To put it simply right at the start – preparing an income statement is the key to understanding a company’s profitability. From what you’ve earned, to what you’ve spent – it records everything to the last penny, providing a clear snapshot of financial performance during a specific period.

Read: A Complete Guide to Financial Statement Analysis for Strategy Makers

The income statement, sometimes called profit and loss statement (P&L), enables you to assess operational efficiency, plan for growth, control costs, and much more. And it’s worth nothing if it’s not done properly.

Well-planned is half done – so here’s how to prepare an income statement from scratch in a couple of simple steps.

Which Information Should An Income Statement Include

Not every income statement is the same, just like not every business is. And just how complex your business finances really are will ultimately determine the items to include in your income statement. And that’s not it – your industry will have a huge effect as well.

For example, a retail company will emphasize revenue from product sales and detail metrics like gross margins and inventory costs. On the other hand, a software-as-a-service (SaaS) company will highlight recurring subscription revenue and advance payments from annual contracts.

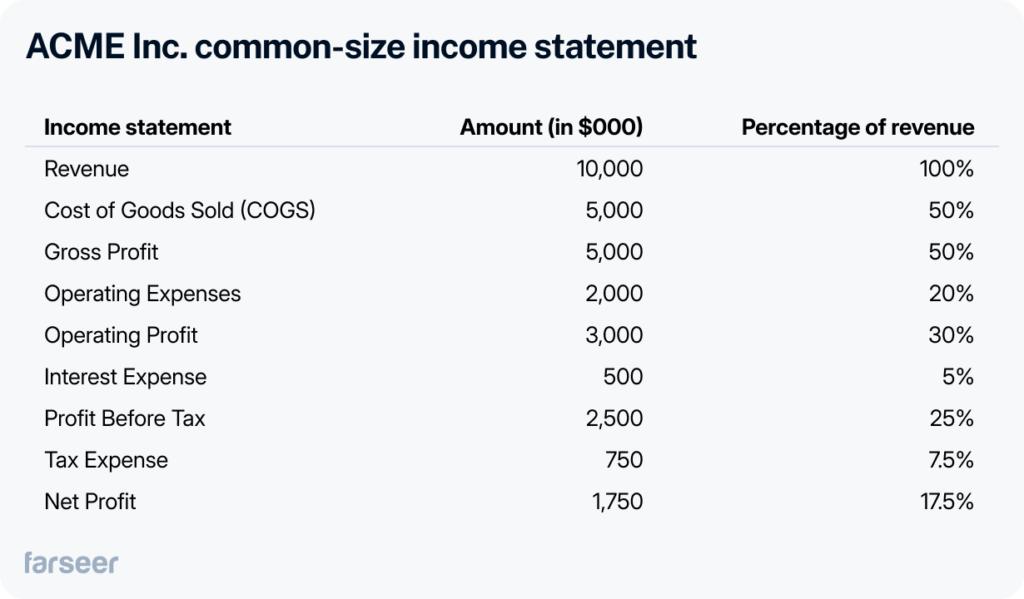

But still, there are some items that are typically included in every income statement, and those are:

- Gross sales. Total amount of sales before any adjustments or deductions.

- Costs of Goods Sold (COGS). The immediate cost of providing any goods or services.

- Gross profit. Total income before taxes and other deductions.

- Operating expenses. Amount spent on day-to-day business operations.

- Operating income. Income from business’ ongoing expenses.

- Tax expenses. Liabilities owed to federal, law, or state government for a specific time.

- Net income. The amount a business makes (profit) after deducting all taxes, deductions, and expenses.

Now that we know what we need to include, let’s go through the process of creating an income statement.

5 Steps to Create an Income Statement

Step 1: Gather all necessary financial data

First things first – you need accurate and complete financial data. Any mistakes you make at this point (like missing transactions or recording figures incorrectly) will influence the reliability of the outcome. This may end up with a misleading income statement and based on that, wrong decisions.

Where to look for data?

There are several valuable resources that typically include what you need:

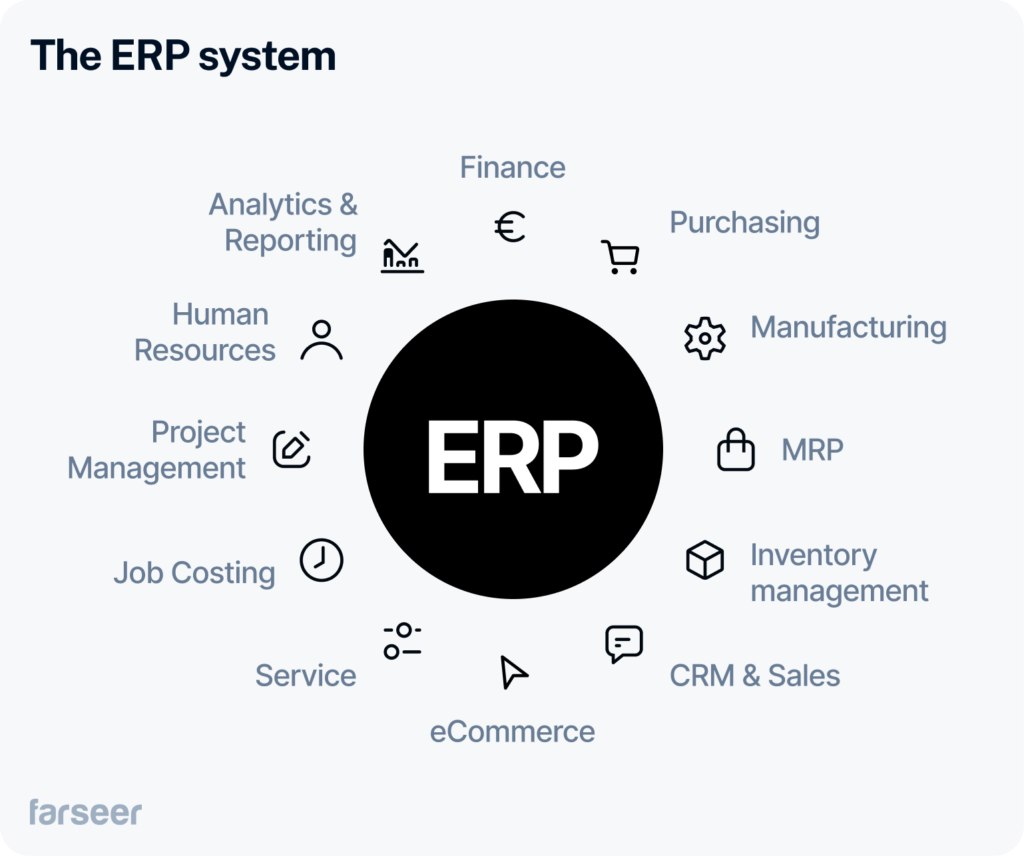

- ERP systems: Integrated systems that combine financial and operational data into one place

- Sales reports: Detailed records of revenue earned from selling products or providing services

- Expense tracking tools: Systems that track operational expenses like utilities, salaries, or supplier invoices

Let’s say you work in the finance department of a pharmaceutical company. You may rely on your ERP system to capture revenue from product sales and a specialized procurement tool to track raw material expenses. What’s important here is that all data sources are synchronized and accurate. This lays a pretty solid foundation for building a reliable income statement.

Step 2: Determine revenue streams

Revenue figures are the foundation of your income statement. Therefore it’s crucial to define and categorize it accurately. We can generally divide revenue into two categories:

- Operating Revenue: Income generated from the company’s core business activities, like sales of products or services.

- Non-Operating Revenue: Income that arises from secondary activities, like rental income, dividends, or one-time gains like asset sales.

Separating one-time gains from recurring revenue is a crucial step if you’re interested in finding out what contributes to sustainable financial performance. One-time gains, such as government grants or asset disposals, may increase earnings figures temporarily, but they don’t have much to do with proving how profitable a business actually is.

If we go back to the example of a pharmaceutical company – a recurring revenue would be the one coming from product sales, and a non-recurring one could be a government grant for research. When you distinguish between these revenue types within your income statement, this helps stakeholders assess whether the company is profitable mainly because of its primary operations or if there are external factors involved.

Step 3: Calculate Cost of Goods Sold (COGS)

The Cost of Goods Sold (COGS), as mentioned, is the actual cost of producing goods or delivering services. This step is important because if you calculate COGS wrongly, it directly impacts gross profit figures.

To determine COGS, focus on the expenses directly connected to production, such as:

- Raw materials: The cost of components or ingredients required to manufacture products.

- Labor: Wages paid to employees involved in production.

- Manufacturing overheads: Costs like equipment maintenance, utilities, insurance, etc.

If we take for example a beverage manufacturer, their COGS might include the cost of sugar, flavoring, and packaging materials, as well as wages for factory workers and electricity used in production. These figures must exclude indirect costs like marketing or general administrative expenses because these are recorded separately as operating expenses.

Step 4: List the operating expenses

Operating expenses are the costs connected with running a business that are not directly tied to production. Common operating expenses are for example:

- Salaries: Payments to administrative staff or managers.

- Utilities: Costs for electricity, water, and internet services.

- Research and development (R&D): Investments in innovation and product development.

Categorizing these expenses into 2 groups clears out the image additionally:

- Fixed Costs: Expenses that remain constant regardless of business activity (e.g., rent or salaries).

- Variable Costs: Expenses that change with production levels or business activities (e.g., shipping costs).

If you categorize your costs properly, you’re making sure everything is transparent and you’re also giving yourself the opportunity to manage costs more effectively.

Step 5: Finalize and analyze the income statement

When you’re done with collecting all revenue, COGS, and operating expenses figures listed, you’re ready to finalize your income statement. Key items to summarize include:

- Gross Profit: Revenue minus COGS

- Operating Profit: Gross profit minus operating expenses

- Net Income: The bottom line, indicating overall profitability after taxes and other deductions.

Once you’re done with your income statement, you’ll have a powerful tool for performance analysis and strategic planning. It gives you the basis for trend analysis and the opportunity to pinpoint areas for improvement, validate strategic investments, and align financial goals with broader business goals.

Read What is Financial Statement Consolidation, and How to Make it Simple

Common Mistakes to Avoid

Even small errors in preparing an income statement can have enormous impacts on the overall financial image you get. Common mistakes include:

- Double-counting revenue: Recording the same income multiple times because of mistakes in matching data.

- Underestimating depreciation: Not including the loss in value of long-term assets, which can make profits look higher than they really are.

- Misclassifying expenses: Mixing up operating and non-operating costs, which leads to unclear financial insights.

To minimize errors, consider using FP&A software or other automation tools. These systems help consolidate data from multiple sources, reduce manual errors, and provide a single source of truth for financial reporting.

Conclusion

Everything comes down to this – it’s easy to prepare an income statement if you have accurate and valid data and reliable data sources. After that, taking these five structured steps should be like a walk in the park and will give you a clear image of your financial health. Ultimately, this enables businesses to make informed decisions, from cost control to strategic investments.

Ready to put theory into practice?

Now that you know how to create an income statement, you don’t have to start from scratch.

Download our free Profit and Loss (P&L) Statement Template – it’s Excel-based, easy to adapt, and aligns perfectly with the 5-step process in this guide.