Margins under pressure everywhere?

According to Farseer’s State of Finance 2026 report, 51% of finance leaders list cost optimization among their top priorities, reflecting how margin pressure dominates finance agendas across industries.

Welcome to finance 2025.

Rising costs, unstable markets, and shifting customer demands make it harder than ever to know what’s really driving profit. The problem? Most finance teams are still stuck piecing this together with spreadsheets or static reports.

Profitability analysis software to the rescue!

Instead of just showing revenue and cost totals, these tools let you drill into profitability by product, customer, region, or business unit. They give finance leaders the visibility to see where money is being made, and where it’s silently being lost.

Read: What Great Financial Reporting and Analytics Actually Look Like

In this guide, we’ll explore why software makes all the difference and which tools are worth considering in 2025.

Why Profitability Analysis Software Makes a Difference

Doing profitability analysis manually is slow, screams errors, and it’s often outdated by the time results are in. Modern software changes the game:

- Automated data consolidation: no more manual copy-paste across endless spreadsheets.

- Multi-dimensional insights: instantly see profitability across products, customers, or markets.

- Real-time updates: track margins continuously instead of waiting till the end of the month

- Scenario planning: test “what if” situations like price changes or cost spikes.

- AI-driven insights: forecast margin trends, flag anomalies, and surface hidden opportunities.

- Collaboration: finance, sales, and operations work off the same live numbers.

According to the State of Finance 2026 report by Farseer, only 29% of finance leaders say they have full visibility into profit drivers across products, customers, and regions.

This lack of clarity is exactly why profitability analysis software is becoming essential, not just for reporting margins, but for understanding what’s really driving them in real time.

Best Profitability Analysis Software in 2025

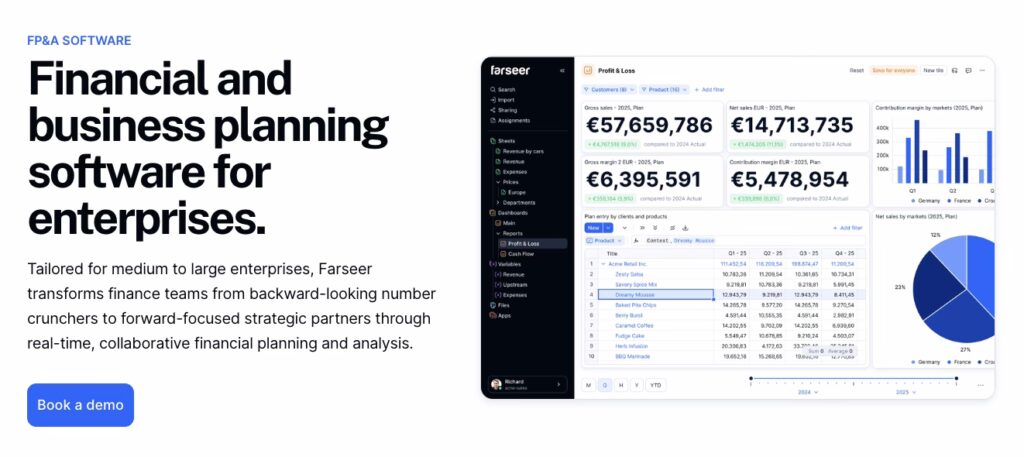

1. Farseer

Most profitability analysis tools either lean heavily toward reporting (BI dashboards) or toward rigid financial modules that take months to implement.

Farseer bridges that gap.

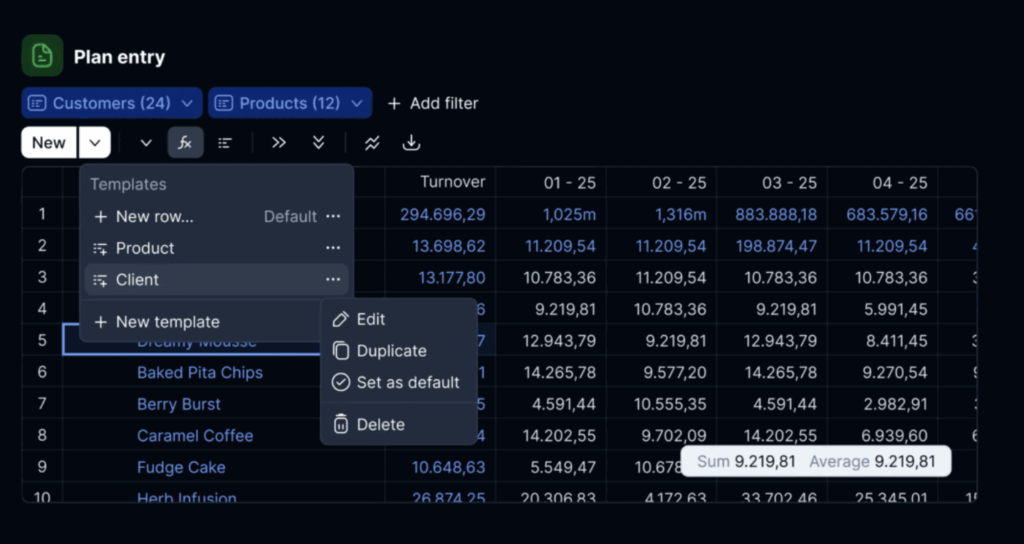

It’s built as a no-code FP&A platform that combines speed, flexibility, and AI-driven intelligence. The platform acts as a control center for planning, forecasting, and profitability analysis, allowing companies to connect financials with operational drivers in real time. That means you don’t just see what happened last month – you can model what happens next, simulate pricing or cost changes on the go, and collaborate across finance, sales, and operations without IT bottlenecks.

Key features for profitability analysis

- Multi-dimensional profitability views: Drill into profit by product, customer, region, or channel in seconds, without building endless pivot tables.

- No-code modeling: Finance teams can set up profitability models on their own. No IT dependency, no long consulting projects.

- Real-time scenario planning: Test how changes in pricing, volumes, or costs impact margins instantly. Both top-down and bottom-up approaches are supported.

- AI-powered insights: Farseer AI keeps your forecasts live, explains variances and provides what-if simulations

- Integration & consolidation: Connects with ERP, CRM, and other systems to pull in actuals automatically. Multi-entity support makes it suitable for complex group structures.

- Fast time-to-value: Where legacy FP&A suites may take 6–12 months to roll out, Farseer typically goes live in weeks, not quarters.

Why finance teams choose Farseer

- Lower total cost of ownership compared to legacy platforms.

- Simpler user experience: formulas and navigation are intuitive for finance professionals.

- Enterprise-grade scalability while still serving mid-market companies effectively.

- Designed for the future: AI features, collaboration layers, and continuous product innovation.

Want to see it in action?

2. Oracle (EPM Cloud / Hyperion)

Oracle has long been one of the biggest names in enterprise performance management. Its profitability and cost management tools, first through Hyperion and now part of Oracle EPM Cloud, are built for large, complex organizations that need detailed financial modeling and compliance-ready reporting.

Key features for profitability analysis

- Advanced cost allocation models – handle complex multi-entity, multi-driver profitability structures.

- Integration with Oracle ERP – seamless data flow for companies already in the Oracle ecosystem.

- Enterprise-scale reporting – strong compliance, audit, and financial close capabilities.

Why finance teams choose Oracle

Global enterprises and regulated industries often turn to Oracle for its depth, reliability, and tight ERP integration. It’s a fit for organizations that prioritize robust audit trails and standardized processes, even if it means longer implementation times and higher total cost of ownership.

Read more: Oracle Hyperion Competitors: The 6 Platforms Finance Teams Consider in 2026

Datarails

Datarails is designed for finance teams that live in Excel but need more automation and control. It layers consolidation, reporting, and analysis on top of spreadsheets, making it easy to upgrade without leaving familiar workflows.

- Excel-native interface – keeps the look and feel finance teams already know.

- Automated consolidation – pulls data from ERP, CRM, and other systems into one place.

- Reporting & dashboards – visualize profitability and financials without manual prep.

Why teams choose Datarails

Mid-market companies that don’t want a steep learning curve pick Datarails for its fast adoption and Excel-first approach. It’s ideal for teams that want to modernize without abandoning their spreadsheet culture.

Apliqo

Apliqo is built on IBM TM1 technology but packaged with pre-built applications for planning and profitability analysis. It focuses heavily on cost allocations, driver-based models, and activity-based costing (ABC).

Key features

- Pre-built profitability and costing models – ready-to-use templates speed up deployment.

- Activity-based costing support – allocate overhead more accurately than traditional methods.

- Integration with IBM Planning Analytics (TM1) – leverages the power of an established calculation engine.

Why teams choose Apliqo

Organizations that already use IBM TM1 but want industry-specific apps often pick Apliqo. It reduces the need for heavy customization and accelerates profitability modeling projects.

Tagetik (Wolters Kluwer)

Tagetik, part of Wolters Kluwer, is a corporate performance management (CPM) platform known for consolidation, compliance, and financial close. It also provides profitability and cost management capabilities, especially for finance-driven organizations.

Key features

- Integrated consolidation & reporting – strong for groups managing complex financial closes.

- Profitability and cost modeling – tie financial results directly to business drivers.

- Regulatory compliance features – audit trails, IFRS/GAAP support, and disclosures.

Why teams choose Tagetik

Finance teams in heavily regulated industries (banking, insurance, pharma) choose Tagetik for its compliance strength and integration of profitability into the broader close-to-disclose process.

Read more: Top 10 Finance Automation Software for Enterprise FP&A in 2025

Finally…

Profitability analysis is no longer something finance teams can afford to run once a quarter in spreadsheets. With margins tightening and markets shifting faster than ever, companies need real-time visibility into where profit is being created, and where it’s slipping away.

That’s where profitability analysis software makes the difference. Whether it’s established enterprise platforms like Oracle and Tagetik, Excel-friendly solutions like Datarails, or niche specialists like Apliqo, each tool comes with its own strengths and trade-offs.

But modern finance teams are increasingly looking for platforms that combine speed, flexibility, and predictive power without months of implementation or IT dependency. That’s the gap tools like Farseer are built to fill – enabling finance leaders to model profitability across dimensions, run scenarios in real time, and act on insights with confidence.

If you’d like to learn more on how Farseer can help your profitability analysis, schedule a call, and let’s talk!

FP&A Tool Fit Quiz

Question 1

How complex is your organizational structure?

Question 2

How quickly do you need to implement an FP&A solution?

Question 3

What is your team’s technical profile?

Question 4

What is your primary planning priority?

Question 5

What is your expected FP&A budget?