Financial analysis software allows for more than crunching numbers – it reveals insights that drive strategy. Selecting the proper one, however, can be overwhelming, especially when your staff is growing, procedures are getting complex, and you don’t have time to waste on clunky systems.

If your staff is spending hours attempting to tame spreadsheets and still can’t get a forecast to hit – it’s time to upgrade.

In this post, we’ll break down five of the best financial analysis tools in 2026 – what they do, who they’re for, and how they compare.

Read: A Complete Guide to Financial Statement Analysis for Strategy Makers

What Are Financial Analysis Tools

Financial analysis software allows companies to make improved, faster financial decisions. They’re used for budget planning, revenue forecasting, scenario modeling, and assessing financial performance – all more rapidly and less manually.

They play a vital role in:

- Budgeting and forecasting – creating sound plans and amending them as circumstances change

- Scenario planning – modeling best-case, worst-case, and all other scenarios in between

- Financial modeling – how different inputs affect your bottom line

Whether a startup monitoring cash flow or an enterprise managing intricate driver-based models, financial analysis tools enable CFOs, controllers, and finance teams to remain in command and ahead of the curve.

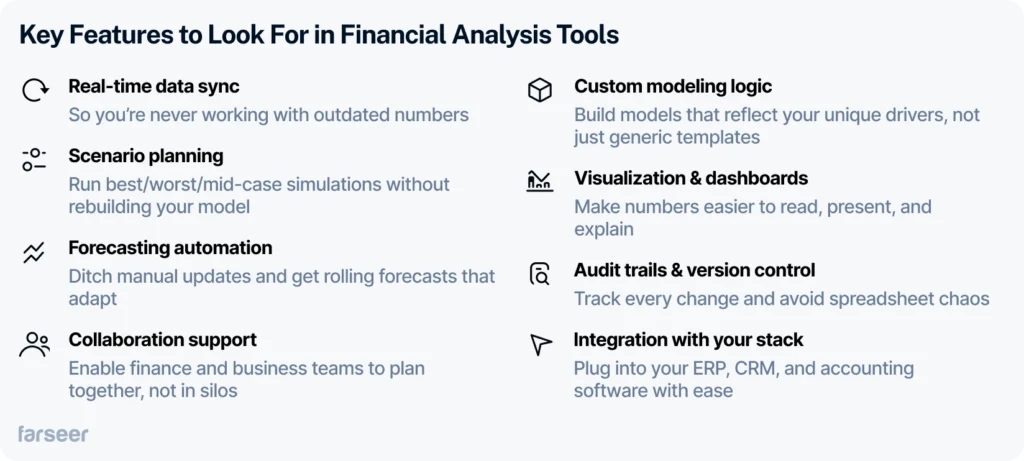

Key Features to Look For in Financial Analysis Tools

Not all tools are created equal. When choosing a financial analysis platform, look for features that actually move the needle in planning speed, accuracy, and decision-making:

- Real-time data sync – so you’re never working with outdated numbers

- Scenario planning – run best/worst/mid-case simulations without rebuilding your model

- Forecasting automation – ditch manual updates and get rolling forecasts that adapt

- Collaboration support – enable finance and business teams to plan together, not in silos

- Custom modeling logic – build models that reflect your unique drivers, not just generic templates

- Visualization & dashboards – make numbers easier to read, present, and explain

- Audit trails & version control – track every change and avoid spreadsheet chaos

- Integration with your stack – plug into your ERP, CRM, and accounting software with ease

Choose based on your needs. A lean startup doesn’t need what a multinational does. But both need tools that make planning less painful and more powerful.

Top 5 Financial Analysis Tools

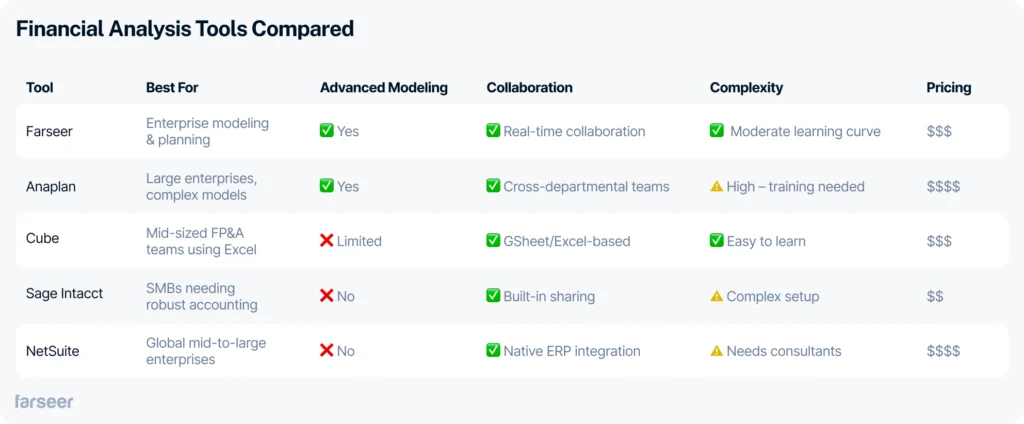

When it comes to financial planning, choosing the right tool makes all the difference. From real-time collaboration to advanced scenario modeling, today’s platforms go far beyond spreadsheets. Below, we’ve broken down five of the most widely used financial analysis tools – each with its pros and cons.

Cube Software

Cube is a cloud-based financial planning and analysis (FP&A) tool designed to work with the spreadsheets finance teams already know and love, like Excel and Google Sheets. In this way, Cube enhances spreadsheet functionality and allows finance teams to streamline tasks such as budgeting, forecasting, reporting, and scenario planning. It offers a unified view of a business’ financial and operational data in one place, offering real-time insights and better control over financial planning processes.

Capterra rating – 4.8 ★

Pros:

- Seamless integration: Cube integrates easily with Excel and Google Sheets, so users can continue working with familiar tools while adding automation features.

- Quick implementation: Unlike many larger FP&A solutions, Cube is designed for fast deployment, so finance teams can be up and running with minimal training.

- User-friendly interface: Cube’s interface makes it easy for finance professionals to perform complex financial analysis, even if they aren’t deeply technical.

Cons:

- Limited customization: Cube offers limited customization options which may be a drawback for larger businesses with specific needs.

- Challenges with model uploads. Some customers report difficulties in updating their operating mode.

- Disorganized data transfer. Cube has predefined custom dimensions and transfer between these dimensions is relatively complex.

- No AI capabilities. Unlike other FP&A vendors, Cube doesn’t have integrated AI features that could speed up the processes.

Anaplan

Anaplan is a cloud-based connected planning platform that enables organizations to deal with complex financial modeling and forecasting across multiple departments. Its primary purpose is to unify data from various sources, making it easier for teams across finance, sales, HR, and operations to collaborate on planning and decision-making processes.

Capterra rating – 4.3 ★

Pros:

- Scalability: Anaplan’s architecture is built to handle large amounts of data. It can scale along with the business needs, which ensures that it remains valuable as the organization grows.

- Real-time collaboration: Anaplan entices collaboration by providing a centralized platform where departments can work together in real-time.

- Advanced scenario planning and predictive analytics: Anaplan’s modeling capabilities allow users to create complex “what-if” scenarios, which makes it easy to understand the potential impact of different business decisions.

Cons:

- High cost: Anaplan’s extensive options come with a higher price tag, making it less accessible for smaller businesses or teams with limited budgets.

- Steep learning curve: Due to its complexity and depth, Anaplan can require a significant amount of training for you to be sure you’re using it to its full potential. Smaller teams or businesses that don’t need such advanced features may find it overwhelming and time-consuming to implement.

- Workflows. Customers have reported challenges with underperformance when building custom workflows.

- Reporting. Some customers complain about the lack of flexibility within the reporting feature. This leads to having to create your reports outside the system to meet your needs.

Read Anaplan Competitors – The 6 Best Alternatives for Enterprise FP&A

Farseer

Farseer is an enterprise-level financial modeling, forecasting, and budgeting platform that empowers organizations to manage complex financial processes with ease. Designed for medium to large enterprises, Farseer combines sophisticated scenario planning with comprehensive data consolidation, enabling finance teams to create precise models and improve decision-making. Its strong emphasis on collaboration allows teams to share insights and make adjustments in real-time, ensuring that the entire organization remains aligned.

Capterra rating – 4.9 ★

Pros:

- Enterprise-level functionality: Farseer provides extensive modeling capabilities, designed to handle the complexities of large organizations. It’s capable of supporting detailed financial scenarios, making it ideal for companies that need complex, multi-dimensional insights.

- Advanced scenario and forecasting tools: Farseer offers powerful forecasting and scenario planning features that enable businesses to simulate various financial outcomes and assess the impact of different business decisions. This helps enterprises stay agile and adapt to market changes.

- Real-time collaboration: With Farseer, finance teams can collaborate seamlessly in real-time, which streamlines communication and ensures data accuracy. This functionality enhances cross-departmental alignment on financial strategies.

- Scalability: Built for enterprise use, Farseer scales effectively with growing organizations. Its infrastructure allows it to handle large datasets and complex operations, making it a reliable choice for long-term business planning.

Cons:

- Integration options: While Farseer is a robust tool, its integration capabilities are slightly limited. Still, it provides a number of integrations with popular and frequently used tools.

- Learning curve: Due to its advanced features, new users may need time to become proficient with Farseer. But Farseer offers extensive support throughout the process, so this potential issue can easily be resolved.

All in all, Farseer provides a comprehensive suite of tools for large enterprises needing powerful financial modeling and planning capabilities. If you’d like to give it a try, book a demo and check it out for yourself.

Sage Intacct

Sage Intacct functions as a cloud financial management system specifically designed for small to midsize businesses. The solution optimizes essential finance activities including general ledger management and payables as well as budget creation and reporting through robust automation capabilities. Users can access deep performance insights through its multidimensional analysis and real-time dashboard system that operates without complicated setup requirements.

Pros:

- Comprehensive feature set: This accounting software includes extensive features for accounts receivable and payable functions and multi-entity consolidation and provides robust budgeting and reporting capabilities along with cash flow forecasting functionality.

- Real-time dashboards: The system provides real-time dashboards combined with detailed financial reports which enable finance teams to make quicker data-based decisions.

- Workflow automation: The system automates approvals and consolidations and journal entries as part of its workflow automation capabilities, thus reducing errors and enhancing operational efficiency.

- Scalability: The system provides exceptional scalability benefits for companies that have outgrown their basic financial tools but do not need complete enterprise software yet.

Cons:

- Complexity for basic users: The extensive feature set combined with customization options within this software creates challenges for users who have basic accounting skills or are transitioning from basic accounting systems.

- Customization limitations: The system provides powerful reporting features, but some users experience restrictions when trying to customize reports and workflows.

- Setup complexity: The implementation process for some users becomes prolonged and complicated according to reports from users.

Oracle NetSuite

The cloud ERP platform Oracle NetSuite features complete financial management capabilities which include budgeting alongside forecasting and real-time financial analysis. The platform serves mid-sized to large enterprises through financial operational visibility from start to finish while connecting all business processes naturally and supporting global operations through multi-entity and multi-currency capabilities.

Capterra rating: 4.1 ★

Pros:

- All-in-one platform: A single platform solution provides financial capabilities along with inventory management, procurement functions, and CRM features for organizations that want to use one system.

- Advanced analytics: Offers powerful built-in BI tools, real-time dashboards, and detailed financial reporting.

- Global readiness: The system enables worldwide readiness through its support for multi-entity accounting and multiple currency options, as well as taxation compliance across various jurisdictions.

- Workflow automation: The system provides workflow automation to streamline budgeting, forecasting, and approval processes through its flexible workflow automation capabilities.

Cons:

- Implementation complexity: The implementation process for NetSuite becomes prolonged because organizations need external consultants to complete the setup.

- High cost: The licensing and implementation fees for NetSuite are expensive, which might pose a challenge for smaller businesses.

- Clunky interface: Some users experience difficulties with the interface because it appears outdated and requires proper training to understand.

Conclusion

Selecting the right financial analysis tool can have a huge impact on how well a business manages its budgeting, forecasting, and planning processes. It is important to know what you are looking for before exploring the options. Cube, Anaplan, Farseer, Sage, and Net Suite each bring unique strengths to the table, catering to different needs based on company size, complexity, and financial priorities.

Ultimately, which one is the best, depends primarily on a company’s specific needs. So before choosing a tool, it would be best to take a step back and assess which financial analysis processes need automation or improvement, and take that as a starting point.

Quick Comparison: Which Tool Fits Your Needs?