In finance, when you say CAPEX, you mean long-term. CAPEX planning is known as the process of evaluating, prioritizing, and approving long-term investments like equipment, infrastructure, or technology.

As it often gets with long-term planning, it can feel more chaotic than strategic. Due time investment requests can come in late, business cases vary in quality, and the final budget ends up being a mix of politics, gut feel, and outdated numbers. Once approved, projects tie up cash, affect the balance sheet, and can’t be reversed without cost. That’s why structure matters, and why relying on spreadsheets or email threads to manage CAPEX is a risk most finance teams can’t afford.

In this blog, we’ll break down why CAPEX planning is still a pain point in many organizations, where it typically breaks down, and how to build a process that actually supports better capital allocation.

Read more: Financial Consolidation: Definition, Challenges & Solutions

What Makes CAPEX Planning So Difficult

CAPEX planning isn’t just budgeting but long-term financial decision-making under uncertainty. Unlike operational expenses, capital investments tie up large amounts of cash, often for years. They impact not only this year’s budget but future depreciation, maintenance, and financing needs.

This complexity makes CAPEX harder to manage, especially when the process lacks structure.

Read: CAPEX vs PPE: What Finance Teams Need to Know

Here’s why it often breaks down:

- Short-term planning for long-term decisions

If we go with the assumption that most budgets operate on a 12-month cycle, CAPEX projects often span multiple years. When project timelines or costs shift, the original plan quickly becomes irrelevant, and without regular updates, finance loses visibility into actual spend vs. expectations. - No consistent way to compare projects

One team submits a detailed ROI analysis, another just says “we need this.” Without standardized metrics like payback period, NPV, or strategic value, it’s difficult to prioritize projects objectively, or justify them to leadership. - Approval workflows are informal or inconsistent

In many companies, CAPEX requests are still passed around by email, with unclear responsibilities or timelines. This slows down approvals and leads to confusion over what’s been approved, by whom, and at what stage. - Poor visibility after approval

Once a project is approved, tracking tends to stop. There’s often no link between the approved plan, actual spend, and current forecast. That means delays or cost overruns often go unnoticed until it’s too late to act.

CAPEX planning becomes even more difficult when multiple departments, countries, or systems are involved. Without a centralized process, finance ends up managing dozens of separate files, chasing updates, and redoing reports, instead of focusing on the investment decisions that matter.

According to the State of Finance 2026 report by Farseer, 38% of finance leaders cite data quality and disconnected systems as their biggest obstacle in FP&A, especially when managing multi-entity or cross-departmental planning.

CAPEX planning is one of the areas where this disconnect shows most clearly – with fragmented data and manual updates making it harder to evaluate projects consistently and keep forecasts aligned.

What Good Looks Like: A Structured CAPEX Planning Process

When CAPEX planning is done well, it stops being a budgeting headache and becomes a tool for better investment decisions. It brings structure, accountability, and visibility across the entire lifecycle of a project, from request to reforecast. Here’s what that looks like in practice:

All projects tracked in one place

Every Capex initiative stage, whether it’s proposed, approved, or in execution, is managed in a shared model with clear ownership, cost breakdown, business justification, and a timeline.

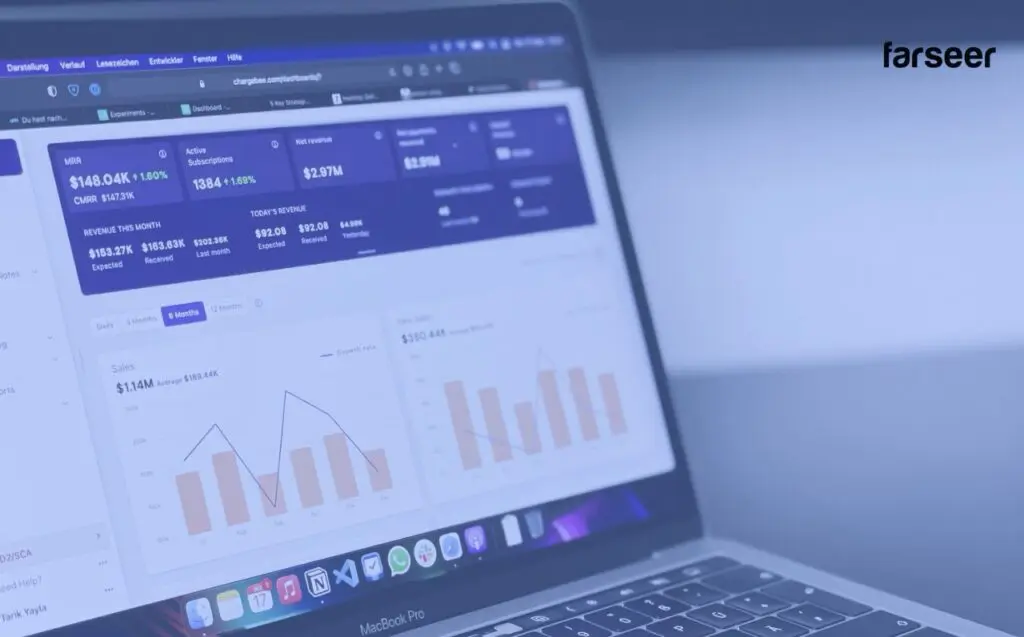

Let’s say you work in a multi-location manufacturing business. Instead of each plant submitting investment plans in their own spreadsheet, all requests are logged in one place, a modern FP&A tool like Farseer. This gives the finance team a complete view of what’s coming and how it affects cash flow.

Standardized evaluation criteria

Each project includes required metrics like ROI, payback period, and strategic alignment. This makes it easier to compare and prioritize investments.

For example, when two teams request €500K each, one for a warehouse automation upgrade and one for a regional expansion, standardized metrics let you weigh them side by side, rather than relying on whoever made the stronger case over email.

Clear approval workflows

Instead of approvals scattered across emails or meetings, the process is structured with predefined roles and checkpoints.

Let’s say the logistics team submits a €200K request. The model automatically routes it to department leads, then to finance and operations for review, with each decision point logged. No lost threads, no guessing who said yes.

Tight integration with financial planning

Capex decisions directly feed into your broader financial model, across the P&L, cash flow, and balance sheet. Imagine approving a €1M project to expand production. With integration in place, the forecast immediately reflects the impact on depreciation, funding requirements, and working capital, so nothing gets missed downstream.

Ongoing tracking and reforecasting

As project timelines shift or costs increase, the forecast is updated, not just once a year. For instance, a project approved at €800K might grow to €900K after supplier changes. With live tracking, finance can see the delta, flag it, and adjust the budget and cash planning in real time.

When these basics are in place, CAPEX planning becomes more than an annual exercise, and according to KPMG, companies that prioritize CAPEX investments based on ROI, risk, and strategic alignment are better positioned to adapt when conditions change. It becomes a live part of the business, supporting capital allocation that’s grounded in real data, not just rough estimates or gut feel.

The Time has come to Rethink CAPEX Planning for Real Decision-Making

CAPEX planning doesn’t need to be a manual, frustrating process. When the structure is right, and when finance owns the model instead of chasing pieces of it, capital investment decisions become faster, more consistent, and easier to explain.

Whether you’re managing a handful of projects or planning across multiple entities, the key is the same: standardize the process, tie it to your broader financial model, and keep it connected as things change.

Tools like Farseer help finance teams move beyond spreadsheets and create a live CAPEX model, one that tracks project status, supports prioritization, and shows the impact of every investment on your cash flow and long-term plan.

If your CAPEX process still runs on disconnected templates and approvals lost in inboxes, it’s time to rethink the workflow. A more structured approach doesn’t just reduce friction, it helps finance teams allocate capital where it matters most.

Đurđica Polimac is a former marketer turned product manager, passionate about building impactful SaaS products and fostering connections through compelling content.