Closing the books manually without the right balance sheet software? Sounds like a complete headache. Endless spreadsheets, last-minute fixes, and that constant fear that one small mistake could throw everything off.

Now, picture this: Your reports update themselves in real time, pulling data straight from your ERP. You don’t need to copy and paste numbers or lose time fixing mistakes before an audit.

Read: FP&A Software Buyer’s Guide

That’s the power of balance sheet software – it eliminates errors, speeds up reporting, and lets you focus on what actually matters.

In this blog, we’ll cover:

- Why manual financial reporting is slowing you down

- How automation improves accuracy and efficiency

- The top tools to transform your financial reporting

But let’s go from the beginning.

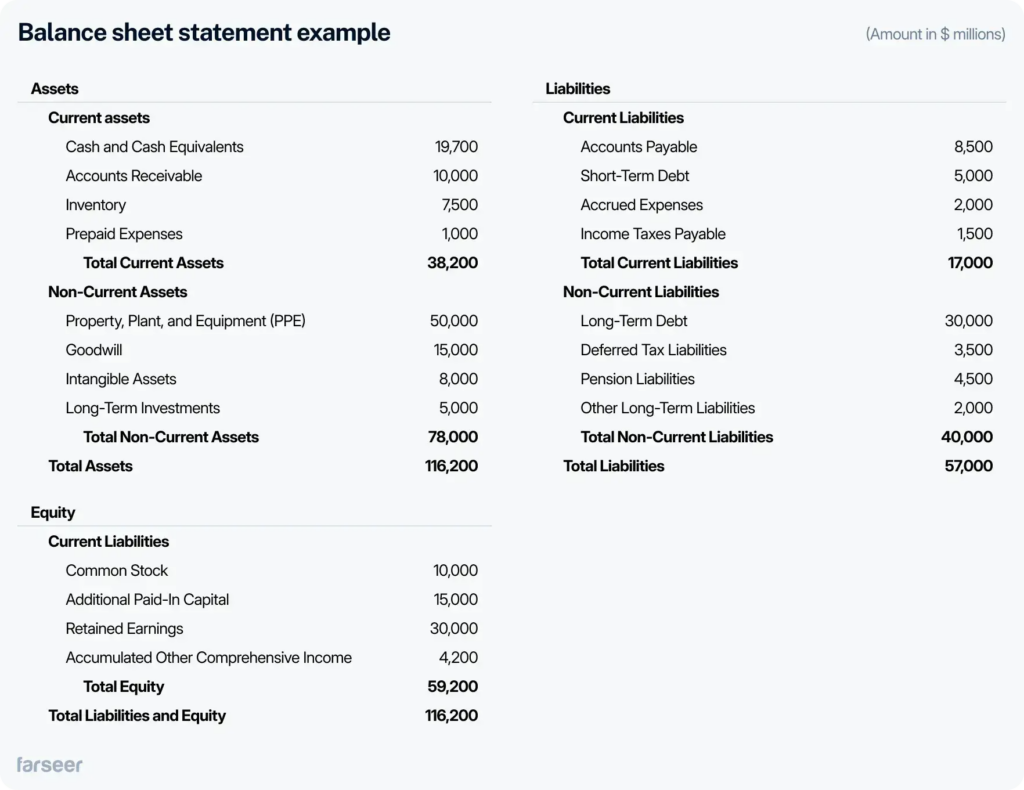

How Balance Sheet Software Automates Financial Reporting

Manual financial reporting is like trying to solve a puzzle with missing pieces – data scattered across systems, numbers that don’t match, topped with a never-ending chase to fix errors. Balance sheet software changes that because it automates the entire process.

Here’s how:

- Instantly pulls and updates data from all your financial systems: No need for copying and pasting from spreadsheets. The software pulls live data from your ERP, accounting system, and databases, which keeps your balance sheet always up to date.

- Numbers update themselves automatically as transactions happen: Assets, liabilities, and equity update automatically as transactions happen.

- Provides adjustable financial reports: Whether it’s for internal teams, auditors, or regulators, the software creates tailored reports instantly, so you can save on preparation time.

- Makes sure you’re compliant and ready for audit: The software helps you stay aligned with IFRS, GAAP, and other financial regulations. Built-in controls ensure accuracy and transparency.

With automation, financial reporting becomes faster, easier, and far less stressful, which lets you focus on analyzing the numbers instead of fixing them.

Key Features to Look for in Balance Sheet Software

Not all balance sheet software is created equal. To truly save time, reduce errors, and improve decision-making, you need the right features. Here’s what to look for:

- Seamless integration – The software should connect effortlessly with your ERP, accounting system, and data sources, so you don’t have to do anything manually.

- Scenario modeling and forecasting – A great tool doesn’t just report – it predicts. Look for software that models future balance sheet positions based on different financial scenarios.

- Automated reconciliation – Matching transactions manually? Forget it. The software should identify discrepancies automatically to make financial close faster and more accurate.

- Custom report generation – Every business has unique reporting needs. Your software should adapt to your financial structure and generate tailored reports for stakeholders, auditors, and regulators.

With these features, balance sheet software does the heavy lifting, letting you focus on strategy instead of spreadsheets.

Read What Are Primary Limitations of the Balance Sheet (and How to Overcome Them)

Top Balance Sheet Software Tools for Financial Reporting

How to know which balance sheet software is the best fit for your business?

Here are the top tools and what they do best:

1. Farseer – best for fast and dynamic financial modeling

If you need a real-time, flexible approach to balance sheet forecasting, Farseer should be your number one choice. Unlike traditional FP&A tools, Farseer automates financial modeling and consolidates balance sheet data immediately. This is perfect for businesses that require fast scenario planning and real-time insights.

- Driver-based forecasting lets you project future assets, liabilities, and cash flow without relying on static spreadsheets.

- Seamless ERP and accounting integrations ensure your balance sheet always reflects the latest financial data.

- Automated calculations and adjustments reduce errors and make financial planning much faster.

- Real-time liquidity and working capital insights help you manage cash flow proactively.

- Automated currency conversions simplify financial consolidation for multinational companies.

- Scenario planning lets you evaluate the impact of market shifts, interest rate changes, or investment decisions on your balance sheet.

- Customizable reporting and drill-down analysis allow finance teams to understand balance sheet fluctuations instantly.

Read 10 Ways Farseer Simplifies Enterprise Budgeting and Forecasting

For companies looking to move beyond slow, manual balance sheet planning, Farseer offers speed, accuracy, and real-time financial control.

2. Jedox – best for multi-entity balance sheet consolidation

Jedox is ideal for businesses managing multiple entities or subsidiaries, since it provides a centralized view of balance sheet performance. It offers:

- Automated data consolidation across different business units.

- Strong Excel integration, making adoption easier for teams used to spreadsheets.

- Advanced performance tracking, helping organizations compare financials across entities.

Similarly, if you need a tool that brings all financial data together in one place, Jedox is a solid option.

3. Moody’s Balance Sheet Management Software – best for liquidity risk & compliance

Moody’s specializes in risk assessment and financial stability, which means that it’s a great fit for companies focused on liquidity management and regulatory compliance. Key features include:

- Stress testing tools to assess financial resilience.

- Regulatory reporting compliance (IFRS, GAAP, and Basel III).

- Liquidity risk monitoring to help businesses maintain financial health.

For instance, for companies in highly regulated industries, Moody’s provides the oversight and risk management tools they need.

4. Oracle NetSuite – best for cloud-based balance sheet reporting

NetSuite is a comprehensive ERP solution with built-in balance sheet management, ideal for companies looking for scalability and multi-currency support. It offers:

- Automated financial reporting and reconciliation, reducing close time.

- Multi-entity and multi-currency capabilities, which is great for global operations.

- Strong cloud-based accessibility, ensuring real-time financial data visibility.

If your company operates across different locations and currencies, NetSuite provides a centralized financial system to keep everything in sync.

5. Workiva – best for audit-ready compliance and SEC reporting

Workiva is built for companies that need strict financial reporting governance, so it’s only logical that it’s a top choice for public companies and enterprises. It includes:

- Audit-ready balance sheet compliance to meet SEC and regulatory requirements.

- Connected reporting across financial statements, which reduces the risk of inconsistencies.

- Secure collaboration tools for finance teams to manage compliance documentation.

For businesses focused on transparency and regulatory reporting, Workiva provides a robust compliance solution.

Automate, Simplify, and Take Control of Your Financial Reporting

Manual balance sheet reporting takes too much time and leaves room for errors. Automation, on the other hand, keeps everything accurate, speeds up closing, and makes compliance easy.

If you’re not ready for a full-blown software switch, you can start by using our free Excel balance sheet template. It includes built-in KPIs, monthly structure, and versions for Actuals, Plans, and Forecasts -perfect for reducing manual work while keeping everything consistent.

Whether you need fast financial modeling (Farseer), multi-entity consolidation (Jedox), risk management (Moody’s), cloud-based reporting (NetSuite), or tools to track profitability alongside your financial position with P&L software – the right balance sheet software will transform the way you handle financial reporting.

Key Takeaways

- Manual reporting is inefficient – errors, delays, and compliance risks slow down financial processes.

- Balance sheet software automates data consolidation, calculations, and reporting, improving accuracy and efficiency.

- Key features to look for: ERP integration, scenario modeling, automated reconciliation, and compliance tools.

- Choosing the right software depends on your business needs – from forecasting and risk management to multi-entity consolidation and audit readiness.