Scenario planning is what keeps plans from falling apart when things change fast.

Picture this: two weeks before the end of the year, a European manufacturing company is very close to achieving its EBITDA targets when its largest raw material supplier announces a 15% price increase. The CFO has two days to react before the board review. No time for new forecasts. No room for mistakes.

In this situation, they don’t need a new forecast – they need a plan B (and C and D). And this is something you get with scenario planning.

In this guide, we’ll break down what scenario planning actually means in finance, when and how to use it, and how to make it part of your monthly planning cycle – not something you only go for in times of panic.

KEY TAKEAWAYS:

- Scenario planning means planning for multiple outcomes, not just one.

- Key use cases: cash flow, CapEx, pricing, OPEX, revenue.

- Common blockers: siloed data, Excel overload, no ownership.

- Start simple: 2–3 variables, 3 cases (base, upside, downside).

- Set action triggers so you know when to respond.

- Make it part of your regular planning cycle.

What Scenario Planning Really Is

Scenario planning is the process of preparing for multiple possible futures, not just betting on the most likely one.

Let’s say you’re running finance for a large food distribution company. You know raw material costs could increase easily, FX rates might shift, and major buyers might delay orders. Instead of hoping for the best, your team builds three scenarios:

- Prices stay flat.

- Costs rise 10%.

- Key shipments are delayed by two weeks.

Each version runs through your financial model, so when one of those situations becomes reality, you don’t need to start everything from scratch. You already have a response ready.

That’s the power of scenario planning. It turns uncertainty from a threat into something you’ve already taken into consideration.

Key Business Use Cases for Scenario Planning

Cash flow management

You can’t always control when customers pay, but you can prepare for it.

Say you’re expecting a big payment from a key customer at the end of the month.

What happens if it comes 30 days late? Or 60? With scenario planning, you can run both versions through your model and see how each delay impacts your working capital, supplier payments, and even payroll.

You might discover that a 60-day delay would force you to draw on your credit line, or delay a planned CapEx purchase. If you know that ahead of time you have options – like renegotiating payment terms with vendors or pressing pause on unnecessary spending.

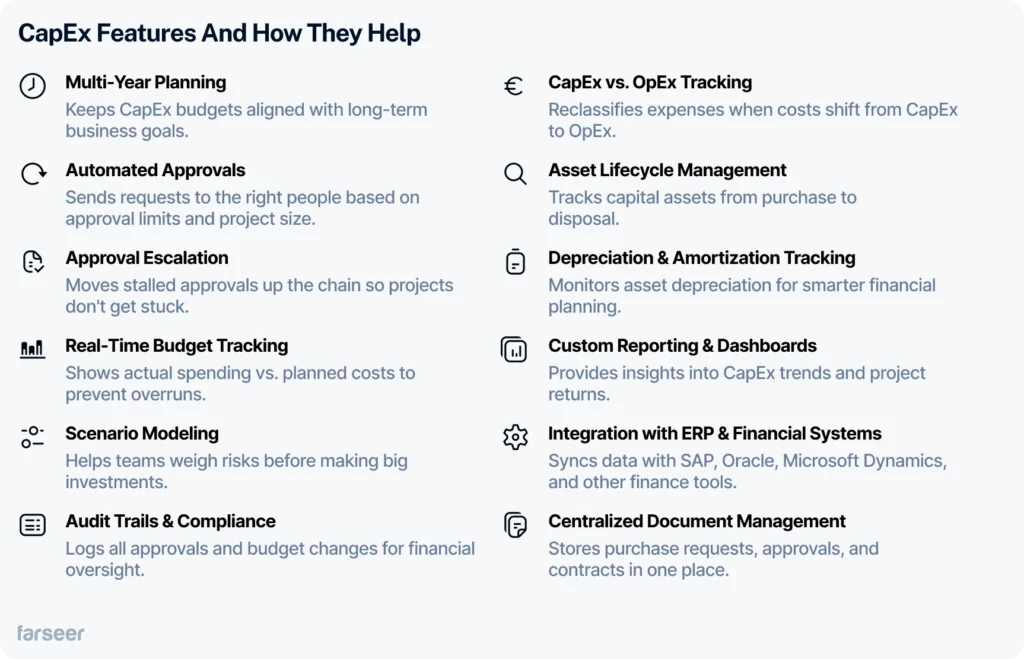

CapEx planning

Planning a big investment, like a new production line or facility, comes with a lot of unknowns. Things rarely go exactly as planned.

With scenario planning, you can model what happens if costs go over budget by 10%, or if it takes three extra months to reach full capacity. How does that affect your cash flow, your break-even point, or your ability to take on other projects?

Instead of being caught off guard, you can see the impact before everything unfolds and plan around it – whether that means adjusting the timeline, securing extra financing, or rethinking other expenses. And if you want to dive deeper into how individual changes in cost or volume affect outcomes, sensitivity analysis can give you sharper insights on each assumption.

Read more: How to Bring Structure to CAPEX Planning

Pricing strategy

When costs are rising fast, like in a high-inflation environment, you need to know how price changes will affect your bottom line.

With scenario planning, you can test what happens if you raise prices by 5%, 10%, or more. Will sales volume drop? How much margin can you protect?

For example, a consumer goods company might model three versions: one with no price change, one with a moderate increase, and one with a more aggressive one. Each version shows how revenue, margin, and market share might shift, so the team can pick the strategy with the best trade-off between profit and customer retention.

Workforce and OPEX planning

Not sure if you should hire, freeze, or reduce headcount? Scenario planning helps you see the financial impact of each option before making your decision.

You can model what happens if the team stays the same, grows by 10%, or shrinks slightly. What does each version do to your OPEX, EBITDA, and cash position?

For example, if sales targets are uncertain, you might hold off on hiring until a certain revenue threshold is reached. Scenario planning helps you see the impact upfront, so you don’t end up hiring too much or too little when it matters most.

Revenue planning

Launching a new product or entering a new market? It’s hard to know exactly how sales will go.

With scenario planning, you can build a base case, an optimistic case, and a more conservative one. Each version helps you understand what the business looks like if demand takes off, or if it’s slower than expected.

This way, you’re ready to scale quickly or adjust your plans without guessing.

text here

Obstacles to Effective Scenario Planning - and How to Overcome Them

Siloed data

One of the biggest blockers to solid scenario planning is when each department works in its own spreadsheet, disconnected from the rest of the business.

Sales builds their plan. Operations builds theirs. Finance tries to stitch it all together – and it rarely adds up, especially when your S&OP process isn’t supported by the right tools.

The problem? You can’t model real business risks if the pieces aren’t talking to each other. For example, what’s the point of modeling a demand spike if production hasn’t accounted for it, or procurement hasn’t factored in material lead times?

To fix this, you need a connected planning model – one where changes in one area automatically flow through the rest. That’s also what real-time reporting enables – making sure everyone’s working with the same data, without manual refreshes or conflicting versions.

The good news: you don’t need to rebuild everything from scratch.

Manual workload

If you’re doing scenario planning in Excel, you already know the pain.

Copying tabs. Renaming files. Updating formulas in five different places just to test one assumption. It’s slow, messy, and easy to break, especially when multiple people are involved.

Before you know it, you’ve got version chaos. One team’s working off “Final_Final_v4” while another is updating numbers in a copy from last week. By the time the numbers are aligned, the decision window has passed.

To avoid this, you need a setup where scenarios are easy to build, share, and compare – without duplicating files or rechecking formulas. That’s where modern financial planning tools come in. They let you run new versions in minutes, not hours, and keep everything in one place. Less manual work. Fewer errors. Faster decisions.

Lack of ownership

In many companies, scenario planning only happens when things go wrong, and even then, it’s rushed and last-minute. Why? Because no one actually owns it.

It’s not part of the regular planning process. It’s not tracked. And it usually ends up as “someone in finance” pulling together a rough version under pressure.

Without a clear owner and a repeatable process, scenario planning stays reactive. It doesn’t scale, and it doesn’t get better over time.

The fix? Make scenario planning a standard part of your monthly or quarterly planning cycle, and assign clear responsibility for it. When it’s built into the process and not treated as an emergency process, it becomes a real asset instead of trouble.

text here

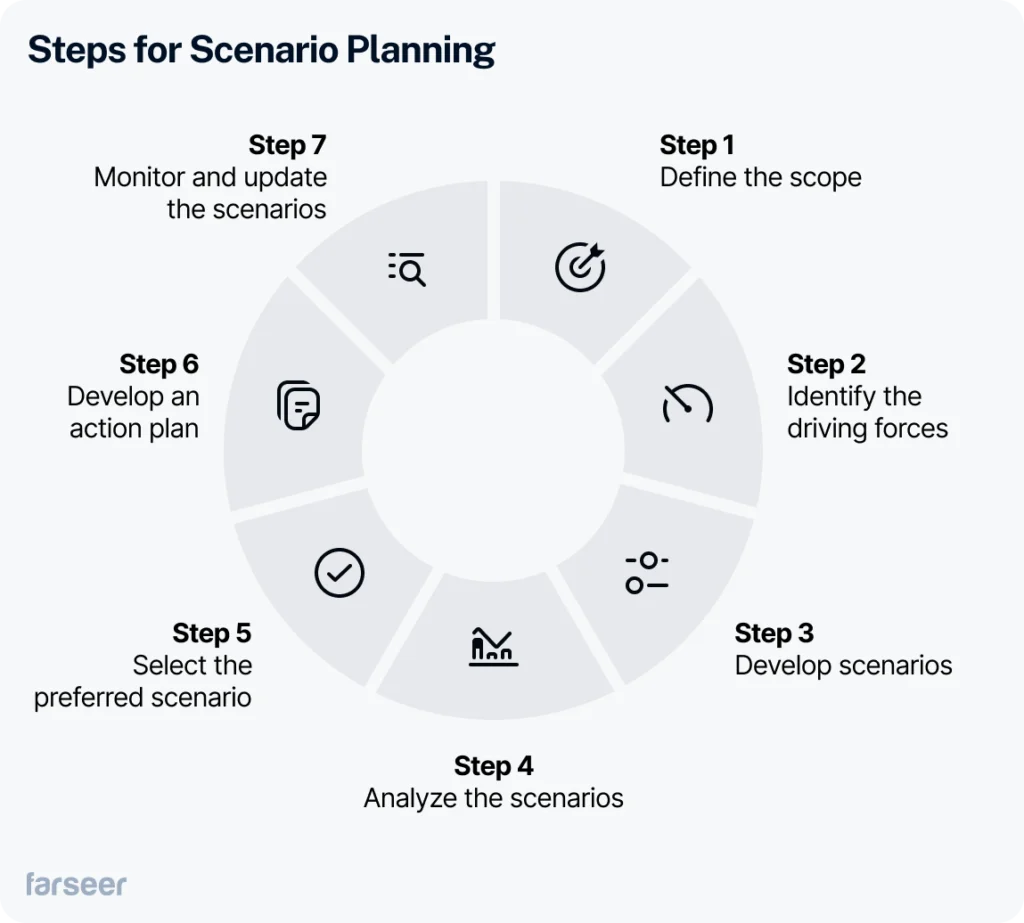

Scenario Planning Framework You Can Start Using Today

1. Identify key uncertainties

You don’t need to model every detail – just focus on what could actually move the numbers. Pick 2–3 major variables that carry the most risk or uncertainty.

Think input costs, demand levels, FX rates, or supplier lead times. Ask yourself: If this changed by 10–20%, would it impact my decisions? If the answer is yes, it’s worth modeling.

Keep it simple at first. The goal is to make better decisions, not build the world’s most complex model.

2. Define your cases

Now build out three versions of the future. You don’t need ten – just enough to cover the main possibilities:

- Base case – What you expect to happen if things go according to plan.

- Upside case – What if sales beat expectations? Or costs drop?

- Downside case – What if demand slows? Or key costs spike?

Each one should be built on the same model, using different assumptions for your key drivers. That way, you can quickly see how changes affect your financials.

Real-world example: See how pharma finance teams model multi-scenario outcomes under the Inflation Reduction Act.

Read more: Financial Planning for Pharmaceutical Manufacturers in the IRA Era

3. Build models

Once you’ve defined your scenarios, plug in the numbers. For each case, see how changes in assumptions affect your revenue, costs, cash flow, and key KPIs.

This doesn’t have to be overly complex – just consistent. Use the same structure for all three cases so you can compare them easily.

The goal is to answer: If this happens, what does it mean for our financials? That way, you’re not just guessing – you’re planning with real data.

Decide ahead of time when you’ll take action. For each scenario, define the signals that would push you to switch plans.

For example: If revenue drops by 10%, pause hiring. If raw material costs jump above a certain level, raise prices by 5%.

These thresholds turn your scenarios into real decision tools, not just models you look at once and forget. You’ll know exactly when to act, and you won’t waste time debating in the middle of a crisis.

Make Scenario Planning a Standard, Not a Side Project

Scenario planning shouldn’t be something you only do when things go wrong. It should be part of how you plan, every month, every quarter, just like forecasting or budgeting.

When it’s built into your regular rhythm, it helps you move faster, stay flexible, and make smarter financial decisions. And the best part? It doesn’t have to mean more work, just a better setup.

If you’re comparing tools and want to see which ones actually support driver-based planning, versioning, and real-time scenario modeling – check out our breakdown of 7 scenario modeling software tools that actually work.