Are you in control of your cash, or is it controlling you? For many businesses, the problem isn’t how much money is coming in—it’s how long it takes to get there. The Cash Conversion Cycle formula (CCC) helps you spot where your money gets stuck-like when inventory takes too long to sell or customers delay their payments.

Read: A Complete Guide to Financial Statement Analysis for Strategy Makers

By breaking down your CCC, you can identify these delays and fix them. In this blog, we’ll explain the CCC formula, show you clear examples, and share practical tips to turn your cash flow into a competitive advantage.

If you’re ready to take back control of your cash, let’s get started.

What is the Cash Conversion Cycle?

The Cash Conversion Cycle (CCC), also known as the cash-to-cash cycle, tells you how efficient your business is in moving cash through its operations. It shows how long your company takes to turn investments in inventory and receivables into cash – and helps you pinpoint exactly where money gets stuck. Extremely simplified, it tells you how many days pass from the time you spend money until you get it back.

Think of CCC as your business’ financial stopwatch. A shorter cycle means cash is coming in and out quickly, while a longer cycle could signal delays in your processes.

Example: A grocery retailer moves inventory fast and customers pay at checkout. It might have a CCC of just a few days. A luxury goods manufacturer’s production is slower, and customers take longer to pay, so its CCC can span months.

Breaking Down the Cash Conversion Cycle Formula and its Components

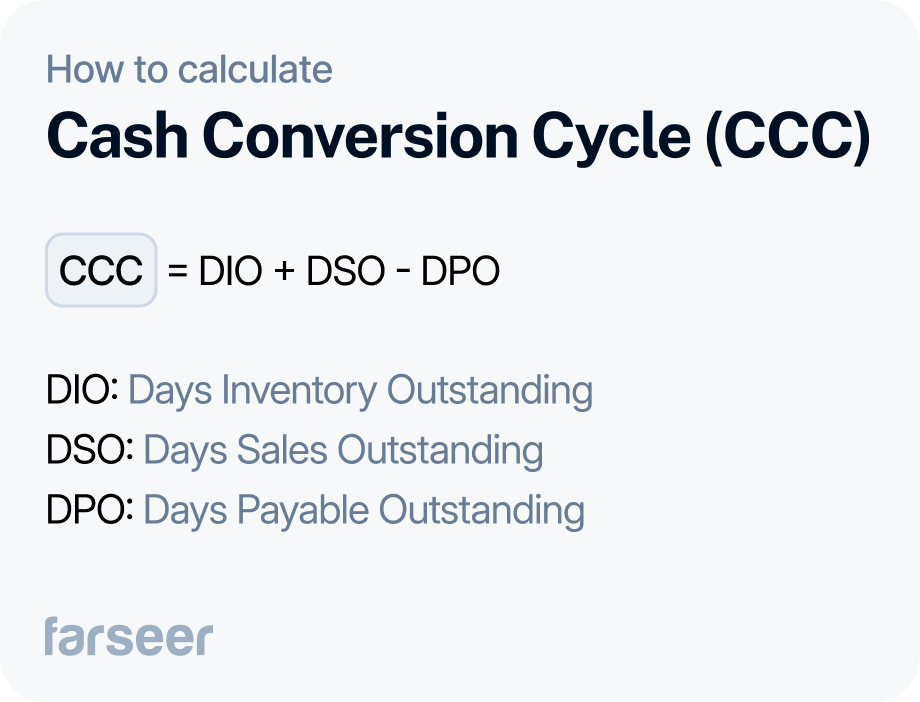

The Cash Conversion Cycle (CCC) combines three key metrics into one formula and it’s very simple: CCC = DIO + DSO – DPO.

Now let’s go deeper into each of its components.

Days Inventory Outstanding (DIO)

This measures how long it takes to sell your inventory. If your DIO is lower, you’re turning stock into cash faster.

Example: A clothing retailer might have a DIO of 90 days if seasonal stock sits unsold after the season ends.

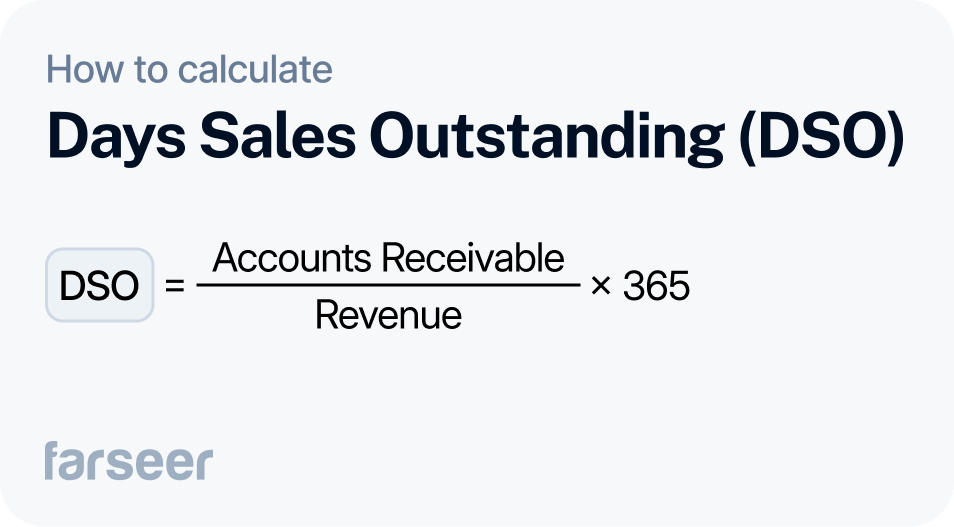

Days Sales Outstanding (DSO)

DSO shows how quickly your customers pay you. A lower DSO means you’re getting paid faster.

Example: A B2B company offering net 30 terms might have a DSO of 40 days due to delayed payments.

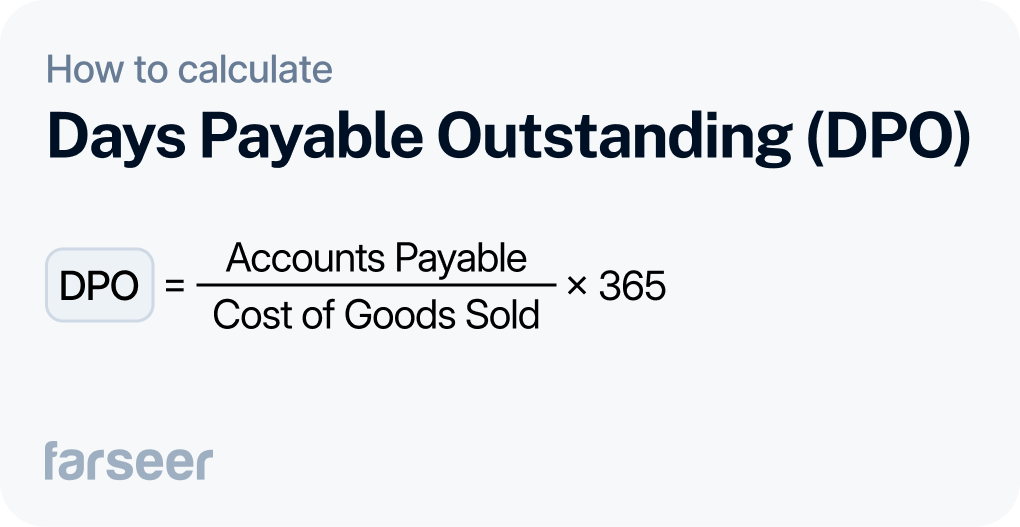

Days Payable Outstanding (DPO)

DPO measures how long you take to pay your suppliers. A higher DPO gives you more breathing room by keeping cash in your hands longer.

Example: A large retailer with strong supplier relationships might negotiate a DPO of 60 days or more.

These metrics come together to show how cash moves through your business. Once you calculate your CCC, you can pinpoint exactly where delays happen and start making improvements.

Walmart’s Cash Conversion Cycle

To see how the Cash Conversion Cycle (CCC) works in the real world, let’s look at one of the largest retailers in the world – Walmart.

Walmart holds inventory for about 41 days before it’s sold. Once a sale is made, they collect payment in 5 days, and it takes about 42 days for them to pay their suppliers.

Now, let’s calculate the CCC:

CCC = DIO + DSO – DPO

= 41 days + 5 days – 42 days

= 4 days

So, we can see that it takes just 4 days for Walmart to turn its inventory and receivables into cash.

A short CCC like Walmart’s means cash is moving quickly through the business. The company can reinvest into operations faster, without significant loans, and keep running smoothly.

What a Healthy Cash Conversion Cycle Looks Like

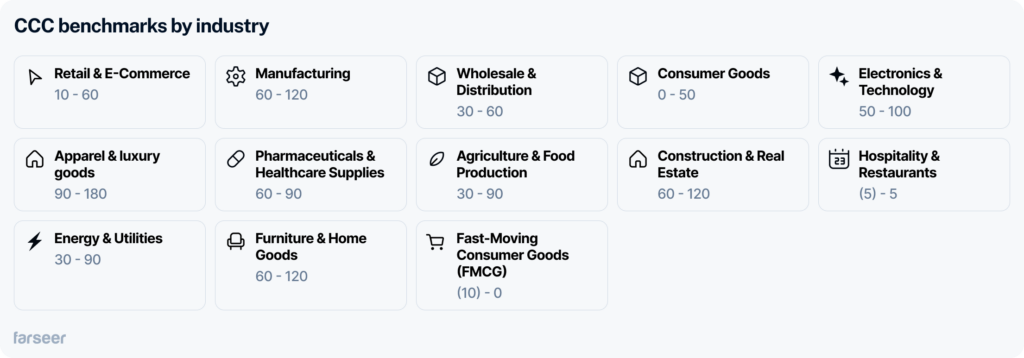

A “good” Cash Conversion Cycle (CCC) depends on your industry. What one business considers healthy might not work for another.

Fast-moving consumer goods (FMCG) companies like grocery stores usually have a CCC of 10 – 20 days. They sell quickly, customers pay instantly, so the cash flows smoothly.

Luxury goods manufacturers often deal with CCCs of 90+ days. Their products take longer to make, and customers take longer to pay, so their cash stays tied up for much longer.

Then there are companies like Amazon, which have a negative CCC. This means they get paid by customers before they pay their suppliers. By holding onto cash longer, they can grow faster without borrowing.

Common Roadblocks to a Better Cash Conversion Cycle

Fixing your Cash Conversion Cycle (CCC) often means dealing with a few common problems:

- First, inventory isn’t selling fast enough: When Days Inventory Outstanding (DIO) is too high, cash gets stuck in unsold products. In this case, efficiency ratios can help you figure out what’s slowing down inventory turnover and where to improve.

- Second, customers take too long to pay: Late payments drag out your Days Sales Outstanding (DSO) and hurt cash flow. Pairing your CCC analysis with liquidity and solvency ratios gives you a clearer picture of how late payments affect your financial health.

- Finally, you’re paying suppliers too fast: If your Days Payable Outstanding (DPO) is too short, you’re spending cash before you need to. On the other hand, stretching payment terms can free up money for other operations, but it’s a balancing act to keep supplier relationships healthy.

Practical Tips and Tools to Improve Your CCC

Improving your Cash Conversion Cycle (CCC) doesn’t have to be complicated. Here’s how you can make your cash work harder and smarter:

Sell Inventory Faster

Don’t let products gather dust on shelves. Use demand forecasting to predict what your customers need and stock accordingly. For even greater efficiency, consider a just-in-time (JIT) system, which keeps inventory moving quickly.

Get Paid Quicker

If customers are slow to pay, your cash flow suffers. Simplify invoicing to make it easy for them to pay on time. Offer early payment discounts and encourage faster payments. For stubborn cases, automate payment reminders so no one forgets.

Delay Payments Strategically

The longer you can hold onto cash before paying suppliers, the better. Negotiate terms that work for both sides—suppliers will often agree if you have a strong relationship.

Use Tools to Stay on Top of Things

Tracking your CCC is just as important as improving it. Start with something simple like an Excel spreadsheet to calculate your metrics. As your business grows, you’ll have to upgrade and start automating, though. Spreadsheets are manual and prone to errors, and FP&A platforms like Farseer let you automate your work, and track and predict CCC changes in real-time.

Helpful Reads:

Want to see cash flow in real-time: What is Direct Cash Flow Method and When to Use It

Explore tools to make tracking your CCC easier: 5 Best Financial Analysis Tools to Look Out For in 2025

Conclusion

The Cash Conversion Cycle (CCC) is a straightforward tool for understanding and improving your cash flow. By analyzing how inventory, customer payments, and supplier terms impact your finances, you can identify where cash gets stuck and make changes to free it up.

Specifically, use CCC to spot inefficiencies, such as slow-moving inventory or late payments, and act quickly to address delays in inventory, receivables, or payables to keep your cash flow steady. Advanced tools like Farseer can help automate calculations and provide real-time insights, making it easier to stay on top of your cash flow.