Figuring out how to go from top-down to bottom-up budgeting and forecasting isn’t easy. Leadership sets financial targets, but teams on the ground see different realities. The result? Unrealistic budgets, missed goals, and constant back-and-forth.

Read: Strategic Financial Planning: How to Plan for Success

Bottom-up budgeting flips the process. Teams own their numbers, forecasts get more accurate, and financial plans actually make sense. But getting there takes more than just good intentions. You need the right process, tools, and mindset to make it work.

This guide breaks it down step by step, so you can switch without the usual chaos.

What is Top-Down Budgeting and Forecasting?

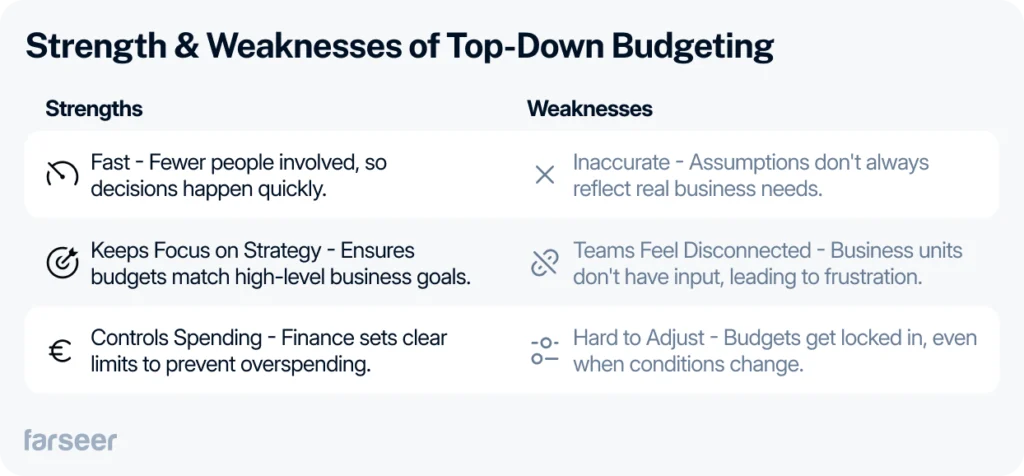

In top-down budgeting, CFOs and executives set financial targets based on strategy, past performance, and market trends. They pass those targets down to departments, expecting them to adjust their budgets to fit.

This approach keeps spending under control and aligns budgets with business goals. But it has a big flaw – it often ignores what’s happening on the ground. Teams don’t have a say, so budgets end up disconnected from actual needs.

For companies in stable industries, top-down budgeting can work. But when markets shift fast, a rigid budget can create more problems than it solves. That’s why many companies are switching to a different approach.

Example: A global retail chain set high sales targets for every store without asking managers for input. Some stores had too much inventory, while others ran out of bestsellers. Revenue goals were missed, and teams felt stuck with numbers that didn’t match reality. If they had factored in local demand, the plan would have worked better.

Relying only on budgeting without forecasting makes it hard to adjust when things don’t go as planned.

What is Bottom-Up Budgeting and Forecasting?

In bottom-up budgeting, teams, departments, or regional managers create their own forecasts based on real business data. Finance pulls everything together into a consolidated company-wide budget. Instead of relying on high-level guesses, this approach builds financial plans from real numbers, making them more accurate and flexible.

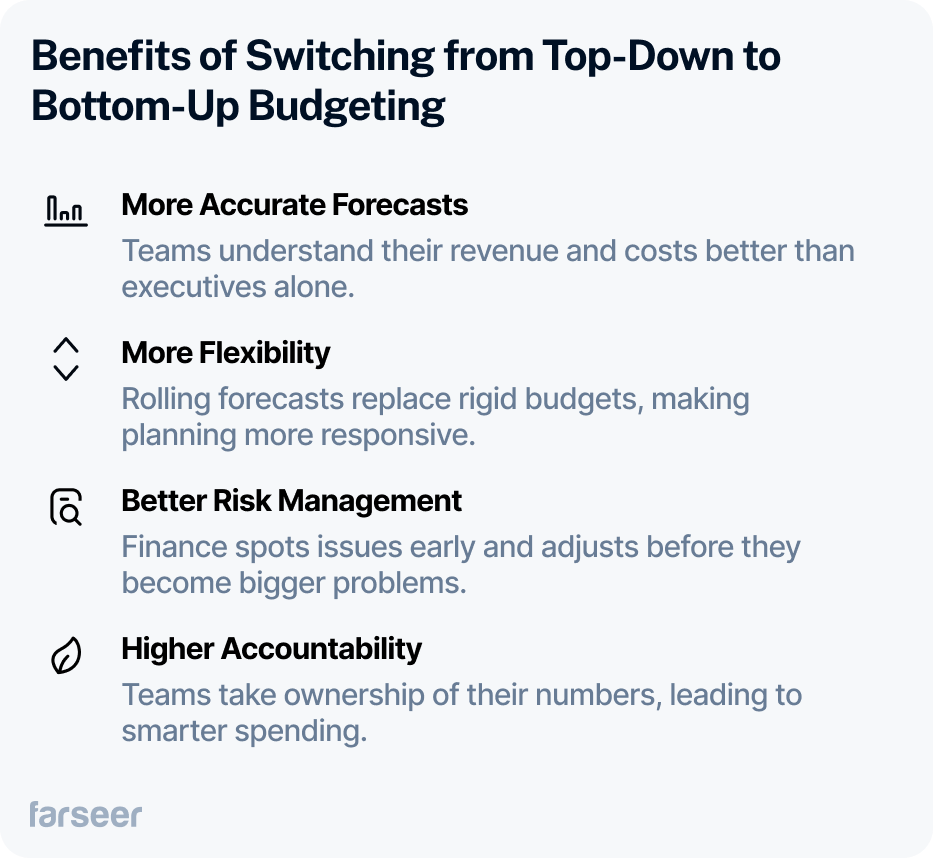

Companies that use bottom-up budgeting get better forecasts, more accountability, and faster adjustments when things change. But it’s not perfect. It takes longer, and without clear guidelines, teams might inflate budgets or set goals that don’t match the company’s strategy.

Want to dive deeper into why this method leads to better results? Check out why the bottom-up approach works better for budgeting.

Example: A construction company switched to bottom-up budgeting and cut unexpected cost overruns by 20%. Project managers tracked labor and material costs in real time, so finance got accurate forecasts instead of last-minute surprises. Before, top-down targets led to budgets that didn’t match actual project needs.

Short-term forecasting helps bottom-up budgeting work even better by letting teams adjust numbers quickly when things change.

Why Go from Top-Down to Bottom-Up Budgeting & Forecasting?

Top-down budgeting worked when markets were predictable. Now, things change too fast. Budgets based on last year’s numbers quickly become outdated, leaving teams stuck with unrealistic targets. That’s why more companies are moving to bottom-up forecasting, letting the people closest to the numbers drive financial planning.

When teams own their forecasts, budgets become more accurate and flexible. Finance gets real insights instead of assumptions, and companies can adjust plans before problems get too big. Instead of reacting too late, they stay ahead of market shifts, ensuring financial resources are allocated efficiently – whether for operational needs or a long-term capital investment plan.

Example: A car manufacturer improved production planning by letting factory teams report demand changes in real time. Instead of relying on outdated executive estimates, they adjusted forecasts weekly, reducing costly last-minute fixes.

Budget forecasting methods break down common budgeting mistakes and show how bottom-up forecasting helps companies stay ahead of market changes.

Challenges of Moving to Bottom-Up Budgeting

Bottom-up budgeting gives teams more control, but it also creates new challenges. Without the right structure, the process takes longer, numbers don’t always add up, and teams may focus on their own needs instead of the company’s big picture.

Common challenges include:

- Leaders lose control – Letting teams set their own budgets feels risky, especially when priorities conflict.

- Takes more time – Gathering input from every department slows things down, making budgeting more complex.

- Data overload – Teams submit massive amounts of data, and finance struggles to consolidate it into a clear budget.

- Inconsistent assumptions – Different departments use different forecasting methods, making numbers hard to align.

- Teams inflate budgets – Some overestimate costs to secure more funding, making it harder to control spending

- Resistance to change – Some managers prefer the old top-down approach and push back on the extra work of justifying their numbers.

Example: A manufacturing company struggled when teams worked in silos, leading to inconsistent forecasts and budgets that didn’t align. They fixed it by using rolling forecasts, updating numbers regularly instead of relying on static annual budgets.

Rolling forecasts help companies keep bottom-up budgeting fast, accurate, and aligned with business goals.

Why Traditional Spreadsheets Make Bottom-Up Budgeting Nearly Impossible

Excel works for simple budgets, but it falls apart when companies switch to bottom-up budgeting. Finance teams spend more time fixing errors than analyzing numbers, and budgeting turns into a slow, frustrating process.

Why Excel falls short:

- New data breaks the model – Every time a new SKU, client, or cost center is added, someone manually updates formulas. If one cell is missed, the entire budget can be off.

- Calculations don’t scale – Changing assumptions across thousands of rows requires complex formulas like SUMIF, INDEX/MATCH, or VBA, making troubleshooting a nightmare.

- Version control is a mess – Teams send different budget versions, creating mismatched numbers and confusion.

- No real-time collaboration – Multiple users working on the same file can overwrite formulas, and without an audit trail, fixing mistakes takes hours.

Example: A retail company struggled with revenue forecasting because new SKUs weren’t added correctly in Excel. Teams worked with outdated numbers, leading to inaccurate sales projections and overstocked inventory.

FP&A platforms automate roll-ups, prevent formula errors, and keep numbers accurate, so finance teams can focus on strategy instead of fixing spreadsheets.

Instead of fighting with spreadsheets, finance teams can use what-if analysis in sales planning to test different scenarios and improve forecasts.

For companies ready to move beyond Excel, the FP&A software buyer’s guide explains what to look for and how to compare solutions.

Step-by-Step Guide to Transitioning from Top-Down to Bottom-Up Budgeting

Most companies don’t fully replace top-down budgeting with a bottom-up approach. Instead, they use a hybrid model that balances strategic control with operational accuracy. Leadership sets high-level financial targets—such as EBITDA margins and cost limits—while teams create detailed plans on how to achieve them. This prevents unrealistic top-down goals and budget inflation in bottom-up models, keeping financial planning both structured and flexible.

Ready to learn exactly how to go from top-down to bottom-up budgeting? Let’s break down the steps clearly.

Step 1: Set Strategic Guidelines

Bottom-up budgeting works best when teams have clear targets. Leadership should define high-level goals while giving departments room to plan their own budgets. Many companies use zero-based budgeting to ensure every expense is justified instead of rolling over last year’s numbers, making it a strong fit for bottom-up approaches.

Example: Amazon lets teams forecast independently but sets profitability targets to maintain financial discipline.

Step 2: Standardize Data Collection & Budgeting Frameworks

Mismatched numbers across departments create confusion. Using driver-based forecasting—where budgets are tied to key business drivers—keeps financial plans consistent. Finance teams also need a standardized way to track spending. Many companies improve this by running spend analysis, which helps spot inefficiencies and control costs.

Example: A healthcare company structured labor costs across departments, ensuring financial planning stayed aligned.

Step 3: Move Away from Excel and Use FP&A Software

Like mentioned earlier, spreadsheets slow down bottom-up budgeting. Version control issues, formula errors, and slow updates make it hard to consolidate inputs from multiple teams. Many companies switch to FP&A software, which automates data roll-ups and improves accuracy. A financial services firm improved forecasting by integrating sales pipeline data directly into their planning tool, avoiding manual errors (workforce planning software).

Step 4: Train Teams on Budget Ownership & Financial Literacy

When teams don’t understand budgeting, they inflate costs or guess numbers. Finance should train department heads on variance analysis to help them track budget accuracy and make better financial decisions.

Example: A retail chain reduced budget inflation by educating store managers on financial planning and accountability.

Step 5: Use Rolling Forecasts Instead of Static Budgets

Annual budgets quickly become outdated. Rolling forecasts help teams adjust financial plans based on real-time data, improving accuracy in fast-changing industries.

Example: A global FMCG company transitioned to rolling forecasts to better respond to changing raw material costs and shifting consumer demand, avoiding supply chain disruptions.

Measuring Success: How to Know It’s Working

Switching to bottom-up budgeting should make financial planning faster, more accurate, and more useful for decision-making. If the shift is working, you’ll notice:

- Budget variance stays under 5% – Forecasts match reality, with fewer surprises at month-end.

- Budgeting takes less time – Instead of chasing inputs for weeks, finance gets real-time updates from teams.

- Fewer last-minute budget changes – Teams adjust forecasts proactively, not in crisis mode.

- Better cost visibility – Business units track expenses more in detail, leading to smarter spending decisions.

- Rolling forecasts replace rigid budgets – Plans adjust continuously, instead of relying on outdated annual targets.

Example: A manufacturing company cut budget variances by 30% after switching to bottom-up budgeting. Instead of broad cost estimates, teams started tracking expenses at the SKU level, making forecasts much more precise.

Main Takeaways

- Bottom-up budgeting leads to better accuracy but requires structure. Shifting from top-down budgeting gives teams ownership of their numbers, but without clear guidelines, it can lead to inflated budgets and misalignment.

- A hybrid approach works best. Leadership should set financial targets, while teams handle detailed forecasting to balance flexibility with control.

- Traditional spreadsheets make bottom-up budgeting inefficient. Manual updates, version control issues, and formula errors slow things down and create risk.

- Rolling forecasts make the process more dynamic. Instead of sticking to a fixed annual budget, companies should continuously adjust their plans to reflect real-time business conditions.

- Success is measurable. Lower budget variance, faster planning cycles, and fewer last-minute budget revisions signal that the transition works.

Understanding how to go from top-down to bottom-up budgeting helps your company align financial goals with operational realities, creating smarter, data-driven plans.