When numbers come from different systems and outdated reports, mistakes happen. Finance teams waste time fixing errors instead of making decisions. Without real-time data, it’s hard to know if the business is on track.

Read: FP&A Software – A Practical Guide for Finance Teams

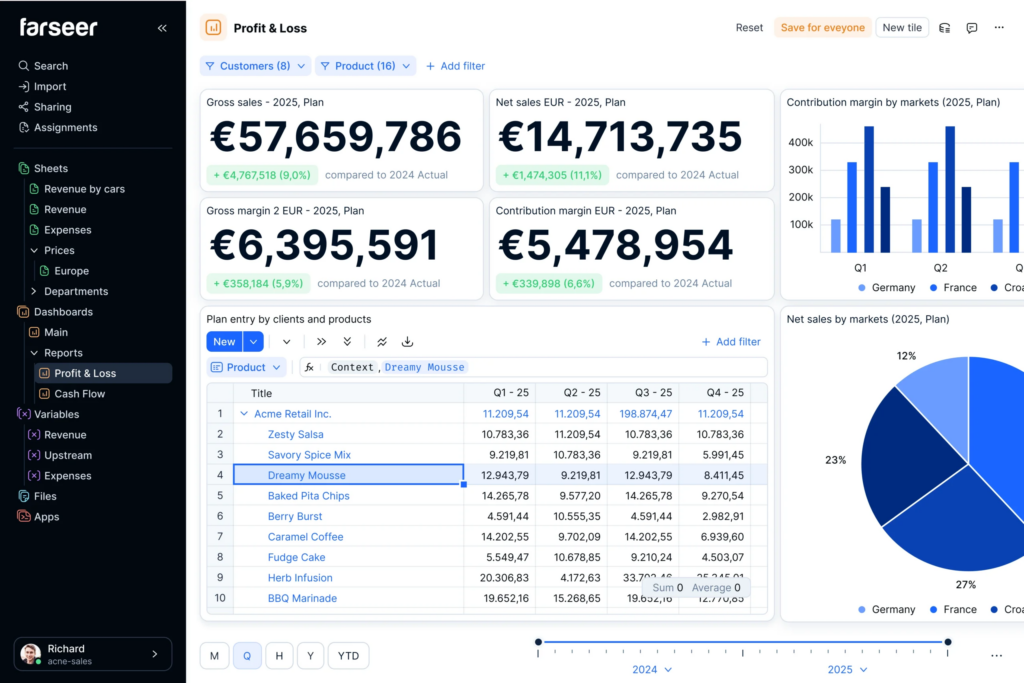

The right P&L software eliminates these problems, giving you instant access to accurate numbers.

In this guide, we’ll cover key features, how to choose the right tool, and how Farseer helps finance teams stay in control of profitability.

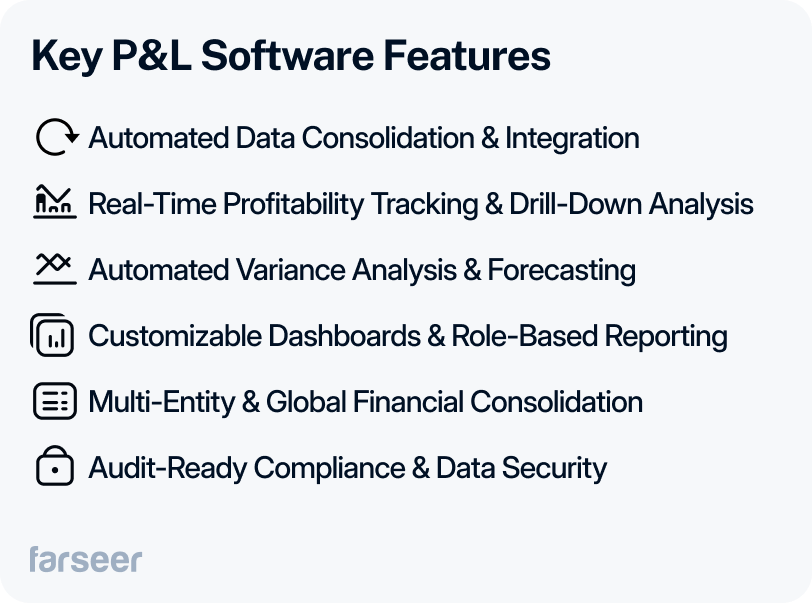

Key Features of P&L Software & Why They Matter

P&L software helps finance teams track profit, control costs, and make faster decisions by eliminating slow, manual work. Instead of digging through spreadsheets or waiting for outdated reports, you get real-time financial insights when you need them.

If you’re still starting from scratch every time, or fixing broken sheets, you’re not alone. Even enterprise teams often begin their budgeting cycle in Excel.

That’s why we created a free, finance-grade Profit & Loss template built for enterprise use – with multi-version support, consistent formatting, and rolling forecast compatibility.

Automated Data Consolidation & Integration

Most businesses pull P&L data from different sources – ERPs, accounting software, and FP&A tools. Doing this manually is slow and full of mistakes. P&L software syncs everything automatically from tools like SAP, NetSuite, and Microsoft Dynamics, so your numbers are always accurate.

Read: A Complete Guide to Financial Statement Analysis for Strategy Makers

Real-Time Profitability Tracking & Drill-Down Analysis

Automated Variance Analysis & Forecasting

P&L software automates variance analysis, so you don’t have to hunt for differences between budgeted and actual numbers. It also helps plan for cost increases and demand shifts, so there are fewer surprises.

Read more: How to Create a Good Variance Report

Customizable Dashboards & Role-Based Reporting

Executives, finance teams, and department heads all need different reports. P&L software lets you build custom dashboards, so each team sees the numbers that matter to them – without the clutter.

Multi-Entity & Global Financial Consolidation

If your company has multiple entities, financial consolidation can get messy fast. P&L software automates intercompany eliminations, tracks profitability across regions, and handles multi-currency conversions, so your reports stay accurate and easy to manage.

Audit-Ready Compliance & Data Security

Finance teams need clean, structured records for tax filings, investor reports, and audits. P&L software automatically tracks every transaction, and balance sheet software ensures key financial statements are accurate, and always up to date. User permissions keep sensitive financial data safe, so the right people see the right information.

How to Choose the Right P&L Software for Your Business

The best P&L software depends on your company’s size, complexity, and financial needs. A mid-sized manufacturer focused on product profitability has different priorities than a global business managing multiple entities.

Mid-Sized Manufacturers & Retailers Need Real-Time Numbers

Margins change fast. Waiting for outdated reports makes it harder to adjust pricing and control costs. Finance teams need live visibility into revenue, expenses, and profit margins to make quick decisions. The software should also connect with ERP and supply chain systems so teams don’t waste time pulling numbers from different places.

Large Enterprises Need Strong Financial Consolidation

Businesses with multiple entities deal with currency conversions, intercompany eliminations, and complex financial reports. Without the right software, consolidating financial data across regions takes too long and increases the risk of errors. AI-powered forecasting and variance tracking help finance teams spot trends early and adjust before problems grow.

Must-Have Features for Any Business

No matter the size of your company, some features matter more than others. Seamless integration keeps systems connected so teams don’t do extra work. Variance tracking flags budget issues before they cause real damage. Scenario planning helps finance teams test different strategies before making big moves.

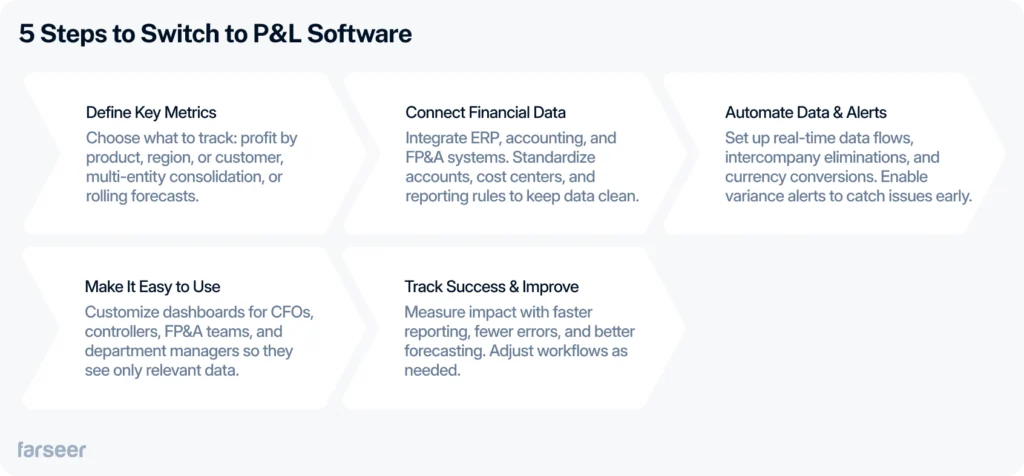

How to Switching to P&L Software

Rolling out P&L software isn’t just about upgrading tools. It’s actually changing how finance teams manage profitability. Without a plan, adoption stalls, and manual work creeps back in.

Step 1: Define What You Need to Track

Start with the numbers that matter most. Are you tracking profit by product, region, or customer? Do you need features like multi-entity consolidation, rolling forecasts, or variance tracking? For example, a manufacturer may need real-time margin tracking by product line, while a retailer might focus on store-level profitability. Choose software that fits how your business measures success.

Step 2: Connect All Financial Data Sources

Inconsistent data leads to bad decisions. The software should integrate ERP, accounting, and FP&A systems without extra manual work. Standardizing chart of accounts, cost center mappings, and allocation rules keeps reports consistent across business units.

Step 3: Automate Data Flows & Variance Monitoring

Manual consolidation wastes time and increases errors. Automate data imports, intercompany eliminations, and currency conversions to keep reports accurate. Set up variance alerts so finance teams can catch and fix budget issues before they escalate.

Step 4: Make Adoption Easy for Every Team

New software only works if people actually use it. A CFO needs scenario modeling to plan for different financial outcomes, while a cost controller needs detailed variance analysis to track budget deviations. Instead of forcing everyone to sift through the same reports, custom dashboards and workflows ensure each team sees only what’s relevant to them. This reduces complexity and helps finance teams trust and rely on the system instead of going back to spreadsheets.

Step 5: Track Impact & Improve Over Time

Measure success with reporting speed, error reduction, and forecasting accuracy. Regularly assess performance, collect feedback, and fine-tune workflows to keep improving.

Why Finance Teams Choose Farseer as Their P&L Software

Most P&L tools make big promises but fall short when finance teams need fast, accurate answers. Farseer puts real-time profitability, cost tracking, and financial planning in one place, without the hassle of spreadsheets or slow legacy systems.

- See profitability in real-time – Track profit by product, region, or cost center instantly. No waiting for reports, know exactly where your business makes or loses money.

- Catch budget issues early – Farseer flags budget vs. actual differences as they happen. If costs jump or revenue drops, you’ll know right away, without surprises at month-end.

- Make consolidation easy – Automate intercompany eliminations and multi-currency reporting, so finance teams don’t waste time fixing reports.

- Automate cost allocations – Farseer distributes overhead and shared costs automatically, giving a clear view of unit profitability without manual calculations.

- Work smarter with live collaboration – Finance teams can update forecasts and reports together, avoiding version control issues and endless email chains.

- AI-Generated P&L reports, instantly – Farseer’s AI creates live, on-demand P&L reports in seconds. Finance teams, executives, and investors get real-time, accurate numbers without manual work or waiting for static reports.

Here are 3 real-life examples.

Violeta: Tracking Profit Without the Spreadsheet Chaos

Violeta, a hygiene products manufacturer, struggled with manual profitability tracking. Finance teams spent hours in spreadsheets, pulling numbers from different sources and fixing errors instead of analyzing margins.

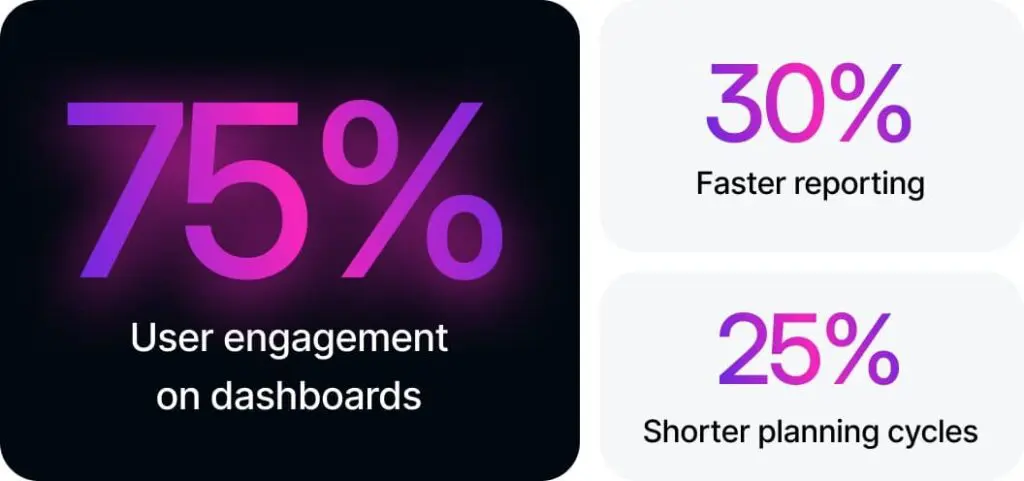

With Farseer, they automated profit tracking and cost allocations, cutting reporting delays and improving accuracy. Now, finance teams see profit by product and region instantly, making it easier to adjust pricing and control costs.

Hrvatski Telekom: Faster Forecasts, Smarter Decisions

Hrvatski Telekom needed faster, more accurate forecasts across multiple business units. Slow, spreadsheet-based processes made it tough to track revenue, costs, and profitability in real time.

By switching to Farseer, they automated reporting and forecasting, giving finance teams real-time insights into their numbers. With forecasts now 4x faster, they react quickly to market changes, optimize spending, and spot budget issues before they grow.

Altium: Cutting Reporting Time and Planning Smarter

Altium, a biotech distributor operating in nine countries, struggled with slow reporting and inconsistent financial planning. Managing numbers across different regions took too long, and outdated reports slowed down decision-making.

With Farseer, Altium standardized reporting, automated forecasting, and improved financial accuracy. Instead of fixing spreadsheets, finance teams focus on strategy, cost control, and growth. Leadership now sees the full financial picture in real time, making it easier to plan and stay profitable.

Smarter, Faster P&L Management with Farseer

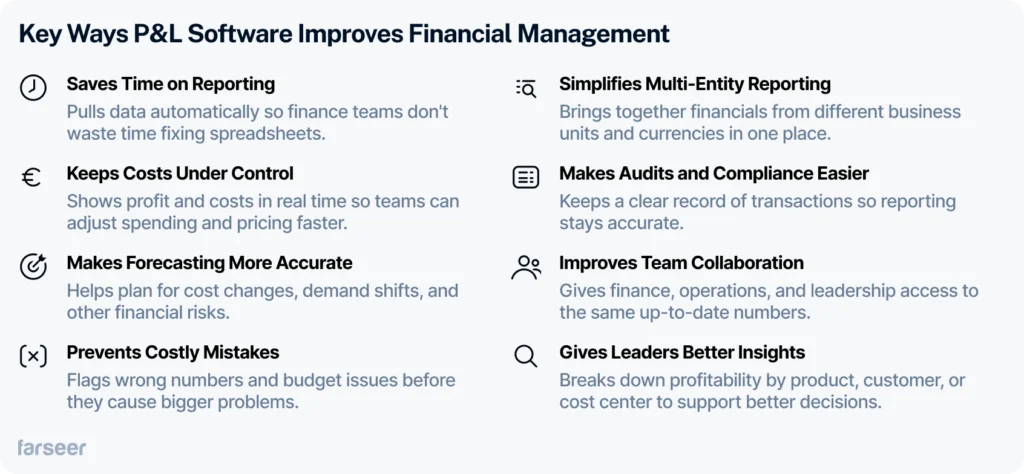

Managing a P&L with spreadsheets slows teams down and leads to errors. P&L software centralizes financial data, automates reporting, and ensures finance teams always work with accurate, real-time numbers.

With the right tool, you can:

- Automate P&L reporting and data consolidation

- Track revenue, costs, and margins in real time

- Eliminate manual errors and spreadsheet chaos

- Streamline financial planning across all business units

Farseer helps finance teams replace slow, manual processes with AI-driven reporting, seamless consolidation, and real-time financial insights.

Book a demo to see how Farseer simplifies P&L management.