Traditional annual budgets have a short shelf life and by the time they’re finalized, market conditions have often shifted, costs have moved, sales pipelines have changed, and priorities have evolved. For many finance teams, this makes the annual budget less of a plan and more of a snapshot.

This is why continuous budgeting is gaining traction.

Continuous budgeting is a structured way of keeping the budget up to date throughout the year, typically with monthly or quarterly updates. It doesn’t mean rebuilding everything from scratch. It means adjusting the parts of the plan that are most sensitive to change: input prices, demand volumes, margins, and resource allocations.

This approach brings flexibility to companies working in dynamic environments, with fluctuating costs, short sales cycles, or multiple business units. It allows finance to stay aligned with reality without sacrificing control or accountability.

This article looks at why more finance teams are adopting continuous budgeting, where it adds the most value, common pitfalls to avoid, and six practical actions to make it work without creating more complexity.

Read more: How Top FP&A Teams Use Rolling Forecasts to Stay Ahead

Why Continuous Budgeting Is Gaining Ground

Most finance teams know when the budget stops being useful: not at year-end, but often just weeks after it’s finalized. This was a major pain point for a long time. What’s changing now is that more organizations are doing something about it.

Continuous budgeting is gaining traction because it solves a specific set of problems: delayed decisions, misaligned targets, and static plans that can’t absorb change. When cost structures shift mid-year or demand drops unexpectedly, waiting for the next budgeting cycle is no longer an option.

Instead of locking into assumptions, continuous budgeting allows you to adjust regularly, often monthly, based on what’s actually happening across the business. This keeps forecasts relevant and helps the business course-correct sooner, not after the quarter’s closed.

According to the State of Finance 2026 report by Farseer, 36% of finance teams already update forecasts monthly or quarterly, while another 19% are adopting rolling or continuous forecasting. This shows a clear shift from static annual cycles to dynamic, always-on planning – exactly the mindset continuous budgeting is built for.

It’s not just about agility – it’s about control. A PwC report states that 58% of CFOs are now spending more time on FP&A and business performance than they did a year ago, reflecting a clear push toward more active and forward-looking planning processes. The goal isn’t to create more work but to ensure planning supports faster decision-making when conditions change.

For companies exposed to pricing volatility, shifting input costs, or fast sales cycles, this approach isn’t a trend, it’s becoming the baseline.

Read more: Continuous Forecasting: Why It Beats Annual Budgets

Where Continuous Budgeting Works Best

Continuous budgeting isn’t a universal fix ,but in certain business environments it solves real problems that static planning can’t.

One of the most common is high cost volatility. For companies in manufacturing, pharma, or logistics, input costs can shift monthly. When material prices, energy rates, or transportation costs move faster than your budgeting cycle, being able to adjust assumptions regularly is critical to protect margins.

It also works well in sales-driven businesses with short visibility. Distributors and B2B retailers often plan around month-to-month demand, not annual targets. Continuous budgeting helps them respond to volume shifts early, adjust spend, and align sales and operations in real time.

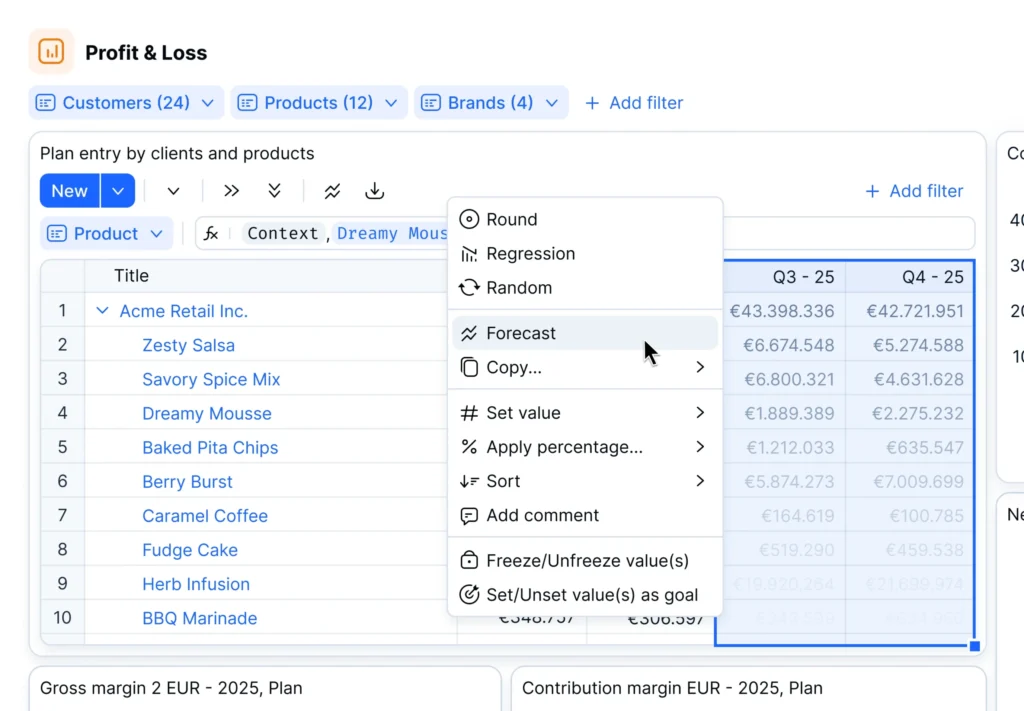

In companies with large product portfolios, monthly updates are key for managing SKU-level profitability. Violeta, a regional FMCG company, uses Farseer, a driver-based planning and forecasting platform, to manage over 30 brands and hundreds of SKUs across multiple markets, enabling their finance team to track margins, adjust forecasts, and respond quickly to changes in pricing or demand.

It’s also effective in multi-entity or regional operations. When each unit faces different market realities, allowing local teams to update their numbers while keeping a centralized structure in place improves both accuracy and accountability. EOS Matrix, operating across several countries, uses Farseer to manage this balance across business units without losing version control.

Wherever the business model is exposed to fast-changing inputs, short planning cycles, or decentralized decision-making, continuous budgeting helps keep finance aligned with reality and gives leadership the numbers they need to act sooner, not later.

Common Traps to Avoid

While continuous budgeting can bring more flexibility and control, it’s also easy to get it wrong. Many teams jump in with good intentions, only to end up with more complexity, unclear accountability, and minimal impact on decision-making.

These are the most common mistakes and how to avoid them:

- Confusing reforecasting with continuous budgeting – Simply updating the forecast every month isn’t the same as continuous budgeting. Without adjusting key drivers, reviewing assumptions, or aligning with business priorities, it’s just a reporting routine. Continuous budgeting needs to feed into actual planning decisions, not just refresh numbers.

- Adding too much process without improving decisions – Some teams fall into the trap of increasing the frequency of budgeting without changing how it’s done. If updates don’t lead to better or faster decisions, they just create more work. The goal is to stay relevant, not to plan for the sake of it.

- Trying to run the process in spreadsheets – Excel isn’t the problem, but using it to run an evolving business is. With monthly updates across regions, departments, and product lines, version control breaks down quickly. Small errors compound fast, and teams spend more time reconciling than planning. Without a centralized, structured system, continuous budgeting becomes unmanageable.

- Keeping the process isolated in finance – Budget updates that don’t involve sales, operations, or supply chain lose their grounding. If assumptions aren’t connected to what’s happening in the business, finance ends up planning in isolation, and credibility suffers. Cross-functional input is non-negotiable.

Avoiding these pitfalls isn’t about having more tools or more time, it’s about designing a process that reflects how the business actually works, and keeping finance in a position to lead planning, not just maintain it.

Read more: Budget Management Software for Business: How to Finally Leave Excel Behind

Six Critical Actions to Make Continuous Budgeting Work

Continuous budgeting isn’t about updating numbers more often, it’s about updating what matters, when it matters, in a way that supports better decisions. When done well, it brings agility without sacrificing structure. These six actions separate effective processes from those that just add noise.

1. Connect budgets to operational drivers

Budget updates should reflect real business activity, not arbitrary percentages. Anchor your model in volumes, pricing, discounts, product mix, cost structures, and headcount. When those drivers shift, the plan should adjust automatically, without needing to rebuild it from scratch.

Read more: How to Connect Headcount Planning with Strategic Goals

2. Shorten the planning cycle

Move from quarterly to monthly updates using rolling forecasts. This doesn’t mean redoing everything, it means revisiting key assumptions and adjusting where it counts. The goal is to stay close to actual performance without overwhelming the team.

3. Centralize the model, decentralize the inputs

One source of truth, many contributors. Finance owns the structure, but local teams, sales, and operations should be able to update their part of the plan directly, without creating version chaos. A centralized system (like Farseer) makes this manageable.

4. Define clear triggers for updates

Not every small change requires a plan revision. Set thresholds: if raw material costs shift by 8%, or if sales volumes miss plan by 10%, a review is triggered. This keeps the process focused and prevents constant rework.

5. Automate where possible, but keep finance in control

Automation can streamline data refreshes, scenario comparisons, and driver updates. But finance must still validate inputs, review logic, and approve final numbers. AI and tools can support planning, they shouldn’t own it.

Read more: Top 10 Finance Automation Software for Enterprise FP&A in 2025

6. Focus on insights, not just iterations

Every budget update should answer a question or support a decision, otherwise, it’s just admin. Continuous budgeting should move the business forward, not just maintain a model, whether it’s a spending adjustment, pricing change, or operational pivot.

Making It Work Long-Term

A budget that can’t adapt is a budget that quickly loses value. As business conditions change, whether it’s input costs, demand patterns, or strategic priorities, finance needs a process that responds just as quickly.

Continuous budgeting offers that flexibility, but it only works if it’s built for how the business actually runs. That means clear drivers, short planning cycles, collaborative input, and systems that eliminate manual effort, not add to it. This isn’t just a process upgrade. It’s a shift in how finance supports decision-making: not by predicting everything upfront, but by adjusting with precision as conditions evolve.

At the end we can say that continuous budgeting is becoming a default for teams under pressure to deliver faster insight, fewer surprises, and tighter alignment, not just another nice-to-have metric.