Paying upfront for things like rent, insurance, or subscriptions is standard practice in many businesses. But handling those payments correctly in your accounting isn’t just a formality – it directly affects your financial reporting and cash flow.

Read: A Complete Guide to Financial Statement Analysis for Strategy Makers

In this guide, we break down prepaid expenses: what they are, how they work in accounting, and how to manage them effectively. If you’ve ever been unsure how to treat advance payments or want to improve how they factor into your financial planning, you’re in the right place.

Examples of Prepaid Expenses

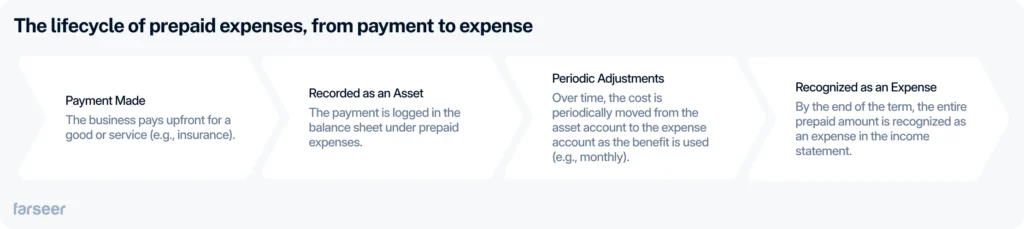

A s mentioned, prepaid expenses are costs your business pays in advance for things you’ll use later. This includes insurance, rent, or software subscriptions. Since you haven’t received the full benefit yet, you don’t count them as expenses. You record them as current assets.

As time passes and you use what you paid for, you move the cost from your asset account to your expense account. That way, your reports show costs in the right period.

A common example of a prepaid expense is business insurance. You pay for a few months or a year upfront, and use that coverage over time. Other examples include annual software fees or advance payments for equipment you lease and use throughout the year.

Why Are Prepaid Assets Important?

Prepaid expenses matter because they help you match costs to the right time period. That keeps your reports accurate. They also help you plan cash flow better, since you know what’s already paid and what’s still coming.

Most businesses deal with some kind of prepaid cost. When you track it right, your numbers stay clear and useful.

How Prepaid Expenses Work in Accounting

Understanding how to record and adjust prepaid expenses is key to keeping your financial reports accurate. They involve tracking value over time and making sure costs match the periods they benefit.

Recording Expenses Paid in Advance

When your business pays upfront for goods or services, the payment is logged as a current asset. This ensures it’s tracked until the benefit is used. Prepaid expenses are recorded in the accounting system with a simple journal entry:

For example, if you pay $6,000 for six months of warehouse storage, the full amount goes into the prepaid expenses account. This keeps the payment out of your expense account until you start using the storage. By recording the payment this way, you ensure that your books reflect the value of what you’ve paid for but haven’t yet used.

This approach not only keeps your financial reporting accurate but also helps you plan for future adjustments as the benefit is realized over time.

Adjusting Prepaid Expenses Over Time

As you use the goods or services you paid for upfront, you need to move their cost from the prepaid expenses account to an expense account. You adjust periodically, often monthly, using a simple journal entry like this:

Following the previous example, you would adjust $1,000 each month. This reflects the portion of the prepaid amount that has been “used up” during the month.

These periodic adjustments ensure that your financial reports match expenses to the periods they benefit.

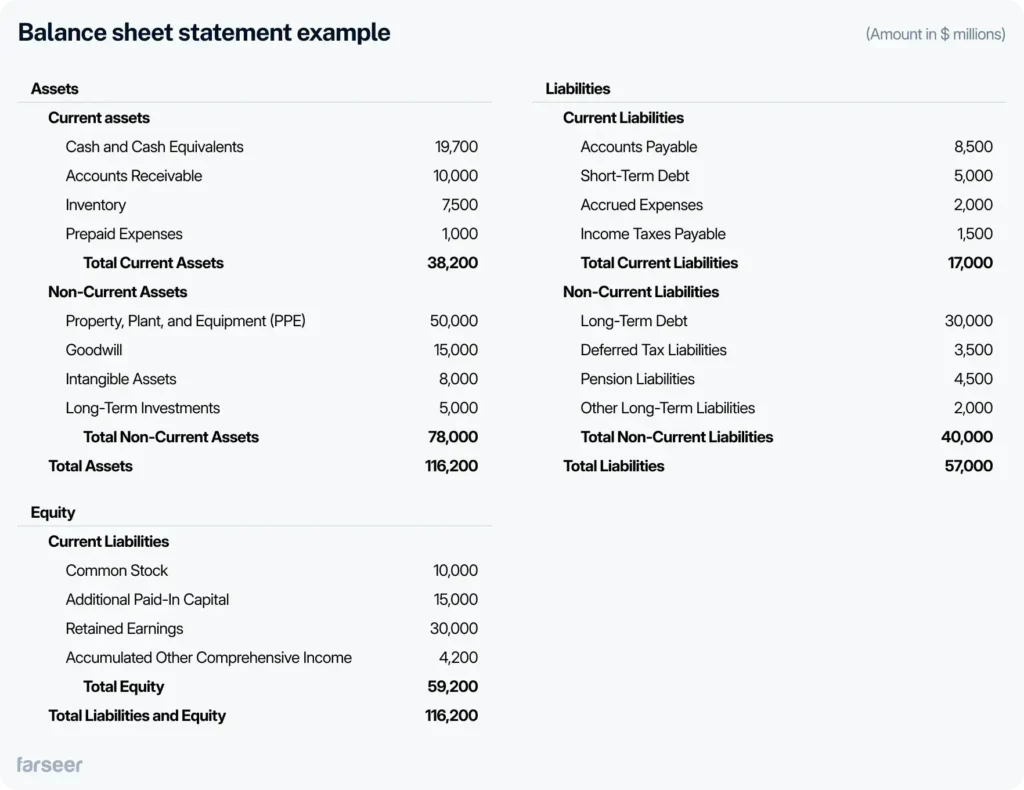

Prepaid Expenses on the Balance Sheet

As mentioned earlier, your balance sheet lists prepaid expenses under current assets. Over time, as the value is used up, the prepaid expenses account decreases.

After adjusting $1,000 for one month of storage from a $6,000 prepaid amount, the balance sheet would show $5,000 remaining as prepaid expenses. Over time, the prepaid expenses account will be fully reduced to zero, and the entire amount will have been recorded as an expense on your income statement.

Related: Learn more about the primary limitations of the balance sheet.

The Tax Side of Prepaid Expenses

Prepaid expenses can also affect your taxes. In many cases, you can only deduct the portion that applies to the current year.

Payments that cover more than one year, like insurance policies or service contracts, must be split, with future amounts staying on the balance sheet as an asset.

For example, if a logistics company prepays freight costs for the next fiscal year, it won’t be able to deduct those expenses until the logistics company uses the services. The same applies to a multi-year insurance policy: only the portion that applies to the current year is deductible.

Keep detailed records of prepaid expenses and make sure your books are accurate. A tax professional can help you follow the rules and avoid mistakes.

Related: Learn more about financial statement limitations.

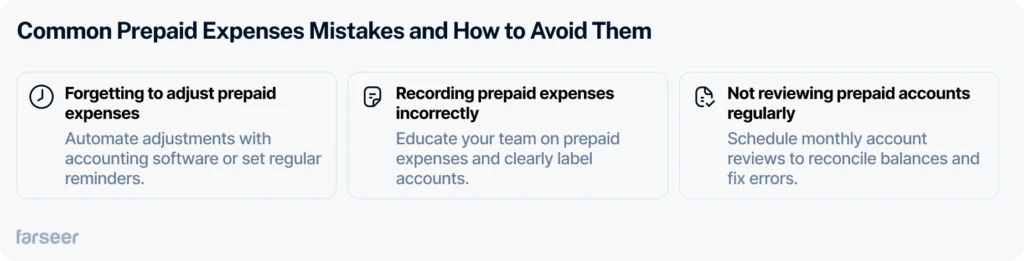

Common Prepaid Expenses Mistakes and How to Avoid Them

Mistakes can lead to inaccuracies in financial reports and errors that could prove expensive in the long run. Here are the most common ones:

Forgetting to Adjust Prepaid Expenses

This mistake happens because adjusting prepaid expenses isn’t always top of mind. It’s easy to focus on new transactions and forget about payments already made. Without a clear process or reminders, these adjustments can slip through the cracks, leading to overstated assets and inaccurate profits.

How to avoid: Build a habit of reviewing and adjusting them regularly. Accounting and/or FP&A software can also help by automating the process.

Recording Prepaid Expenses Incorrectly

A common mistake is treating prepaid expenses as regular expenses or placing them into the wrong accounts. This often happens when people don’t understand what qualifies as a prepaid expense or when they make entries in a hurry. Naturally, this can lead to messy financial reports and confusion during reviews.

How to avoid: Make sure your team understands how they work and where to record them. Label accounts clearly in your system and double-check entries when reviewing your books.

Not Reviewing Prepaid Accounts Regularly

Some businesses forget to review their prepaid accounts regularly, which can lead to small errors piling up over time. Payments that are no longer valid may remain in the prepaid account, or adjustments may not match the actual use of the goods or services.

How to avoid: Schedule monthly reviews to reconcile prepaid accounts. Make sure balances match the remaining value of the prepaid service or benefit.

Avoiding mistakes like missed adjustments or wrong entries and reviewing accounts regularly can make a big difference. With the right software and simple processes, managing prepaid expenses gets much easier.

See how tracking expenses affects overall cash flow with our guide to the cash conversion cycle, and guide to net working capital.

Conclusion

Prepaid expenses might seem like a small part of your business’s finances, but managing them properly is key to keeping your financial reports accurate and your cash flow predictable. By recording payments correctly, adjusting them over time, and avoiding common mistakes, you can stay on top of your books without the headaches.

Whether it’s rent, insurance, or software subscriptions, understanding how prepaid expenses work helps you make better financial decisions. With the right tools and processes in place, managing these payments can be simple and stress-free.