Financial reporting software has changed far beyond its old role as a month-end packaging tool. Reporting now moves at the pace of operations: numbers shift daily, decisions cannot wait, and finance is expected to explain what is happening even while the close is still underway.

Most tools, however, still treat reporting as a static export. They ignore that reporting is continuous: data arrives unevenly, structures change, and teams need visibility long before accounting finalizes anything. The result is familiar to every finance team: systems that don’t align, files that need constant fixing, and reports that lose relevance almost immediately.

Read more: What Great Financial Reporting and Analytics Actually Look Like

These problems have real costs. They slow down decisions, complicate planning, and create unnecessary rework. This guide looks at financial reporting software through a practical lens: can it actually support the way finance operates today, with ongoing reporting, multiple entities, cross-functional inputs, and the expectation to produce a forecast before the close is even finished?

What Today’s Reporting Environment Demands

Modern reporting depends on data that is stable, connected, and updated continuously. Finance can’t rely on periodic uploads or stitched spreadsheets; it needs a system that consolidates information in real time, tracks changes, and preserves an audit trail that can be trusted.

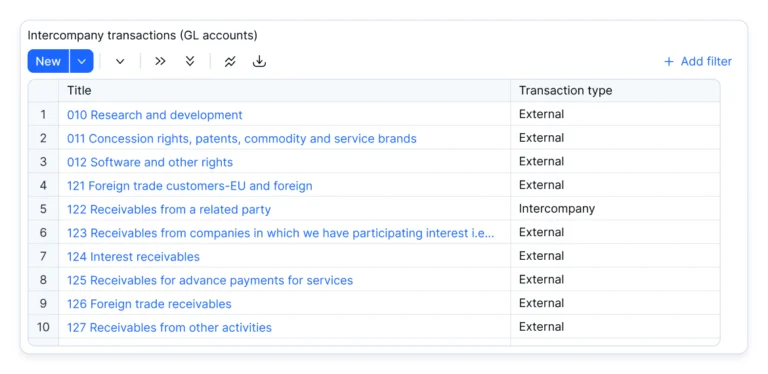

It also has to reflect how the business is structured. Multi-entity groups, intercompany flows, FX, eliminations, and operational drivers all need to live in one model. Reporting now pulls from CRM, HR, ERP, billing, and warehouse systems. When these inputs stay disconnected, the planning cycle slows immediately.

Good software reduces that friction. It keeps reporting, forecasting, and scenarios aligned instead of pushing them into separate workstreams that eventually contradict each other.

Read more: Financial Reporting Automation – What It Actually Fixes (And Doesn’t)

Accounting Reporting vs Management Reporting

Most finance teams still operate with two separate reporting streams. One is built to meet accounting standards and close the books; the other exists because management needs explanations long before the close is complete. The first is rigid and backward-looking, while the second is flexible and focused on what is changing right now.

Most tools address only one side. They either generate compliant statements or produce light KPI dashboards, but rarely support both without forcing finance to maintain duplicate logic and reconcile conflicting numbers.

A workable finance stack needs to unify the two. Accounting accuracy and operational insight must sit on the same structure; otherwise reporting, forecasting, and scenarios drift apart every month. When both rely on one model, finance stops reconciling versions and starts delivering a single, coherent narrative the business can act on.

Evaluation Criteria: How to Judge Whether a Reporting Tool Is Fit for Purpose

Here is evaluation criteria:

Consolidation impact

Reporting software should eliminate manual consolidation, not add another layer around it. If core consolidation still lives in spreadsheets, the tool is not improving the workflow.

Direct integrations

The platform must connect directly to your systems. Tools that rely on weekly uploads, manual mapping, or file handling will fail once reporting volume, number of entities, or data sources increase.

Ease of use

Non-technical users should be able to build and refresh reports independently. If every update depends on one Excel specialist or IT, the tool creates a new point of delay.

Unified logic

Reporting and forecasting must share the same underlying model. When they sit in separate workbooks or disconnected templates, accuracy breaks the moment planning begins.

Governance quality

As the organization expands, version control, audit trails, and user permissions become essential for keeping data reliable when multiple teams contribute inputs.

The 10 Tools You Should Consider in 2026

It is hard to choose which tool can fit your business best, therefore we made a list to make it a bit easier.

1) Abacum – For collaborative mid-market reporting

Abacum positions itself as a reporting and planning platform built for finance teams that operate across multiple departments and locations. It focuses less on dashboards and more on speeding up cross-team workflows: collecting inputs, reviewing assumptions, and standardizing reporting cycles.

Key Features

- Real-time reporting with predefined templates that reduce manual formatting.

- Collaboration tools that structure how teams submit, review, and approve inputs.

- Automated consolidation across departments and cost centers.

- Version control and review trails that keep changes traceable.

- Integrations with common mid-market systems (CRM, HR, accounting).

What to Look Out For

Abacum fits companies with moderate complexity. When structures exceed 5–10 entities or require intricate modeling, its flexibility tightens. Some users report friction when syncing large or highly customized datasets. It performs best when the organization aligns to its workflows rather than trying to replicate old spreadsheet logic inside the tool.

2) NetSuite – ERP-integrated financial reporting software

NetSuite’s reporting sits directly inside the ERP, which makes it strong for organizations that prioritize compliance, auditability, and standardized accounting across multiple entities. Its value is structural: once configured, it becomes the backbone for financial operations, ensuring every report draws from the same transactional source.

Key Features

- Native financial statements with drill-down to transaction level.

- Reliable multi-entity, FX, and intercompany functionality.

- Built-in internal controls and audit trails.

- Broad ERP modules that unify accounting, procurement, inventory, and operations.

- Strong suitability for regulated or fast-growing organizations that need consistency above speed.

What to Look Out For

NetSuite is not lightweight. Implementations require time, change management, and internal discipline. Reporting is robust but less flexible for ad-hoc or operational analysis. Custom reports often need admin support, and smaller teams may struggle to maintain the system without dedicated ownership. Cost escalates quickly with modules and users.

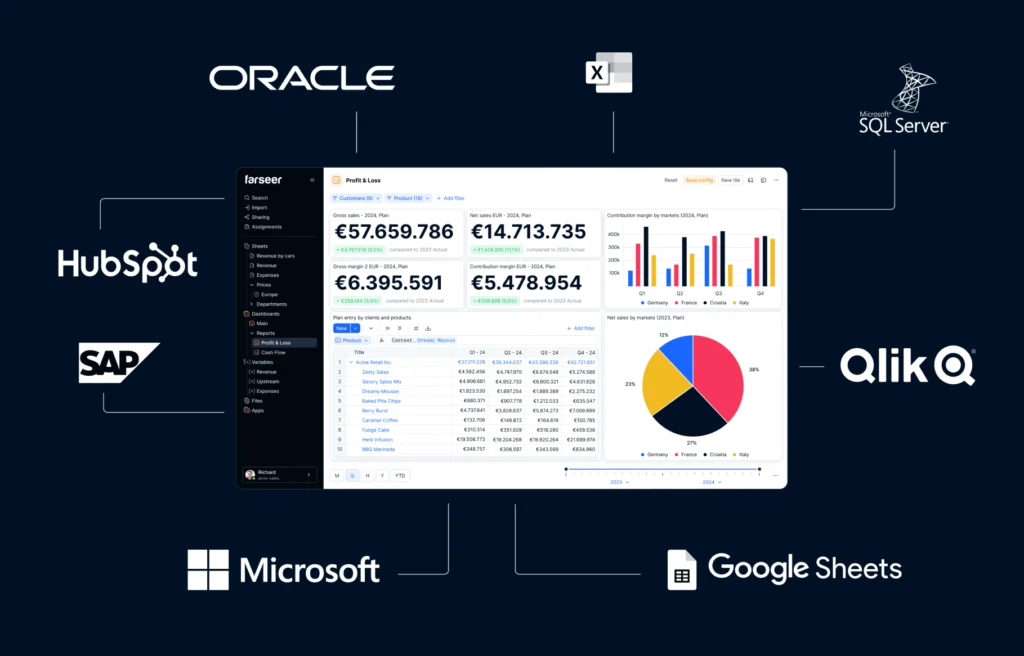

3) Farseer – Best for structured multi-entity reporting + forecasting

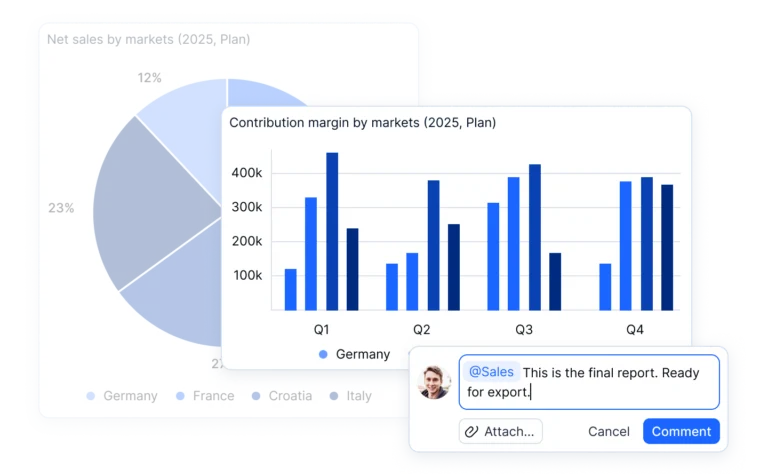

Farseer, one of financial reporting software, treats reporting, forecasting, and scenarios as one continuous process instead of three separate workstreams. That design choice matters: it allows teams to rebuild the monthly cycle around a unified model rather than juggling dozens of templates, versions, and side files.

Key features

A real modeling layer that mirrors how finance thinks

Farseer allows teams to build logic directly into the model rather than burying them in spreadsheets or script-based tools. Revenue engines, production logic, workforce planning, eliminations, and any custom business mechanics sit in one structured environment. Changing a driver updates reporting, forecasts, and scenarios instantly because they all rely on the same model.

Continuous actuals ingestion from multiple systems

The platform pulls data from ERPs, CRMs, HR systems, and operational tools on a schedule you define. Imports reconcile automatically with the model’s structure, so month-end doesn’t require manual mapping or copy-paste exercises. This also enables rolling reporting; numbers update as soon as the source system does.

Multi-entity consolidation that finance can control

Intercompany rules, eliminations, FX conversions, and entity-specific adjustments can be defined once and reused automatically. Finance teams don’t have to maintain ten parallel spreadsheets or reapply the same logic each period. Consolidated statements update in real time as new actuals arrive or assumptions change.

Reporting and forecasting in the same environment

P&L, balance sheet, and cash flow reports come from the same model used for planning. This eliminates the typical gap between “reporting numbers” and “forecast numbers”. Scenario work becomes more reliable because it does not duplicate logic or rely on shadow models.

What to look out for

Farseer works best when finance teams want structure, consistency, and a single modeling environment instead of maintaining dozens of spreadsheets. Companies that prefer fully ad-hoc, unmanaged spreadsheet workflows may need time to adjust to a more organized process.

4) Workday Adaptive Planning – Best if you run Workday HR

Adaptive is the logical choice for companies that operate fully inside the Workday ecosystem. It ties financial reporting, budgeting, and workforce planning into one environment, which is attractive for HR-heavy organizations or enterprises with established Workday governance.

Key Features

- Prebuilt planning and reporting templates suitable for enterprise processes

- Strong workforce planning because of the Workday HR connection

- Structured budgeting workflows with approvals

- A stable, consistent reporting logic suitable for large organizations

What to Look Out For

Adaptive’s value drops once you’re outside the Workday ecosystem. Integrating it with non-Workday ERPs (SAP, NetSuite, Microsoft, custom systems) usually requires middleware or expensive integrations that take time to maintain.

The modeling environment is rigid compared to modern FP&A tools. Anything that deviates from standard FP&A structures, such as complex revenue engines or operational drivers, becomes hard to express without workarounds.

Read more: 4 Workday Adaptive Planning Competitors Worth Considering in 2025

5) Vena – Excel-native financial reporting software

Vena is built for finance teams that want centralized data without abandoning Excel. It reinforces spreadsheet familiarity while layering governance, workflows, and controlled models underneath. For companies with a long Excel culture, Vena reduces friction during adoption and improves consistency across reporting processes.

Key Features

- Excel interface with centralized data storage

- Workflow-driven budgeting and reporting

- Version control layered on top of familiar models

- Extensive template library for standard financial statements

What to Look Out For

Vena brings Excel discipline issues with it. If a team already struggles with inconsistent formulas, scattered logic, or poor sheet hygiene, Vena does not magically fix these habits; it simply centralizes them. The dependency on Microsoft is real. Companies using Google Workspace or cross-environment setups often face operational friction, especially during collaboration. Integrations outside Microsoft are weaker. Pulling ERP, CRM, or operational data into Vena reliably may require additional IT effort.

Read more: 7 Vena Alternatives and Competitors to Take a Look at in 2025

6) Datarails – For automating spreadsheet-heavy reporting

Datarails is aimed at teams whose reporting still relies on dozens of Excel files. It automates consolidation, standardizes inputs, and reduces manual work without forcing a complete shift into a new modeling environment. It’s a pragmatic tool for SMB and lower mid-market teams that need structure quickly.

Key features

- Automated consolidation of Excel models

- Central database for imported spreadsheet data

- Reporting templates for P&L, balance sheet, cash flow

- Automatic extraction of numbers from disparate workbooks

What to look out for

Datarails makes Excel faster, but it does not replace Excel logic. If the underlying spreadsheets contain inconsistent formulas or outdated structures, the platform will replicate those issues more efficiently rather than eliminate them. Dashboards are basic. Visuals and analytical depth lag behind more modern FP&A platforms, which limits its use for operational teams outside finance.

In short, Datarails works best as a short- to mid-term solution for automating existing spreadsheet processes, not as a long-term modeling environment for complex organizations.

How to Map These Tools to Real Finance Environments

Choosing reporting software is not about features; it is about operational fit. Based on implementation data and industry patterns, it can be observed that different tools solve different types of problems.

FP&A Tool Fit Quiz

Question 1

How complex is your organizational structure?

Question 2

How quickly do you need to implement an FP&A solution?

Question 3

What is your team’s technical profile?

Question 4

What is your primary planning priority?

Question 5

What is your expected FP&A budget?

Conclusion

Technology only works when the structure beneath it is clear. A reporting tool can automate processes, but it cannot compensate for fragmented data, unclear ownership, or inconsistent inputs. Once those fundamentals are aligned, the choice of software becomes much simpler.

Finance now operates in a rhythm where waiting for month-end is no longer an option. Teams that succeed move from reacting to numbers to monitoring them continuously and adjusting decisions in real time.

Reporting, forecasting, and scenarios are becoming one connected cycle and the organizations that build this capability now will navigate complexity with far more clarity and confidence.