Financial consolidation is the foundation of accurate reporting for companies with multiple subsidiaries, units, or entities.

For CFOs and FP&A teams, the reality is often messy: endless spreadsheets, different currencies, intercompany transactions that don’t match, and close cycles that take far too long. The result? Delays, stress, and less time for real analysis and decision-making.

In this guide, we’ll break down what financial consolidation really means, how the process works, the most common challenges, and the solutions modern finance teams use.

Read more: Real-Time Reporting: Why Excel Isn’t Enough

What Is Financial Consolidation?

Financial consolidation means pulling together the financials from all subsidiaries, units, or entities into one clean report. Instead of scattered numbers across different ledgers and spreadsheets, everything is brought into a single, unified set of statements.

The purpose goes beyond accounting. Consolidation gives leadership and stakeholders the big picture of performance and financial health, something you can’t get from looking at each entity separately.

It’s also about visibility, compliance, and smarter decisions. A good consolidation process ensures that intercompany transactions are eliminated, foreign currencies are aligned, and reports meet the standards required by regulators and auditors.

Why Is Financial Consolidation Important?

Financial consolidation isn’t just about neat reporting – it’s a compliance necessity. By aligning group accounts under frameworks like GAAP or IFRS, companies reduce regulatory risks and avoid costly mistakes that could invite auditors or penalties. Standardization keeps the organization on the right side of the rules while ensuring the numbers are consistent across all entities.

Beyond compliance, consolidation gives CFOs and finance leaders a clear, unified view of performance across subsidiaries and regions. Instead of juggling fragmented reports, leadership can rely on one version of the truth to make faster, more strategic decisions.

Finally, consolidated statements help build trust with external stakeholders – from investors and lenders to rating agencies. When the numbers are transparent, timely, and reliable, stakeholders gain confidence in the company’s stability and future prospects.

Financial Consolidation Examples

Financial consolidation isn’t just for Fortune 500 giants. Any company that owns or controls more than one legal entity eventually faces the same challenge: how do you pull everything into one clean set of financial statements?

Here are a few examples:

Global Corporations (PepsiCo)

PepsiCo doesn’t just sell soda. Under the same corporate roof sit Quaker Oats, Frito-Lay, Tropicana, and Gatorade – each keeping its own books, often in different currencies and ERP systems . Left unadjusted, the raw numbers would look chaotic and inflated. For example, Quaker might sell oats to Frito-Lay for snack bars – if those transactions weren’t eliminated, PepsiCo’s revenue would be overstated.

That’s where consolidation comes in. By removing intercompany transactions and standardizing reporting across subsidiaries, PepsiCo produces one clean financial statement. This gives shareholders, analysts, and regulators a reliable view of performance across the entire business, not just a patchwork of disconnected entities.

Medium-Sized Multinationals (Mi Hub)

Mi Hub, a UK-based uniform supplier, operates through brands and subsidiaries in both the U.K. and U.S. Each region used different ERP systems, which made monthly and quarterly closes painfully manual. For years, the finance team leaned on one giant Excel workbook, maintained by a single controller – essentially a “single point of failure.” Finalizing group numbers could drag on for weeks.

After adopting a dedicated consolidation platform, Mi Hub was able to automate eliminations, currency conversions, and data imports. What once took weeks now takes about five days, and leadership can access consolidated performance across regions much faster. The process not only sped up reporting but also gave the business confidence that their numbers are accurate and audit-ready.

Smaller Businesses (Restaurant Groups, Franchise Models)

Even a local restaurant group with just two or three locations runs into the same challenge. Each location tracks its own P&L, payroll, and cash flow. On their own, those reports are useful, but at month-end the owner needs one big picture: total group revenue, combined expenses, and whether the entire business is truly profitable.

Consolidation solves that. By aligning reporting periods, standardizing the chart of accounts, and eliminating intercompany loans (like one location covering another’s shortfall), the owner can roll everything into one consolidated statement. The principles are identical to what global corporations face – just at a smaller scale.

Read more: Line Items Explained

The Financial Consolidation Process (Step by Step)

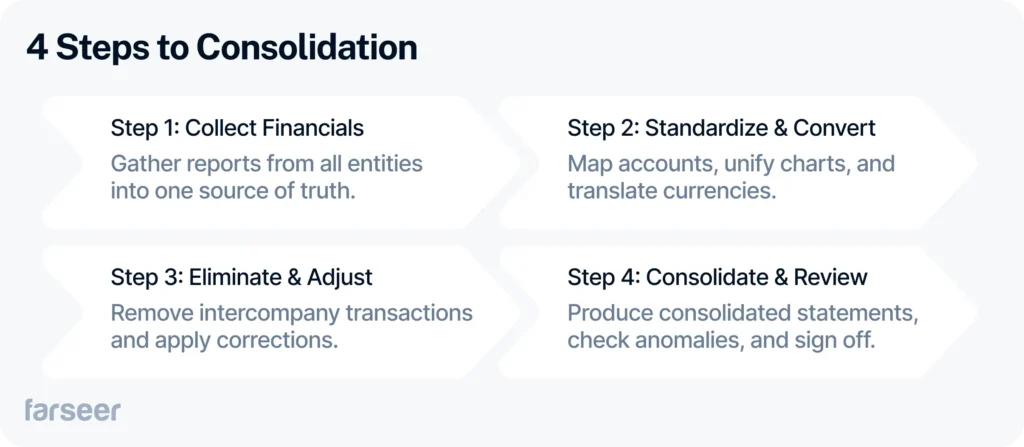

The process starts with collecting financials from each entity – subsidiaries, joint ventures, or business units. These reports need to be pulled together into one place to create a single source of truth for the group.

Next comes standardization and conversion. Different charts of accounts and multiple currencies get mapped into a unified structure. For global companies, this means translating results into the parent company’s reporting currency.

Then, finance teams handle intercompany eliminations and adjustments. Any transactions between group companies – sales, loans, or services – are removed, and final corrections (like depreciation or accruals) are applied.

Finally, the parent company prepares consolidated financial statements – balance sheet, income statement, and cash flow – followed by review and approval. Once signed off, the period is closed, giving leadership and stakeholders an accurate, complete view of performance.

Read more: Consolidation Entries 101 – A Modern Guide for Finance Teams

Methods of Consolidation

Full Consolidation (Voting Interest Entity)

When a parent company owns more than 50% of another entity’s voting shares, it must consolidate 100% of the subsidiary’s assets, liabilities, revenues, and expenses. Even if the parent doesn’t own the full equity, the remainder is shown as non-controlling interest in the consolidated financial statements. This gives a complete view of the group’s financial health while still recognizing outside shareholders.

Example: PepsiCo fully consolidates Quaker Oats after acquiring 100% of the company. Nestlé likewise consolidates Nespresso into its group accounts as it is a wholly owned subsidiary.

Full Consolidation (Variable Interest Entity - VIE)

Sometimes control exists without majority voting rights. A Variable Interest Entity (VIE) must be consolidated when the parent has both the power to direct the entity’s key activities and the obligation to absorb losses or benefits from it. This ensures that companies cannot hide entities they effectively control.

Example: Toyota consolidates special purpose entities used for leasing and financing operations, since it retains control and exposure to their risks even without holding majority voting stock.

Equity Method

The equity method applies when ownership is between 20% and 50%, giving the parent significant influence but not full control. Instead of consolidating, the parent records its investment as an asset and adjusts it periodically for its share of the investee’s profit or loss. Dividends received reduce the carrying value of the investment rather than being treated as regular income.

Example: Alphabet (Google) accounted for its stake in Uber using the equity method. Berkshire Hathaway also uses this method for its ~27% stake in Kraft Heinz, including a proportional share of Kraft Heinz’s earnings in its reports.

Proportionate Consolidation

This older method allowed companies in joint ventures to consolidate their share of assets, liabilities, revenues, and expenses rather than the whole amount. If a company owned 50% of a joint venture, it would report 50% of the JV’s numbers in its own financials. While it gave visibility into shared projects, it was phased out under IFRS 11 and GAAP in 2013 in favor of the equity method.

Example: Oil and gas companies historically used proportionate consolidation for joint exploration projects, recognizing their proportional share of revenues and costs.

Cost Method (Legacy)

The cost method is used when a parent owns less than 20% of a company and lacks significant influence. The investment is recorded at purchase price, and only dividends are recognized as income. The parent does not pick up any share of profits or losses from the investee.

Example: A company holding a 10% stake in a startup without board representation would account for the investment at cost and only record dividend income, if any.

Challenges in Financial Consolidation

Manual processes & spreadsheets

Relying on Excel makes consolidation slow and highly prone to mistakes. One formula error or copy-paste slip can throw off the entire report.

Currency conversion issues

Subsidiaries using different currencies require constant adjustments. Exchange rate fluctuations add another layer of complexity.

Intercompany eliminations

Transactions between entities must be reconciled and eliminated. Without automation, this quickly turns into a messy, time-consuming task.

Data silos & inconsistent systems

Different ERPs, charts of accounts, and reporting formats make it hard to unify data. Consolidation teams spend more time cleaning data than analyzing it.

Tight reporting deadlines

Month-end or year-end closes put enormous pressure on finance teams. Errors become more likely when speed is prioritized over accuracy.

Regulatory compliance

Meeting GAAP, IFRS, and local rules adds layers of complexity. Non-compliance risks fines, audit issues, and reputational damage.

Tackling these challenges isn’t just about working harder – it’s about working smarter. That’s where best practices come in, helping finance teams simplify consolidation, cut errors, and close faster.

Read more: Financial Reporting Automation – What It Actually Fixes (And Doesn’t)

Best Practices

Standardize reporting across entities: Use the same chart of accounts, accounting policies, and reporting schedules across all subsidiaries. Consistency makes consolidation smoother and avoids last-minute fixes.

Automate wherever possible: Automate data collection, eliminations, and reconciliations. This reduces human error and frees up time for analysis instead of number-crunching.

Strengthen data governance: Put clear ownership and validation rules in place. Clean, accurate data is the foundation of fast and reliable consolidation.

Improve communication between teams: Set clear timelines and workflows across regions and teams. Transparent collaboration avoids delays and confusion.

Leverage real-time reporting tools: Dashboards and live reports give management visibility during the cycle. No more waiting weeks for consolidated results.

Train and upskill finance staff: Equip teams with the right tools and skills. Proper training ensures smooth adoption of new systems and processes.

Benefits of Financial Consolidation Software

Faster close cycles

Automation speeds up consolidations that used to take weeks. Finance teams can close the books in days, not months.

Error reduction

Software eliminates manual copy-paste work and reconciliations. This means fewer mistakes and cleaner financial statements.

Real-time visibility

Instead of waiting for month-end, CFOs see group performance instantly. Live dashboards give transparency across subsidiaries.

Simplified intercompany eliminations

Automated rules handle sales, loans, and balances between entities. No more chasing mismatched entries.

Multi-currency & compliance support

Platforms handle currency conversion and reporting standards like GAAP and IFRS. This reduces compliance risk and audit headaches.

More time for analysis

Less time spent on data wrangling means more time for FP&A. Finance shifts focus from reporting the past to shaping the future.

All these benefits show why financial consolidation software is no longer optional; it’s essential. But not every tool is built the same. Here’s how Farseer approaches consolidation and why it matters for modern finance teams.

Read more: Best Consolidation Software in 2025: Top Tools, Key Features, and How to Choose

Farseer’s Take:

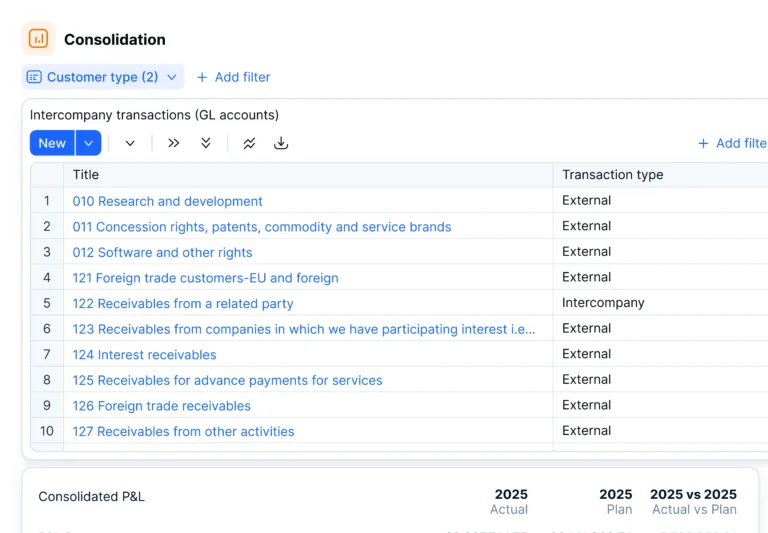

At Farseer, we’ve seen first-hand how consolidation can become the biggest bottleneck for finance teams. Spreadsheets get too big, intercompany eliminations take forever, and finance leaders are left chasing numbers instead of focusing on strategy. That’s why we built Farseer as a platform designed to take the chaos out of consolidation.

With one governed model, all entities speak the same language – no matter how many ERPs, currencies, or subsidiaries you’re dealing with. Intercompany eliminations, FX translations, and adjustments happen in a controlled environment, with full audit trails and transparency. The result? Faster closes, fewer errors, and numbers you can finally trust.

But the real advantage goes beyond compliance. By consolidating and planning in the same platform, CFOs and FP&A teams can move from backward-looking reporting to forward-looking decision-making. Instead of waiting weeks for reports, you get live visibility into group performance – and the time back to focus on profitability, ROI, and growth.

Conclusion

Financial consolidation isn’t just an accounting exercise – it’s the foundation of accurate reporting, smarter decisions, and regulatory compliance. Whether you’re running a multinational group like PepsiCo, a mid-sized company with regional subsidiaries, or even a small franchise, the need is the same: one version of the truth that leadership and stakeholders can rely on.

The challenges are real – from intercompany eliminations to currency conversions and tight deadlines – but the right processes and tools make all the difference. Standardization, automation, and clear communication turn consolidation from a painful, weeks-long task into a streamlined process that supports faster closes and better insights.

For CFOs and finance leaders, the message is clear: investing in strong consolidation practices (and technology to back them up) isn’t optional – it’s a competitive advantage.

FAQs

To give a single, accurate picture of a company’s financial health across all entities. It ensures compliance with GAAP/IFRS, eliminates duplicate entries, and helps leadership and stakeholders make better decisions.

Most do it monthly, quarterly, and annually – depending on reporting requirements and management needs. Larger enterprises often run preliminary consolidations mid-cycle to spot issues earlier.

The close finalizes books for a single entity at the end of a period. Consolidation takes those closed books from multiple entities and rolls them into one set of financial statements for the group.

Primarily CFOs, controllers, investors, lenders, regulators, and auditors. They rely on them to assess financial performance, risk, and compliance at the group level.

Yes, if they own more than one legal entity (e.g. franchises, subsidiaries, or multi-location operations). Even with just two entities, consolidation gives a clearer view of overall profitability.

Traditionally spreadsheets or ERP add-ons, but modern finance teams are shifting to specialized platforms like Farseer that automate eliminations, currency translations, and reporting.