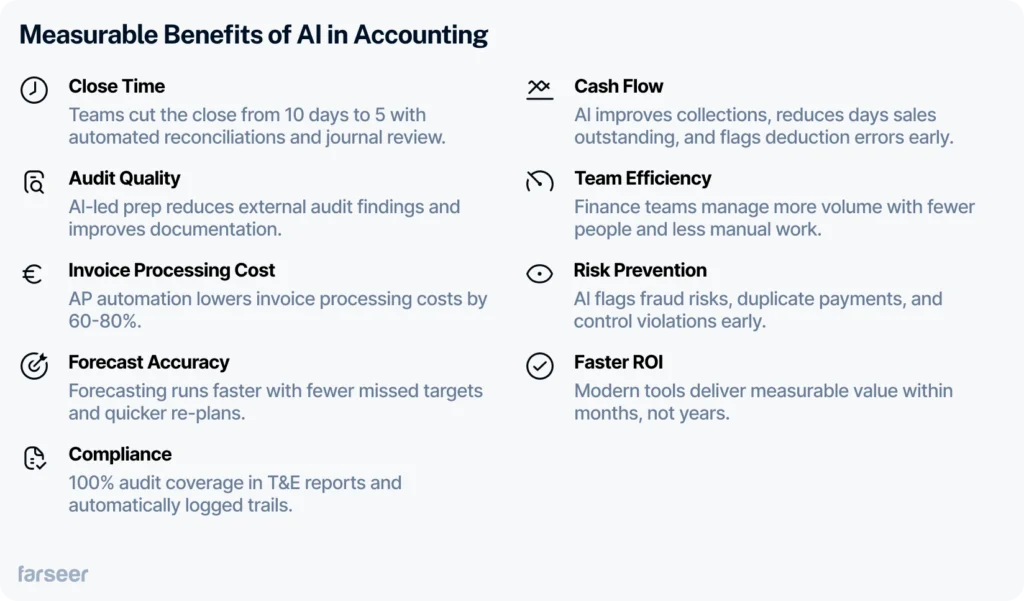

AI in accounting isn’t experimental anymore, it’s part of daily work. A Gartner survey shows 58% of finance functions now use it, up from 37% the year before. And 98% of accountants say they’ve worked with AI in the past 12 months.

Read: Finance Automation in 2025: Tools, Use Cases, and Real-World Strategy

This blog breaks down nine real use cases of AI in accounting. From invoice processing to forecasting, you’ll see how finance teams are saving time, reducing errors, and making better decisions, with tools that are already in use.

What AI in Accounting Actually Means

AI helps accounting teams move faster, spot mistakes early and cut down on busy work. It’s not like RPA (Robotic Process Automation), which runs fixed rules. RPA is great when the process never changes. But accounting isn’t like that, exceptions happen all the time.

That’s where AI fits in. It looks at patterns, flags things that don’t make sense, and helps you make decisions without digging through spreadsheets and piles of documents.

Most teams use it for three things:

- Anomaly detection for catching unusual entries or transactions

- Process automation for high-volume tasks like invoice matching and reconciliations

- Forecasting that updates quickly and adapts when the numbers shift

You’ll find AI baked into most FP&A software now. It works behind the scenes to save time without needing a full IT project.

Next, we’ll walk through nine ways accounting teams are using it every day.

Technology & digital transformation: planning for future investments

AI shows up in places where finance teams feel the most pressure: volume, speed, and accuracy. These nine use cases cover where it’s already working, what it improves, and which tools are actually in use.

Accounts Payable (AP)

approvals waste hours and cause mistakes like double payments or missed discounts. AI speeds things up by:

- Reading invoices using OCR (optical character recognition)

- Matching them to purchase orders

- Coding them to the right accounts

- Flagging anything that looks off

Applied Industrial Technologies used AppZen to automate 87% of their invoices. They cut processing time from five days to minutes and handled more work with fewer people.

Read more: AI Trends in FP&A Software: What Finance Teams Should Expect in 2026

Tools like AppZen, Tipalti, and SAP Invoice Management connect easily to most ERP (enterprise resource planning) systems.

Accounts Receivable (AR)

Payment matching takes time, especially when customers pay partial amounts, round numbers, or forget to include invoice references. AI steps in by comparing payments to open invoices, learning from past transactions, and flagging issues like short-pays or duplicate deductions before they pile up.

Danone used HighRadius to match 98% of payments and recovered $20 million in invalid deductions.

AI also helps with collections. It scores customer risk and shows who’s likely to delay payment, so teams can act early. Tools like HighRadius and Oracle AI for Financials support this. Teams that use cash flow forecasting software alongside it improve predictability and planning.

Reconciliations and Month-End Close

Closing the books still takes too long at many companies. Teams spend days chasing checklists, reconciling accounts, and tracking down issues. AI cuts that time by:

- Auto-certifying clean accounts

- Matching transactions across systems

- Flagging unusual balances or late entries

BlackLine customers reconcile up to 85% of accounts automatically and save hundreds of hours each month. FloQast users report a 26% faster close, thanks to automation and better visibility.

Both tools connect to your ERP and help your team focus on the exceptions, not the admin work.

Journal Entry Anomaly Detection

Month-end journals come in fast. It’s hard to catch risky entries when the volume spikes, especially late adjustments or strange account combos. AI learns what “normal” looks like and flags anything that stands out.

BlackLine’s Journals Risk Analyzer uses historical data to surface unusual entries before they hit the final ledger. It highlights things like out-of-period adjustments, unexpected user activity, or irregular amounts without slowing the team down.

Finance teams use tools like BlackLine and MindBridge to cut review time and reduce the risk of missed errors during close.

Travel & Expense (T&E) Audit Automation

Expense reports often slip through with issues: duplicate charges, fake receipts, or out-of-policy spend. Most teams review a small sample. AI changes that by:

- Auditing every report in real-time

- Checking vendors, receipts, and spending patterns

- Flagging anything that doesn’t follow policy

One global firm used AppZen to audit 100% of expense reports. In the first months, it flagged 8% for violations, four times more than manual checks had caught. That led to tighter controls and fewer bad reimbursements.

Tools like AppZen and SAP Concur help teams catch problems before payouts happen.

Forecasting & Scenario Planning

Forecasts take too long and fall out of date fast, especially in spreadsheets. AI makes planning quicker and more accurate by:

- Learning from actuals to improve forecast accuracy

- Running dynamic scenarios without rebuilding models

- Highlighting unusual variances and trends

Hrvatski Telekom used Farseer to cut forecasting time by 30% and consolidate scenarios 80% faster. Their team now adjusts plans in real-time instead of waiting on Excel updates.

Farseer helps enterprise finance teams do more with less, without heavy setup or long onboarding.

Fraud & Compliance Monitoring

It’s easy to miss small patterns, like repeat charges from the same vendor or someone approving their own payments. AI spots these early by:

- Watching for unusual transactions across systems

- Catching approval rule violations

- Flagging behaviors that point to fraud or weak controls

One controller using AppZen found a vendor billing the same amount twice under slightly different names. The system flagged it right away. That helped the team close the gap and prevent more issues.

Tools like AppZen, and Oracle AI for Financials give teams a live view into risks before they turn into losses.

Credit Risk Scoring

Customers don’t always show clear signs before they fall behind. They start paying later, cut order size, or change behavior with no heads-up. AI helps Accounts Receivable (AR) teams catch the early signs by:

- Tracking payment behavior and delays

- Using external data like credit scores and business news

- Scoring customer risk in real-time

Global teams use HighRadius and Dun & Bradstreet to act before accounts become a problem. D&B’s Receivables Intelligence platform uses AI to monitor risk and suggest next steps. Teams use it to adjust credit terms early and reduce bad debt.

Audit Prep & Narrative Automation

Audits take up time your team doesn’t have. Chasing documents, explaining variances, and answering the same questions every quarter slows down real work. AI cuts the back-and-forth by:

- Pulling supporting documents automatically

- Highlighting changes or gaps in the data

- Drafting variance explanations and audit responses

Companies using tools like BlackLine, MindBridge, and Oracle Narrative Reporting say they spend less time preparing and fewer hours answering auditor follow-ups. Some also report fewer audit findings, since the data is cleaner and the documentation is already there.

How to Start with AI in Accounting - Practical Tips

Rolling out AI in accounting doesn’t mean overhauling everything at once. The most successful teams start small—then build from real results.

Start where it’s easy to win:

Pick a process that’s high-volume and easy to measure. Invoice matching, reconciliations, or cash application are great first steps. They’re consistent, low-risk, and quick to improve with automation.

Use what you already have:

You don’t need a full data warehouse to get started. Most AI tools can work with existing ERP data. Structured inputs are enough to test and validate results.

Build trust in the system:

Review the AI output manually at first. Spot-check results, adjust if needed, and let the team see how it works before scaling.

Bring the right people in early:

Involve both accounting and IT. Teams that move fastest make sure everyone understands the data, the tools, and what to expect.

Most teams see value within 1–2 months. The key isn’t a perfect setup, but rather starting with one clear use case and improving from there.

If you’re launching a pilot, keep it simple and focused. Here’s what a strong first project usually includes:

What a good first pilot looks like:

- A clear owner from the finance team (not just IT)

- One defined process and one success metric

- A 30–90 day timeline

- A manual fallback in place in case something breaks

Will AI Replace Accountants? No. But It Will Change the Job.

AI isn’t here to cut roles—it’s here to change what those roles focus on.

Instead of chasing numbers or reviewing line items all day, accounting teams now spend more time analyzing results, spotting risks, and supporting planning. That shift is already happening in teams using AI for close, forecasting, and audit prep.

The job is becoming more forward-looking. Less about inputs, more about insights. And that’s exactly where accounting teams can bring the most value.

The teams seeing the biggest gains aren’t replacing people – they’re giving them better tools.

AI in Accounting Is a Competitive Advantage

AI in accounting isn’t a trend anymore, it’s how leading teams work today.

It’s solving real problems across AP, AR, close, forecasting, and audit prep. The benefits are clear: faster cycles, fewer errors, and more time for strategic work. And you don’t need a massive IT project to get started. Most teams begin with one process, use existing ERP data, and see results in weeks.

The teams seeing the biggest gains aren’t replacing people – they’re making their teams more effective. AI handles the routine tasks so your team can focus on what really matters: reviewing results, managing risk, and supporting the business.

If you’re evaluating tools, make sure they actually support these use cases – and deliver measurable value.

If you want to go one step further, check out The Future of AI in Finance – or see the best AI for finance already in use by enterprise teams.