Real-time reporting isn’t about speed, it’s about survival.

When your numbers are stale, your decisions are wrong. Simple as that.

Finance teams today are dealing with volatile markets, shrinking margins, and the constant pressure to act faster. But if you’re still relying on static exports, emailed spreadsheets, or “last week’s numbers,” you’re flying blind.

Real-time reporting gives you live data, department by department, down to line items, always up-to-date.” No reconciliation marathons. No gut-feeling decisions. No delay.

It’s not just a more intelligent way to report. It’s a fundamentally more intelligent way to handle finance.

Not sure what that looks like in real life? Let’s break it down.

What is Real-Time Reporting

Real-time reporting encompasses collecting financial and operational data, processing it, and presenting it in real-time as it evolves – without waiting for batch exports, end-of-day reconciliation, or manual refreshes.

In contrast to delayed insights of conventional reporting, real-time reporting systems refresh in real-time from your ERP, CRM, and other business applications. This is to guarantee all stakeholders see the same numbers now – finance, operations, or the boardroom.

It’s not a matter of writing reports faster.

It’s a matter of removing the delay entirely.

Read: Scenario Planning: How to Prepare Your Business for Uncertainty

The Myth

Many companies still believe they’re doing real-time reporting simply because they’ve shortened their reporting cycles. But let’s be honest – if your finance team is still emailing spreadsheets, waiting for manual inputs, or reconciling numbers at the end of each day, then you’re not in real time. You’re just in limbo with slightly better Wi-Fi.

The Reality

Real-time reporting isn’t a speed hack. It’s a system shift.

Here’s what it actually looks like:

- Data “syncs” in real-time across all of your systems — no refresh buttons, no lag

- Everyone’s looking at the same version of the truth, instantaneously

- Reports automatically refresh as new data comes in

This kind of visibility is what allows CFOs and controllers to act, not guess.

What Real-Time reporting Unlocks for Enterprises

Real-time reporting isn’t an acceleration.

It’s a shift in how decisions are made – from delay fixes to real-time action.

- Cash flow visibility – View liquidity risks before they’re problems. Not after the quarter’s done.

- Budget control – Catch overspending before it occurs. Not two weeks into the month.

- Cross-department sync – Finance, ops, and sales all operate off the same numbers, since they’re being updated live. No version confusion. No reconciliation lag.

- Operational agility – Respond to supply shocks, price changes, or declines in demand without hysterically “getting the latest file.”

Why Most Companies Still Aren't There

Too Many Systems, Not Enough Integration

Finance draws numbers out of the ERP. Sales records deals in the CRM. HR tallies headcount in yet another HRIS. Operations keeps production KPIs in yet another application. And Excel as the duct tape that manages to hold everything together.

Aside from this, duct tape doesn’t hold up under pressure. Without real integration, finance staff spend hours pursuing data instead of analyzing it.

Example: A regional manufacturing company needs to reforecast in response to unexpected supply chain holds ups. But procurement, inventory, and sales information are scattered in five systems – so the updated scenario isn’t built until it’s too late to react.

Lack of Trust in the Numbers

When version chaos erupts, credibility is lost. When a CFO and a controller walk into a meeting with two conflicting versions of the same forecast, the conversation starts off on a skeptical note. Real-time reporting is achievable only when there is one version of truth.

Example: A CFO at a consumer goods company noticed forecasted margins looked unusually high. Turns out the sales input file hadn’t been updated in two days. That single lag led to misaligned pricing decisions across multiple markets. In the CPG industry, a 48-hour lag can misprice promotions and trigger stockouts.

Outdated Habits

Legacy processes are comforting – but expensive. If you’re still closing the books on day 10 and finalizing reports on day 15, you’ve already lost half the month.

Real-time reporting requires a shift away from set cycles and towards dynamic, continuous forecasting.

Example: A pharma distributor previously updated forecasts only every month. When one of its major drug deliveries was held up, the impact on cash flow didn’t show until weeks later. After implementing real-time reporting, they were able to model the impact of the delay in real-time and negotiate credit terms immediately.

The Benefits of Real-Time Reporting

Real-time reporting is not hype – it delivers tangible benefits across the finance function.

Fewer Mistakes, Accelerated Cycles

When you eliminate manual data moves and end-of-cycle reconciliations, mistakes drop. Finance teams that make the switch to automated real-time flows typically slice close cycles by 30% or more by HFS.

Read more: How to Choose the Right Forecasting Tool for Rolling Forecasts

Better Decision-Making

Real-time reporting gets executives out of the business of relying on lagging exports or guesswork.

They make decisions instead with timely, rollup numbers – faster and with greater confidence.

Whether it’s cutting staff, shifting production, or responding to a shock price change, timing is the name of the game.

More Agility

Volatility is not the exception, it’s the rule.

When your numbers report in real-time, your plans can do the same. Real-time reporting enables finance leaders to make course corrections mid-month, not after the fact.

Example of Real-time Reporting in Finance: How Altium Transformed Reporting in Practice

When nine-country biotech and life sciences distributor Altium expanded, its finance function hit a familiar pain point: Excel couldn’t keep up. Every legal entity had its own cadence, format, and planning means – creating reporting, forecasting, and strategic alignment bottlenecks.

Despite being a top-performing team, they spent days on validating inputs, double-checking numbers by regions, and consolidating data. Forecasts relied heavily on manual computation and personal interpretation, and this constrained consistency and responsiveness.

That was when Altium came to Farseer.

The Challenge

Altium’s organizational design had been decentralized – granting autonomy to each region. But as Altium grew, there was more visibility, consistency, and speed required from leadership within entities. Processes that existed worked but only because the finance team fought valiantly to keep them together.

- Manual reporting was cumbersome and error-prone

- Forecasting was disconnected, oftentimes misaligned between teams

- No single version of truth – data existed in spreadsheets across systems, currencies, and departments

The Solution

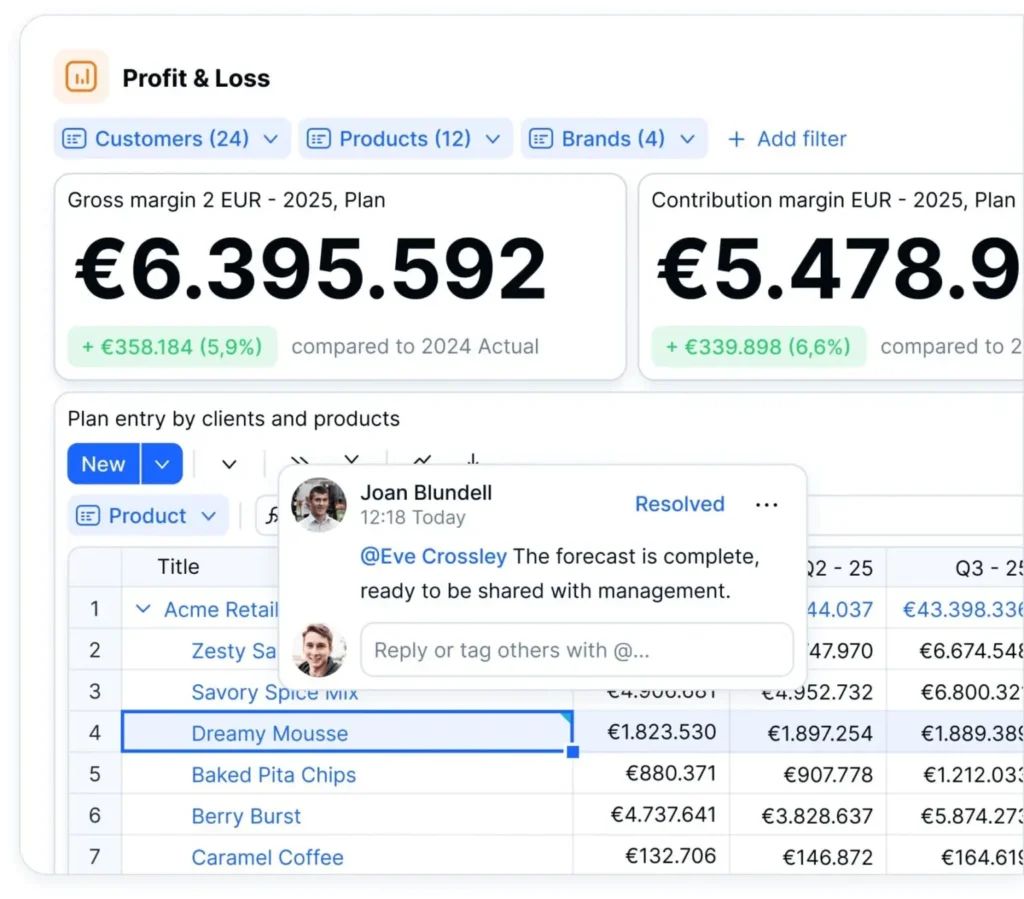

Farseer allowed Altium to merge all its financial planning into a single, live FP&A platform:

- Standardized, global reporting templates, enabling fast and accurate consolidation

- Automated, driver-based forecasting that prohibited duplicate inputs and enabled what-if

- Live dashboards giving over 50 stakeholders real-time access to key KPIs like EBITDA, gross margins, and sales trends

It was all live, traceable, and synchronized.

The Result

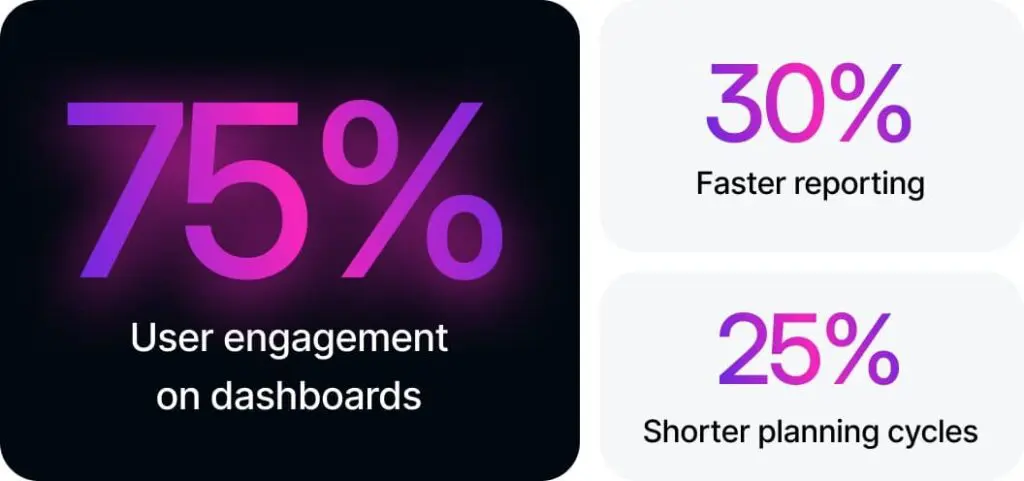

- Deliver output 30% faster – no more Excel stitching hours

- 25% cycle reduction in planning cycles – departmentaligned forecasts that are updated in real-time

- 75% of daily dashboard adoption – real-time visibility becomes the new normal

Is Your Team Ready for Real-Time reporting?

Finance teams can’t afford to wait. In a world where decisions must happen by the hour, not by the quarter, operating on old data isn’t just inefficient, it’s risky. Real-time reporting is now the baseline for relevance, accuracy, and control.

Real-time reporting isn't a competitive advantage

Companies that delay this shift lose more than just time.

They lose credibility, alignment, and the ability to course-correct when most needed.

You simply can’t run a 2025 business on 2005 processes.

Final Check – Are you there yet?

Let’s test it out:

- Do you still hold out for manual inputs prior to reporting being “final”?

- Are your reports updated more than once per day – or are they locked until the next close?

- Does your team trust the numbers enough to make immediate, high-stakes decisions?

If any answer is “no,” you’re not in real time yet.

You’re operating on delay – and every delay costs clarity, time, and margin.

Curious how real-time reporting would work for your team? Book a Farseer demo and see it in action.