If you’re still using spreadsheets as your main cash flow forecasting software, you’re not alone. But it’s probably slowing you down.

Manual updates, version chaos, and broken links are fine when you’re small. But at scale, they kill speed and clarity. And when your forecast drives board decisions, hiring plans, or debt coverage, that’s a problem.

Read: FP&A Software – A Practical Guide for Finance Teams

This blog is for finance teams who need a faster, more reliable way to forecast, without relying on IT or waiting weeks for changes.

We’re not covering lightweight dashboards or tools built for small businesses. This is a side-by-side look at six enterprise-grade cash flow forecasting tools that actually solve for complexity: multiple entities, currencies, teams, and scenarios.

What Is Enterprise Cash Flow Forecasting Software?

Enterprise cash flow forecasting software gives you one place to plan, manage, and track cash across your business, without juggling spreadsheets.

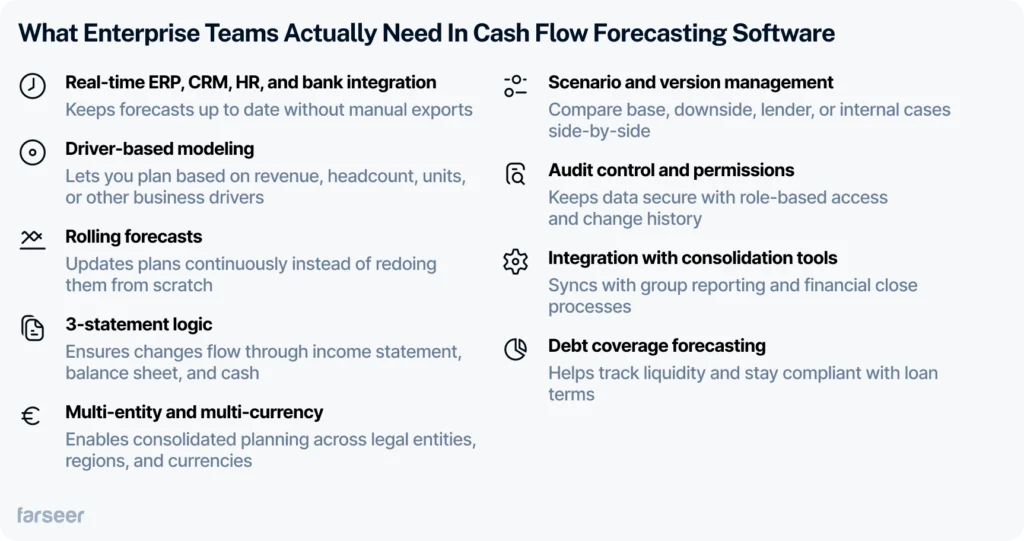

It pulls real-time data from your ERP, HR, CRM, and banking systems. You can build driver-based forecasts, update assumptions in seconds, and track cash flow forecasts across entities, regions, and currencies, all in one model.

The best tools support rolling forecasts, full 3-statement logic, and direct integration with your consolidation and reporting workflows. You can run different scenarios side by side, version forecasts, and get a clear view of working capital or covenant limits.

You stay in control, with audit logs, user permissions, and real-time collaboration that actually works.

This all starts with a solid 3-statement financial model. Top-tier platforms support it out of the box.

Read How to Do a Cash Flow Forecast in Enterprise Environments

Who Needs Enterprise-Grade Cash Flow Forecasting Software?

This type of cash flow forecasting software is built for complex, high-stakes environments where decisions depend on speed, accuracy, and collaboration across teams.

You likely need it if:

- You’re consolidating forecasts across multiple entities, currencies, and business units

- You’re tracking deferred revenue, headcount costs, or project cash flows across regions

- You’re running lender, board, and investor scenarios in parallel, and you need fast answers

- You’re updating forecasts monthly or more, and Excel can’t keep up with changes

- You’re managing liquidity, debt coverage, and working capital targets under pressure

You need software that connects your systems, updates in real time, and helps you adjust plans quickly when things change.

If your cash plan shifts every few weeks, building a rolling cash flow forecast will give you more control than static, annual models.

Top Tools for Enterprise-Grade Cash Flow Forecasting

These are the platforms built to handle complexity: multi-entity, multi-currency, and fast-changing plans, without slowing you down.

Drivetrain

Drivetrain helps companies connect financial and operational data to build forecasts and track performance. It’s built for B2B organizations, especially those with recurring revenue models, and comes with solid integrations, rolling forecasts, and scenario planning.

It supports 3-statement logic, driver-based models, and offers AI-powered insights through features like anomaly detection and natural language queries. The interface is clean and familiar for teams used to spreadsheets.

That said, getting started isn’t always smooth. Some users report spending extra time cleaning their data before going live. Others say certain data transformations need help from Drivetrain’s support team.

Best for: Companies moving from spreadsheets to a connected forecasting tool, especially in B2B SaaS.

Strengths:

- Over 200 pre-built integrations (ERP, CRM, billing, etc.)

- Driver-based forecasting with rolling updates

- Scenario planning and what-if modeling

- AI features for trend spotting and forecasting

- Clean UI that feels familiar

Limitations:

Narrower fit outside B2B SaaS. Some setup steps take time, especially if your data isn’t clean or if you need custom logic.

Pricing: Starts around $24,000 per year, depending on setup and features.

Farseer

Farseer is a modern cash flow forecasting platform built for enterprises with complex planning needs. It combines a proprietary calculation engine and spreadsheet-like interface with an in-memory database for fast calculations, real-time scenario planning, and AI-driven forecasting. It’s part of a newer wave of forecasting software that’s fast, flexible, and finance-owned.

It’s designed to handle indirect and direct cash flow methods, rolling forecasts, and dynamic driver-based models, all without relying on IT or consultants. You can build multi-entity, multi-currency forecasts that stay synced with your ERP, CRM, HR, and billing systems.

Forecasts are versioned, auditable, and easy to adjust, even during reforecasts or last-minute board prep. Many users online praise Farseer’s support and implementation teams.

Best for: Enterprise teams replacing fragmented spreadsheets with a centralized, flexible cash forecasting engine.

Strengths:

- Extremely fast calculation engine

- AI-powered forecasting and anomaly detection

- Driver-based and rolling forecast logic

- Industry agnostic

- Full 3-statement modeling support

- Easy to implement and use without technical help

Limitations: Less suited for smaller companies with basic forecasting needs.

Pricing: Starts around $20,000 annually, with the final cost depending on company size, complexity, and feature requirements.

Interested? Feel free to book a demo and see how Farseer solves the cash flow forecasting problem firsthand.

Planful

Best for: Mid-sized to large companies looking to modernize planning with a structured FP&A platform.

Strengths:

- 13-week cash forecasting and rolling projections

- AI-powered Predict: Projections tool

- Built-in consolidation and close workflows

- Excel-like UI for easier adoption

- Strong integrations (ERP, CRM, HRIS)

Limitations:

- Longer implementation and onboarding

- May require consulting support

- Performance can lag with large models

Pricing: Starts around $36,000 annually, depending on company size, modules, and support level.

Read 6 Planful Competitors Finance Teams Should Consider in 2026

Anaplan

Anaplan is a flexible planning platform built for large enterprises managing highly complex operations. When it comes to cash flow forecasting, Anaplan allows you to model everything from short-term liquidity to long-term capital planning, using connected, driver-based logic across departments and geographies.

It supports both direct and indirect cash flow forecasting, and its in-memory engine handles large volumes of data across multiple time horizons – daily, weekly, and monthly. Forecasts can be adjusted in real-time, and teams can run multiple scenarios (lender, downside, board) without duplicating models. It also supports automated cash flow statements under GAAP or IFRS.

But all that flexibility comes with tradeoffs. Most companies need outside help to get up and running, and even basic changes often require an Anaplan specialist. Admin overhead is high, and implementation can stretch into months.

Read more: Capital Planning vs Capital Budgeting: The Practical Differences

Best for: Large enterprises with the budget and resources to fully customize a cash forecasting framework.

Strengths:

- Handles large-scale models with complex logic

- Real-time data sync across departments

- Supports multiple time granularities (daily to annual)

- Full cash flow statement automation under GAAP/IFRS

- Strong scenario modeling and audit controls

Limitations:

- Long setup and onboarding, steep learning curve.

- High internal admin costs

- Requires specialized training or consulting

Pricing: Starts around $87,000 annually. Total cost varies based on deployment scope, user count, and configuration needs.

Read: Anaplan Competitors – The 6 Best Alternatives for FP&A

Workday Adaptive Planning

Workday Adaptive Planning is part of the broader Workday ecosystem and is a solid choice for organizations already using Workday for HR or finance. It supports indirect cash flow forecasting with driver-based models and lets you plan across income statements, balance sheets, and cash flows in one place.

It’s especially useful for building rolling forecasts and running scenario comparisons. Teams can model different outcomes, like revenue drops or cost increases, and adjust quickly when things shift. The dashboards are customizable, and the reporting tools help surface trends and outliers in real time.

However, some users say implementation can take time, and the platform isn’t always intuitive out of the box. Working with large datasets can also slow things down, especially during reporting.

Best for: Enterprises using Workday HCM/Finance that want a connected planning tool.

Strengths:

- Rolling cash forecasts with scenario modeling

- Full integration with Workday systems

- Driver-based planning across all statements

- Real-time reporting with customizable dashboards

Limitations:

Setup takes time and may require help. Some users report performance issues with larger models.

Pricing: Starts around $50,000 per year. Final pricing depends on user count, data volume, and feature scope.

SAP Analytics Cloud

SAP Analytics Cloud (SAC) combines planning, forecasting, and reporting in one platform. If your organization runs on SAP S/4HANA, it can be a natural fit for cash flow forecasting, especially when working across regions, currencies, and entities.

You can build driver-based forecasts, run short- and long-term cash flow models, and use predictive tools to flag risks or gaps early. SAC pulls actuals from SAP systems and supports version control, scenario planning, and audit trails out of the box.

But it’s not plug-and-play. You lose on flexibility, setup takes time, and most teams rely on IT or SAP consultants to get started and maintain models. The interface isn’t always intuitive, and financial users may find the learning curve steep.

Best for: Enterprises already deep in the SAP ecosystem that need integrated planning and analytics.

Strengths:

- Deep integration with SAP S/4HANA, BPC, and BW

- Predictive forecasting with time-series modeling and outlier detection

- Driver-based and rolling forecast logic

- Multi-scenario and version management

- Built-in governance, security, and audit controls

Limitations:

- Requires heavy IT/admin involvement

- Long implementation and onboarding

- Not purpose-built for finance—UI can feel clunky

Pricing: Starts around $90,000 annually. Final cost depends on licenses, data volumes, and implementation scope.

Read Looking for SAP Analytics Cloud Competitors? Here Are the 5 Best Options

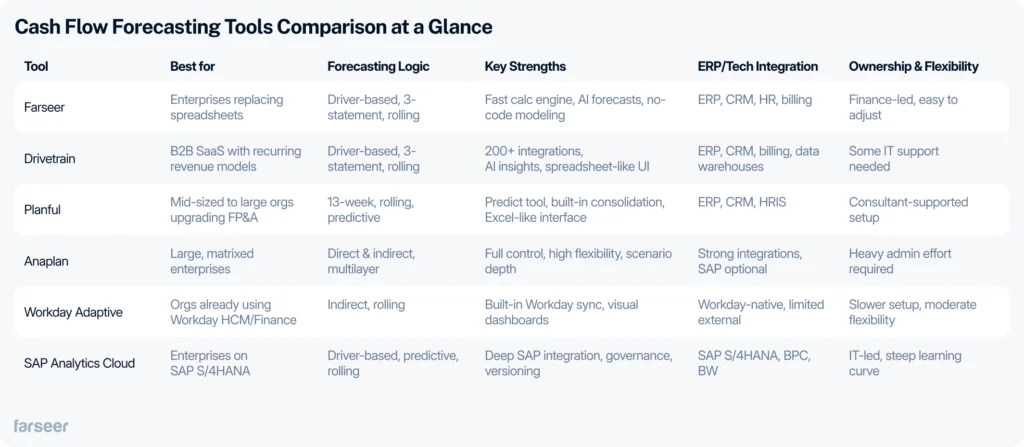

Cash Flow Forecasting Tools Comparison at a Glance

See how the six enterprise tools stack up on core cash flow forecasting features:

Match the Tool to How You Plan

The right cash flow forecasting software depends on how you plan – not just today, but as your business scales.

If you’re reforecasting often, managing complexity, and need fast answers, choose a tool that’s flexible, fast to adapt, and doesn’t depend on IT.

Some tools are powerful but slow to change. Others are quick to deploy but limited later. Pick one that supports how you actually work, and that can keep up as your needs grow.

If you’d like to test out Farseer, book a demo, and let’s talk.