The pharmaceutical manufacturing industry stands at a regulatory crossroads. The Inflation Reduction Act’s (IRA) Medicare Drug Price Negotiation Program, combined with recent modifications from the One Big Beautiful Bill Act (OBBBA), has fundamentally transformed the financial planning landscape for drug manufacturers.

Traditional planning approaches can no longer keep pace with the multi-scenario complexity now required to forecast revenue, manage tax exposure, and allocate capital effectively within the pharmaceutical industry.

This isn’t just about price negotiations. It’s about a complete reimagining of how pharmaceutical companies model their financial future. Companies must move to more rapidly adjust product portfolio decisions, M&A valuations, tax planning and even investor communications. For organizations still relying on spreadsheet-based planning, the complexity will be overwhelming.

The IRA Foundation: What Hasn't Changed

Enacted in August 2022, the Inflation Reduction Act granted the Centers for Medicare & Medicaid Services (CMS) unprecedented authority to negotiate drug prices directly with manufacturers.

Drug Eligibility Selection Criteria:

- Small-molecule drugs are eligible for selection in negotiation, 7 years after FDA approval with the Maximum Fair Prices (MFPs) taking effect at 9 years.

- Biologics are eligible 11 years after licensure with an MFP effective date at 13 years.

Selection based on highest Medicare Part B and Part D spending without generic or biosimilar competition.

Drug Selection Timeline:

- 2026: 10 Part D drugs (MFPs already negotiated – effective January 1, 2026)

- 2027: 15 additional Part D drugs (negotiations ongoing, but no later than November 2025) for a total of 25.

- 2028: The previous 25 drugs + 15 Part D + Part B drugs (physician-administered drugs) To be published by February 1, 2026

- 2029+: The previous list + 20 new Part B or Part D drugs each year (for a total of 60, 80, and so on)

The first round of negotiations delivered significant price reductions representing a 38% to 79% discounts off 2023 list prices and an estimated $6 billion in Medicare savings. The Congressional Budget Office (CBO) forecasts that the program will reduce net prices for selected drugs by about 50% on average.

The cost of non-compliance continues to be a non-starter. Those who fail to sign a negotiation agreement within 30 days of selection or fail to agree to an initial or renegotiated MFP or do not submit required information about the drug to CMS then face escalating excise tax rates up to 95% of gross sales after 270 days. As an additional sprinkle on the sundae, the IRA excise tax is explicitly nondeductible for income tax purposes. The tax is designed to be so onerous that 100% compliance is expected.

OBBBA's Modifications: What Changed?

Orphan Drug Exemption Expansion (Section 71203): Previously, only drugs approved for a single orphan indication were exempt from price negotiations. Under OBBBA, drugs designated for more than one rare disease or condition are now entirely exempted from the Negotiation Program, and the negotiation period for drugs that lose their orphan status only begins after approval as a non-orphan drug.

Not Just Negotiations: The Inflation Rebate Program

The Medicare prescription drug inflation rebate program is a separate IRA provision affecting far more products. The rule is straightforward. If a manufacturer increases the price of a qualifying Medicare Part B or Part D drug faster than the rate of inflation, the manufacturer must pay the difference back to the Medicare Trust Fund in the form of a rebate. The rate of inflation is measured by the CPI-U.

The government calculates what the drug’s price would have been if it had only risen with inflation since its launch. Any revenue the manufacturer collected from Medicare above that inflation-adjusted price is subject to the rebate.

Rebate calculations are based on Average Manufacturer Price (AMP) quarterly data. CMS will begin invoicing manufacturers in late 2025 for 2023-2024 rebates with Payment due within 30 days of invoice receipt.

This program can affect a pharmaceutical manufacturers’ behavior and finances in several significant ways:

Direct Financial Impact:

Manufacturers who raise prices above inflation must write a check to the government. This could directly reduce profitability on some of the portfolio’s most lucrative drugs, essentially “clawing back” a portion of the price increase.

A Shift in Pricing Strategy:

A common industry practice involved launching a drug at a certain price and then implementing significant, often twice-yearly, price increases for years afterward. The inflation rebate program is designed to stop this. Manufacturers are now heavily incentivized to:

- Set Higher Launch Prices: Since future price increases are constrained, manufacturers may try to set a higher initial price for new drugs to maximize revenue over the drug’s lifespan.

- Limit Annual Price Hikes: The risk of paying a large rebate forces companies to keep their annual price increases at or very close to the rate of inflation. This effectively ends the era of routine 10-15% annual price hikes on older drugs.

Increased Public Scrutiny and Administrative Burden:

The process of identifying which drugs are subject to rebates is public. CMS will release quarterly reports on Part B drugs with price increases above inflation. This creates a “name and shame” effect, putting manufacturers under the public spotlight for their pricing decisions. It also adds an administrative layer of tracking, reporting, and payment to their operations.

Transfer Pricing and IP Valuation Disruption

For multinational pharmaceutical companies, the IRA creates unprecedented challenges in tax planning: How do you value intellectual property when future U.S. revenue is government-controlled rather than market-determined?

There are potentially multiple tax considerations including intercompany pricing agreements, cost-sharing arrangements, valuation reports for M&A (may require explicit IRA impact analysis), Section 482 transfer pricing documentation that must justify methodology under price control regimes and OECD Pillar Two implications. These pressures are further compounded by evolving global regulatory frameworks, including emerging EU Pharma Tax Regulations, which introduce additional uncertainty into long-term tax planning.

Read The Compliance Iceberg: Your Financial Models May Be Missing Billions in Risk

The Financial Modeling Nightmare: Multi-Scenario Revenue Forecasting

For pharmaceutical finance teams, the IRA creates unprecedented forecasting complexity. Unlike gradual market erosion from generic competition, drug selection creates step-function revenue cliffs with limited visibility. At least three scenarios should be modeled that create binary outcomes with massive financial impacts.

Portfolio Drug Gets SELECTED for Price Negotiation

This could lead to an average 50% price reduction, implemented within 2 years of selection. Requires mandatory participation (or face punitive excise taxes) and loss of pricing autonomy for the product’s remaining patent life.

Portfolio Drug NOT SELECTED for Price Negotiation

Even drugs that avoid selection face inflation rebate requirements whereby price increases above CPI-U will trigger penalties. Expected competitive pressure from selected therapeutic alternatives, uncertainty about future selection and continued payer formulary positioning challenges.

Portfolio Drug Gains Orphan Status

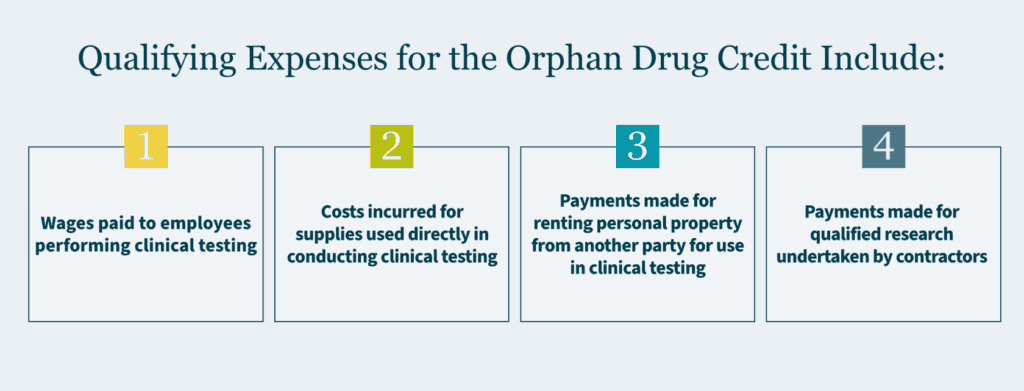

Given the changes in OBBBA, a strategic decision about pursuing multi-indication orphan drugs may be warranted including the timing of new therapeutic uses. Tax planning regarding optimizing the Orphan Drug Tax Credit for qualified clinical testing expenses (up to 25% of qualified expenses) and exclusion of the pharmaceutical fee. Possibly even portfolio rebalancing toward rare disease therapeutics.

Given the scenarios above, the modern pharmaceutical finance teams must now model:

- Selection probability arrays: On a by product, by year basis.

- If selected, MFP negotiation outcomes: Optimistic (30% reduction) vs. conservative (60% reduction) scenarios.

- Market share erosion impacts: How will selection of competitor drugs affect portfolio drugs?

- Impact of inflation rebate: Separate from CMS negotiations that will affect all Medicare drugs.

- Portfolio mix effects: Cannibalization dynamics including alternative pricing structures.

- Drug classification variability: Part B drugs have fundamentally different reimbursement patterns than Part D.

Increased Commercial Forecasting Complexity

Beyond manufacturer economics, the IRA transforms market dynamics including:

- Out-of-pocket cap: Medicare Part D $2,000 out-of-pocket cap increases utilization (CMS estimates $1.5 billion in beneficiary savings in 2026).

- PBM response: How do PBMs adjust preferred drug lists when MFPs take effect?

- Cash flow constraints: Delayed MFP reimbursements by manufacturers may create liquidity pressures for pharmacies, especially smaller community pharmacies with low cash reserves.

- Biosimilar competition dynamics shift: If the originator biologic gets selected for negotiation, does that help or hurt biosimilar uptake?

- Real-time market intelligence integration: When CMS announces new drug selections each February, finance teams need to update forecasts within hours, not weeks.

M&A and Business Development Impact

The IRA has already begun affecting pharmaceutical dealmaking with some late-stage assets facing valuation discounts depending on:

- Proximity to IRA eligibility (7-year small molecule threshold)

- Medicare exposure (Part D vs. Part B vs. commercial payer mix)

- Orphan designation status (post-OBBBA this became more valuable)

- Competitive landscape (therapeutic alternative considerations)

The IRA also increases due diligence complexity with buyers now requiring sophisticated IRA scenario modeling with probability-weighted outcomes, transfer pricing analysis (how will deal structure affect tax efficiency?), regulatory risk assessment (litigation outcomes, future legislative changes) and integration planning (how quickly can the target be incorporate into an FP&A system?).

For sellers to command premium valuations, they must demonstrate robust financial planning capabilities, transparent, scenario-based revenue models, integration into proactive IRA risk management processes, “IRA-resilient” business model with diversified portfolio or low-risk of inclusion.

For manufacturers of selected drugs, CMS imposes extensive data collection and submission requirements that must be disclosed.

Drug Costs and Information

- How much the company spent on research and development (R&D) and how much of it has already been made back.

- The cost to make and ship each dose of the drug.

- Any government money (federal support) that helped create the drug.

- Details on the drug’s patents and how long the company has the exclusive right to sell it.

- U.S. sales data (how much is sold and how much money it makes).

Information on Alternative Treatments

- How much better this drug is than existing treatments and what those other options cost.

- The official guides for doctors (prescribing information) for the drug and its alternatives.

- How well do the drug and other treatments work in different groups of people (like children, the elderly, or people with disabilities).

- If the drug helps with a medical problem that current treatments don’t handle well.

Most submissions have a 30-day response window from CMS requests, during negotiation periods.

Technology-Enabled Solutions—The Farseer Advantage

When it comes to managing IRA complexity, spreadsheets simply aren’t enough. Consider a typical FP&A workflow at a mid-sized pharmaceutical company with even a modest product portfolio facing IRA exposure.

Using only Excel spreadsheets, FP&A teams face a daunting process.

- Coordinate data collection across multiple departments: tax, product lines, compliance, accounting, and financial reporting.

- Conduct extensive external market research to develop a list of assumptions for a consolidated base cases.

- Run multiple scenarios for each potentially affected product with varying degrees of assumptions.

- Present findings to executives, then iterate through countless revisions and new scenarios based on feedback.

This spreadsheet-driven approach typically requires 4-8 weeks of turnaround time, involves numerous FTEs, and carries significant risk of manual errors. This is done while teams juggle existing priorities and system constraints.

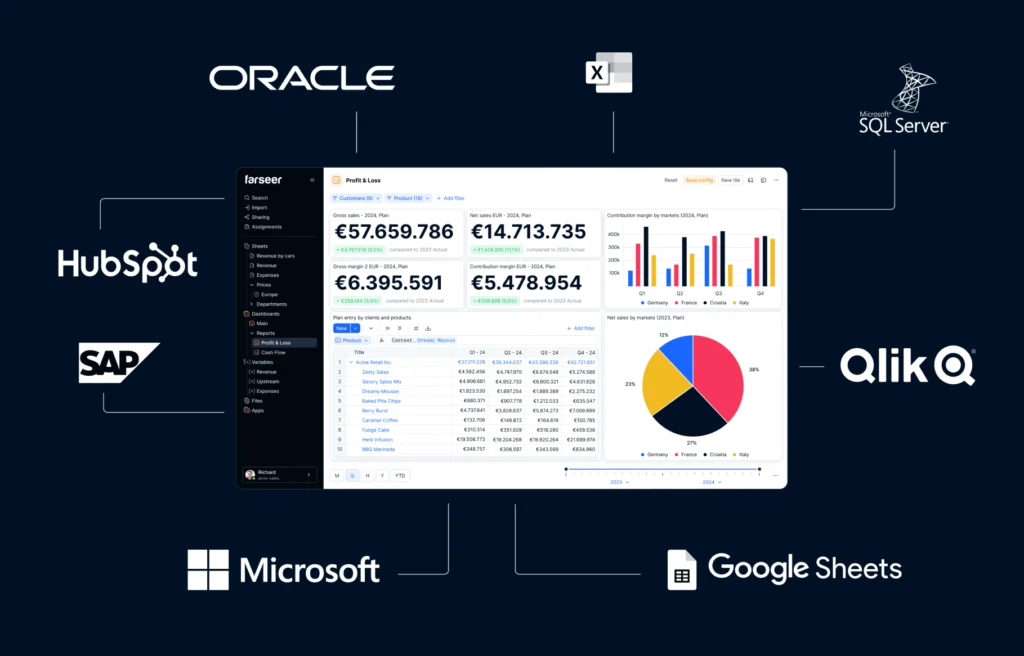

With Farseer, the same complex analysis becomes streamlined.

- Automated internal data pull from ERP, CRM, regulatory sources.

- External research seamlessly consolidated into financial models for rapid assumption validation.

- Assumptions used to create pre-built IRA scenario templates applied across portfolio.

- Centralized collaboration platform for stakeholder alignment and decision tracking.

- Real-time executive dashboards and board-ready materials generated automatically

What once took weeks now takes days. Scenarios update in real-time. Executives gain confidence through accurate, timely insights and finance teams evolve from number-crunchers to strategic champions driving organizational success.

Turning Regulatory Complexity into Competitive Advantage

The convergence of IRA drug price negotiations, OBBBA modifications, inflation rebates, and ongoing tax complexity creates the most challenging financial planning environment the pharmaceutical industry has ever faced. CFOs can no longer rely on annual budget cycles and spreadsheet-based models.

The stakes are clear. The pharmaceutical industry is entering a new era where financial planning sophistication separates winners from losers. Companies that invest in robust FP&A Systems that have scenario-based planning infrastructure will outmaneuver competitors stuck in spreadsheet hell.

The IRA isn’t going away. Neither is the complexity. But with the right tools, processes, and strategic mindset, pharmaceutical finance leaders can transform this regulatory burden into a source of competitive advantage.

Ken Fick is a CPA, and MBA with over 25 years of finance experience providing leading-edge solutions designed to improve forecasting, budgeting, planning, and decision-making to companies from $3 million to over $50 billion in revenue. He is a freelance writer that focuses on producing engaging content on all things business, accounting, finance and investment related. You can view a sampling of his published work at FPAexperts.com.