Every day finance teams make use of line items throughout their work on invoices and P&Ls and budget spreadsheets. However, many people fail to maximize their use of this feature.

The combination of properly organized line items converts basic data points into important business choices. This paper explains the meaning of line items and their importance beyond bill processing as well as their application for improved business planning and reporting.

Read Scenario Planning: How to Prepare Your Business for Uncertainty

What is a Line Item?

The term line item refers to individual details which appear in documents such as invoices and contracts as well as profit and loss statements. The data appears separately on each line to present exact details regarding the purchased item along with its cost and purchase price. Line items simplify complicated financial transactions by dividing them into specific and trackable elements.

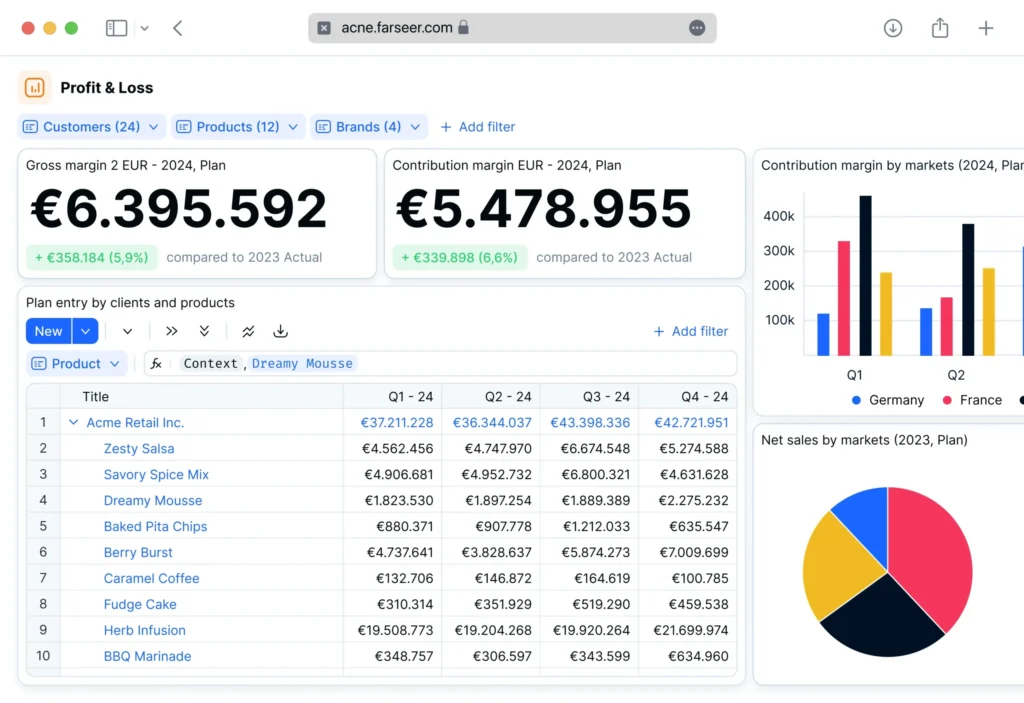

The example of a line item within an Excel-based invoice shows “Marketing consulting, 10 hours, $100/hour, total $1,000.” The same rule operates in FP&A software because it enables finance teams to distinguish between different revenue streams and cost centers and project expenses for effective analysis and reporting.

The individual component constitute the fundamental elements that establish organized financial transparency throughout operational activities and strategic planning processes.

Why It Matters in Financial Planning

Line items do more than just describe what was purchased. They’re essential for cost transparency, scenario modeling, and auditability in financial planning.

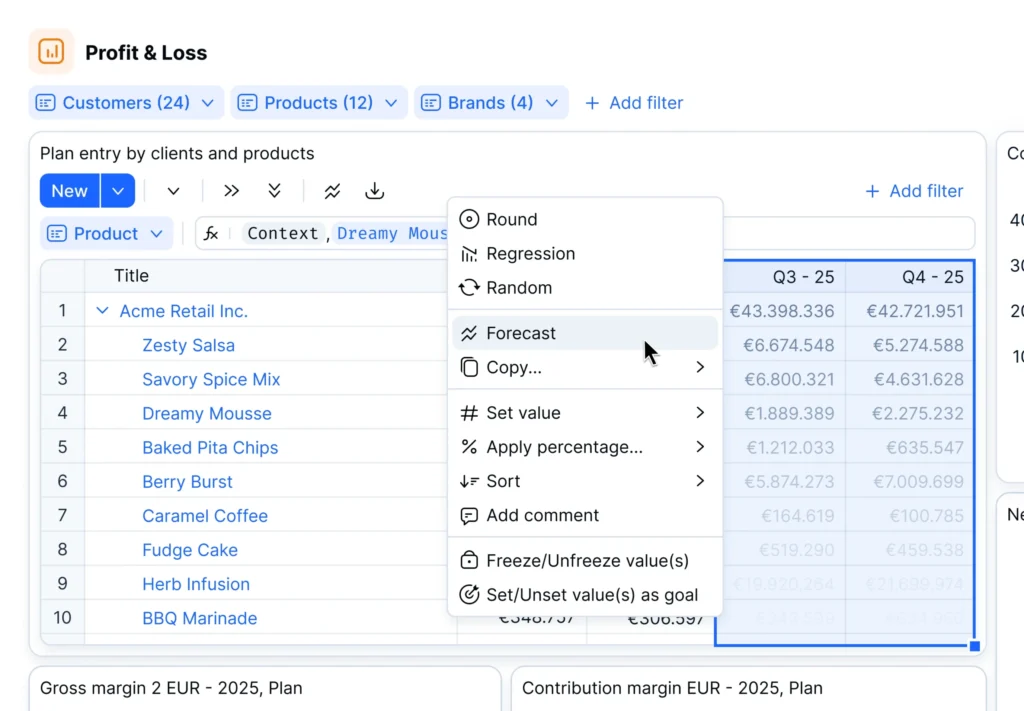

For instance, when building a scenario model, individual line items allow FP&A teams to tweak one variable say, marketing spend without touching the rest of the plan. This granularity enables agile, data-driven decision-making, especially in uncertain environments.

From an audit trail perspective, line items provide a clear, traceable record of all financial assumptions. Whether you’re explaining a spike in travel costs or verifying a vendor charge, well-structured line items remove ambiguity and reduce risk.

How Modern Planning Tools Use Line Items

Modern planning tools use line items as interactive structured components which work together with drivers and assumptions as well as real-time inputs.

When you modify a unit cost it automatically adjusts margins throughout different dimensions including months and regions and product lines without modifying formulas or spreadsheets. The high level of detail allows organizations to implement rolling forecasts and zero-based budgeting systems effectively.

Beyond Invoicing: Using Line Items for Forecasting & Planning

The majority of people connect line items to invoices or P&L statements but contemporary financial planning extends their utility far beyond these traditional uses.

The main distinction emerges from different purposes: accounting uses them to document historical transactions but FP&A employs them to forecast future operations.

Take an IT budget, for example. Planning teams divide software costs into separate lines that distinguish between Slack and Notion and HubSpot alongside their respective licenses and business unit affiliations. CAPEX plans require each equipment purchase or facility investment to have its own item to enable future cycle adjustments and cancellations.

They help to organize headcount planning by allowing finance teams and HR to create detailed departmental and role-based maps which link to salary expenses and hiring plans.

The detailed approach serves a purpose beyond mere detail collection. The detailed approach enables businesses to perform scenario planning while maintaining agile re-forecasting capabilities and making improved decisions across all organizational levels.

Common Mistakes with Line Items

Line items are only as useful as the clarity they provide. But in many companies, especially those still relying on manual spreadsheets, that clarity quickly breaks down. Here are some of the most common mistakes:

- Lumping multiple costs into one line: Instead of separating items like software subscriptions, travel, and training, some teams pile them into a generic “Misc. Expenses” line. This makes forecasting and variance tracking almost impossible.

- No descriptions = no analysis: Vague items like “services” or “admin costs” tell you nothing. Without clear labels and categories, it’s impossible to trace spending or model different scenarios.

- Mismatched units or currencies: When quantity, currency, or time units differ across departments, consolidating and comparing becomes messy. One team reports in hours, another in days, someone else in FTEs – creating noise instead of insight. In the CPG industry, mixing cases, packs, and single units (or liters vs. pieces) ruins SKU-level comparability.

If you’re struggling with any of these issues, it’s worth reviewing your planning templates and processes. Clean, well-structured items are the foundation of scalable, intelligent planning.

The Bottom Line

The quality of line item organization makes all subsequent steps in planning more dependable.

Every number must have its context along with a clear definition and decision-making logic in order to succeed.

Modern financial tools use line items to do more than display rows in reports. The system functions as a dynamic system which connects all elements to support live model functionality beyond static reporting. The established structure enables organizations to create accurate forecasts while offering flexible scenario planning and real-time insights.