Rolling forecast software is becoming a must-have for modern finance teams.

According to Farseer’s State of Finance 2026 report, only 12% of finance teams use rolling forecasts today – but that number is rising fast as agility becomes a top priority.

Read: Rolling Forecast – 101 Guide For Smarter Planning

Traditional financial forecasts often fall short in fast-changing environments. That’s where rolling forecast software – and the broader shift toward continuous forecasting – comes in. It helps teams stay ahead of uncertainty by updating projections throughout the year, not just when annual planning rolls around.

And it’s not just a nice-to-have. According to IBM research, companies using rolling forecasts are:

- 12% more accurate in their projections

- Spend 50% less time on budget preparation

- See 10% higher profitability

In this blog, we’ll break down:

- Why rolling forecasts are replacing traditional budgeting

- Which companies benefit most from this type of software

- A comparison of the top tools on the market

- What features to look for

Let’s get into it.

Why Rolling Forecasts Are Replacing Traditional Budgeting

Traditional budgeting assumes the world will stay the same for 12 months. But inflation, price fluctuations, changing customer demand, and global supply chain issues aren’t waiting for your next budget cycle.

Teams relying on static annual plans often find themselves manually adjusting Excel sheets mid-year or running last-minute reforecasts to respond to unexpected changes. It’s inefficient and stressful.

Rolling forecasts, on the other hand, allow you to:

- Update forecasts monthly or quarterly

- Base projections on the latest actuals

- Model different scenarios before making decisions

Companies that shift to rolling forecast software often see better cash flow planning, improved agility, and fewer surprises during the year.

Who needs rolling forecast software?

If your team:

- Runs more than one forecast per year

- Spends too much time collecting data from multiple systems

- Uses Excel or fragmented tools to update plans

- Has trouble aligning operations with financial targets

…then you’re ready for rolling forecast software.

These tools are especially helpful for companies with multiple departments, cost centers, or subsidiaries. A logistics firm operating across 4 countries or a pharma distributor selling by region, these are the kinds of businesses that benefit the most.

Top Rolling Forecast Software Options

There are plenty of planning tools on the market, but not all are built for companies with complex structures or industry-specific needs. Here’s a quick overview of the main ones worth considering in 2025:

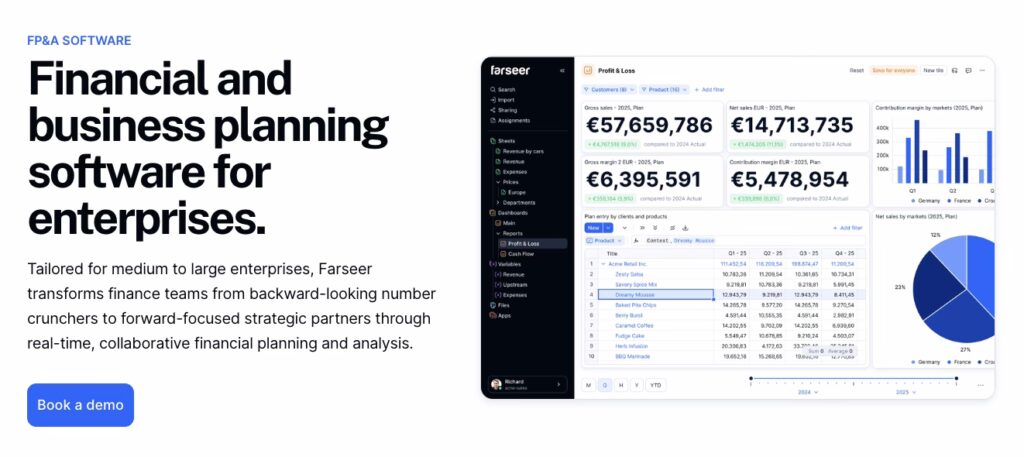

Farseer – Built for fast, flexible rolling forecasts

Farseer is a smart choice for teams that are serious about rolling forecasts but don’t want the complexity of traditional enterprise tools. It was designed specifically for mid-sized and large companies that need flexibility, speed, and collaboration across finance and operations – without getting buried in implementation or consulting hours.

Unlike legacy solutions that force you into rigid modules and pre-defined templates, Farseer gives you full modeling flexibility (similar to Excel) while keeping everything centralized, structured, and auditable.

Why companies choose Farseer for rolling forecasts

Farseer stands out for three reasons:

- Speed: Forecasts and scenario models can be built and updated quickly, even across multiple business units.

- Familiar logic: Finance teams can model in a way that feels like Excel, so they don’t lose time or control during migration.

- Cross-functional planning: Sales, operations, and finance can all contribute without sending files back and forth.

Strengths

- Excel-style modeling: For finance professionals who want power without having to learn a new language or logic model.

- Fast time to value: Typical implementation takes 4 – 8 weeks, not months.

- Full flexibility: You can build any model you need – revenue, OPEX, headcount, CAPEX, scenario analysis – and connect them all.

- Transparent and auditable: Full version history, user tracking, approval workflows, all built-in.

- Designed for scale: Handles planning complexity across cost centers, product lines, and markets.

Weaknesses

- May be too robust for very small teams: If your planning team is just 1–2 people and you’re not dealing with complex forecasting needs, Farseer might be more than you actually need.

- Takes a bit of learning upfront: While the platform follows familiar Excel-style logic, building more advanced models requires some initial effort. That said, most teams ramp up quickly thanks to hands-on onboarding and responsive support.

Anaplan – Flexible but complex

Anaplan is a strong choice for large enterprises with highly complex planning needs across departments, regions, or business units. It offers a powerful modeling engine that can handle detailed multi-dimensional forecasting and large data volumes. If your company already has a mature FP&A function and a team of dedicated model builders, Anaplan gives you the flexibility to build almost anything.

But that flexibility comes at a cost, both financially and operationally. Implementation can take several months, and even small changes to the model structure often require trained specialists. It’s best suited for companies that already have the internal resources to manage and maintain a centralized planning platform. For teams looking to balance complexity with agility, especially in fast-moving environments, rolling forecast software might be a more scalable alternative.

Read Anaplan Competitors – The 6 Best Alternatives for Enterprise FP&A

Best for:

Large enterprises with complex forecasting structures and the budget to support them.

Weaknesses:

- Longer setup times

- High licensing and consulting costs

- Steeper learning curve for non-technical users.

Jedox – BI-integrated, Excel-friendly

Jedox is often used by teams that already rely on business intelligence tools like Power BI or Tableau. It integrates well with data warehouses and allows finance teams to keep working in a spreadsheet-like environment. Its strength lies in BI integration, data consolidation, and support for planning workflows inside a familiar Excel-style interface.

That said, when models become highly complex or when multiple stakeholders need to collaborate at scale, Jedox can become harder to manage. Performance and clarity may suffer if you’re trying to do too much in one place. For companies seeking more scalability and automation in their planning process, rolling forecast software may offer a more efficient path forward.

Read Looking for Jedox Competitors? Here Are the 7 Best Options

Best for:

Organizations that already use BI tools and want a planning solution that fits into that environment.

Weaknesses:

- Model management and performance can suffer under heavy planning loads

- Less ideal for rolling forecasts with many contributors.

Vena – Excel on steroids

Vena is built around Excel, literally. It adds structure, governance, and automation to spreadsheet-based processes, making it appealing to teams that don’t want to move away from Excel but still need more control and consistency. It’s especially strong in budgeting workflows and financial close processes.

But that reliance on Excel is also its limitation. It doesn’t fundamentally change how planning works, it just makes your spreadsheets smarter. If your team is aiming for a true rolling forecast process with integrated operational and financial planning, Vena can feel like a transitional step rather than a long-term solution. In contrast, rolling forecast software allows you to move beyond spreadsheets entirely, enabling real-time updates, automated workflows, and deeper cross-functional alignment.

Read 7 Vena Alternatives and Competitors to Take a Look at in 2025

Best for:

Finance teams that want to keep Excel but need better audit trails, workflows, and templates.

Weaknesses:

Not ideal for continuous planning or fast-moving forecast updates across departments.

Oracle PBCS – Enterprise-grade, but heavy

Oracle Planning and Budgeting Cloud Service (PBCS) is a robust platform built for global enterprises with strict governance, audit, and integration requirements. It offers a wide range of planning functionalities, including driver-based forecasting, scenario modeling, and advanced user permissions.

It works best in environments that already use other Oracle products. For companies not already embedded in Oracle’s ecosystem, the setup and long-term maintenance can feel overwhelming. The platform also tends to require significant IT involvement for customizations and integration work.

Best for:

Multinational corporations with complex governance needs and existing Oracle infrastructure.

Weaknesses:

- High complexity

- Longer implementation

- Overkill for companies without Oracle’s broader stack.

What to Look for in Rolling Forecast Software

When you’re comparing tools, here’s what to prioritize, especially if you’re in a complex industry like manufacturing, retail distribution, or pharma:

- Fast, flexible modeling: You should be able to change assumptions and see updated results immediately.

- Integrated actuals: You want actual data flowing in directly from your ERP or BI tools to keep forecasts grounded in reality. Real-time reporting plays a key role here – making sure your numbers are always up to date, without manual refreshes or delays.

- Scenario planning: Forecast different outcomes based on price changes, demand shifts, or new investments.

- Collaboration: Multiple planners across departments should be able to contribute without sending files back and forth.

- Audit trail and governance: Especially important in regulated industries or group-level planning.

Final Thoughts

Rolling forecasts are not just a trend, they’re a necessity for companies operating in uncertain, fast-moving industries. The key is finding a tool that matches your planning complexity, team structure, and existing systems.

If your current tools make rolling forecasting difficult or slow, it might be time to consider a platform that was built with this approach in mind like a rolling forecast software that supports fast updates, real-time data, and full team collaboration.