Many teams face the same situation – operating profit looks solid, EBITDA tells a slightly different story.

This often happens in manufacturing, pharma, and FMCG companies with large asset bases and regular investments. On paper, both metrics look healthy. Yet the direction and scale of change may differ.

Both metrics matter. Still, they measure different things. Operating profit includes all operating costs. EBITDA removes depreciation and amortization. The issue arises when a company uses the wrong metric for the wrong decision.

Read more: A Complete Guide to Financial Statement Analysis for Strategy Makers

The goal is not to choose one. The goal is to understand how they work together.

This article explains operating profit vs EBITDA in simple terms. It shows how each metric behaves in planning and forecasting. It also highlights where teams often misread margins, especially when numbers look fine on paper, but costs, assets, or investment plans tell a different story.

What is Operating Profit?

Operating profit shows how much money the business earns from its core operations. It starts with revenue and subtracts the cost of goods sold and operating expenses. These expenses include SG&A, depreciation, and amortization. Interest and taxes are excluded.

Read: What Are Profitability Ratios

In practice, operating profit answers a simple question: Are we profitable after all operating costs?

This is especially important in asset-heavy industries. For example, a manufacturing company may invest in new production lines. Sales improve. EBITDA increases. However, operating profit may stay flat. Why? Because depreciation from the investment is recorded as an expense.

As a result, operating profit reflects the real cost of growth. It includes the cost of using assets, not only the benefit of higher output.

Operating profit is especially useful when teams:

- Track cost efficiency by plant, region, or business unit

- Review budget vs actual performance

- Analyze the impact of headcount growth, logistics costs, or overhead changes

If operating profit improves, something structural has improved. Either costs are lower, pricing is stronger, or productivity increased.

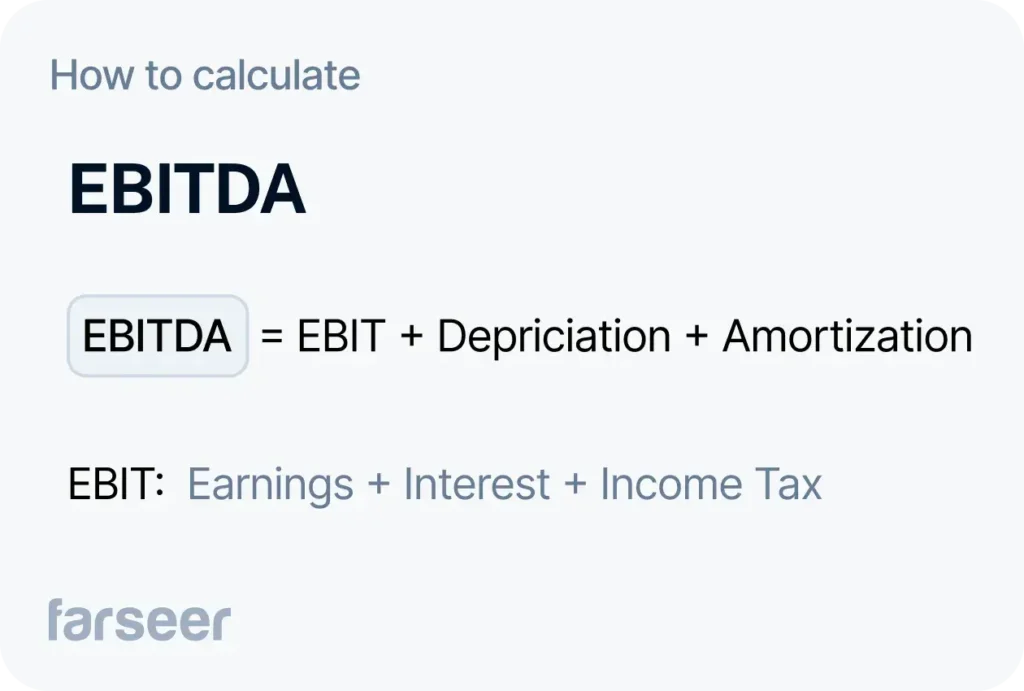

What Is EBITDA?

EBITDA stands for earnings before interest, taxes, depreciation, and amortization. In simple terms, it is operating profit plus depreciation and amortization.

The concept is straightforward. EBITDA removes accounting effects linked to assets and financing. This makes performance easier to compare across business units, countries, or companies with different CAPEX histories.

That’s why EBITDA often appears in board reports and external reporting.

For example, a food manufacturer operates three plants. One invested heavily in automation five years ago. Another still uses older equipment. Depreciation levels are different, even though daily operations are similar.

EBITDA removes that difference. It allows management to compare performance without the impact of past investment timing.

EBITDA is most useful when teams:

- Compare performance across regions or legal entities

- Report results to banks or investors

- Track covenant metrics linked to financing

- Prepare high-level performance views for management

That said, EBITDA is not a cash metric. It ignores asset consumption and future reinvestment needs. In asset-heavy businesses, this can create a gap between reported performance and economic reality.

Used correctly, EBITDA gives a clean operational signal. Used on its own, it can hide where costs and investments actually sit.

Operating Profit vs EBITDA: The Real Differences

The difference between operating profit and EBITDA comes down to what costs you choose to ignore.

Operating profit includes depreciation and amortization. EBITDA removes them. That single adjustment changes how the numbers behave, and how people interpret performance.

When a business invests in machinery, production lines, or IT systems, those costs do not disappear. Accounting spreads them over time through depreciation and amortization. Operating profit reflects this. EBITDA does not.

This creates two very different signals.

- Operating profit shows how well the business performs after all operating costs, including asset usage.

- EBITDA shows how the business performs before asset consumption and financing structure enter the picture.

In asset-light businesses, the gap between the two is often small. In manufacturing, pharma, logistics, or energy, the gap can be material.

Consider a pharmaceutical distributor expanding its warehouse network. EBITDA improves after volume growth and process optimization. Operating profit stays under pressure because new warehouses increase depreciation. EBITDA suggests strong momentum. Operating profit signals tighter margins once assets are fully accounted for.

Neither metric is wrong. They simply answer different questions.

The risk starts when teams:

- Use EBITDA to judge cost efficiency

- Use operating profit to compare entities with very different asset bases

- Mix both metrics in planning without clear reconciliation

Strong finance teams track both, and understand why they differ. They make sure everyone reading the numbers knows exactly what is included, and what is not.

When to Use Operating Profit - and When EBITDA Works Better

Both metrics have a role. Problems start when teams use them interchangeably.

Use Operating Profit for Internal Steering

Operating profit works best when the goal is to run the business, not to present it.

It helps teams see the full cost of operations, including people, overhead, and assets. This makes it the right metric for decisions that affect cost structure and efficiency.

Typical use cases include:

- Budget vs actual analysis by cost center or plant

- Productivity and efficiency tracking

- Headcount and overhead planning

- OPEX control discussions

Read: How to Connect Headcount Planning with Strategic Goals

For example, a packaging manufacturer reviews monthly results by factory. One site shows improving EBITDA due to higher output. Operating profit, however, declines because maintenance costs and depreciation rise after a machinery upgrade. Operating profit highlights the real trade-off between efficiency gains and asset costs. That is the metric that drives corrective action.

Use EBITDA for Comparability and External Views

EBITDA works better when the goal is comparison, not control.

By removing depreciation and amortization, EBITDA allows teams to compare entities with different asset ages, lease structures, or investment cycles.

EBITDA is commonly used for:

- Board and investor reporting

- Bank covenants and financing discussions

- M&A analysis and valuation

- High-level performance comparisons across regions

For instance, a food distribution group compares EBITDA margins across countries. Some markets operate their own warehouses; others lease them. EBITDA reduces distortion from accounting treatment and keeps the discussion focused on operational scale and margin.

The Practical Rule

- If the decision affects costs or assets – use operating profit

- If the decision compares entities or supports financing – use EBITDA

Strong planning teams do not choose one. They model both, reconcile them clearly, and ensure each metric is used in the right discussion.

How Better Planning Models Reduce Confusion Between EBITDA and Operating Profit

Most confusion around operating profit and EBITDA does not come from definitions. It comes from how planning models are built.

In many companies, EBITDA lives in one Excel file. CAPEX sits in another. Depreciation is either hardcoded or updated annually. The link between decisions and outcomes breaks quickly.

This creates three problems:

- EBITDA forecasts ignore future depreciation

- Operating profit becomes a surprise, not a planned result

- Teams spend time explaining gaps instead of managing them

Stronger planning models treat EBITDA and operating profit as connected outputs, not separate metrics.

In practice, this means:

- CAPEX plans drive depreciation automatically

- EBITDA and operating profit reconcile in every forecast

- Teams can see margin impact before approving investments

Read: How to Bring Structure to CAPEX Planning

This is exactly where structured FP&A platforms such as Farseer change the dynamic. Instead of managing separate spreadsheets, teams work in one connected model where operational planning, CAPEX, and financial outcomes sit together. Depreciation is not adjusted manually. It flows from investment decisions. EBITDA and operating profit remain aligned because they are calculated within the same framework.

For example, a manufacturing group planning a new production line can test scenarios before committing. One scenario shows higher EBITDA but weaker operating profit due to depreciation timing. Another delays CAPEX and smooths margins. In a connected planning model, both views update instantly. The discussion shifts from “why did profit drop?” to “which option fits our margin targets?”

When tools like Farseer support this structure, finance teams spend less time fixing models and more time supporting decisions.

Final Takeaway

Operating profit and EBITDA are not competitors. They are signals with different purposes.

- Operating profit shows the full cost of running the business

- EBITDA highlights operational performance without asset effects

The mistake is not using one over the other. The mistake is using either without context.

Teams that plan well:

- Track both metrics

- Reconcile them clearly

- Use each one for the right discussion

When that happens, margins stop being a reporting debate and start becoming a management tool.

Structured planning platforms like Farseer help connect operational plans, CAPEX, and financial outcomes in one consistent framework. As a result, both EBITDA and operating profit stay aligned.

If you want to see how that works in practice, it may be time to review how your current planning model handles investments, depreciation, and margin scenarios. Because the difference between EBITDA and operating profit should drive better decisions, not more explanations.

Đurđica Polimac is a former marketer turned product manager, passionate about building impactful SaaS products and fostering connections through compelling content.