Ever wondered why some companies decide to take on debt even when they have cash, while others avoid issuing new shares unless absolutely necessary? The Pecking Order Theory explains these decisions.

Imagine you’re running a manufacturing company that needs $50 million to expand production. You have three choices:

- Use your company’s profits (retained earnings).

- Take out a loan.

- Issue new shares of stock.

If you have enough profits, you’ll probably use the first one – it’s the simplest and cheapest option. If that’s not enough, you’ll look at debt, because interest rates are usually lower than the cost of issuing shares. Selling stock is the last option you’d want to take because it reduces ownership and may make investors think the company is overpriced.

Read: A Complete Guide to Financial Statement Analysis for Strategy Makers

This decision-making process follows the Pecking Order Theory, a concept in corporate finance that explains why companies prefer using their own funds over debt, and debt over equity. And it’s not just a theory – big companies like Amazon and Nvidia have made financing decisions based on this principle.

Why has it worked for them and what can you learn from that? Read on.

How the Pecking Order Theory Works

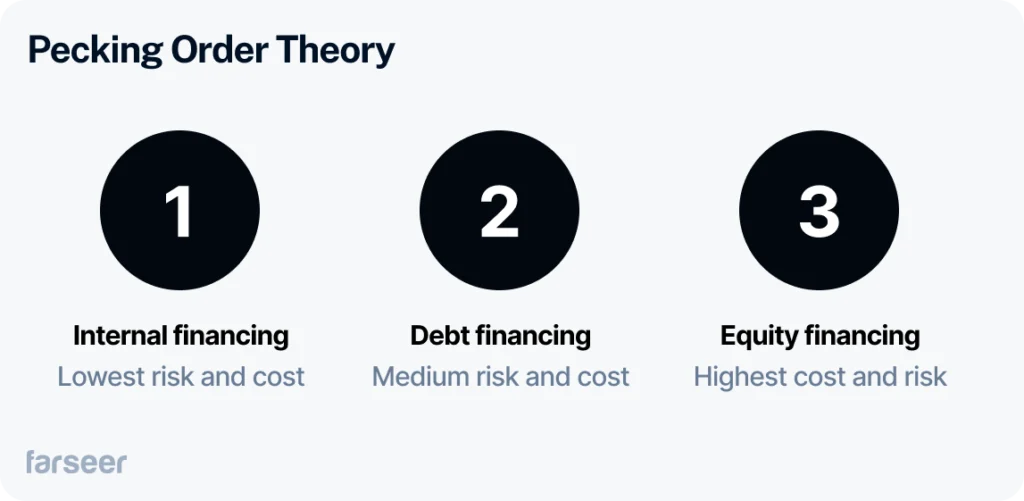

As mentioned, the Pecking Order Theory (POT) explains how companies decide where to get funding – and why they make their choices in a specific order.

Here’s the hierarchy:

- Internal funds (retained earnings) – Usually the first choice because it’s free – no interest, no dilution, no concerns for the investors. If a company has enough profits, there’s no reason to borrow or issue shares.

- Debt financing – Second choice if the company doesn’t have enough internal funds. Borrowing comes with interest costs, but it is usually cheaper than issuing new stock.

- Equity financing – The last resort. Selling shares dilutes ownership, and investors often see it as a red flag, assuming the company is overvalued or in trouble.

Why this order? Primarily because of the cost, but also perception. Debt is often cheaper than equity, and issuing new shares can send the wrong message to investors. That’s why most companies avoid it unless they have no other option.

How Real Companies Follow This Order

Amazon – prefers debt over equity to fund growth

Amazon has a clear strategy when it comes to raising money – they prefer borrowing over selling stock. In April 2022, the company issued $8.25 billion in bonds instead of diluting ownership by selling new shares. This allowed Amazon to raise cash while keeping control in the hands of existing shareholders.

And this isn’t a one-time move. In 2021, Amazon pulled off its biggest bond sale ever, raising $18.5 billion to help fund big projects like the $8.45 billion MGM Studios acquisition and expanding its logistics network. Amazon chose debt over equity, meaning they were sure of their ability to generate cash and pay off what they borrowed, while keeping the investors satisfied and without a single worry about losing their stake.

Nvidia made a smart move back in 2020 when it bought Mellanox Technologies for $6.9 billion – instead of issuing new shares, it used cash. This decision helped the company avoid diluting shareholder ownership, and at the same time they brought in a valuable tech asset to strengthen their data center business. Mellanox’s high-performance networking solutions have played a big part in powering AI and cloud computing, which is extremely important to Nvidia’s growth.

This is just one example of Nvidia’s overall capital strategy. Rather than relying on issuing more stock, the company prefers pulling out of their cash reserves or, when needed, using debt.

When Is Pecking Order Theory Not Working

Pecking Order Theory provides a useful guideline, but not every company follows it strictly. In some cases, raising equity first makes more sense – especially for startups, struggling businesses, or companies that have strategic priorities.

Here are some examples when the Pecking Order Theory remains just that – a theory.

- Startups and high-growth companies: Young companies, like Hopin, don’t have a lot of strong profits or credit history. This makes debt expensive and most likely unavailable. Instead, they issue equity early in order to make enough money for expansion. Investors accept dilution because they believe in long-term growth.

- Companies facing financial trouble: When debt becomes too risky, raising equity can be a lifesaver. A clear example is WeWork, which had to rely on equity funding from SoftBank to stay afloat after its failed IPO and mounting losses.

- Strategic considerations: Some companies choose to issue stock even when they could take on debt. Reasons might include preserving cash, reducing leverage, or preparing for acquisitions. For example, in 2020, Airbnb issued equity instead of taking on more debt to strengthen its balance sheet before going public.

And while the Pecking Order Theory explains how most companies finance their operations, real-world business decisions depend on factors like growth stage, financial stability, and market conditions.

Read Liquidity and Solvency Ratios – Metrics for Your Business’ Survival

What Does Pecking Order Theory Mean For Financial Planning

As you’ve probably figured out til now – Pecking Order Theory directly impacts financial planning and decision-making. FP&A teams play a critical role in evaluating the best financing options based on cost, risk, and market perception.

- Debt vs. equity planning: Finance teams should model different scenarios to compare the true cost of debt versus equity. Factors like interest rates, leverage ratios, and credit ratings all influence whether borrowing is a smarter move than issuing shares. A well-structured financial model can prevent companies from taking on too much risk.

- Using retained earnings: Just because internal funds are preferred doesn’t mean they should always be used. FP&A teams must analyze when to reinvest profits into growth and when to return capital to shareholders through dividends or buybacks.

- Investor communication: If a company needs to issue equity, how it’s communicated matters. A surprise stock offering can trigger a sell-off, so FP&A teams must work closely with investor relations to position the move strategically.

In short, capital structure decisions aren’t just about theory – they need careful planning, risk evaluation, and clear communication to avoid extra costs and negative reactions from the market.

Final Thoughts

Pecking Order Theory helps explain why companies prioritize certain funding sources over others, but it’s not a one-size-fits-all rule. Understanding these financing choices can help businesses optimize capital structures and avoid costly mistakes.

For finance teams, the key takeaway is this: capital decisions should be driven by cost, risk, and strategy – not just a textbook model. By carefully weighing debt vs. equity, managing retained earnings wisely, and communicating financing moves effectively, businesses can ensure they raise capital in the smartest way possible.

Thinking about your company’s next funding move? Make sure you’re following the right order.