Consolidation entries sit at the core of accurate group reporting. They’re the adjustments that turn many sets of books into one clean story.

Most finance teams juggle multiple entities, intercompany transactions, currencies, and mismatched charts of accounts. Do it manually and you invite slow closes, duplicated revenues, and avoidable errors.

This guide breaks down what consolidation entries are, why they matter for compliance and clarity, and how to post them step by step – from eliminations to non-controlling interest and final statements.

Read more: Financial Consolidation: Definition, Challenges & Solutions

What Are Consolidation Entries?

Consolidation entries are accounting adjustments made to combine the financial results of subsidiaries and their parent company into one set of statements.

They serve to eliminate intercompany transactions, align accounting policies, and standardize data across all entities within a group.

By applying these entries, finance teams ensure that consolidated statements reflect the organization as a single economic entity – not a collection of disconnected companies.

The process is governed by key accounting frameworks such as IFRS 10 and ASC 810, which define how control, ownership, and reporting should be treated.

Why They’re Important

Consolidation entries are crucial for producing financial reports that are accurate, compliant, and trustworthy. They help:

Provide a transparent view of group performance, showing how the company operates as a whole.

Eliminate double counting of revenues, expenses, assets, and liabilities between entities.

Ensure compliance with GAAP and IFRS standards for financial consolidation.

Build trust among investors, auditors, and management by maintaining consistency and accuracy across reports.

Common Types of Consolidation Entries

In practice, consolidation entries follow a consistent pattern summarized by the S.A.I.D.E.P. framework – six key adjustments that ensure accurate, compliant group reporting:

- S – Eliminate investment in subsidiary: Removes duplicate equity by offsetting the parent’s investment account with the subsidiary’s capital.

- A – Allocate fair value adjustments: Records goodwill or asset revaluations made during acquisitions.

- I – Remove equity income: Avoids double counting by eliminating profits recognized both by the parent and subsidiary.

- D – Eliminate dividends: Clears intra-group dividend payments that don’t represent external income.

- E – Record excess amortization: Accounts for amortization of acquisition-related fair value adjustments over time.

- P – Eliminate intercompany payables/receivables: Offsets internal loans and balances since a company can’t “owe itself.”

Together, these entries align every entity’s books so that the consolidated statements show one true financial picture.

In Farseer, this process is automated – eliminations, adjustments, and validations run in the background, giving finance teams an accurate, audit-ready consolidation without endless manual entries.

The Consolidation Process (Step by Step)

Consolidation isn’t just adding up numbers – it’s a structured process that turns dozens of disconnected ledgers into one single source of truth.

Here’s how finance teams handle it – and how automation tools make each step faster and more reliable.

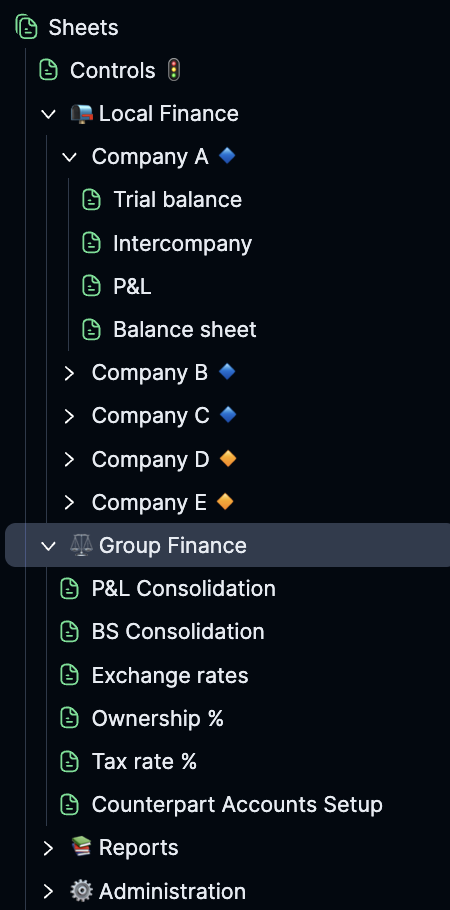

1. Collect Data

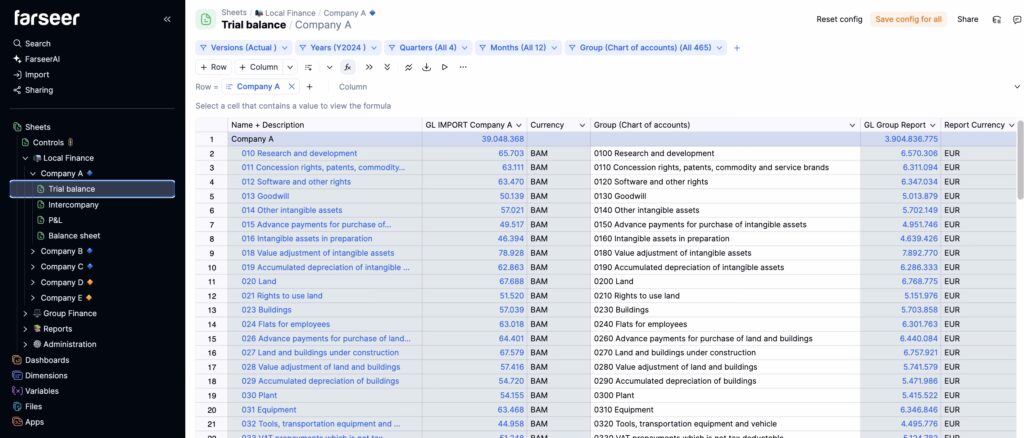

Gather P&L, Balance Sheet, and Cash Flow statements from every entity.

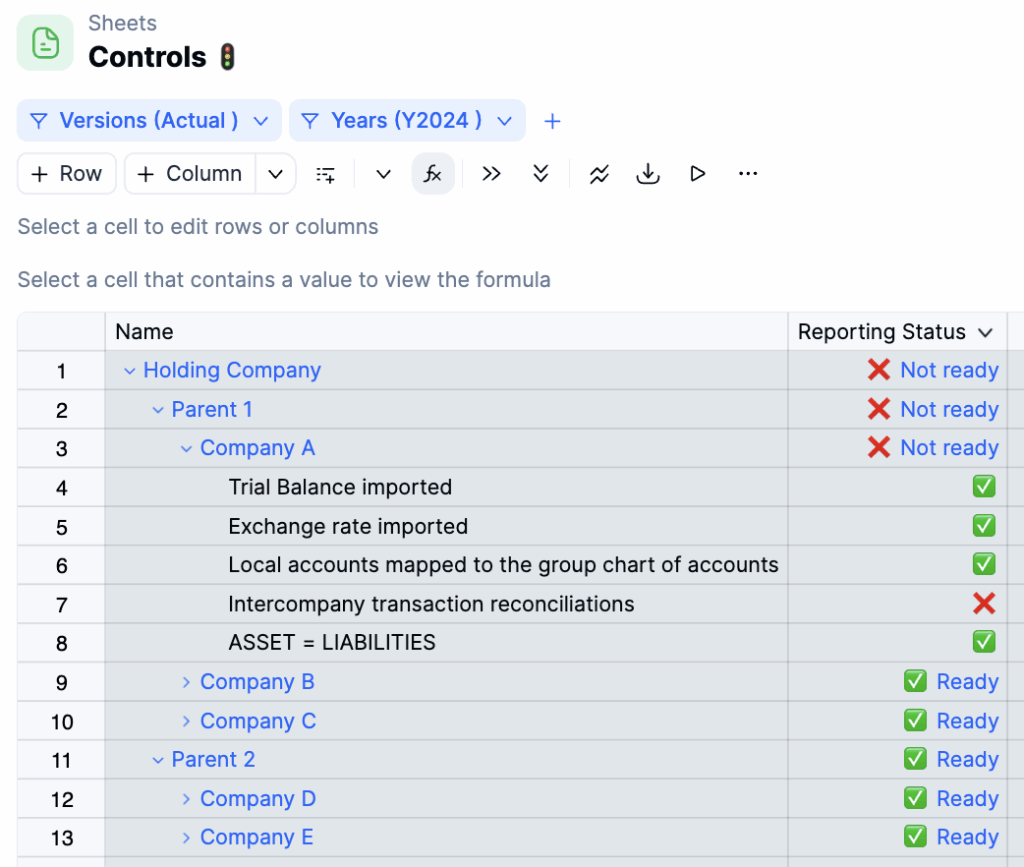

In Farseer, this step is automated – finance teams import trial balances or upload files directly, while the system validates completeness and structure across entities.

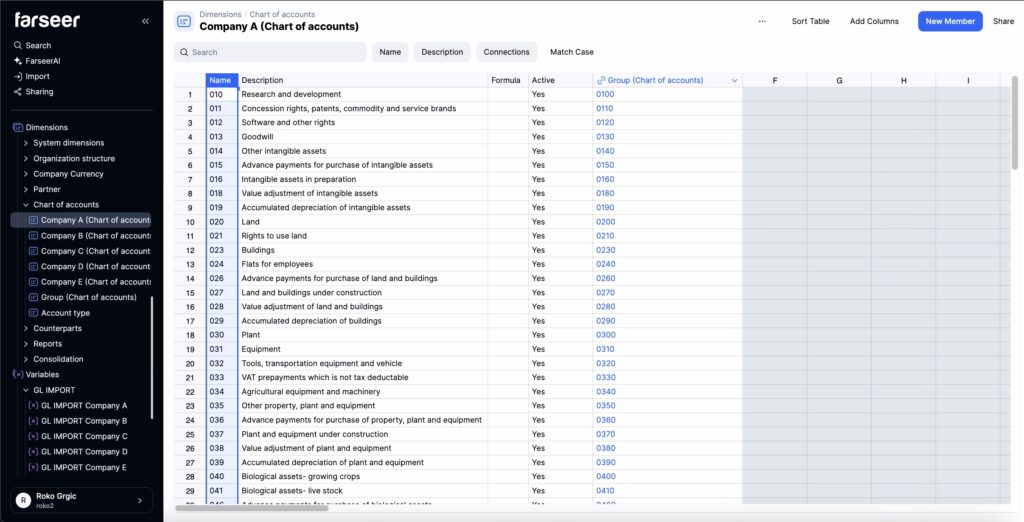

2. Standardize Data

Align all charts of accounts, currencies, and accounting policies to ensure consistency.

Farseer automatically maps local accounts to group-level standards and applies dynamic currency conversion, eliminating manual rework and spreadsheet lookups.

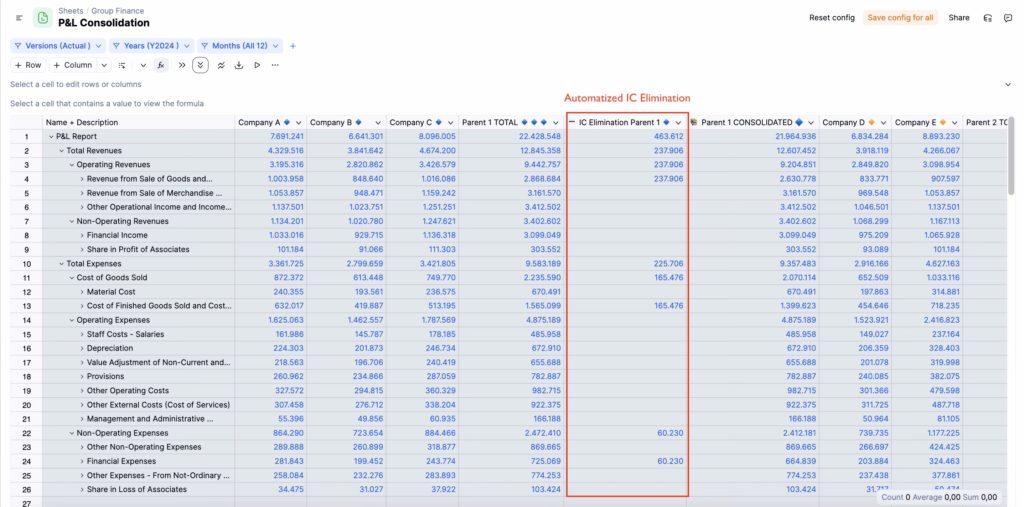

3. Eliminate Intercompany Activity

Remove internal transactions (intercompany sales, loans, and unrealized profits) to avoid double counting.

Farseer’s logic engine automates eliminations across entities and highlights mismatches for review, ensuring intercompany reconciliation is clean and auditable.

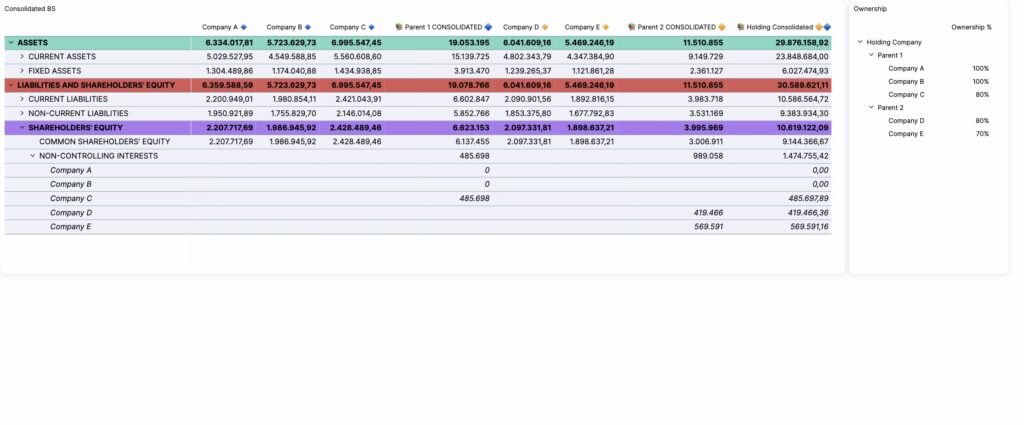

4. Recognize Non-Controlling Interest

Record the ownership share of minority investors.

With Farseer, these entries are generated automatically based on ownership rules defined in your model – no manual calculations or late-night Excel checks.

5. Post Consolidation Entries

Combine all entity-level data into one set of books.

Farseer handles both local and group-level adjustments, from goodwill and tax provisions to translation differences, giving CFOs a complete consolidated view in real time.

6. Review & Publish

Verify, approve, and finalize consolidated statements.

Dashboards and live validation flags ensure accuracy before publishing. With all data centralized, teams can drill down to entity or account level and close the books in days, not weeks.

Real-World Example: CIOS Group Consolidation

One real-world example of how consolidation entries and automation transform group reporting comes from CIOS Group – Croatia’s leading waste management company operating across 15 legal entities.

Before Farseer, every consolidation cycle meant hundreds of Excel sheets, manual adjustments, and weeks of cross-checking intercompany transactions.

Each entity submitted separate reports, and even small formula shifts caused hours of troubleshooting.

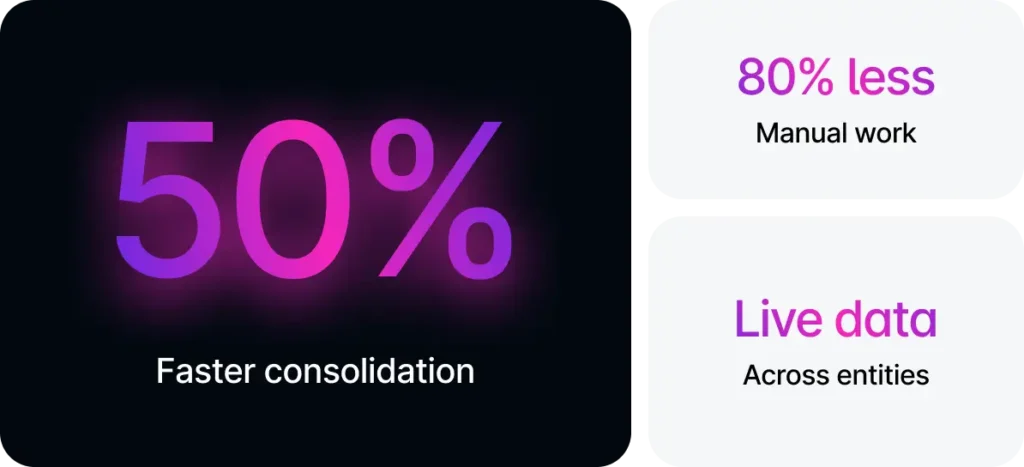

After implementing automated consolidation with Farseer, CIOS cut the close cycle by 50% and reduced manual work by 80%.

Data from all entities now flows directly into a unified model – eliminating errors, intercompany discrepancies, and version-control chaos.

Today, the process is faster, cleaner, and more resilient – proving that the right approach to consolidation entries can turn reporting from firefighting into foresight.

Conclusion

Consolidation entries are what turn dozens of disconnected ledgers into one unified, reliable financial picture.

They’re the foundation of trust; for investors, auditors, and leadership teams alike.

But as organizations grow, manual methods simply can’t keep up. Complex structures, multi-entity data, and tight deadlines make automation and consistency essential.

Modern finance teams now treat consolidation not as a back-office task, but as a strategic process – one that enables transparency, governance, and faster decision-making.