with financial data helps drive faster decision-making.

Board strengths

- Single platform for analytics and planning: Reduces the need for separate BI and FP&A tools.

- Good visualization capabilities: Makes it easier for executives and non-finance teams to understand key metrics.

- Multi-language and multi-currency support: Useful for multinational companies.

Board limitations

- May lack depth for specialized FP&A needs: As a jack-of-all-trades, it sometimes can’t match the modeling depth of dedicated planning tools.

- Implementation complexity: Requires careful scoping to avoid bloated or unfocused builds.

- Less intuitive for finance-first users: The interface leans more toward BI dashboards than spreadsheet-like modeling.

Pricing

Pricing starts around $1,250 per user per year and can reach $2,500 or more. Add-ons, consultants, and support drive the total cost up quickly.

Read 5 Best Board Competitors in 2026 With Pros, Cons, and Pricing

Jedox - Familiar for Excel Power Users

Jedox, one of Pigment competitors, offers an Excel-like interface layered on top of a centralized database, appealing to finance teams that want to modernize without abandoning the spreadsheet experience. It’s flexible and can handle a variety of planning and reporting scenarios, but its quality often depends heavily on the partner delivering the implementation.

Jedox strengths

- Spreadsheet-like interface: Shortens the learning curve for Excel-savvy users.

- High flexibility: Can be customized to fit unique business processes.

- Competitive pricing: Often more affordable than larger enterprise tools.

Jedox limitations

- User experience can feel dated: Especially compared to newer cloud-native platforms.

- Implementation quality varies: Success often depends on the skills of the chosen partner.

- Less cohesive ecosystem: Fewer out-of-the-box integrations compared to some competitors.

Pricing

Jedox offers pricing starting from $26 000 per year, on average.

Read Looking for Jedox Competitors? Here Are the 7 Best Options

Oracle NetSuite Planning and Budgeting: Strong ERP Tie-In for Oracle Users

NetSuite Planning and Budgeting (often referred to as PBCS or NSPB) is Oracle’s cloud-based planning solution, tightly integrated with its ERP platform. For companies already running on Oracle NetSuite, it offers a streamlined way to extend financial and operational planning within the same ecosystem. It’s a strong option for organizations that prioritize compliance, data security, and robust ERP-to-planning workflows.

Oracle NetSuite Planning and Budgeting strengths

- Deep ERP integration: Works seamlessly with Oracle NetSuite and other Oracle applications, reducing data transfer headaches.

- Enterprise-grade security and compliance: Meets the needs of highly regulated industries.

- Robust financial consolidation: Handles multi-entity and multi-currency requirements reliably.

Oracle NetSuite Planning and Budgeting limitations

- Heavy implementation: Projects often require significant time, resources, and Oracle-certified consultants.

- Higher total cost: Licensing and consulting fees can add up quickly.

- Slower rollout compared to agile tools: Typically measured in months rather than weeks, which may delay ROI.

- Best for existing Oracle customers: Integration benefits diminish for companies not already in the Oracle ecosystem.

Pricing

Pricing for Oracle NetSuite Planning and Budgeting typically starts from around $1,000 per user per year, with total costs increasing significantly once you factor in modules and implementation, which can run from $30,000 to $300,000 depending on complexity.

Which Pigment Competitor to Choose?

Choosing the right Pigment alternative comes down to more than just ticking boxes on a feature list. It’s about finding a platform that matches your team’s size, processes, and pace of work, without creating unnecessary cost or complexity.

If you’re a large enterprise with a global footprint, tools like Anaplan or Oracle NetSuite Planning and Budgeting might fit your scale, even if they require heavier implementations. For companies already invested in a specific ecosystem, Workday Adaptive Planning or Board can offer tight integration with existing systems. And if you want to modernize while keeping a familiar spreadsheet-like interface, Jedox is worth a look.

But for mid-to-large companies in manufacturing, pharma, FMCG, and other complex industries, Farseer stands out:

- Faster go-live, in weeks, not quarters.

- True self-service, no long-term partner dependency.

- Lower total cost of ownership, fewer outside resources needed.

- Superior calculation engine, ML forecasting, top-down and bottom-up planning, instant what-if simulations.

- Covers the entire planning cycle, from operational detail to fully consolidated financial statements.

In other words: if you want enterprise-grade capabilities without the enterprise-grade overhead, Farseer delivers.

Want to check it out?

FP&A Tool Fit Quiz

Question 1

How complex is your organizational structure?

Question 2

How quickly do you need to implement an FP&A solution?

Question 3

What is your team’s technical profile?

Question 4

What is your primary planning priority?

Question 5

What is your expected FP&A budget?