FREE TOOL

Break Even

Point Calculator

How to Use This Break Even Calculator

Use this break even calculator to figure out how many units you need to sell to cover your fixed and variable costs. It’s built for finance teams working on pricing, cost recovery, or investment planning.

Enter your fixed costs first. These are your recurring expenses like rent, salaries, or equipment depreciation. Use either monthly or yearly values, but stay consistent throughout.

Next, input your price per unit. This is what you plan to charge for each item or service.

Then, enter your variable cost per unit. These are costs that change with volume, such as raw materials, packaging, or third-party services.

The calculator immediately shows how many units you need to sell to break even.

Use this tool to:

Test pricing before launching a product

Check if a capital investment makes financial sense

Set realistic sales targets

Track profitability against actuals

Read: Cost-Volume-Profit Analysis — a deeper look at how sales volume and cost structure shape your margins.

Break Even Calculator Formula Explained

The break even calculator uses this formula:

Break-Even Units = Fixed Costs / (Price per Unit – Variable Cost per Unit)

It shows how many units you need to sell to cover all costs. After that point, every sale contributes to profit.

Example:

Fixed costs: €120,000

Price per unit: €40

Variable cost per unit: €25

Break-even = €120,000 / (€40 – €25) = 8,000 units

Always keep your time period consistent. If fixed costs are monthly, use monthly pricing and costs per unit.

Read: How to Do a Profitability Analysis That Actually Improves Your Bottom Line

When to Use Break-Even Analysis

Use the break even calcuator and analysis when you need a clear answer on cost recovery. It’s a quick way to check if your pricing, volume, or cost structure makes sense.

Common use cases:

Launching a new product or business line

Set a sales target that covers your costs from the start.Evaluating a capital investment

See how many units you need to sell to justify a €250,000 equipment purchase.Adjusting your pricing strategy

Understand how a price change affects the number of sales you need to stay profitable.Planning under uncertainty

Recalculate break-even if input costs go up or demand drops.

Example

Let’s say a manufacturing team is planning a new production line. Monthly fixed costs are €320,000. Price per unit is €22, and the variable cost is €12. The break-even point is 32,000 units. They use this number to set minimum sales targets in distributor agreements.

Read: Scenario Planning: How to Prepare Your Business for Uncertainty

How to Interpret and Act on Break-Even

Break-even gives you a clear threshold, but you need to compare it to your actual business plans.

Ask the right questions:

Is your break-even point higher than your expected sales?

Cut fixed costs, raise prices, or reconsider the product.Is it close to your full capacity?

Even a small drop in demand could put you at risk. Build in a buffer.Is it far below your forecast?

You have room to improve margins or scale further.

Break-even is most useful when you combine it with other tools. Many teams:

Track break-even against actual sales

Test the impact of discounts, cost increases, or volume shifts

Use it as a baseline when reviewing pricing or planning volume

Break-Even vs Payback Period

Break-even tells you how many units you need to sell to cover your costs. Payback period tells you how long it takes to recover an investment.

Use break-even for fast decisions tied to pricing or cost structure. It’s useful when you’re launching products, testing prices, or adjusting volume plans.

Use payback period when you’re evaluating long-term investments. It looks at cash flows over time, not just unit economics. Both are useful, but they serve different purposes. Break-even is quicker. Payback requires more forecasting but gives a better view of timing.

Plan Beyond the Break-Even Calculator

Use the break even calculator to validate your pricing and cost structure. Once you have a clear break-even point, the next step is to build it into your financial plan.

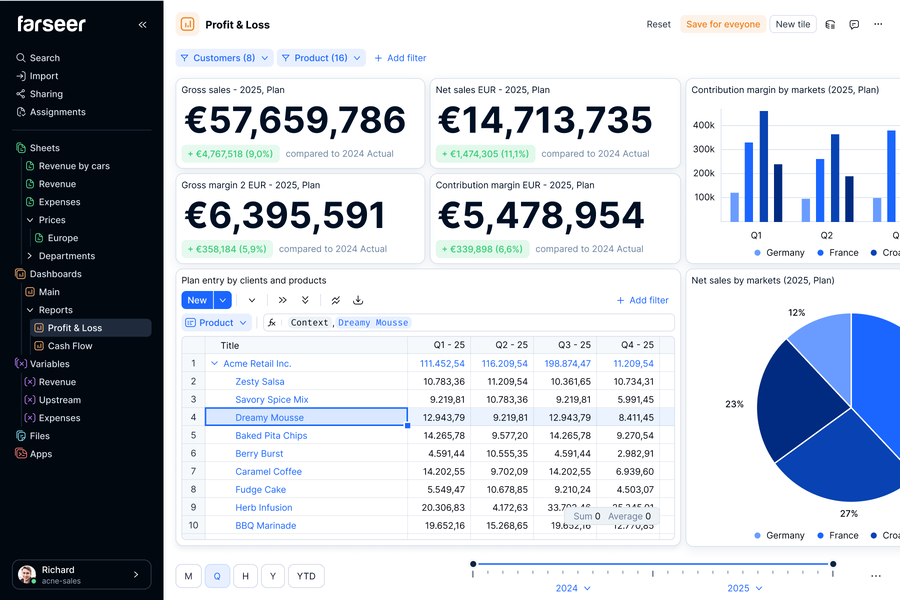

Farseer lets you connect break-even logic to your forecasts, scenarios, and margin planning. No exports, no manual updates, just real-time insights across your business drivers.

If you’re tracking break-even in spreadsheets or planning software that can’t handle changes fast enough, you’re working with outdated numbers.

See how Farseer helps finance teams plan with speed and accuracy, and book a demo today.