Finance is standing on the edge of its biggest transformation in decades. The slow, spreadsheet-heavy systems that once held the industry together are now holding it back.

According to Farseer’s State of Finance 2026 report, 72% of finance leaders are investing in advanced analytics, 61% in automation, and 33% in AI/ML to build smarter, more connected planning environments. Yet, most teams still rely on spreadsheets or legacy tools, struggling to connect data, people, and strategy in real time.

Budgets take too long to build, forecasts feel like educated guesses and financial data is scattered across different systems. Fixing errors takes hours, sometimes days. By the time leadership gets the numbers, things have already changed.

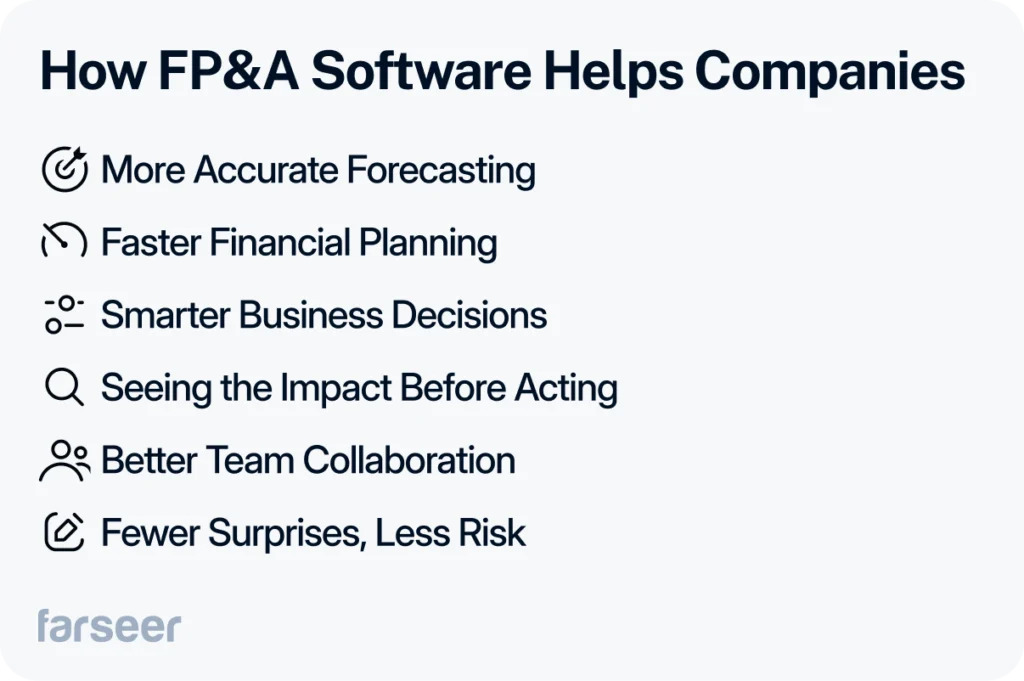

The right FP&A software solves these problems. It gives finance teams real-time data, automation, and better forecasting tools, so they can focus on strategy instead of manual work. But not every tool is the same. Some are too rigid. Others take months to implement. Choosing the wrong one can slow you down instead of pushing you forward.

This guide breaks down what FP&A software does, how it helps, and how to choose the right one.

What is FP&A Software?

Most finance teams rely on spreadsheets to plan budgets, build forecasts, and track financial performance. But as businesses grow, spreadsheets become too slow, messy, and unreliable.

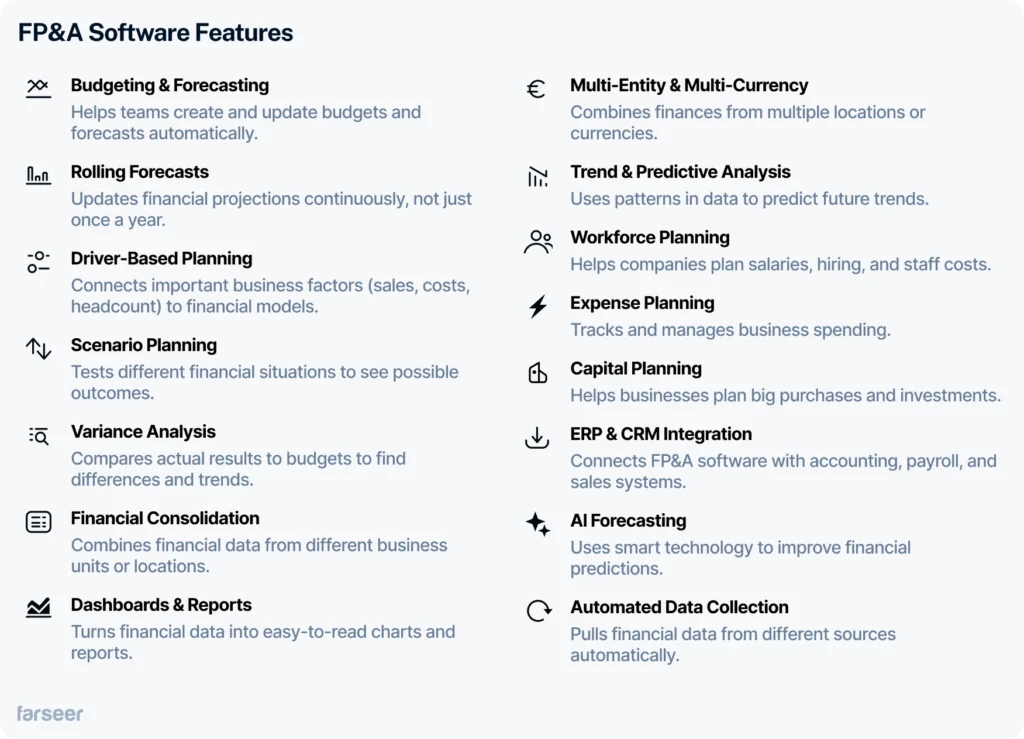

FP&A software fixes this. It pulls financial data from different systems into one place, automates calculations, and makes planning faster and more accurate. Instead of spending hours updating formulas and fixing errors, finance teams get real-time numbers they can trust.

Best FP&A Software Tools for 2026

Choosing the right FP&A platform depends on your goals, company size, and complexity. The market is full of “Excel replacements” that promise automation but often add more chaos.

Here’s an overview of the top FP&A software tools for 2026 – and where each one fits best.

Anaplan

Best for large enterprises with highly complex planning structures and global operations.

Anaplan is one of the pioneers of connected planning. Its modeling engine (Hyperblock) allows for enormous flexibility, making it ideal for enterprises with thousands of users, layered hierarchies, and deep integration requirements.

However, that power comes at a price – both literally and in complexity. Implementation can take months, even years, and usually requires dedicated administrators or consultants. Smaller teams often find it difficult to adapt without significant IT support.

Anaplan shines when planning spans multiple departments and countries, but it can feel heavy for finance teams that need agility and fast iteration.

Read Anaplan Competitors – The 6 Best Alternatives for Enterprise FP&A

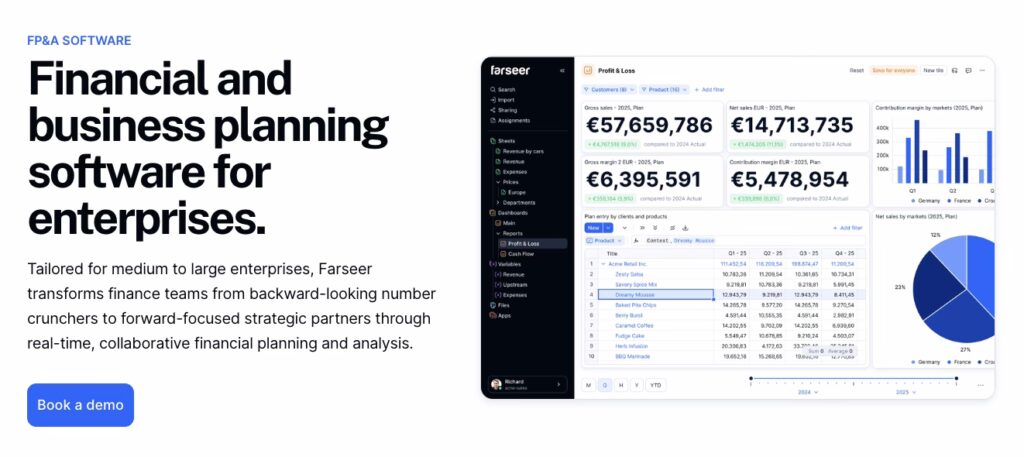

Farseer

Best for mid-to-enterprise finance teams that want to plan faster, collaborate smarter, and govern every assumption, all without touching a single line of code.

Farseer is a new generation of FP&A software built for finance teams tired of Excel chaos and rigid legacy tools. Instead of scattered spreadsheets or disconnected modules, Farseer gives you one governed model for everything: P&L, Balance Sheet, and Cash Flow, all linked, automated, and audit-ready.

Every number in Farseer has a source. Every change is traceable. Every assumption, logged. It’s financial modeling, forecasting, and analysis, reimagined for the speed and complexity of modern business.

Unlike first-generation tools that rely on IT or consultants to build models, Farseer is no-code by design. Finance owns the logic, the structure, and the automation. You can model anything, from workforce and CapEx to tenders, pricing, or inventory, all in the same connected planning environment.

Key advantages of Farseer:

- One governed model for all financial statements and operational drivers.

AI-assisted forecasting that learns from historicals and identifies anomalies.

Real-time data synchronization with ERP, CRM, and HR systems, no more manual imports.

Full audit trail and version control: every assumption and change traceable by default.

Multi-entity and multi-currency support for global operations.

Collaboration built-in: departments plan in parallel, finance controls the logic.

No-code modeling environment: finance teams create, update, and scale models instantly.

Scenario and variance analysis embedded directly in models, not in Excel exports.

Why finance teams choose Farseer

Because it replaces a fragmented planning stack, Excel templates, disconnected ERPs, BI dashboards, and endless report versions, with one connected financial brain.

Farseer doesn’t just make budgeting faster. It connects finance, operations, and data in real time, helping CFOs steer the business instead of reconciling it.

Pigment

Best for fast-growing scaleups and data-driven finance teams looking for flexibility and design clarity.

Pigment has quickly positioned itself as one of the most modern FP&A tools on the market. Its interface is visually clean, collaborative, and intuitive – perfect for teams that want transparency in how numbers move.

The platform offers driver-based modeling, scenario analysis, and impressive visualization features. Its biggest strength is the user experience, building and presenting financial models feels fluid and interactive.

Still, Pigment is geared toward companies with relatively simple governance requirements. For industries like pharma or manufacturing, where auditability and validation rules are essential, it may lack depth in financial control.

Cube Software

Best for mid-market finance teams that want to move beyond spreadsheets without leaving them behind. Cube bridges the gap between Excel and modern FP&A tools. It plugs directly into Excel and Google Sheets, automates consolidation, and centralizes formulas in the background. Finance teams can keep their familiar workflows while gaining better version control and data accuracy.

Its advantage is speed to implementation – setup takes days, not months. However, because Cube’s core still depends on spreadsheet logic, it can struggle with scaling complexity, driver relationships, and enterprise-grade governance.

Cube is ideal for smaller teams that value familiarity and want quick wins in forecasting automation.

Read 5 Best Board Competitors in 2026 With Pros, Cons, and Pricing

Vena Solutions

Best for companies that live and breathe Excel but need process control, collaboration, and workflow automation.

Vena modernizes Excel-based planning with centralized templates, approval workflows, and audit tracking. Its “embrace Excel” approach makes adoption smooth, users don’t need to change how they work, just where their data lives.

The tradeoff is flexibility. Because it relies heavily on Excel, complex models and cross-department automation can become difficult to manage. Vena works best for mid-sized organizations that want structure and accountability without abandoning the spreadsheet environment entirely.

Read 7 Vena Alternatives and Competitors to Take a Look at in 2026

Prophix

Best for traditional mid-market companies that value consistency and proven reliability.

Prophix is one of the more established players in the FP&A space, with strong capabilities in budgeting, reporting, and workflow automation. It supports both cloud and on-premise deployments, appealing to businesses with strict data requirements.

Its focus on standardization makes it stable and dependable but less dynamic than newer platforms.

For teams seeking heavy customization or AI-assisted forecasting, Prophix can feel dated. Still, it’s a solid choice for organizations prioritizing process discipline over modeling innovation.

Datarails

Best for small to mid-size finance teams making their first step away from spreadsheets.

Datarails integrates directly with Excel and automates data aggregation from multiple sources. It’s lightweight, fast to implement, and great for simplifying monthly reporting, variance analysis, and consolidation.

Its simplicity is both strength and limitation, perfect for smaller teams but not built for multi-entity structures or large-scale planning. It delivers a strong first step into automation but eventually requires an upgrade for deeper modeling and scenario capabilities.

How to Choose the Right FP&A Software

Before jumping into demos, clarify your priorities. Every platform can build a budget; not every one can transform how your finance team works.

Ask yourself:

How complex are your planning models, single-entity or multi-market?

Who owns modeling, finance, IT, or both?

How fast do you need to implement?

What level of governance and audit trail do you require?

Are you planning to automate a process, or reimagine it?

Teams that align their data, logic, and ownership around one connected model report up to 70% shorter planning cycles and 40% higher forecast accuracy.

How Companies Actually Use FP&A Software - Farseer

Here’s how three companies in different industries made their finance operations faster and easier with FP&A software – Farseer.

Hrvatski Telekom cut forecasting time from ten days to two days

Hrvatski Telekom’s finance team managed budgeting and forecasting with 50+ spreadsheets across different departments. Consolidating financial data was slow, and updating forecasts took more than 10 days every quarter. The finance team spent more time fixing numbers than planning for the future.

FP&A software replaced spreadsheets with automated forecasting and budgeting, giving teams a single system where they could plan, update numbers, and adjust forecasts instantly.

Results:

- Quarterly forecasting time reduced from 10 days to 2.

- 50+ spreadsheets eliminated.

- Finance teams now spend time analyzing numbers, not fixing them.

Altium standardized reporting across nine countries

Altium operates in nine countries, and every region had its own way of handling budgets and forecasts. Finance teams had to manually consolidate numbers from different formats and systems, which slowed down reporting and created inconsistencies.

FP&A software helped Altium standardize financial reporting and automate forecasting, so finance teams could work with one set of numbers instead of constantly adjusting data from different sources.

Results:

- 30% faster reporting by eliminating manual data consolidation.

- 25% shorter planning cycles, making forecasting quicker and easier.

- Finance teams across all regions now work in one system instead of juggling spreadsheets.

Key Takeaways

- FP&A software replaces spreadsheets for budgeting, forecasting, and financial planning, making processes faster and more accurate.

- ERP systems track financial history, while FP&A software plans for the future – most companies need both to run efficiently.

- Better forecasting leads to better decisions – automation reduces errors, speeds up planning, and helps businesses test different financial scenarios.

- The right FP&A software depends on company size and complexity – enterprise tools offer deep automation, mid-market solutions balance flexibility and cost, and SMB tools help small businesses move beyond spreadsheets.

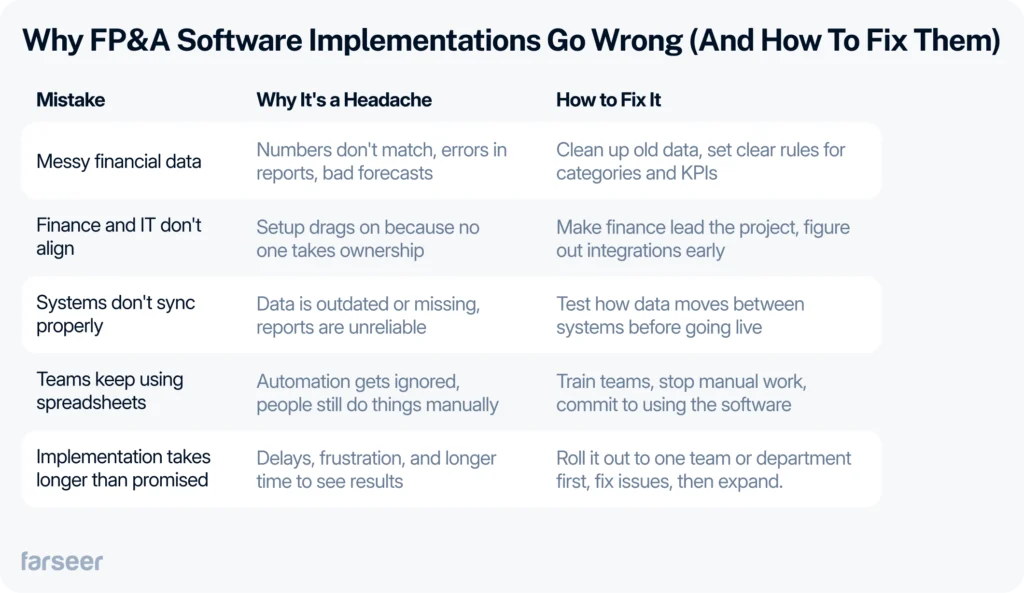

- Implementation often fails due to messy data, IT misalignment, and slow adoption – cleaning data, setting clear workflows, and phasing the rollout prevent delays.

- Real companies see real improvements – Hrvatski Telekom, Altium, and LELO all reduced forecasting time, improved reporting, and made financial planning easier with Farseer FP&A software.

- Manual processes only get worse as a business grows – FP&A software isn’t just about speed; it makes financial planning smarter, more scalable, and more strategic.