Prophix competitors are becoming the go-to choice for finance teams that once started their digital planning journey with Prophix. While Prophix has been around for a while and covers the basics – budgeting, reporting, consolidating numbers – the reality is, the market has moved on.

Talk to Prophix users and you’ll hear the same themes:

- Reports that take forever to build or load.

- Dashboards that look and feel like yesterday’s tools.

- Advanced features that sound great on paper, but take too much training to use in practice.

- Performance that struggles once datasets get bigger or more complex.

For lean finance teams in fast-moving industries these are huge blockers. When you’re trying to close the books faster, re-forecast mid-quarter, or consolidate multiple entities, waiting 10 minutes for a report to load simply isn’t an option.

Read FP&A Software for Modern Finance Teams: Compare the Best Tools in 2026

That’s why more and more companies are looking beyond Prophix. The good news? There are plenty of strong competitors out there: from agile, spreadsheet-native platforms to enterprise-scale powerhouses.

In this post, we’ll break down six of the best Prophix alternatives in 2026, with a clear look at their strengths, limitations, and pricing, so you can see which one actually fits the way your team works.

Vena Solutions – Excel-First FP&A

Vena Solutions, one of Prophix competitors is often seen as a natural step up for teams that have outgrown manual Excel but aren’t ready to move into heavy enterprise FP&A platforms. It keeps Excel at the core while layering on workflow management, templates, and centralized data, making it appealing for finance teams that want familiarity without giving up structure.

Strengths

- Deep integration with Excel – ideal for teams that don’t want to leave spreadsheets behind.

- Strong budgeting, forecasting, and reporting capabilities.

- Pre-built templates speed up adoption.

Limitations

- Heavy reliance on Excel can limit scalability for highly complex organizations.

- Dashboards and UI less modern than newer cloud-native competitors.

Pricing

The price ranges usually from $5,000 to $25,000/year, scaling with users and modules.

Farseer – Full-Scale Planning Power for Agile Finance Teams

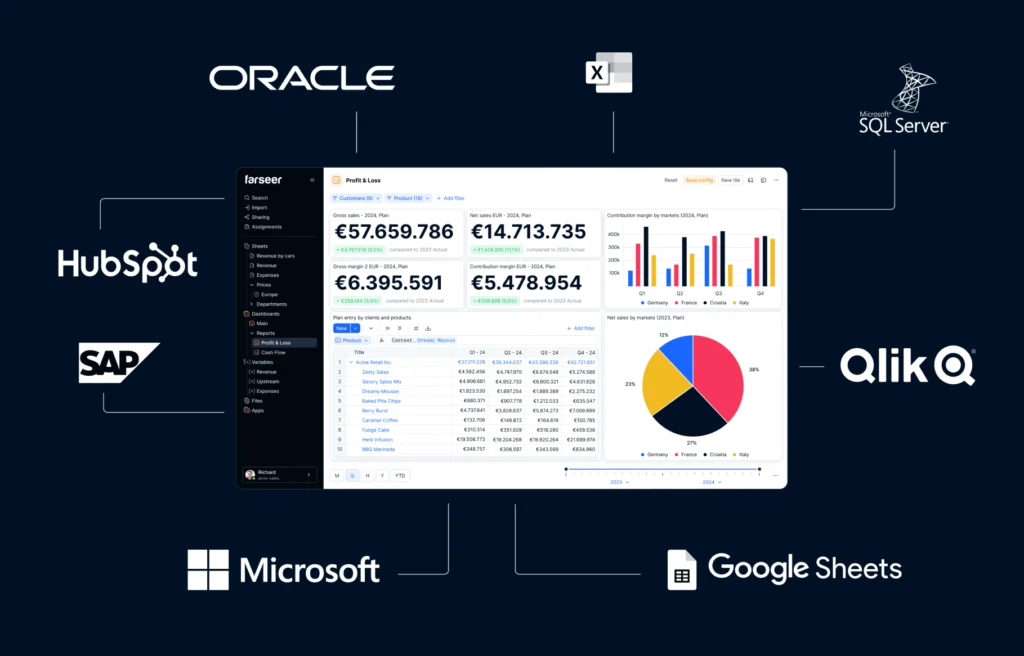

Farseer, one of Prophix competitors is built for mid-to-large companies that want the power of enterprise-grade FP&A without the long rollouts or consultant dependency. Its spreadsheet-native interface makes it easy to adopt, while its high-performance engine, AI-driven forecasting, and real-time collaboration features give finance teams the speed and flexibility Prophix often lacks.

Strengths

- Fast deployment – Most teams are live in 6-8 weeks, far quicker than traditional enterprise tools.

- No-code modeling – Finance teams can build and adapt models on their own, without waiting on IT or external consultants.

- Handles scale effortlessly – Even large, complex datasets are calculated instantly, with no performance lag.

- AI-enhanced forecasting – Machine learning improves forecast accuracy and helps identify anomalies early.

- Always up to date – Real-time collaboration ensures everyone works with the latest budgets, forecasts, and assumptions.

- Adaptive dashboards – Automated dashboards and workflows adjust quickly as business needs change.

- Familiar interface – Spreadsheet-like design makes it intuitive from day one, with minimal training required.

- Faster ROI – Companies see value within the first planning cycle, instead of waiting quarters for results.

Limitations

- Best suited for mid-to-large companies (may be too advanced for very small teams).

- Spreadsheet-like interface may not appeal to teams seeking a fully dashboard-first approach.

Pricing

Starts at $20,000 per year, depending on team size and features.

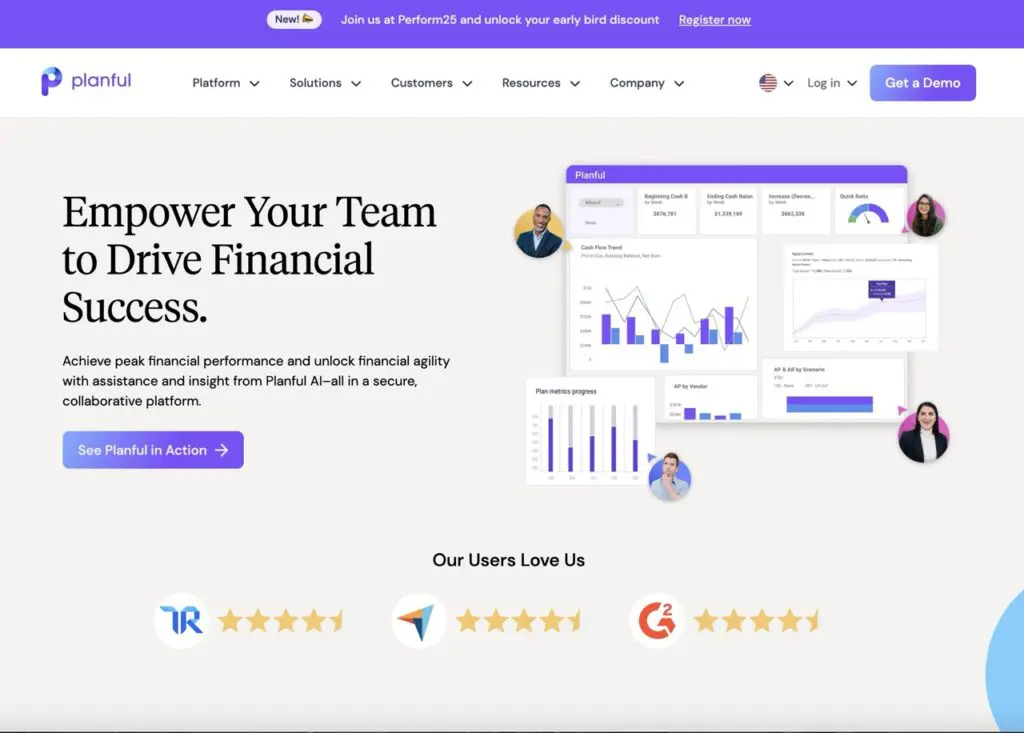

Planful – Cloud FP&A With Speed

Planful, another one of Prophix competitors positions itself as a cloud-first FP&A platform built for speed. It’s especially popular with mid-market companies that need faster reporting, forecasting, and consolidation without the complexity of heavy enterprise tools. With a modern interface and quicker deployments than legacy systems, Planful appeals to finance teams that want agility and a cleaner user experience.

Strenghts

- Cloud-native platform with faster deployments than legacy systems.

- Strong reporting and consolidation capabilities.

- Intuitive user interface compared to older Excel-heavy tools.

- Good balance for mid-market companies looking for scale.

Limitations

- Limited flexibility for very complex or industry-specific workflows.

- May require outside consultants for advanced configurations.

Pricing

Planful doesn’t have a public pricing.

Read 6 Planful Competitors Finance Teams Should Consider in 2026

OneStream – Consolidation Powerhouse

OneStream is best known as a consolidation powerhouse. It’s designed for large enterprises with complex, multi-entity structures that demand strict compliance, detailed reporting, and enterprise-grade audit capabilities. While it’s heavier and more expensive than mid-market tools, OneStream is often the go-to choice for organizations where financial consolidation and regulatory requirements are non-negotiable.

Strengths

- Industry leader for financial consolidation and reporting.

- Enterprise-grade compliance, audit, and regulatory features.

- Supports multi-entity, multi-currency, and global consolidation with ease.

Limitations

- High cost and long implementation timelines.

- Requires dedicated expertise to manage.

- Overkill for most mid-market companies.

Pricing

Pricing averages $170,000 per year, varying by company size and selected features

Centage – Budgeting & Forecasting for Mid-Market

Centage focuses on giving mid-sized companies a structured way to handle budgeting and forecasting without the weight of an enterprise platform. It’s built to simplify core FP&A tasks, making it appealing to finance teams that need straightforward planning tools and reliable support at a more accessible price point.

Strengths

- Focused on budgeting, forecasting, and reporting for mid-market organizations.

- Straightforward implementation and good customer support.

- Affordable compared to enterprise-level platforms.

Limitations

- Limited advanced modeling capabilities.

- Less scalable for companies with multi-entity or complex operations.

Pricing

Usually between $27,000 and $51,000/year, depending on users and features.

Which Prophix Competitor Should You Choose?

Plenty of FP&A platforms can cover the basics, but most come with trade-offs — whether it’s long implementations, high reliance on consultants, or features that look impressive but don’t speed up day-to-day work.

That’s where Farseer stands out. It combines enterprise-grade modeling with the speed and flexibility finance teams actually need. Go live in weeks, not months. Run advanced forecasts and what-if scenarios without IT support. Consolidate full financial statements in one place, without waiting on external consultants. And do it all at a price point that makes sense for mid-to-large companies.

If Prophix has started to feel like a bottleneck, Farseer gives you a faster, more agile alternative, built for finance teams that want control, accuracy, and results without unnecessary overhead.

Want to see it in action?

FP&A Tool Fit Quiz

Question 1

How complex is your organizational structure?

Question 2

How quickly do you need to implement an FP&A solution?

Question 3

What is your team’s technical profile?

Question 4

What is your primary planning priority?

Question 5

What is your expected FP&A budget?