Continuous forecasting is changing the way companies plan. For years, companies relied on annual budgeting cycles.

How did that usually look?

You would build a budget once a year, lock in assumptions, and hope external conditions stay stable enough to make it usable. But in practice, especially over the past five years, that approach simply doesn’t hold up anymore.

Forecasts built in Q4 often become irrelevant by Q2. That’s why building a flexible financial forecast is now essential for staying ahead. When raw material prices swing, demand shifts across markets, or new regulations hit, your static budget can be outdated before the board even gets a chance to approve the last one.

Read: Rolling Forecast – 101 Guide For Smarter Planning

A global KPMG survey of 540+ executives found nearly half rate their financial forecasting data as just adequate or worse. Despite all the effort, traditional budgets often can’t be trusted.

That’s why more companies are moving to continuous forecasting, rolling forecasts updated monthly or quarterly, using real-time data and inputs from across departments. Instead of forecasting once and forgetting it, finance teams now revise revenue, OPEX, and CAPEX based on current sales, hiring plans, and production shifts.

It’s faster, more realistic, and built for how business actually works.

Business Impact of Continuous Forecasting

Why does this matter beyond process efficiency?

Because forecasting agility equals financial control. Companies that forecast more frequently are more likely to:

- Spot cash flow issues before they hit the balance sheet

- Reallocate resources faster, based on where demand really is

- Improve alignment between operational planning (units, pricing, headcount) and financial targets

And the shift is already underway: Over half of finance chiefs (53%) are looking to accelerate digital transformation through data analytics, AI, automation, and cloud, to drive agile, data-driven decision-making.

What Do You Need to Make Continuous Forecasting Work

For most mid-sized and large companies, switching to continuous forecasting isn’t a question of desire, it’s about whether the process and systems allow it.

Here’s what’s usually required:

1. Consolidated, clean data

When teams rely on scattered spreadsheets, disconnected BI dashboards, and manual input collection, forecasting becomes slow, error-prone, and unsustainable. Version control breaks down, and finance teams waste time reconciling inconsistencies instead of delivering insights.

The foundation for continuous forecasting is a centralized data structure – where actuals automatically flow in from ERP, sales, HR, and operations, and forecast inputs are based on current, trusted data.

Real-life example: How CIOS eliminated spreadsheet chaos

CIOS Group, a leading waste management company in Croatia with 15 legal entities, faced this challenge firsthand. Their reporting process was entirely manual, involving Excel packages that were 30 to 40 sheets deep per entity. Consolidation took weeks and required intense coordination, locking up finance resources in repetitive work and constant error-checking.

Even though they always met deadlines, the process left no time for agility. Leadership asked for more frequent, mid-year reporting and real-time insights, but the old structure couldn’t support that.

After implementing Farseer, modern FP&A software, CIOS connected their ERP and set up automated data flows across the group. Today, the majority of financial data flows into the system clean, structured, and ready for use. Consolidation that used to take weeks now takes a few days, with over 80% of manual work eliminated. Finance can finally focus on analysis instead of chasing down broken formulas.

2. Flexible planning tools

Having the right data is one side of the equation, but without the right tools, your forecasting process still stalls. Traditional spreadsheets can’t handle the volume, complexity, or pace required for continuous forecasting. Version control becomes a mess. Audit trails are non-existent. And simulating scenarios turns into a multi-day effort, often copied across dozens of files. That’s why more teams are turning to real-time reporting – to work with live, connected data instead of reconciling broken versions each month.

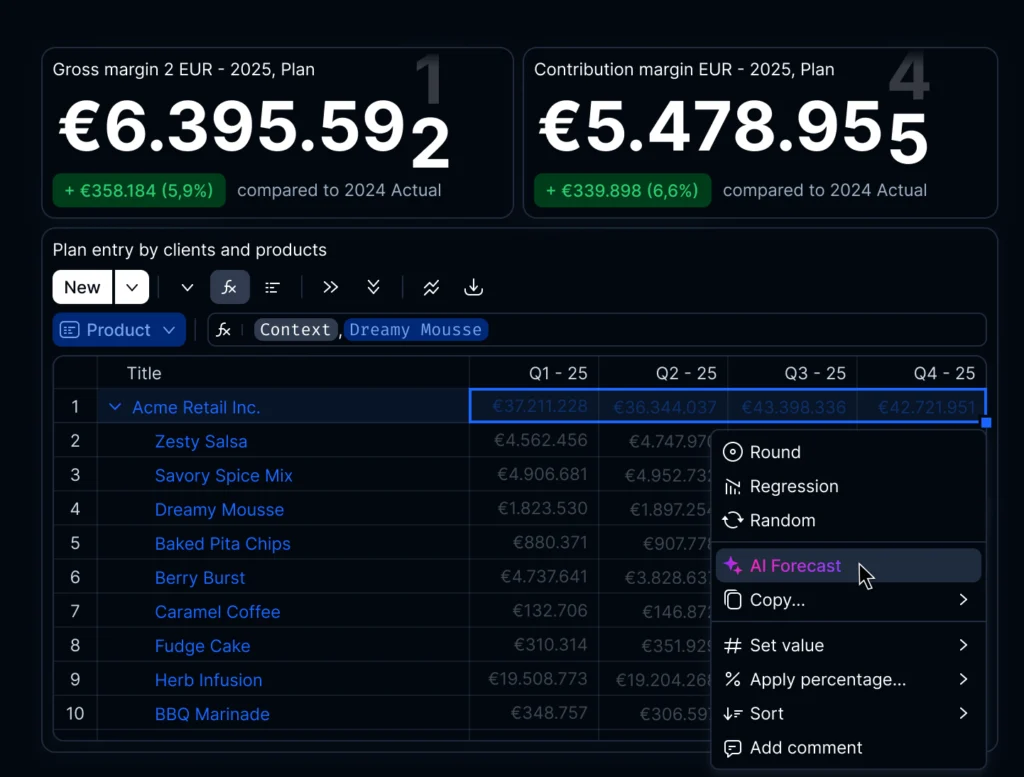

Modern finance teams need tools that go beyond basic spreadsheet functions. A continuous forecasting environment requires:

- Monthly (or even weekly) updates that don’t break models

- Scenario planning capabilities that allow teams to test assumptions quickly—like what happens if raw material costs spike by 8% or a product line underperforms in Q3

- Built-in collaboration features, so budget owners, HR, and sales can input data directly without creating chaos

- Versioning and workflow control to track changes, manage approvals, and lock critical assumptions when needed

That’s why more companies are moving toward cloud-based FP&A platforms. These tools are purpose-built for speed, scale, and flexibility, allowing finance teams to work across departments without losing structure.

If you’re evaluating your options, here’s a breakdown of the top rolling forecast software tools in 2025 – with pros, cons, and pricing compared side by side.

3. Collaboration across departments

Even the most sophisticated forecasting model breaks down if the inputs aren’t reliable. Continuous forecasting depends on consistent input from sales, HR, operations, and other business functions, not just finance working in isolation.

The problem is that, in many companies, input ownership is unclear. Sales teams might use a separate pipeline sheet. HR keeps hiring plans in siloed trackers. Operations may forecast demand based on assumptions finance isn’t even aware of.

The result? Finance teams spend more time chasing numbers than analyzing them.

Successful companies approach this differently: they create structure around collaboration. That means defining who owns each part of the forecast, aligning timelines, and using a single platform to collect, validate, and update assumptions.

Real-life example - How Hrvatski Telekom streamlined their financial planning

Hrvatski Telekom, part of Deutsche Telekom Group and one of the largest telecom providers in the region, faced exactly this challenge. With multiple business units and fast-changing priorities, keeping financial forecasts in sync with operational plans was becoming increasingly difficult.

After implementing Farseer, they established a collaborative planning process where each department updates its own inputs directly in the platform. Sales inputs, HR headcount plans, and OPEX projections are now reviewed and updated in one place, on a set calendar, with automated workflows and full version control. Finance no longer needs to consolidate 15 different files or email multiple departments for late updates.

Challenges You’ll Likely Face (And How to Work Around Them)

Still, making the shift to continuous forecasting isn’t always smooth.

Here are a few typical roadblocks:

- Resistance to change. Sales might ask, “Why do we need to update numbers again?” The key is to connect forecasting to business impact, make the data relevant to them, and automate what you can.

- Ownership issues. If input owners don’t feel responsible for the data, this data won’t be accurate. Set deadlines, communicate expectations, and share forecast quality results with contributors.

- Tool limitations. Legacy systems or Excel-heavy processes slow everything down. One controlling director at a logistics company told us: “Forecasting is great in theory, but preparing 20 Excel files every month kills the team.” If your tools can’t keep up with the rhythm of monthly or rolling forecasts, people will stop using them and the process will break down.

A good workaround? Start with one area, like revenue forecasting, and scale from there once processes are tested.

Key Takeaways

- Continuous forecasting = control. Updating forecasts monthly or quarterly helps spot risks early and stay aligned with operations.

- Data quality matters. Nearly half of finance leaders say their forecasting data is only “adequate” or worse (KPMG).

- Three essentials for success:

- Clean, centralized data — Like CIOS Group, who cut consolidation time in half by automating data flow from 15 entities.

- Flexible planning tools — Cloud FP&A platforms allow scenario planning, collaboration, and auditability Excel can’t handle.

- Cross-functional input — Hrvatski Telekom aligned sales, HR, and finance in one system to streamline updates.

- Start small, scale fast. Begin with one area (e.g. revenue) to test and prove the process before expanding.

- Adoption hinges on usability. If tools and processes aren’t fast and simple, forecasting won’t stick.