Finance automation isn’t a buzzword. It’s the difference between a team that runs on systems and a team that runs on busywork.

Manual workflows slow everything down – decisions, reporting, forecasting, and even hiring. Teams stuck in disconnected spreadsheets and tools spend their time fixing errors instead of moving the business forward.

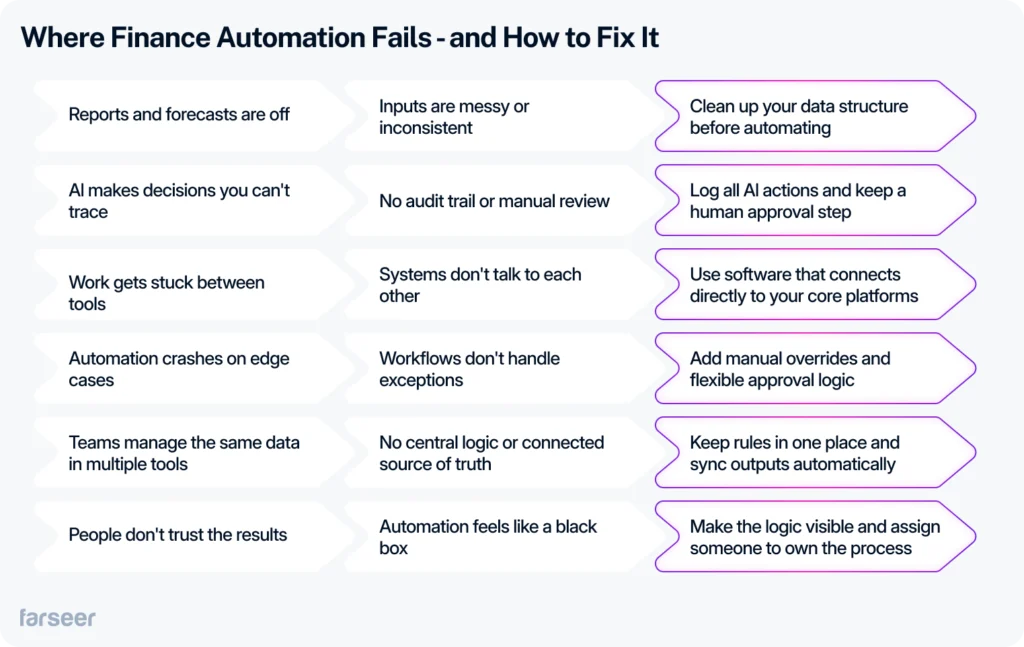

But automation done poorly creates more problems than it solves. Automating a broken process just makes the mess run faster.

This guide is for teams that want to fix that by learning:

- What to automate first, and what to leave alone

- How to connect automation with your planning and reporting logic

- Where AI makes sense, and where it doesn’t

- How to scale automation without breaking operations

If you’re serious about fixing the work behind the numbers, you’re in the right place.

What Is Finance Automation, and Why Most Teams Get It Wrong

Finance automation means using software and AI to remove manual work from your key financial processes. That includes budgeting, forecasting, reporting, and approvals.

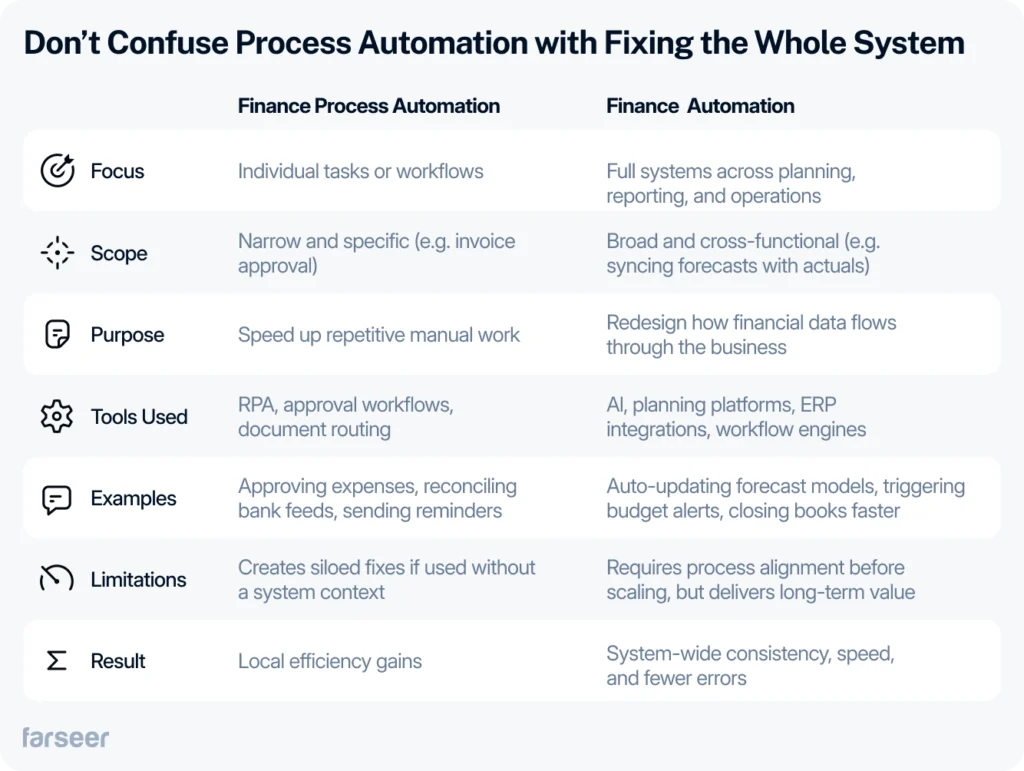

But many teams mix up two very different things.

Task Automation ≠ System Automation

Finance process automation helps you move faster through repetitive tasks, like approving invoices or reconciling accounts.

Finance automation focuses on the system. It connects workflows across planning, reporting, and operations. It makes sure your logic, data, and outputs stay in sync without extra handoffs or spreadsheet patchwork.

If you automate individual tasks without fixing how the system works, you’ll only create more problems later.

RPA and AI Do Different Jobs

RPA (Robotic Process Automation) follows rules. If the process doesn’t change often, RPA can help you speed it up and keep it consistent.

AI does something else. It spots patterns, classifies data, and makes suggestions. It helps when things change or when you need to make sense of messy inputs. But it only works if your structure makes sense. If the data is inconsistent or the rules are unclear, AI will only confuse things.

You need clean processes before you bring in learning-based tools.

Workflow Debt Slows Everything Down

As mentioned earlier, if the process is broken, automation just spreads the problems faster.

Teams often build workflows on top of inconsistent templates or outdated rules. Then they add automation to “make it faster.” Instead, they end up with broken reports, bad data, and more manual cleanup than before. It’s a common trap in enterprise reporting too – where automation can amplify confusion if the data foundation isn’t solid.

This creates workflow debt, and it gets more expensive the longer you let it pile up.

Clean It Up First, Then Automate

Start by aligning your structure: planning templates, naming conventions, and reporting logic. Make sure the flow from planning to reporting is clear and consistent. Then automate the steps that don’t need people thinking through them every time.

That’s how you scale without breaking things.

Technology & digital transformation: planning for future investments

Finance automation works best when you start with the right processes. Those are the ones that drain time, follow clear logic, and don’t require judgment calls – such as invoice processing, reconciliations, or forecasting. For practical examples, see how teams use AI in accounting to automate some of these processes.

The most successful teams focus on high-impact, low-complexity use cases first and scale from there. Think less about what looks impressive and more about what removes actual friction.

Read more: AI Trends in FP&A Software: What Finance Teams Should Expect in 2026

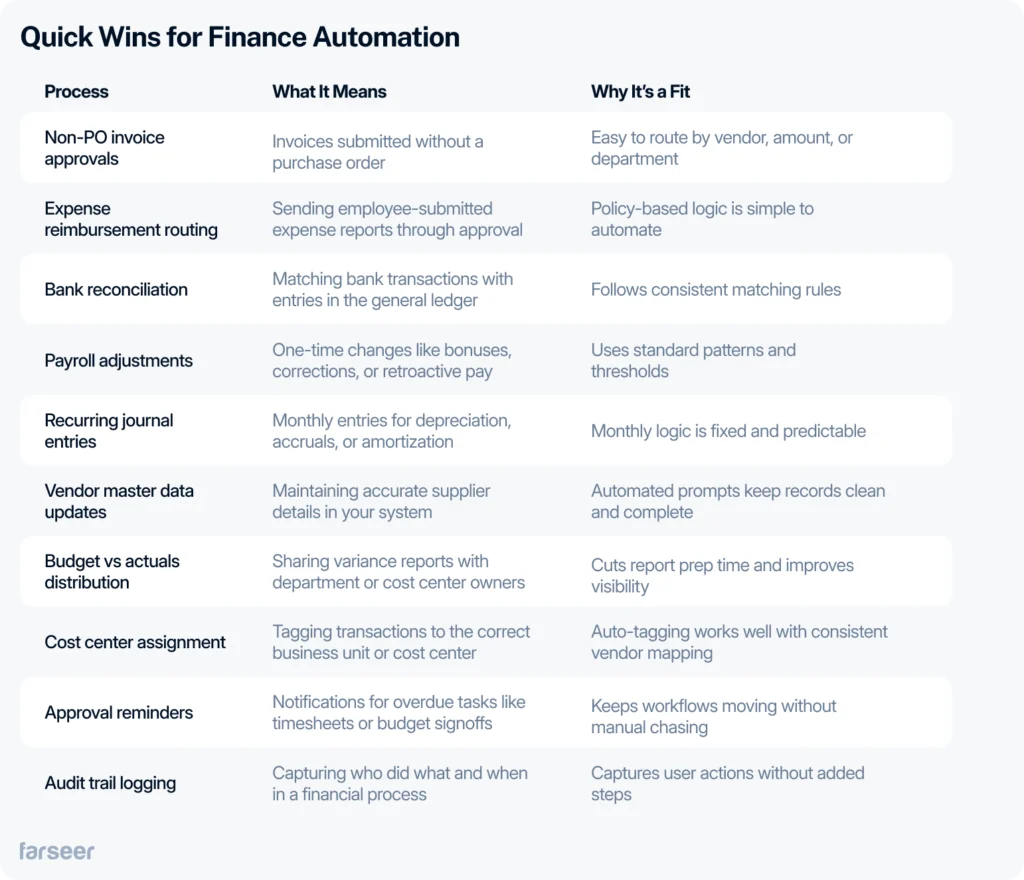

Quick Wins That Prove Value Fast

Some finance processes are ready for automation from day one. They’re consistent, rules-driven, and waste hours every month. Automating them removes friction without changing how the whole system works.

Here are the ones that show value fast and require minimal complexity to implement.

When these are automated, your team stops chasing updates and starts managing outcomes. These tasks eat up hours, but they don’t require critical thinking. Getting them off your plate gives you time to fix bigger problems, like building a better model or improving how you track spending against plan.

Once the small stuff is handled, you can move into processes that change how your team works, not just how fast they move.

Use Cases That Make Finance Automation Worth It

Quick wins help you get time back. But if you want real change, you need automation that improves how your team plans, reacts, and makes decisions.

These use cases take more setup, but they give your team more control over the numbers – and the outcomes.

- Forecast model versioning

Your forecast should shift as the business does. Automation can pull in actuals, update assumptions, and keep your models current without rebuilding everything each month. - Cash flow forecasting

If you’re still chasing inputs across spreadsheets and systems, you’re wasting time. Automating the data flow keeps your forecast fresh and improves how you manage short-term liquidity. This becomes essential once you start using enterprise cash flow forecasting tools that depend on timely, structured inputs. - Scenario-based cost modeling

Testing “what if” decisions manually takes too long. When you automate how key drivers affect your cost base, you can model headcount shifts, price changes, or currency impact in minutes, not hours. - Variance alerts

If a number moves out of range, your team should know before month-end. Automating alerts on actuals vs plan helps you act faster and keeps accountability tight across cost owners. - Rolling forecast automation

Running one static budget doesn’t work when things move fast. Rolling forecasts help you stay ahead, but they’re hard to maintain manually. With the right setup, automation keeps your forecast updated each month, without starting from scratch. If you’re thinking about this shift, our rolling forecast guide is a good place to start.

These aren’t just efficiency plays. They give you faster answers, tighter planning cycles, and better ways to support decisions across the business.

Also see: What financial reporting automation actually fixes (and doesn’t)

What Not to Automate (Yet)

Some processes look like good candidates on the surface, but automation will just make them harder to manage if your structure isn’t ready.

Skip these until your logic is solid and your data is clean:

- Accruals that need judgment

If someone has to stop and think every time, automation won’t help. - Allocations from messy inputs

Don’t build logic off PDFs, emails, or comments in a spreadsheet. - CapEx and OpEx approvals

These often involve attachments, multiple reviewers, and case-by-case decisions. You’ll need consistent rules and routing before automation can work. Here’s how to think about automating CapEx and OpEx decisions when you’re ready. - Free-text budget requests

If teams send numbers through Teams or email, start by adding structure. - Approval flows with exceptions

If routing changes based on who’s asking, clean it up first. - Intercompany eliminations

Timing mismatches and manual corrections make this risky without strong controls.

When the process isn’t clear, automation makes things worse. Clean it up first, then make it faster. Once your structure’s in place, the next step isn’t more tools, it’s smarter tools. That’s where AI starts to matter.

How AI Is Reshaping Finance Automation in 2026

AI has moved from buzzword to baseline. It’s not about replacing people but about removing the grunt work that slows them down.

Most automation in finance used to be rule-based. If X happens, do Y. That still works for fixed workflows. But AI changes the game when inputs are messy or always changing.

Here’s where it adds real value:

- Classification

AI can tag transactions with the right GL code or cost center, based on past behavior — without needing a rule for every case. - Prediction

It spots trends in spending, forecasts cash flow shifts, and flags variances before they show up in reports. - Anomaly detection

AI catches duplicates, off-policy spend, or data outliers you’d otherwise find too late.

But AI needs structure. If your data is inconsistent, it’ll learn the wrong patterns. That’s why “human-in-the-loop” matters: AI suggests, but people still approve.

In Farseer, for example, AI helps refine forecast assumptions as actuals roll in. It flags changes and adjusts deltas, so planners don’t start from scratch each cycle.

The best results come when AI handles the repetitive work and your team stays focused on decisions. Don’t treat it like a black box. Treat it like a smart assistant that learns fast, but still needs a grown-up in the room.

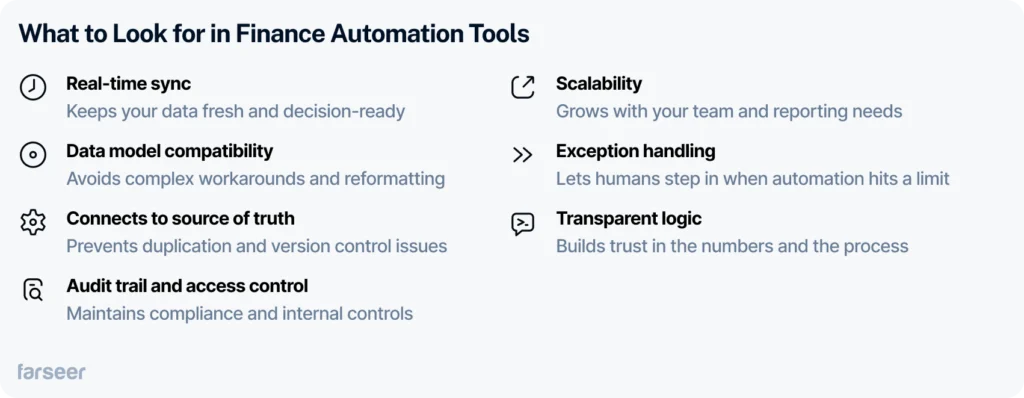

Choosing the Right Finance Automation Tools and Stack

Not every automation tool solves the real problem. Some just shift manual work to another platform. The right stack connects planning, reporting, and operations, without breaking your logic or creating more handoffs.

Here are the three types of tools most finance teams rely on:

- ERP-native workflows

These live inside your ERP, like SAP, Oracle, or NetSuite. They cover things like approvals, entries, and standard reporting. They’re reliable but often rigid, and they rarely match the speed or flexibility finance teams need for planning and analysis. - Point solutions

These are focused tools built to solve one specific problem, like budgeting, payables, or expense control. Because they go deep, they usually outperform general-purpose systems. Examples include Tipalti for payables or Stampli for AP automation. But they need to integrate cleanly with the rest of your stack. - Integration platforms

Tools like Workato or Zapier move data between systems that don’t naturally talk to each other. They reduce manual updates by automating syncs between your ERP, planning tools, payroll, and CRM. For more complex needs, internal APIs or custom integrations are the better route.

Red flag: If it needs a CSV to update your forecast, it’s not automation but a workaround.

The best finance automation software fits into your logic instead of forcing you to rebuild it. If you’re managing asset-heavy spending, CapEx software tools can help automate trickier workflows like approvals, versioning, and cost tracking.

If you’re handling FP&A use cases, a platform like Farseer can cover most of this out of the box, from forecast automation to approval flows, without relying on exports or stitching tools together.

How to Implement Finance Automation Without Breaking Ops

Finance automation fails when teams rush into it without fixing the basics. Don’t start with tools. Start with the way your work actually gets done.

Here’s how to roll it out in a way that works:

Step 1: Map your workflows

Walk through how tasks move today: who does what, where the handoffs happen, and where things get stuck. You can’t improve what you can’t see.

Step 2: Spot the time-wasters

Look for processes that eat up time but follow a clear pattern. These are the ones to automate first: invoice approvals, forecast versioning, or journal entries that follow fixed rules.

Take monthly forecast versioning as an example. If every update means downloading actuals from your ERP, pasting them into spreadsheets, updating formulas, and emailing version 17 to your manager, you’re not planning, you’re copy-pasting. Automating the actuals feed and version creation means your team works on the forecast itself, not on moving numbers around.

Step 3: Check what connects

Automation breaks when the inputs are messy or the output ends up in the wrong place. Make sure upstream and downstream systems are ready before you automate anything. For example, if your HR system feeds cost center data into your planning tool, mismatches in naming conventions will break the flow, and your reports.

Step 4: Choose tools and name an owner

Pick software that works with your core systems. Avoid tools that create new silos. Assign a clear owner who will track what’s working and catch issues early. For example, using Tipalti for invoice approvals but not connecting it to your ERP or planning tool like NetSuite or Farseer just shifts the manual work downstream.

Step 5: Plan for the exceptions

Not everything will go as expected. Build in manual overrides and approval logic from the start. If the edge case breaks the process, it’s not ready yet.

Step 6: Measure the change

Track how much time you’re saving, how often errors happen, and how well people are using the new flow. This isn’t just about speed, it’s about trust in the system.

Hrvatski Telekom used this exact approach. After rolling out automated planning with Farseer, they cut forecasting time by 30% and reduced scenario consolidation time by 80%, while keeping everything in sync across subsidiaries.

Keep it simple. Build it clean. Then let automation do the heavy lifting.

The Future of Finance Automation: From Integration to Autonomy

Automation used to mean syncing tools. Soon, it’ll mean systems that take action on their own, with humans in control, not in the weeds.

Want to see what’s coming next? Take a look at The Future of AI in Finance, where we break down how smart tools evolve into autonomous planning systems – and what that means for finance teams by 2030.

From connected to self-steering

Most finance stacks today still rely on human handoffs. Even when tools are integrated, someone has to spot the issue, interpret the data, and decide what to do next. In the next phase of finance automation, that changes.

Autonomous systems will do more than connect data. They’ll detect changes, understand the impact, and take the next best step (or suggest one), without someone kicking off a workflow.

What autonomous finance could look like

In a company with global operations, finance systems could soon handle reclassifications on their own, spotting spend anomalies, matching them to policy, and suggesting corrections. If a vendor’s pricing drifts out of contract bounds, the system could push that alert into the planning tool and tag the impacted forecast line. A planner would get the context, see the suggested fix, and approve or reject it with a click. No ticket, no handoff. Just self-steering finance.

What finance teams need to prepare

Getting there takes more than tools. It takes teams who understand how the pieces fit together. The skills that matter most:

- Data modeling – building structures that automation can actually follow

- Workflow design – designing flows that handle exceptions, not just the happy path

- Cross-functional collaboration – automation touches payroll, HR, procurement, and ops. You need buy-in from all sides

The goal isn’t full automation for its own sake. It’s a finance team that acts faster, sees more, and spends less time fixing broken workflows.

Make the Work Behind the Numbers Make Sense

Finance automation isn’t about getting rid of people or chasing trends. It’s about fixing the messy, manual work that holds your team back.

If your systems can’t keep up, your planning won’t either. The right automation helps you move faster, stay accurate, and spend more time on the work that matters, not chasing numbers or patching spreadsheets.

Clean up the structure. Automate what’s ready. Use AI where it helps. Then let the systems run, so your team can focus on the decisions that move the business forward.