The role of finance has shifted from tracking performance to shaping strategy.

Automation, integration, and AI-driven analytics now give teams the clarity and speed to make decisions that actually move the business forward.

This guide breaks down what defines next-generation financial analysis software, how to evaluate it, and which platforms are setting the standards in 2026.

Read FP&A Software for Modern Finance Teams: Compare the Best Tools in 2026

What’s Really Slowing Finance Down

If you’ve ever closed a quarter juggling 20 spreadsheets, three data sources, and a dozen late inputs, you already know the limits of Excel. It’s not the people slowing things down, but inadequate tools. What worked five years ago can’t keep up with the pace of today’s finance.

That’s why more and more finance leaders are turning to financial analysis software. It connects data across systems, automates repetitive tasks, and gives teams a clean base for planning. The result is fewer manual steps, faster closes, and more time spent on financial tasks that add value.

.

According to the State of Finance 2026 report, nearly 60% of finance leaders now list automation as their top priority. This shift is about freeing finance leaders to think, plan, and lead instead of chasing numbers across files.

Read more: AI Trends in FP&A Software: What Finance Teams Should Expect in 2026

What to Look For in Financial Analysis Software

Choosing the right financial analysis software is about finding a system that fits the way your finance team works. The goal is to support smarter decisions, not add complexity. Here are the core capabilities that define a modern platform:

Automation & AI

Modern financial analysis software should leverage predictive analytics, anomaly detection, and AI-driven forecasting to improve speed and accuracy. The goal is to move from reactive reporting to proactive insight generation.

Integration

Seamless integration with ERP, CRM, accounting, HR, and BI systems is critical. The more connected your tech stack, the more reliable and unified your financial data becomes.

Scenario Planning

The best platforms allow multi-case modeling across P&L, balance sheet, and cash flow. This flexibility lets finance teams stress-test strategies and prepare for multiple outcomes.

Collaboration & Governance

Version control, approval workflows, and user access rights ensure that financial planning remains structured, auditable, and aligned across departments.

Ease of Use

Spreadsheet-native or low-code interfaces make adoption faster and allow finance users to work comfortably without depending on IT or external consultants.

Scalability & Security

Cloud infrastructure, enterprise-grade encryption, and role-based access protect sensitive financial data while allowing your system to scale with organizational growth.

When these elements are in place, finance teams can plan, report, and forecast more efficiently: with reliable data and fewer manual steps.

Top 6 FP&A Tools in 2026

The FP&A landscape is evolving fast, with finance teams shifting from static spreadsheets to connected, AI-assisted planning environments. The best financial analysis software today blends automation, real-time insights, and flexibility – helping CFOs plan, forecast, and analyze with precision.

Below are six standout tools in 2026 that redefine how modern finance teams operate.

Cube

- Spreadsheet-native FP&A platform connecting Excel and Google Sheets with centralized data and automation

- Ideal for mid-market finance teams modernizing from manual spreadsheets

- Automates reporting, forecasting, and consolidation in real time

- Built-in AI assistant and reporting templates accelerate insights

- Fast implementation, strong for hybrid finance teams

Sage Intacct

- Cloud-based financial management and accounting software

- Offers strong general ledger, accounts, and multi-entity consolidation

- Customizable dashboards and reporting for CFO visibility

- Integrates with Salesforce and ERP systems for seamless data flow

- Ideal for SMBs and mid-market firms seeking reliable cloud finance infrastructure

Farseer - No Code Financial Analysis Software

Farseer is a financial analysis and planning platform built for finance teams that need speed, precision, and control – without leaving the flexibility of spreadsheets. It combines modeling, reporting, forecasting, and scenario planning into one connected environment, enabling CFOs to make decisions based on real-time, reliable data.

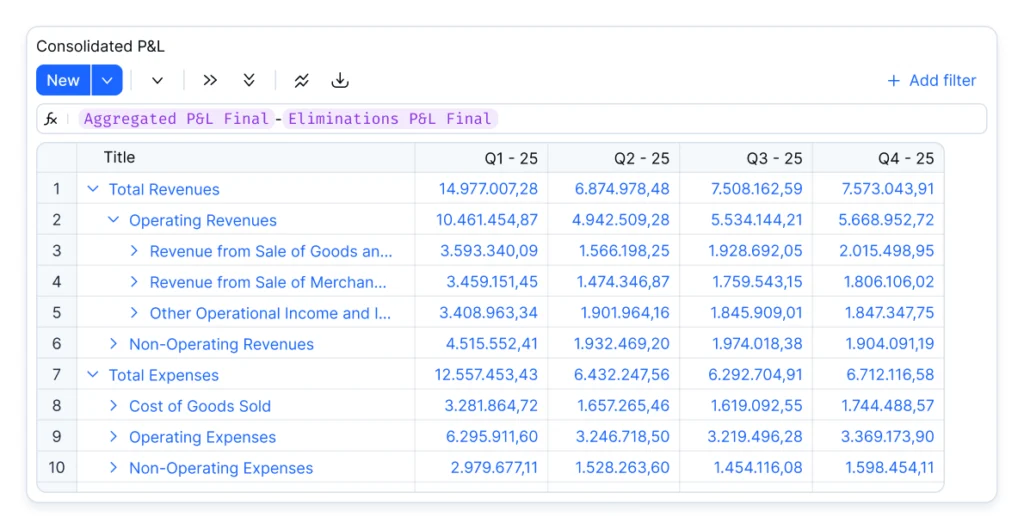

Connected, Automated Financial Modeling

Farseer replaces disconnected spreadsheets with centralized, automated models that update in real time. Finance teams can build complex P&L, balance sheet, and cash flow models directly in an intuitive interface, linking every assumption across departments. Automatic data consolidation eliminates manual errors and accelerates month-end close cycles, helping teams focus on insights rather than maintenance.

Advanced Forecasting and Scenario Planning

The platform supports rolling forecasts and unlimited “what-if” analysis, allowing finance teams to simulate best-case, base-case, and worst-case outcomes in seconds. Users can instantly adjust key drivers (revenue, headcount, or costs) and see the impact ripple through every financial statement. This capability helps leaders make confident decisions in volatile markets, where agility is critical.

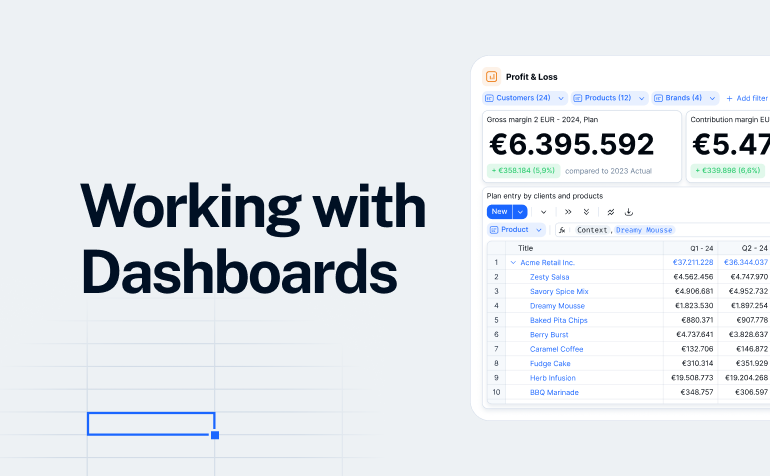

Dashboards and Real-Time Insights

Interactive dashboards bring financial performance to life with real-time KPIs, variance analysis, and visual trend tracking. Every visualization is linked to the underlying data model, ensuring accuracy and transparency. Finance leaders can monitor profitability, cash flow, and budget execution from a single screen, and no more chasing data across sheets or systems.

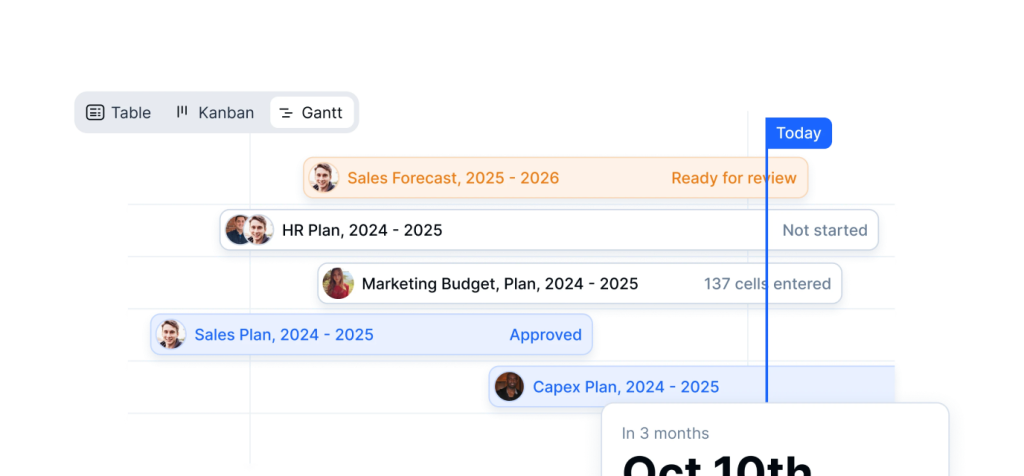

Collaboration, Control, and Governance

Farseer enables structured collaboration between finance, sales, HR, and operations through built-in version control, approval workflows, and role-based access. Each department works with the same dataset while retaining visibility into their own drivers.

Audit trails ensure every change is tracked, maintaining governance without slowing down execution.

Oracle Essbase

- Multidimensional analytics platform designed for large enterprises and complex finance models.

- Supports rapid “what-if” scenario modelling and deployment of analytic applications from spreadsheets to enterprise scale.

- Seamless integration with cloud or on-premises environments – deploy via the Oracle Cloud Marketplace or on your own infrastructure.

- Robust architecture featuring high-performance query engine (hybrid mode), REST APIs, drill-through capabilities and full cloud governance.

Fathom

- Designed for management reporting, KPI tracking, and cash flow forecasting

- Delivers clear visual dashboards for performance analysis

- Enables multi-entity consolidations and group benchmarking

- Automates recurring report generation for finance and leadership

- Best suited for accountants, controllers, and CFOs focused on insight-driven reporting

DataRails

- FP&A platform built for Excel users seeking automation and consolidation without losing spreadsheet flexibility

- Automates data collection, reporting, and scenario analysis

- Connects disparate data sources into a single financial model

- Offers real-time insights and visualization tools

- Ideal for finance teams transitioning from Excel to connected planning

Choosing the Right Platform

Before committing to a new financial analysis software, it’s essential to align the platform’s capabilities with your company’s scale, data maturity, and integration requirements. Conduct a pilot to test reporting and automation workflows before rollout, and evaluate not only license costs but also implementation time and training needs.

Adoption matters more than features. The best tool is the one your team will really use.

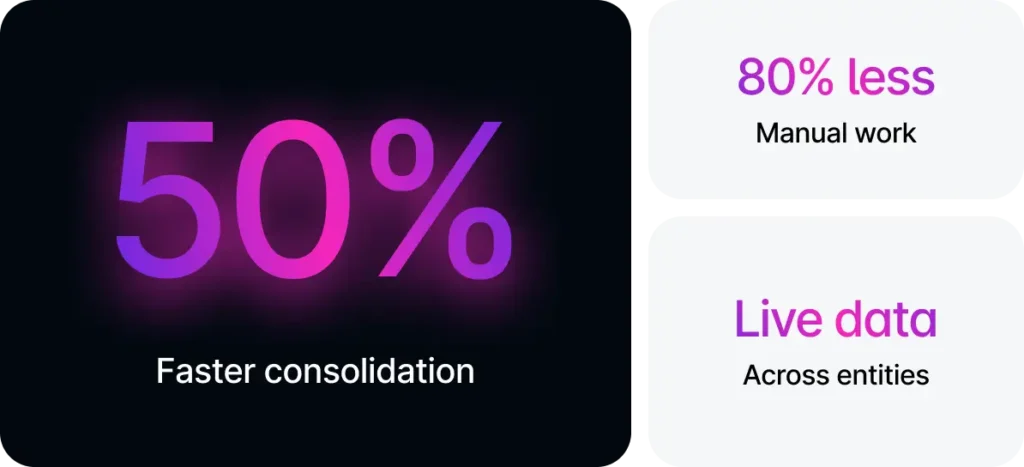

Case Study: CIOS Group Cuts Consolidation Time by 50 %

CIOS Group, the leading waste management company in Croatia, manages around 15 entities across its operations. Until recently, their consolidation process relied on dozens of Excel workbooks, hundreds of sheets, and endless manual checks, an exhausting cycle that took weeks to complete each period.

By implementing Farseer, the team replaced fragmented spreadsheets with an integrated, automated planning environment. Today, most data flows directly from their ERP into structured models, eliminating version-control chaos and manual aggregation.

The impact was immediate:

- 50 % reduction in consolidation time and 80 % less manual work

- Complete transparency with audit trails and version control

- Real-time visibility for leadership without waiting on static reports

This case highlights why platform fit matters. Choosing a system built for finance, not for consultants, can turn consolidation from a manual obligation into a strategic capability

Final Thoughts: The Future of Financial Analysis Software

The future of FP&A is automated, predictive, and collaborative. Financial analysis software is no longer a back-office reporting tool, it’s becoming the strategic engine of decision-making.

For finance leaders, the choice of platform goes beyond features. The right financial analysis software transforms how teams operate – replacing manual data handling with continuous forecasting, real-time insights, and connected planning. It frees analysts from spreadsheets and gives CFOs the clarity to act faster and lead with confidence.

As finance enters a new era shaped by AI, automation, and integration, one truth stands out: technology should work for finance, not the other way around. The teams that embrace intelligent, connected systems today will define the financial agility of tomorrow.

FP&A Tool Fit Quiz

Question 1

How complex is your organizational structure?

Question 2

How quickly do you need to implement an FP&A solution?

Question 3

What is your team’s technical profile?

Question 4

What is your primary planning priority?

Question 5

What is your expected FP&A budget?