Will AI replace finance jobs? It’s the question everyone keeps asking. But it’s not the one that matters.

AI won’t take over the finance function, but it will change who stays relevant. If your day involves manual reporting, reconciliations, or variance analysis, someone with better tools is already moving faster than you.

Read: Finance Automation in 2025: Tools, Use Cases, and Real-World Strategy

This isn’t about losing jobs. It’s about losing tasks. The finance professionals who can use AI to their advantage will solve better problems, spot risks sooner, and deliver more value to the business.

In this blog, you’ll see what AI is actually doing in finance today, which roles are changing, and how to adapt. We’ll share examples from companies already ahead of the curve.

What AI Is Already Doing in Finance

AI is already in the hands of real finance teams. This isn’t a test environment or a pilot phase. It’s working, live, and delivering results in forecasting, controlling, treasury, and reporting.

Teams are using machine learning to build faster forecasts. They use GenAI to explain variances and summarize results. They use NLP to remove friction when working with data. The outcome is simple: more accuracy, less manual work, and more time for decisions that matter.

Here’s what that looks like in practice:

This shift won’t erase jobs overnight, but it’s already redefining them. The teams that move fastest are spending less time on grunt work and more time influencing decisions.

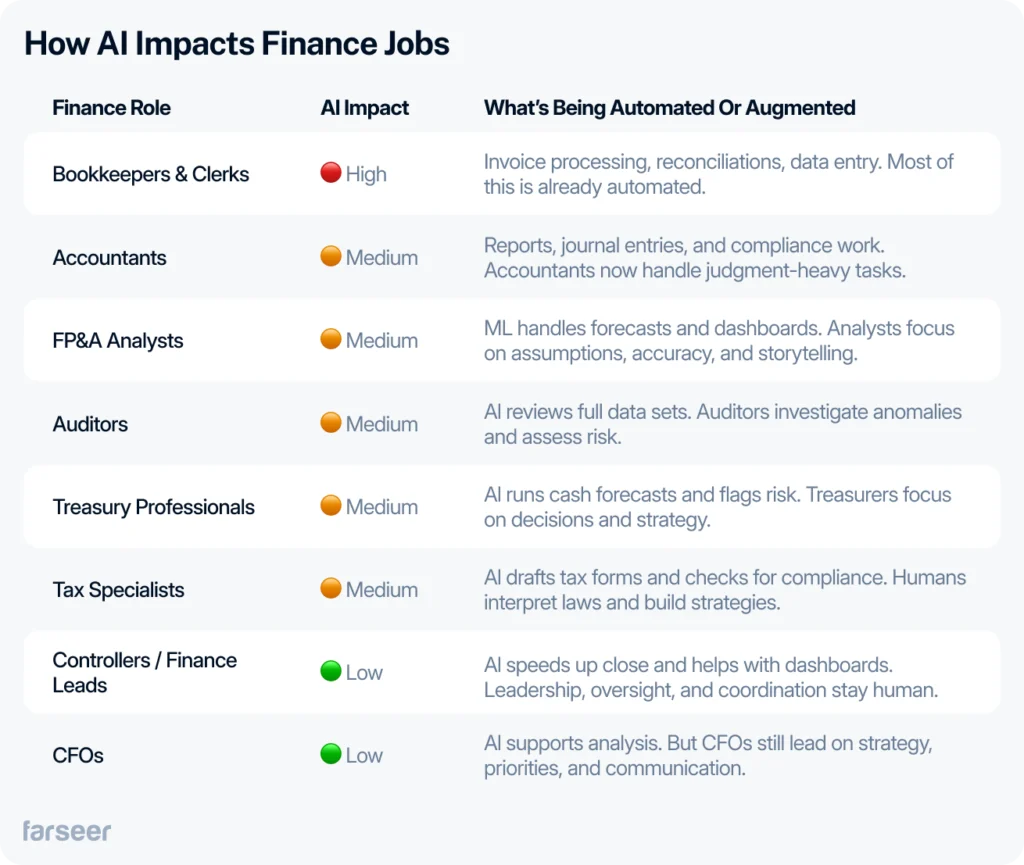

Which Finance Jobs Are Disappearing, And Which Are Evolving

AI doesn’t kill entire roles all at once. It replaces tasks, and it’s already cutting deep. If your job depends on manual reporting, reconciliations, or inputting data, that work is already disappearing. Some of it is already gone, unfortunately.

The first roles to take the hit are entry-level and transactional:

- Bookkeepers

- AP/AR clerks

- Junior accountants

- Data entry and reporting support

These positions were built on predictable, repeatable work. But that work now happens inside software. OCR scans invoices. Bots match payments to transactions. AI writes the first draft of reports. Most teams no longer need a full headcount to cover this. For a detailed breakdown of what’s getting automated today, see our post on AI use cases in accounting.

The World Economic Forum expects 26 million clerical and recordkeeping jobs to disappear globally by 2027. In the U.S., bookkeeping and accounting clerk positions will shrink by about 5% by 2033. That’s not theoretical. It’s already happening.

At the same time, demand is growing for finance professionals who can work with AI, ask better questions, and explain the story behind the numbers. If you’re still building reports, you’re already behind. But if you’re reviewing results, validating assumptions, and making recommendations, you’re in the right place.

Want to see the shift? Here’s how it breaks down by role:

Why AI Can’t Fully Replace Finance Jobs (Yet)

AI handles speed, volume, and pattern recognition better than any analyst ever could. But it still fails where context, nuance, and judgment matter most.

Here’s where it breaks:

- It can’t apply judgment in unclear or unfamiliar situations.

- It struggles with unstructured data and open-ended business questions.

- It doesn’t understand ethics, relationships, or reputational risk.

- It can generate wrong or misleading results, especially with GenAI.

Simply put: AI still needs guardrails.

Human review is still a must. Even the best AI can misclassify transactions or overlook context. It might flag something as a risk that’s perfectly normal, or miss something critical because the pattern looks “safe.” Speed doesn’t help if the output is off.

And when things go wrong, AI doesn’t take responsibility. Finance teams still need to check the results, explain them to stakeholders, and decide what to do next. That’s where finance professionals still matter most.

Here’s what still requires people:

- Designing business scenarios worth testing

- Setting assumptions for forecasts and plans

- Interpreting complex tax rules and regulatory changes

- Evaluating M&A strategy and capital structure

- Explaining results to leadership in clear business terms

- Managing reactions to budget changes or missed targets

- Aligning with HR, sales, or operations in planning cycles

- Making materiality calls on variances and reporting risks

- Handling investor communication and leadership judgment

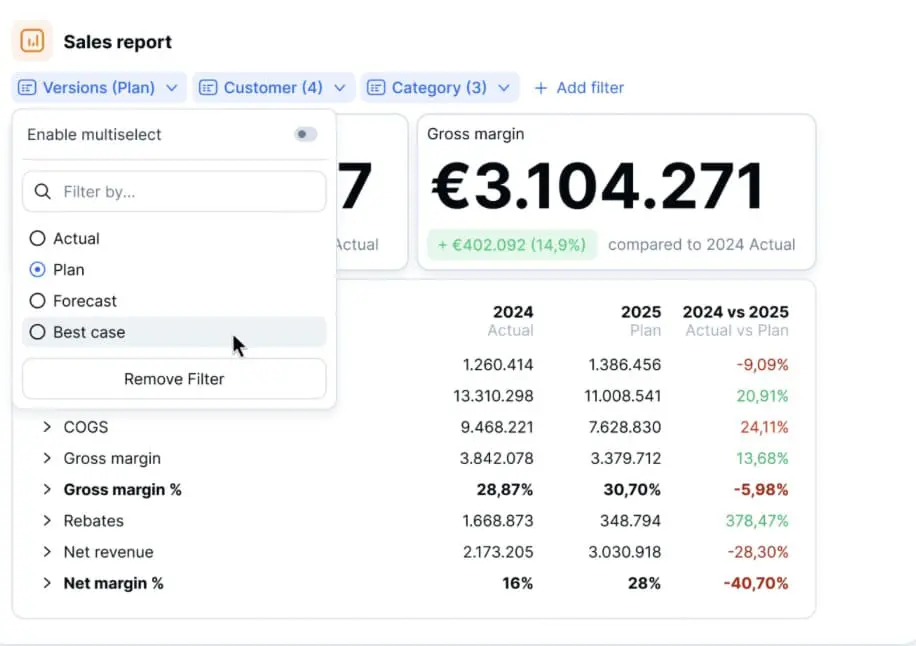

Farseer - AI That Augments, Not Replaces

Farseer isn’t here to cut finance jobs. It’s here to cut the noise.

We help teams remove manual busywork so they can focus on planning, modeling, and strategy – with reporting that runs itself. The AI handles the prep. People still make the decisions.

Here’s what that looks like:

- No more chasing data across spreadsheets

- Forecasts and what-if models ready in seconds

- Commentary built around your logic

- Full control over assumptions, timelines, and outcomes

You stay in charge. The tool just helps you move faster.

Want to see how it fits into your workflow? Book a personalized demo now:

How to Keep Finance Relevant as AI Automates Routine Tasks

If you’re leading a finance team, don’t wait. The shift is already happening. Your job is to make sure your team doesn’t get left behind.

Train your team

They don’t need to code, but they do need to know how to use AI tools. That means writing clear prompts, checking the results, and spotting when something looks off. Give them time to learn and use what they learn.

Rethink junior roles

If someone’s job is to build reports or check totals, that job is already at risk. Shift the focus to reviewing outputs, spotting risks, and helping senior leaders make decisions. Shell took this approach when they introduced automation. They trained their finance staff to work differently instead of replacing them.

Add human checks

Don’t trust the numbers blindly. Assign people to review AI outputs, flag problems, and catch anything that doesn’t feel right. Make that part of the process, not an afterthought.

Use the time you save

AI won’t fix weak workflows. It only helps if you use the time it frees up. Spend that time on better forecasts, better planning, and better conversations with the business.

Build a culture of curiosity

Let people test new tools, question the output, and share what they’re learning. The teams that grow with AI won’t be the ones who play it safe. They’ll be the ones who stay curious.

Key Takeaways

- AI is replacing repetitive tasks, not entire finance functions

- Roles built on manual work are disappearing or shifting fast

- The professionals who stay relevant will be the ones using AI, not avoiding it

- Strategy, judgment, communication, and decision-making still need people

- Leaders need to train their teams, rethink roles, and redesign how work gets done

- The goal isn’t survival. It’s relevance

- The real question isn’t just will AI replace finance jobs, but how teams evolve to stay relevant