Jedox competitors are gaining attention as finance teams look for tools that are faster, easier to use, or more flexible.

Jedox is a popular FP&A tool used for planning, reporting, and modeling. It offers solid features and an Excel-style interface that works for spreadsheet-heavy teams.

But it’s not always the easiest tool to use. Some teams end up frustrated with the learning curve, setup time, or the level of IT support they need just to keep things moving. We’ll break that down in more detail later.

Read: FP&A Software – A Practical Guide for Finance Teams

If you’re in the middle of a buying decision or thinking about moving on from Jedox, this comparison can help. We looked at seven alternatives that come up most often when teams want something more flexible, faster to implement, or easier to manage.

You’ll get a side-by-side look at pricing, Excel integration, setup time, AI features, and more – all based on current user feedback and analyst insights.

Common Problems With Jedox

Setup Takes Too Long

Jedox isn’t a plug-and-play tool. Most teams need at least three months to get a working setup. If you build complex models or reports, expect it to take longer. And unless you already have someone who knows Jedox, you’ll probably need outside help to get started.

Hard to Learn

You can’t just open Jedox and figure it out. Teams often need formal training or certifications just to get the basics down. Creating reports or business logic requires more than just Excel skills. Smaller teams without a technical expert usually rely on consultants for updates or changes.

Not Fully Excel-Compatible

Jedox uses an Excel-style interface, but it doesn’t support all the same features. Some formulas don’t work, and formatting options are limited. Users often have to rebuild their spreadsheets to fit Jedox’s setup.

Outdated Interface and Confusing Tools

Some parts of the tool feel clunky. Report building can be slow. The ETL tool is powerful, but most finance users find it hard to work with. Error messages and change tracking are also weak compared to more modern tools.

Performance Drops With Bigger Models

Jedox handles mid-sized models fine, but performance suffers as complexity grows. Big reports, lots of rules, or many users can slow things down.

Pricing Isn’t Clear

Jedox doesn’t list pricing publicly. Most buyers need a custom quote. You’ll often pay more if you want extra features, more users, or system connectors. Once you factor in the cost of consultants, it adds up quickly.

Weak Consolidation Tools

Jedox includes a financial consolidation module, but some teams find it too limited. If you have complex ownership structures or need more automation, you might need to buy extra tools or services.

Related Reads: 9 Best Forecasting Tools for Enterprise Teams in 2025

Jedox Competitor #1 – Farseer

Why Farseer

Farseer gives finance teams a faster and more flexible way to manage planning. It runs on a high-speed in-memory engine, supports complex logic, and looks and feels like a spreadsheet. Teams can build custom models, analyze scenarios, and forecast with AI, without needing help from IT.

Key benefits:

- Interface based on spreadsheet logic, familiar for most users

- Integration with all related systems (ERP, BI, accounting tools, etc.)

- High performance with large data models

- Setup completed in 6 to 8 weeks

- No-code tools for creating dashboards and workflows

- Advanced forecasting and anomaly detection with AI

- Quick what-if analysis for better decision-making

- FarseerAI in Slack or WhatsApp for checking KPIs, run scenarios, or pull forecasts – no login needed

Weaknesses

- Better suited for mid-sized and large teams

- Some advanced features require time to learn (customer support helps here)

Pricing

Starts at $20,000 per year. Cost depends on team size and features.

Ideal Use Case

Teams moving away from Excel, but still need flexibility, speed, and custom planning. Best for companies managing large models, frequent updates, or complex workflows.

Jedox Competitor #2 – Vena

Why Vena

Vena builds on what finance teams already use every day: Excel. It doesn’t replace spreadsheets. It helps you organize them. Vena brings structure, control, and a central source of truth to your models. You can keep using Excel while gaining features like version control, workflow approvals, and audit trails.

Finance teams often choose Vena when they want to improve collaboration and reduce manual work, without rebuilding everything from scratch.

Read: No More Middlemen: Why User Autonomy in Enterprise Software Is the Future

Key benefits:

- Works directly inside Excel

- Adds user permissions, templates, and approval flows

- Brings all data into one place

- Connects to ERPs and CRMs like NetSuite, Salesforce, and Dynamics

- Speeds up month-end close and reporting

Weaknesses

- Still depends heavily on Excel

- Doesn’t offer much for AI forecasting or scenario planning

- Larger rollouts may need consultants to get up and running

Pricing

Starts around $23,000 per year. Total cost depends on features and users.

Ideal Use Case

Best for teams that want to improve their Excel process without replacing it.

Read 7 Vena Alternatives and Competitors to Take a Look at in 2025

Jedox Competitor #3 – Cube

Why Cube

Cube helps finance teams keep working in Excel or Google Sheets, while adding structure, automation, and a shared source of truth. You don’t need to change your process to use it. It connects your spreadsheets to live data and gives you tools for faster reporting, better control, and easier collaboration.

text here

Key benefits:

- Works inside Excel and Google Sheets

- Centralizes data, formulas, and metrics

- Fast setup in 2 to 4 weeks

- Built-in version control and variance tracking

- Connects with NetSuite, QuickBooks, Snowflake, and others

- Offers basic AI forecasting and integrates with Slack and Teams

Weaknesses:

- Not built for very large models or complex reporting

- Some tasks still need manual work in Excel

- Visuals and permissions are more limited

- AI tools are still early stage

Pricing

Starts at $21,500 per year. Final cost depends on team size and selected features.

Ideal Use Case

Teams that want to keep using Excel or Sheets but need a faster way to plan, track, and collaborate. Cube fits best when you want better control without switching tools.

Jedox Competitor #4 – Workday Adaptive Planning

Why Workday Adaptive Planning

Workday Adaptive Planning is a cloud FP&A tool built for teams that want to keep things simple. It’s known for being easy to use and quick to set up. Most teams don’t need IT support to start working in it, and the interface feels familiar even to new users. It helps with budgeting, forecasting, and reporting, and makes it easy for teams to work together on the same plan.

Key benefits:

- Easy to learn with a clean, simple interface

- Teams can collaborate in real time

- Reports are flexible and don’t need IT to create or adjust

- Setup takes less time than most enterprise tools

- Built-in support for basic what-if scenarios

Weaknesses:

- Not built for detailed financial consolidations

- Doesn’t include advanced forecasting tools

- Basic reporting compared to some competitors

- Can slow down with very large datasets

Pricing

Starts at about $50,000 per year. Final price depends on features and number of users.

Ideal Use Case

Best for companies that want a straightforward planning tool for budgets and forecasts. Good for collaboration, but not the right fit if you need complex consolidation or advanced modeling.

Read more: 4 Workday Adaptive Planning Competitors Worth Considering in 2025

Jedox Competitor #5 – Datarails

Why Datarails

Datarails is built for finance teams that still rely on Excel but need better control, faster reporting, and easier access to data. It connects spreadsheets to your source systems and centralizes everything into a single model. Teams use it to automate reports, run variance analysis, and answer questions quickly with the built-in assistant.

- Works directly in Excel, no need to switch platforms

- Pulls data from ERP, CRM, and accounting systems into one model

- Custom dashboards and spreadsheet-based views

- Includes FP&A Genius for simple Q&A, basic variance insights, and quick PDF reports

- Scenario planning tools for quick what-if analysis

- Fast onboarding with minimal setup

Weaknesses

- Can get slower with many connected spreadsheets

- Advanced features may take time to configure

- Backend connections aren’t always easy to troubleshoot

Pricing

Starts at $25,000 per year. Final price depends on team size and selected features.

Ideal Use Case

Best for finance teams that want to keep working in Excel while reducing manual tasks and improving visibility. Good fit for small to mid-sized companies that need better reporting without replacing their existing tools.

Jedox Competitor #6 – OneStream

Why OneStream

OneStream is built for large companies that need strong financial consolidation and detailed control over planning and reporting. It brings actuals, budgets, forecasts, and close processes into one system. Many teams use it to replace multiple tools and cut down on manual work.

Key benefits:

- Combines consolidation, planning, and reporting in one platform

- Handles complex logic, multi-entity setups, and audit tracking

- Supports custom workflows with scripting and extensions

- Well suited for compliance and governance-heavy processes

Weaknesses:

- Takes time to set up and learn.

- Needs technical admins to manage and maintain

- Excel add-in feels clunky at times

- Interface and dashboards feel dated

Pricing

Starts at $35,000 per year. Final cost depends on features and users.

Ideal Use Case

Works best for large companies with complex group structures and strong internal support. Not a good fit if your team wants a quick rollout or a clean, modern interface.

Jedox Competitor #7 – Phocas

Why Phocas

Phocas helps teams get reports and insights without needing technical skills. It pulls data from systems like your ERP or CRM into one place, so you can see what’s going on across the business. Finance and sales teams often use it to track performance, spot trends, and reduce the time they spend in Excel.

Key benefits:

- Easy-to-use dashboards that show key numbers at a glance

- Brings data together from different systems

- Lets teams build and share reports without IT

- Cuts down Excel-based reporting work

- Helpful support and training materials

Weaknesses:

- Limited options to customize charts and visuals

- Takes time to learn for some users

- Data sync can be slow in larger setups

- Costs go up with extra modules or inactive users

Pricing

Starts at $54,000 per year. Final price depends on features and number of users.

Ideal Use Case

Good for mid-sized companies that want faster reporting and clearer visibility, without hiring a BI team or building complex models.

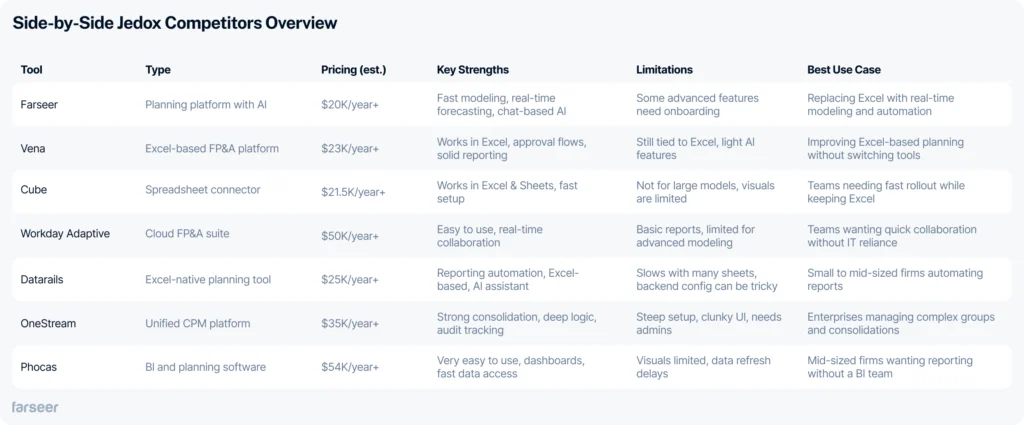

Side-by-Side Jedox Competitors Overview

Here’s a quick recap of the seven tools in this guide:

Conclusion

Jedox works for some teams, but many outgrow it. If you’re spending too much time on setup, struggling with clunky tools, or working around Excel limits, it might be time for something better. Farseer helps you plan faster, handle complex models, and get clear answers without extra effort.

Want to see it in action?