Financial statement consolidation basics

Financial statement consolidation is the accounting process of combining the financial statements of multiple entities into a single set of consolidated statements. Consolidating the financial statements usually happens when a parent company has one or more subsidiaries – separate legal entities controlled by the same parent company. To create consolidated financial statements, the subsidiaries have to prepare financial statements for themselves. Then, the parent company collects subsidiaries’ statements and makes consolidated statements by its accounting principles and policies.

Read: How to Create a Monthly Financial Report in 7 Easy Steps.

These financial statements usually include:

Income statement – also known as a P&L (profit and loss) statement. It focuses on the company’s revenue, expenses, gains, and losses during a particular period.

Balance sheet – a financial statement that reports the company’s assets, liabilities, and shareholder equity at a specific point in time.

Cash flow statement – provides data about all company’s inflows received from its ongoing operations and external investment sources and all outflows that pay for business activities and investments during a given period.

Consolidated statements show the financial results of the group. They provide a complete picture of the group’s financial condition to the owners and other interested parties. With consolidated statements, management and owners have an overview of the company’s business and can detect risks and opportunities on the group’s level.

Steps in the financial statement consolidation process

The consolidation process complexity increases with the company size, the number of subsidiaries, and their intercompany transactions. No matter how big the company is, these are the steps in the consolidation process:

Collect data

If you want to create consolidated statements, the first step would be to collect asset, liability, revenue, and expense data. You have to do so at the subsidiary level and generate financial statements for the subsidiary. All companies must prepare their financial statements using the same accounting principles and policies.

Map data to the centralized chart of accounts structure

The next step is to map collected data to the centralized chart of accounts structure. Different countries and types of businesses have different charts of accounts, and it is necessary to map all charts of accounts to the centralized one. Usually, the subsidiary’s data maps to the parent’s data. This step includes applying a foreign exchange (FX) rate if needed. And just like with a chart of accounts, the subsidiary’s data will translate into the parent’s currency.

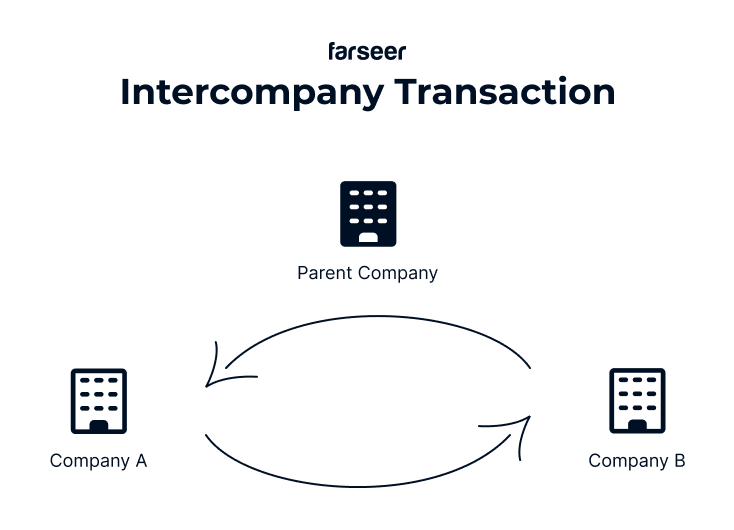

Define intercompany transactions

In this step, the goal is to identify all intercompany transactions. Intercompany transactions involve two or more related companies simultaneously. These include sales of goods or services, intercompany loans, interests, investments in related companies, and other transactions.

Eliminate Intercompany transactions

Previously defined and determined intercompany transactions should be eliminated from the statements. The process of intercompany elimination involves a parent company eliminating transactions between subsidiary companies in a group when preparing consolidated financial statements. This is done to accurately represent the financial position and performance of the parent company and its subsidiaries as a single entity. This step can include adjustments such as the differences in subsidiaries’ books about the same transaction or if transactions do not balance due to the FX differences.

Generate consolidated financial statements

Once all previous steps have been finished, you can close the period for both subsidiaries and parent companies and generate the group’s consolidated statements.

The most common problems in the financial statement consolidation process

As I stated previously, the financial statements consolidation process can be complex and time-consuming. Here are the most common problems related to the consolidation process:

Copy-pasting data from multiple sources

When consolidating, you will need to collect data from multiple sources. Different sources mean different data formatting or different types of exports. And that is what causes errors in the destination file. Also, a lot of copy-pasting in the same file makes it easy to get lost and make errors. And trust me, errors always occur.

Tracking all changes from accounting software

When you think: ‘That’s it, I’m done!’, you usually find out that you are missing at least one transaction. So you get an idea: You will replace the entire trial balance (which often has more than 100k rows). In truth, it will probably take hours to do that, with all errors and loading times and double-checking other intercompany transactions.

Inflexibility and errors

Usually, consolidation models in spreadsheets are static, and it takes a lot of effort and time to change the report format or add a new consolidation rule. The consolidation process involves a large amount of data you want to approach very carefully. Multiple manual model changes or “workarounds” can cause problems and errors that sometimes take days to find and debug.

Opportunities for automation in financial statement consolidation

Thankfully, in the 21st century, you can replace repetitive tasks with a tool that automates them. The consolidation process is just like that: the work is easy and repetitive but time-consuming and monotonous. Here are a few examples of how you can improve your consolidation process:

Automate data collection at the subsidiary level

One of the most challenging parts of the consolidation process is to get up-to-date information from all subsidiaries in one place. With more subsidiaries, the process becomes even more complex. Collecting all this data usually includes entire teams of people, and manually collecting data and working with traditional spreadsheet tools can be very challenging when done this way. In this day and age, there are many FP&A (Financial Planning and Analytics), EPM (Enterprise Performance Management), RPA (Robotic Process Automation), and other software tools that can help you with this by shortening the consolidation time from weeks and even months to days.

Generating consolidated statements

To better present your hard work on consolidating all those financial statements you should visually present the results. Often, the results of the consolidation should be generated in different forms and for different purposes. Pivoting or remaking simple statements or KPIs in spreadsheets is easy, but if it includes a large amount of data with a lot of formulas and related columns it isn’t that easy and can take you much more time than you expect.

When consolidating financial statements, it’s important to consider adjustments for accrued revenue.

Automate consolidation analytics

This point is related to the previous ones. If you handle your data collection and consolidated statement generation right, you will make more room for additional activities. One of the main advantages of an easier and faster consolidation process is that instead of just reporting and making statements, you are bringing analysis into play and improving your company decision-making. Quality analysis requires easy modeling and smooth data workflows, and once again, some of the software tools I mentioned earlier can help you with this.

Financial statement consolidation in Farseer

Farseer is a financial planning and analysis (FP&A) tool that optimizes and improves all financial processes in companies. Naturally, this includes the consolidation process.

Since this process consists of multiple repetitive tasks, Farseer can significantly speed it up by automating them.

Companies can sync Farseer with all data sources, such as ERP and BI solutions, Google Sheets, Excel, and other spreadsheet tools.

With automated and scheduled imports, consolidation models in Farseer can be up to date with actual data at all times, which makes manual data collection obsolete.

Instead of consolidating only once a year, with Farseer, businesses can do it quarterly or even monthly, which can significantly improve analysis and planning on a Group level.

Models created in Farseer are interlinked and automatically connected to Farseer’s interactive dashboards in the form of KPIs or charts. Users can slice them using any of Farseer’s system or custom dimensions (months, years, quarters, accounts, clients, companies, etc.)

Conclusion

Financial statement consolidation is a crucial process for companies with multiple subsidiaries, as it allows them to accurately represent the financial position and performance of the Group as a single entity. The consolidation process involves several steps, including collecting and mapping data, defining and eliminating intercompany transactions, and generating consolidated financial statements. While consolidation can be complex, it is necessary for ensuring the integrity and accuracy of a company’s financial statements. By following a clear and organized process, companies can make financial statement consolidation easier and more efficient.