If your quarterly forecast still takes 10 days and your “single source of truth” lives in 14 spreadsheets, your financial modeling isn’t decision-ready. You’re not alone – scenario-planning adoption grew 60% from 2021–2023 as finance teams rushed to respond more quickly to changing markets.

The goal isn’t prettier spreadsheets; it’s actionable models that test strategy, quantify risk, and guide funding and margin calls in real time.

The purpose of financial modeling isn’t just to produce neat spreadsheets. Done right, it helps finance teams build actionable models that drive decisions – from testing growth strategies and funding scenarios to stress-testing risks before they impact the bottom line.

In this blog, we’ll cover the key benefits and challenges of financial modeling, explore the most important types of models, highlight modern tools and AI-driven solutions, and share proven real-world examples that showcase how better modeling enables better financial decisions.

Read more: Strategic Financial Planning That Actually Drives Results

Benefits & Challenges of Financial Modeling

Benefits

- Risk-aware decisions: Around 85% of firms use financial models not just for forecasting but also to assess operational, strategic, and external risks, making modeling essential for enterprise risk management. For example, Tesla uses simulation and scenario analysis to anticipate production and cash flow challenges, helping guide rapid growth under uncertainty.

- Better commercial outcomes: Over 70% of retailers rely on models to forecast demand and optimize inventory. Starbucks applies a detailed bottom-up and top-down forecasting process supported by external data to drive growth and profitability across its global stores.

- Faster alignment: Driver-based models keep Finance, Sales, and Operations in sync. 80% of FP&A teams use these to shorten cycles and reduce surprises. Netflix employs machine learning and cloud-based forecasting to accurately predict subscriber growth and content demand, enabling faster strategic decisions.

Challenges

- Spreadsheet fragility: Excel remains error-prone, with 88% of spreadsheets containing critical mistakes and 90% of large finance models having material flaws. High-profile errors illustrate the risks of spreadsheet-based modeling.

- Inconsistent models: Disconnected files, mismatched assumptions, and missing audit trails undermine trust, especially as data complexity grows.

- Scaling limitations: Model complexity has tripled over the past decade, leading to slower performance and hesitancy to run deep scenario analysis – demanding more agile, cloud-based, and AI-powered solutions.

According to the State of Finance 2026 report by Farseer, 62% of finance teams still rely on spreadsheets as their primary modeling tool, even though most cite version chaos, data fragmentation, and lack of real-time visibility as their top challenges.

This gap between what teams want – agility, accuracy, and collaboration – and what their tools allow is exactly why modern FP&A platforms are taking over traditional spreadsheet-based modeling.

This balance of real data and industry examples shows how modern companies like Tesla, Netflix, and Starbucks are leveraging advanced financial modeling to achieve better outcomes despite enduring challenges

Types of Financial Models

Classic financial modeling

The 3-Statement Model is foundational, linking the income statement, balance sheet, and cash flow statement to provide a comprehensive view of financial performance and cash needs. It acts like a financial dashboard that helps understand how operational results affect company health.

The Discounted Cash Flow (DCF) Model takes a different angle. It looks ahead, projects the cash a business will generate, and then pulls those future flows back to today’s value. The result? A grounded estimate of what the business is worth. It’s the go-to model for investment decisions and company valuations.

M&A and LBO Models analyze the financial impact of acquisitions or leveraged buyouts, testing deal feasibility, synergies, and return metrics.

Corporate financial modeling

Budgeting & forecasting models develop annual plans with rolling updates that span profit & loss, balance sheets, and cash flow, enabling organizations to plan and adjust dynamically. Starbucks uses such models to support operational efficiency and growth strategies globally.

Scenario models allow companies to perform “What-if” analyses, comparing best, base, and worst cases by flexing key assumptions side-by-side. Tesla employs scenario planning to navigate production and regulatory uncertainties in multiple markets.

Operational (Driver-based) models connect detailed operational drivers such as pricing, headcount, and SKUs back to the core financial statements. These models keep Finance, Sales, and Operations aligned. Netflix leverages driver-based forecasting to optimize content investments and marketing spend effectively.

Read more: 7 Best Financial Modeling Tools and How to Choose the Right One

While these classic and corporate models form the foundation of finance, the way teams actually build and use them is changing fast. Relying only on spreadsheets slows everything down and exposes teams to errors just when decisions need to be fastest.

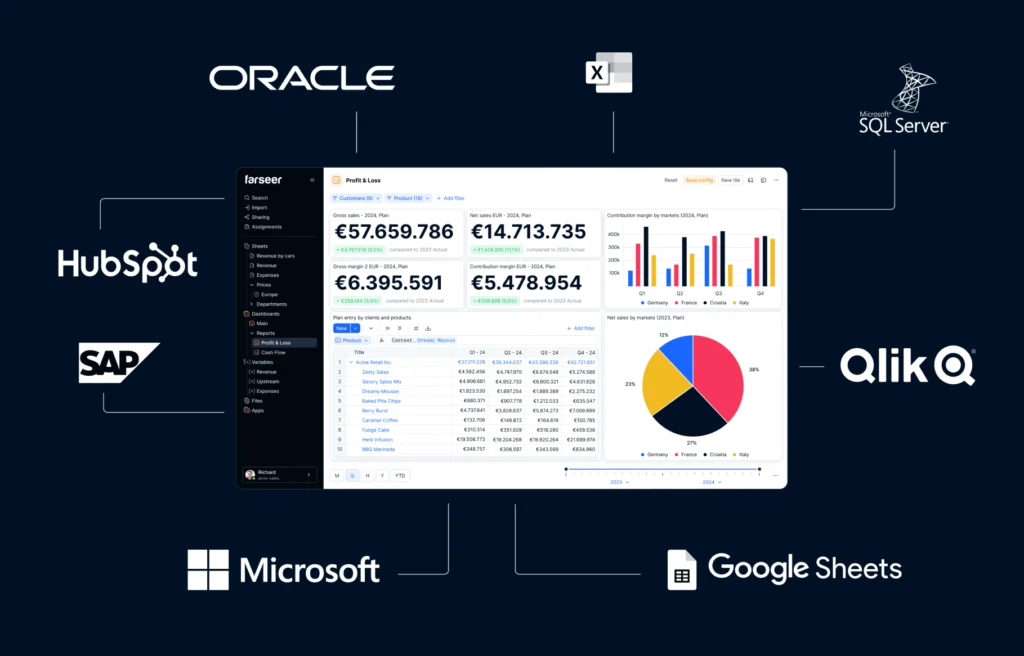

That’s where modern FP&A solutions step in. Today, financial modeling lives inside platforms that automate the heavy lifting, connect all departments, and let you plan multiple scenarios in real time. Instead of patching spreadsheets together, finance teams are moving to solutions like Farseer – purpose-built to make modeling faster, more accurate, and collaborative. In the next section we will show how it looks like.

Smarter Financial Modeling With Farseer

AI forecasting for financial modeling

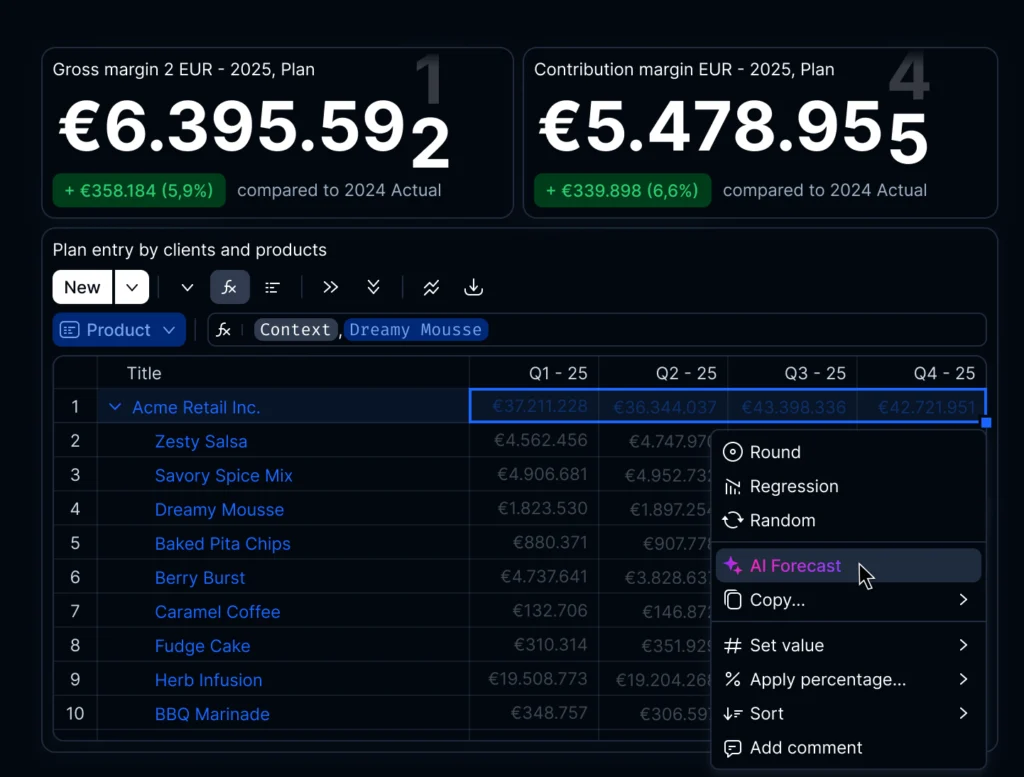

Forecasts don’t stay fresh for long. Markets shift, costs change, and one-off events throw numbers off course. AI forecasting helps finance teams keep models current by spotting patterns like seasonality, trend shifts, or sudden anomalies, without needing a data science team. Instead of static reports, you get explanations behind the movement, so you know why numbers changed, not just that they did.

With Farseer, that means you’re not stuck updating endless spreadsheets. Forecasting works across revenue, costs, and headcount in one place, so CFOs and controllers see the full picture and react faster when things move. Hrvatski Telekom, for example, cut quarterly forecasting from 10 days to just 2.

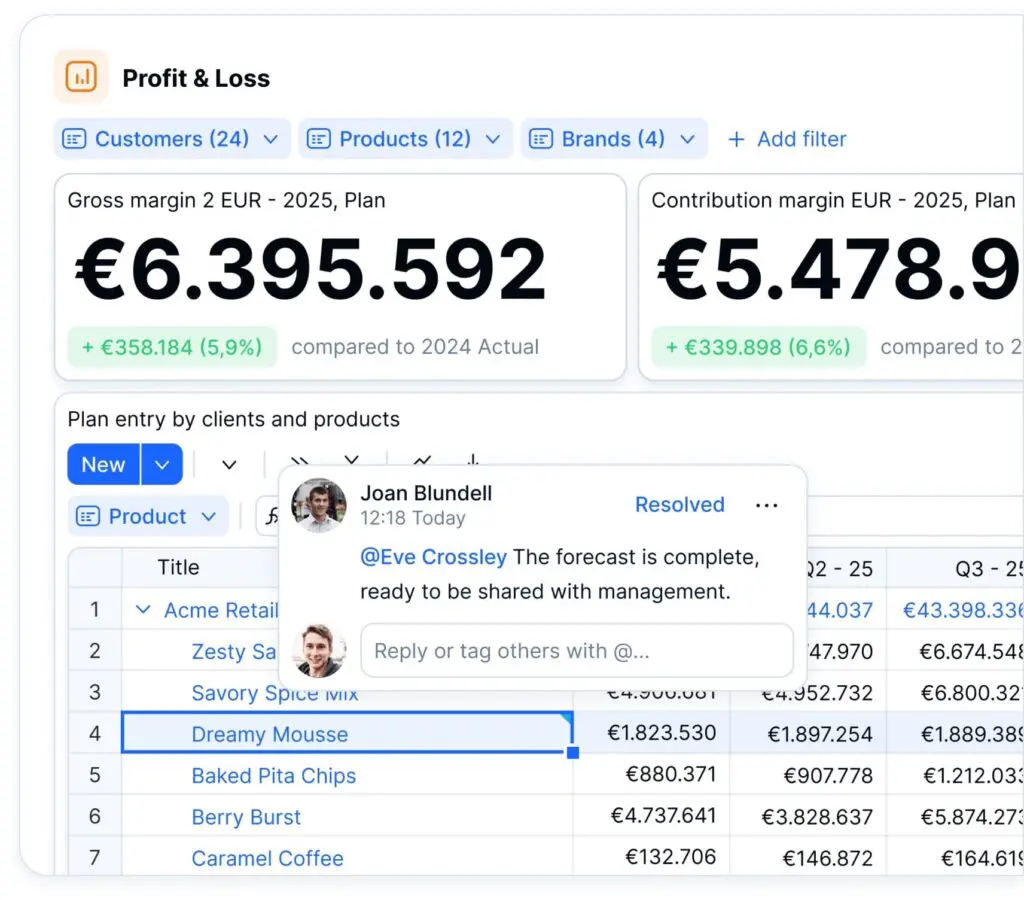

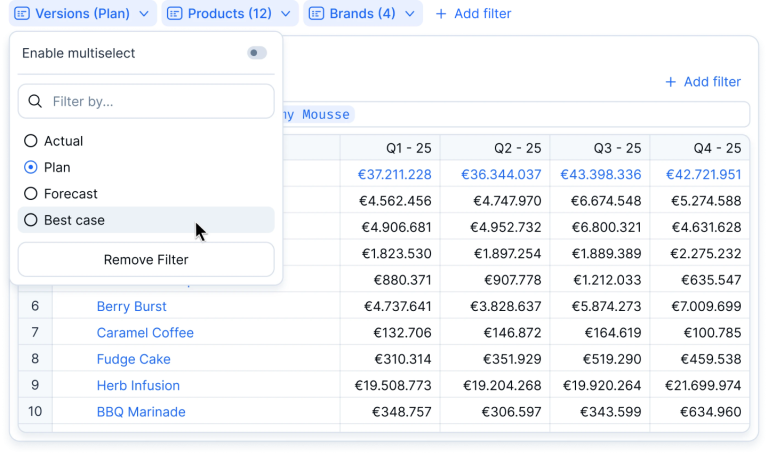

Multi-scenario financial modeling

Forecasting with just one plan is asking for trouble. Markets shift too quickly; prices move, currencies swing, demand changes overnight. That’s why finance teams build multiple versions of the future, not just one.

With Farseer, you don’t waste time cloning files or rebuilding models. You spin up best, base, and worst-case plans in minutes, adjust assumptions like pricing or FX directly, and see the effect across P&L, Balance Sheet, and Cash Flow.

The best part? Everyone works from the same version. Finance, Sales, and Ops can test assumptions together, so leadership isn’t left comparing mismatched numbers. Instead, they get a clear, side-by-side view of trade-offs before making a call.

Fast rollouts for financial modeling teams

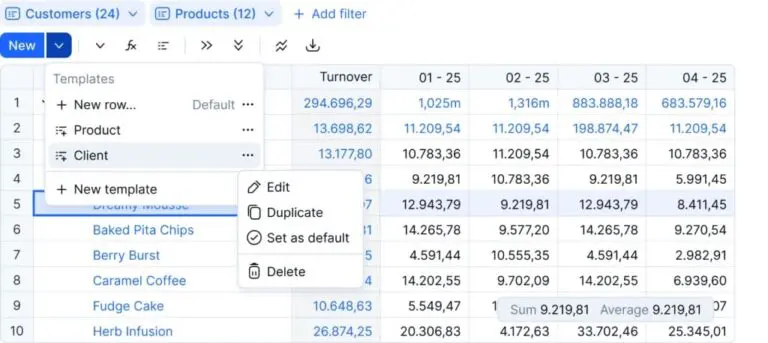

Finance can’t wait months for a system to be ready. Modern tools should deliver value in weeks, not quarters. With prebuilt planning blueprints and no-code modeling such as the one in Farseer, teams get core processes running fast, without leaning on IT.

Because the engine isn’t built on fragile Excel plug-ins, calculations stay instant and multiple users can work together without breaking anything. Integrations with ERP, CRM, and BI systems keep actuals and plans automatically aligned, so reports stay reliable from day one.

Take Altium as an example: they rolled out quickly, cut reporting time by 30%, and shortened planning cycles by 25%. Clear onboarding and role-based access made it easy for contributors outside finance to get involved, easing adoption across the business.

Lower total cost of ownership (TCO)

Financial modeling shouldn’t come with hidden costs. When models can be adjusted directly by finance, there’s less need for external consultants or extra licenses. Built-in version control and audit trails in Farseer replace the mess of disconnected files, cutting down on rework and errors.

Because it’s cloud-native, performance and security are already include – no surprise infrastructure bills or heavy IT support needed. For CIOS, that meant consolidation time was cut in half and 80% of manual steps disappeared. Automatic updates and predictable pricing keep ownership simple, so finance teams stay focused on analysis instead of system maintenance.

Altium: 30% Faster Reporting and 25% Shorter Planning Cycles

Altium, a biotech & life sciences distributor operating across nine countries, replaced spreadsheet-heavy reporting with Farseer’s centralized FP&A.

By standardizing formats, integrating actuals, and rolling out driver-based planning with real-time dashboards, the team cut reporting time by 30% and shortened planning cycles by 25% – with 75% of users relying on live dashboards daily for P&L, margin, and SKU-level visibility.

Key Takeaways

- Financial modeling is only as strong as the tools behind it – Excel slows teams down, while modern FP&A platforms like Farseer enable accuracy, speed, and collaboration.

- The main benefits (risk management, forecasting, decision-making) are often undermined by challenges (errors, manual work, disconnected systems).

- Models come in many forms, from classic 3-statement and valuation models to corporate budgeting and scenario planning, but the need for agility is universal.

- Farseer brings this agility through AI forecasting, multi-scenario planning, fast rollouts, and lower total cost of ownership (TCO).

- Real-life examples, like Altium, prove that better tools transform modeling from manual reporting into a driver of strategic growth.