Every business spends money to operate, but not all expenses are the same. This is where the CapEx vs. OpEx distinction becomes crucial.

For exmample some purchases are big, long-term investments that provide value for years. These fall under Capital Expenditures (CapEx). Others are recurring costs that keep the business running – these are Operational Expenditures (OpEx).

How a company splits its spending between CapEx and OpEx impacts everything – from cash flow and tax benefits to budget flexibility and how quickly it can adapt to market shifts.

Read Strategic Financial Planning: How to Plan for Success

In this blog, we’ll break down the key differences between CapEx and OpEx, the common challenges companies face, and how smarter financial planning tools help businesses stay agile and competitive.

CapEx vs. OpEx: Key Differences & Business Impact

When planning business expenses, companies have two main spending categories: Capital Expenditures (CapEx) and Operational Expenditures (OpEx). The key difference comes down to how the money is spent and the financial impact over time.

CapEx: Long-term investments in the business

As mentioned, CapEx covers big, long-term investments that provide value for years – think purchasing real estate, upgrading machinery, or investing in IT infrastructure. As a result, companies typically record these costs as assets on the balance sheet and depreciate them over time.

Since these purchases provide long-term value, companies spread the cost over time through depreciation (for tangible assets) or amortization (for intangible ones). But before committing to any large expense, it’s important to have a clear capital investment plan in place – one that helps manage impact and avoid sudden hits to profitability. When costs are spread across multiple years, the financial impact becomes more manageable – much better than slashing profits all at once.

OpEx: The cost of running the business

On the other hand,OpEx, includes recurring costs needed to run daily operations, such as rent, salaries, and cloud software subscriptions. Unlike CapEx, companies fully deduct OpEx expenses in the same year they occur.

As you can probably imagine, OpEx expenses don’t need big upfront payments. Because of that they’re usually easier to predict and fit into a budget.

Budgeting & cash flow considerations

The CapEx vs. OpEx decision, in its essence, has real business implications. Meaning: get it wrong, and you might tie up too much cash or miss out on valuable investment opportunities.

- CapEx requires more cash upfront. If a company buys a new warehouse or machinery, it invests capital that could have been used elsewhere. Businesses often choose to finance CapEx purchases through loans or leasing to preserve cash flow.

- OpEx is more flexible. Since OpEx expenses are recurring and don’t require huge investments in advance, they’re easier to adjust as business needs change.

So choosing between CapEx and OpEx is actually about making smart financial moves that impact cash flow, taxes, and long-term growth. The problem? Without real-time financial planning tools, many companies end up guessing instead of strategizing, making it harder to forecast and optimize spending.

Here are some other challenges that financial teams have while managing CapEx and OpEx.

Read more: Capital Planning vs Capital Budgeting: The Practical Differences

Common Challenges in Managing CapEx & OpEx

Even with finance teams working hard on budgeting and forecasting, things don’t always run smoothly. As a result, tracking expenses, getting approvals, and making accurate forecasts come with a lot of blockers. Here’s why:

The spreadsheet problem

Many companies still track CapEx and OpEx manually in spreadsheets. However, this method is highly prone to errors, lacks real-time data, and makes collaboration difficult for several reasons.

- Teams work in silos, increasing the chance of stumbling upon outdated or conflicting numbers.

- CapEx approvals often need to be coordinated among several departments, and without a centralized system like modern CapEx software tools, decisions get delayed.

- Finance teams struggle to see the full picture, which makes it hard to adjust to market changes quickly.

When financial data is spread across different spreadsheets and systems, teams spend more time chasing numbers than making strategic decisions.

Static budgets don’t work anymore

Traditional budgeting methods that are based on current business conditions will stay the same for an entire year. But in reality:

- Unexpected expenses pop up.

- Business priorities shift.

- Market conditions force quick financial changes.

So when you have a static budget it’s difficult to reallocate funds between CapEx and OpEx as needed. For example, a company may plan to invest in new machinery (CapEx), but if a supply chain issue delays delivery, should they redirect funds to operational needs (OpEx)? Without a flexible planning system, these decisions become guesswork.

Read more: Best Capital Budgeting Software: Tools That Go Beyond Approvals

Critical decisions get slowed down

Many businesses struggle with CapEx approvals, as requests must pass through department heads, finance teams, and executives. When teams handle this over email or in spreadsheets, processes get stuck, and delays almost always happen.

- Requests get stuck in inboxes waiting for approvals.

- There’s no clear record of why decisions were made.

- Teams miss out on growth opportunities because they can’t move fast enough.

This is especially problematic in industries with tight margins, where delayed approvals can mean lost revenue, like retail, manufacturing, construction, and logistics.

Poor data integration leads to expensive surprises

Good financial planning needs real-time, connected data. But when CapEx and OpEx are all across ERPs, accounting software, and spreadsheets, forecasting becomes a nightmare.

- Companies underestimate OpEx costs, which leads to unexpected cash flow problems.

- CapEx investments aren’t properly planned and budgets end up going over.

- Finance teams spend too much time deciphering numbers instead of analyzing trends.

Without accurate, connected financial data, companies end up making reactive decisions, which hurts profitability in the long run.

How Farseer Simplifies CapEx & OpEx Management

Managing CapEx and OpEx effectively requires speed, accuracy, and flexibility. For this reason, Farseer provides a modern, automated approach to financial planning – helping companies make smarter spending decisions in real-time.

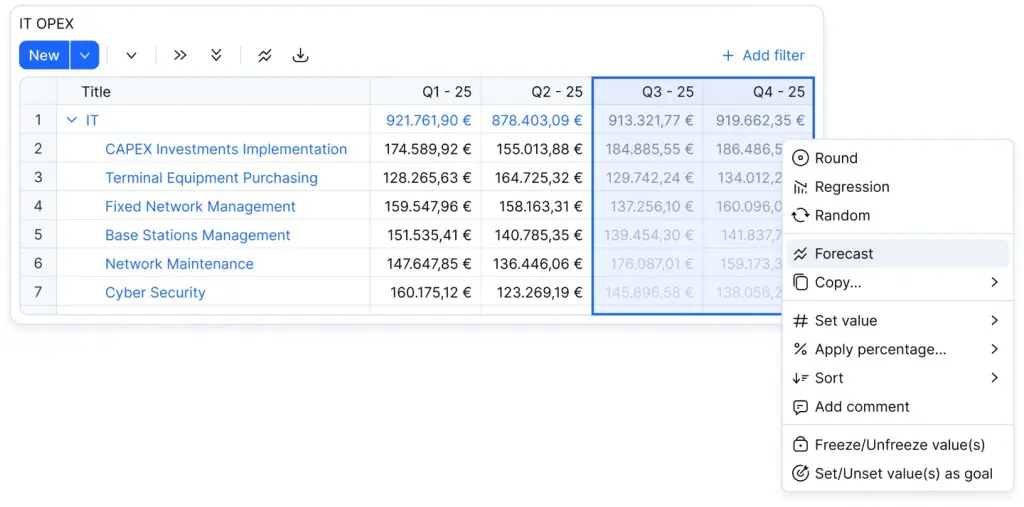

1. Real-time planning & forecasting

In many companies, CapEx vs. OpEx decisions are made based on static, outdated models. But what if you could instantly see how different scenarios impact your cash flow and budget?

With Farseer’s real-time scenario modeling, finance teams can:

- Compare the financial impact of leasing vs. buying equipment before making a decision.

- Run “what-if” scenarios to see how shifting expenses between CapEx and OpEx affects cash flow.

- Adjust forecasts dynamically as business conditions change.

Let’s say that a manufacturing company is deciding whether to buy a new production machine (CapEx) or lease it (OpEx). With Farseer, they can instantly model the impact on cash flow, tax deductions, and long-term financial performance – helping them make the best choice.

2. Automated workflows & approvals

One of the biggest pain points in CapEx management is the approval process. Requests get stuck in email chains, spreadsheets need manual updates, and the ultimate goal – the final decision – is slowed down completely.

Farseer eliminates this with:

- Automating approval workflows, so requests reach the right people without delays.

- Providing real-time status tracking, so finance teams always know where a request stands.

- Reducing errors and delays by removing manual data entry from the process.

When approvals don’t slow things down, companies can move faster and use resources more wisely.

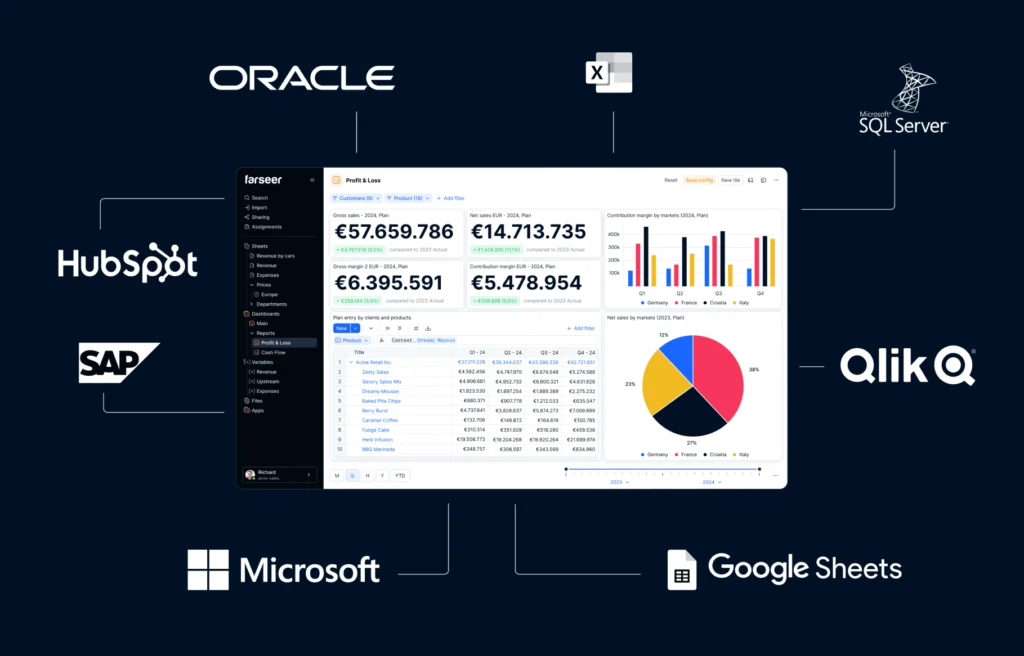

3. Integration with ERP & accounting systems

When financial data lives in different systems, teams struggle to get a clear, up-to-date view. That makes reporting messy and forecasting unreliable.

Farseer integrates seamlessly with existing ERP and accounting systems, ensuring:

- A single source of truth for CapEx and OpEx data.

- Automatic data synchronization – no need for manual fixes.

- Accurate financial reporting, making compliance and audits easier.

By centralizing financial data, companies gain full visibility into their budgets, spending patterns, and future projections.

4. Cash flow & budget optimization

Budgeting goes way beyond tracking expenses, it’s about optimizing spending for long-term financial stability. Farseer helps companies:

- Predict long-term cash flow impact of CapEx and OpEx decisions.

- Reallocate budgets dynamically based on real-time financial performance.

- Avoid surprises by continuously updating forecasts with the latest data.

Instead of reacting to financial issues, businesses using Farseer can plan ahead with confidence.

Smarter CapEx & OpEx Management Starts with the Right Tools

In conclusion, finding the right balance between CapEx and OpEx is a key strategy that affects cash flow, profitability, and growth. When companies manage these expenses well, they gain better control, flexibility, and the ability to make smarter investment decisions.

But relying on spreadsheets and disconnected systems can make it tough to track expenses, forecast accurately, and adjust to changing conditions. That’s why having a modern, flexible approach to financial planning is crucial.

With Farseer, finance teams can:

- Make data-driven CapEx vs. OpEx decisions in real time.

- Automate approvals to eliminate bottlenecks and delays.

- Optimize cash flow and budgeting with accurate forecasting.

Stop relying on outdated processes that slow your business down.

Book a demo today and see how Farseer can help you take control of your financial planning.