When your organization operates across multiple subsidiaries, regions, and currencies, one truth becomes painfully clear: cash doesn’t move as easily as your spreadsheets suggest.

Even if each entity runs efficiently, the group’s liquidity picture is rarely clear. Cash might be locked in one market, while another struggles to cover short-term liabilities. And when the data finally arrives – it’s already outdated.

Read Financial Consolidation: Definition, Challenges & Solutions

What to do?

Consolidated cash flow statement to the rescue.

It’s actually the bridge between profit and liquidity, showing how money moves across the group.

Let’s unpack what it is, how it works, and how modern FP&A tools are turning this once manual task into a real-time financial control system.

What is a Consolidated Cash Flow Statement

A consolidated cash flow statement combines all cash inflows and outflows from a parent company and its subsidiaries into one unified report.

It tells you everything from how much money your business made, to how and where that money moved during a specific period.

This statement is divided into three main sections:

- Operating activities:

Cash generated or used in day-to-day operations, like customer receipts, supplier payments, payroll, and taxes. - Investing activities:

Cash used for or received from investments, such as purchasing equipment, acquiring companies, or selling assets. - Financing activities:

Cash flows from raising and repaying capital, like loans, dividends, or equity transactions.

Together, these categories reveal whether your group is generating enough cash to sustain operations and invest in future growth.

Why consolidated cash flow matters

Profitability and liquidity often get mistaken for the same thing, but they’re not even close.

You can show a solid profit on paper and still be struggling to pay the bills. Maybe customers are slow to pay. Maybe inventory is sitting on shelves. Or maybe cash is trapped in another subsidiary halfway across the world.

Whatever the reason, your P&L might look great, but your bank account tells a different story.

A consolidated cash flow view gives CFOs and finance teams:

- A complete liquidity overview across subsidiaries, currencies, and time periods

- Visibility into which entities are cash-rich or cash-strained

- Insights for treasury planning, debt management, and internal funding optimization

This makes the consolidated cash flow statement one of the few reports that reflects financial reality, because it shows the actual movement of cash, not just accounting figures.

In short: It’s not just about what your business earned, it’s about what your business can use.

Read more: Consolidated Statement of Income: Why It’s More Than Just Numbers on a Page

Common Challenges in Cash Flow Consolidation

Despite its importance, building a group cash flow statement manually is still one of finance’s toughest tasks.

Here’s why:

- Different formats and systems: Subsidiaries often use separate ERPs, local charts of accounts, or reporting templates.

- Intercompany noise: Internal payments distort the true liquidity position unless eliminated correctly.

- FX complexity: Currency rates fluctuate between forecast and actuals, requiring constant adjustments.

- Non-cash adjustments: Depreciation, provisions, and unrealized gains must be handled consistently across entities.

For many teams, the result is a slow, manual process, with dozens of spreadsheets, endless reconciliations, and reports that lose relevance by the time they’re finished.

It’s no wonder that according to research by Farseer, 37% of finance experts see consolidation as one of the biggest potentials for AI.

Download our free Dynamic Menu Reporting Template to simplify reporting with dynamic dropdowns and keep cash flow insights consistent – no broken links, no endless reconciliations.

How Cash Flow Consolidation Works - A Practical Example

Let’s take a simple example.

A holding group has three subsidiaries:

- Entity A generates €2M in operating cash flow.

- Entity B spends €1.5M on new production equipment.

- Entity C borrows €500K from the parent company.

When consolidated, internal loans (like the one between C and the parent) are eliminated, since they don’t represent external cash movement.

The final consolidated cash flow statement shows:

- €2M generated from operations,

- €1.5M used for investment,

- and no net external financing – reflecting the group’s real liquidity position.

This elimination process ensures you don’t double-count or misrepresent internal flows, keeping the focus on how cash truly enters and leaves the group.

Read How to Do a Cash Flow Forecast in Enterprise Environments

The Modern Approach: Automation and Real-Time Visibility with Farseer

Finance teams no longer have to wait until month-end to see where their cash really stands.

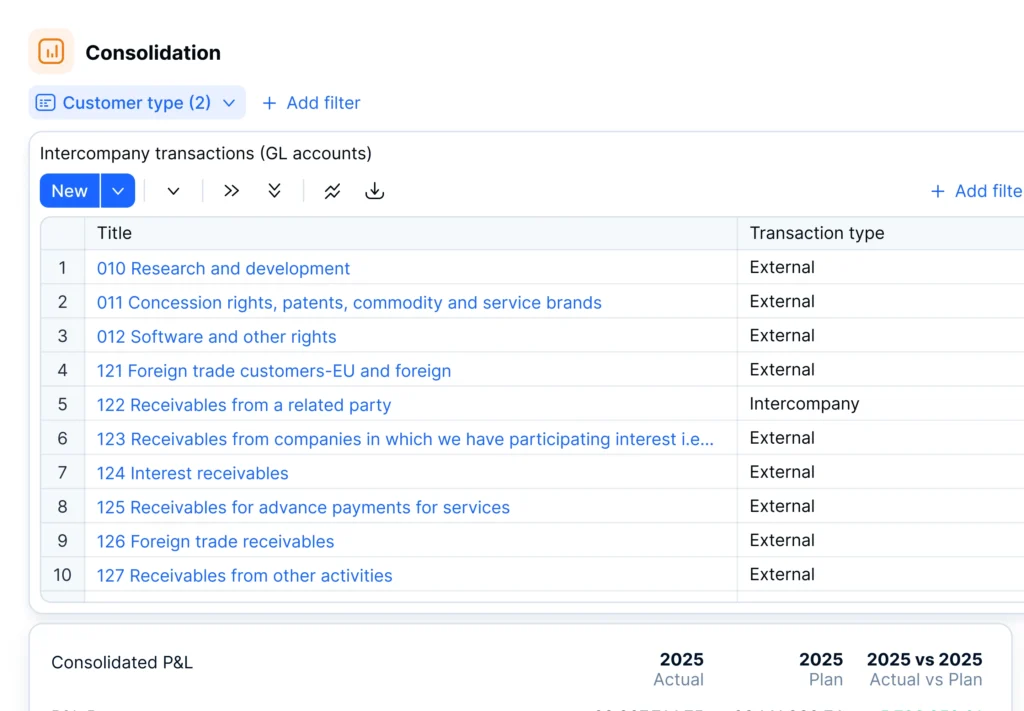

With Farseer, the entire consolidation process runs automatically: from data collection to intercompany eliminations.

Here’s what that looks like in practice:

- Automatic eliminations and FX translations that happen instantly, not days later

- Direct data integration with your ERP and BI systems for real-time updates

- Governed data models that keep every entity aligned under one version of truth

- Scenario simulations to test liquidity under different market or pricing conditions

- Drill-downs from group-level dashboards to individual subsidiaries – all in a few clicks

Read Best Consolidation Software in 2025: Top Tools, Key Features, and How to Choose

Instead of spending days building reports manually, teams can track liquidity live, with dashboards that update the moment data changes.

Imagine seeing, at any moment:

- How much cash is available across all markets

- Which subsidiaries are generating or absorbing liquidity

- How forecasted CAPEX impacts your runway

That’s the difference between reporting and steering.

Farseer flips the script, turning the cash flow statement from a month-end formality into a live dashboard that actually drives decisions.

Key takeaways

- A consolidated cash flow statement shows how money moves across your group, not just profits on paper.

- Manual spreadsheets make this process slow, fragmented, and error-prone.

- Automation connects every entity into one governed model, giving real-time visibility into liquidity.

- Modern finance teams use consolidated cash flow as a strategic driver, optimizing working capital, funding, and investment timing.