If you’ve been considering Workday Adaptive Planning, you’ve probably noticed a pattern in user reviews – it’s a feature-rich platform, but…

The learning curve is reportedly steep, the formula language is complex, and ongoing maintenance often requires specialist admins or consultants. For many finance teams, reporting feels clunky, integrations fragile, and support too slow to rely on.

Add in the high price tag, long implementations, and hidden costs for training and support, and it’s clear why many companies, especially mid-sized ones, start looking for alternatives.

Read FP&A Software for Modern Finance Teams: Compare the Best Tools in 2026

The good news?

You have options.

In this guide, we’ll break down the leading Workday Adaptive Planning competitors, their strengths and how they compare, so you can find the right fit for your finance team.

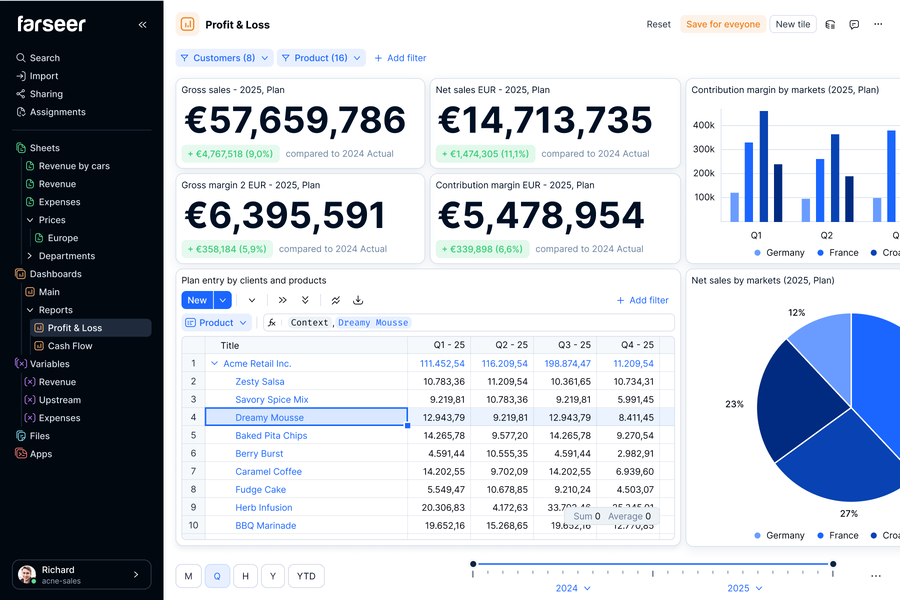

Farseer

If your finance team still spends weeks chasing down spreadsheets and fixing broken formulas, Farseer was built for you. It’s a modern, cloud-based FP&A platform that helps companies plan, forecast, and analyze data without the usual chaos.

Instead of juggling endless Excel files or wrestling with extremely complex systems, Farseer gives you a single place to model your business.

What does this mean?

Finance and business teams can collaborate in real time, test scenarios, and see the impact of their decisions instantly, without relying on IT or external consultants. At its core, Farseer combines a powerful calculation engine with a clean, no-code interface. That means you can run what-if simulations, rolling forecasts, or detailed P&L consolidations as easily as working in a spreadsheet, but with the control, speed, and scalability finance leaders expect from an enterprise tool.

And because it’s designed for growth, Farseer scales from mid-sized businesses to large enterprises, cutting planning cycles down from weeks to days and helping finance teams spend more time on insights, not admin work.

Key features

- Advanced planning engine: Supports machine learning forecasting, what-if simulations, and both top-down and bottom-up planning.

- AI-powered insights: Automated variance analysis, predictive planning, and scenario modeling help finance teams move from reactive reporting to proactive decision-making.

- Modern UX: Intuitive, user-friendly design with dashboards and reports that finance teams can navigate without coding skills.

- Simpler formulas: Reduces dependency on external consultants or specialized administrators.

- Fast implementation: Typically rolled out in weeks, not months.

- Lower total cost of ownership: 4-5x more cost-efficient compared to Workday Adaptive Planning or Anaplan.

- Enterprise-ready flexibility: Handles multi-entity, multi-currency, and complex financial structures with ease.

- Collaboration-first design: Teams can share, edit, and comment in real time, improving alignment across finance and business units.

- Scalable architecture: Built to support growth from mid-market companies to large enterprises without slowing down.

Farseer vs Workday

Looking at these tools back to back, Workday Adaptive Planning often feels heavy and complex, with formulas that require specialist knowledge, interfaces that take time to master, and implementations that stretch into months.

By contrast, Farseer puts usability and speed first: its calculation engine handles advanced planning tasks like ML forecasting and what-if simulations out of the box, the UX is clean and intuitive, and formulas are simple enough for finance teams to own without outside help. Most importantly, Farseer delivers this at a fraction of the cost and time, typically 4-5x lower TCO and implementations measured in weeks, not months.

Anaplan

Anaplan is one of the biggest names in the connected planning space. Known for its scale and flexibility, it’s often used by large enterprises to manage complex, multi-department planning.

Key features

- Powerful modeling with its proprietary Hyperblock calculation engine.

- Strong multi-entity, multi-currency, and enterprise governance capabilities.

- Large marketplace of connectors and partner ecosystem.

- Suited for cross-departmental planning beyond finance (supply chain, sales, HR).

Anaplan vs. Workday

Compared to Workday, Anaplan offers greater scale and flexibility, especially for global enterprises. However, it shares many of Workday’s challenges: a steep learning curve, high total cost of ownership, and lengthy implementations. Both tools often require external consultants, making them less appealing for finance teams that want agility and independence.

Read Anaplan Competitors – The 6 Best Alternatives for Enterprise FP&A

Vena Solutions

Vena positions itself as an FP&A solution for finance teams that want to stay close to Excel. It offers a familiar spreadsheet interface layered with centralized data and workflow management.

Key features

- Excel-native experience with centralized data control.

- Pre-built templates for common finance workflows.

- Workflow automation for approvals and submissions.

- Integrations with ERP and CRM systems.

Vena vs. Workday

Compared to Workday, Vena is easier to adopt for Excel-heavy finance teams, thanks to its familiar interface. However, this reliance on Excel also means limited scalability and performance bottlenecks when models get complex. While Workday feels too heavy for mid-market companies, Vena can feel too lightweight for enterprises that need advanced functionality like predictive planning or robust scenario modeling.

Read 7 Vena Alternatives and Competitors to Take a Look at in 2026

Jedox

Jedox is a planning and performance management platform that combines spreadsheets, web, and mobile interfaces with a centralized database. It’s popular in Europe and among companies that want flexibility without fully leaving Excel behind.

Key features

- Excel add-in combined with web-based modeling.

- Strong OLAP database and multidimensional modeling.

- Pre-built planning templates and workflows.

- Integrations with ERP and BI tools like SAP, Salesforce, and Power BI.

Jedox vs. Workday

Jedox offers more flexibility and a lower entry cost than Workday, with faster implementations and a familiar Excel-style environment. But it lacks the depth and polish of Workday in areas like advanced analytics, AI forecasting, and enterprise-grade dashboards. While Workday can feel too rigid, Jedox can feel too technical and limited, requiring skilled admins to unlock its full potential.

Read Looking for Jedox Competitors? Here Are the 7 Best Options

Which Workday Adaptive Planning Competitor is Best For Your Business

Workday Adaptive Planning remains a strong contender in the FP&A space, but for many teams the trade-offs (complexity, steep learning curves, and high costs) can outweigh the benefits. Competitors like Farseer, Anaplan, Vena, and Jedox each offer their own advantages, which may be a better fit for your finance team, depending on your needs and priorities.

If you’d want to give Farseer a try, book a demo with us and let us show you how easy financial planning and analysis can be.