When/if the next month’s outflows are unclear or uncertain, the real issue could be planning. And it’s a common one, even companies with over €100M in revenue struggle to maintain reliable, forward-looking liquidity visibility across multiple entities and business units.

Too often, finance teams end up managing liquidity reactively. They’re reconciling Excel files, waiting for inputs from other departments, or working with outdated cash flow snapshots. In industries like manufacturing or pharma distribution, where timing is everything, that lack of visibility can quickly get expensive.

Companies miss early payment discounts, delay strategic investments, or exceed credit limits, not because of poor performance, but because liquidity wasn’t planned with enough precision or frequency.

In this blog, we’ll look at how liquidity planning differs from traditional cash flow forecasting, where current approaches fall short, and how companies in complex environments are rethinking the process with better tools and more control.

Read more: How Top FP&A Teams Use Rolling Forecasts to Stay Ahead

Liquidity Planning Is Not Just Another Cash Flow Forecast

Cash flow forecasting answers the question: How much cash will we have at the end of the month? Liquidity planning goes further. It’s all about making sure the company has the right cash available at the right time to fund operations, pay suppliers, invest, and protect against shocks.

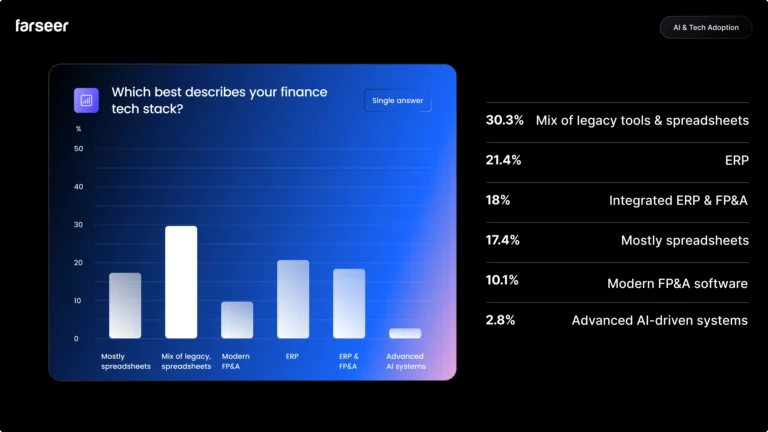

According to our 2026 State of Finance report, more than 70% of finance teams still rely on spreadsheets and mixed legacy stacks for planning, even though 72% are investing in advanced analytics and 61% in automation, which makes modern, continuous liquidity planning the critical missing link between new tools and real-time cash control.

Read How to Do a Cash Flow Forecast in Enterprise Environments

The key difference lies in purpose and scope:

- Cash flow forecasts are typically static, often updated monthly, and focused on short-term visibility.

- Liquidity planning is continuous. It factors in uncertainty, multiple scenarios, and real operational data, from sales pipelines and open purchase orders to project delays and capex schedules.

For example, a controlling team in a pharma distributor might run a monthly cash flow report showing a healthy end-of-quarter balance. But, without planning liquidity by subsidiary, currency, and payment timing, shortfalls can still happen, especially when one region faces late payments and another sees tighter supplier terms.

With liquidity planning, the focus shifts from reporting past and current states to preparing for what’s likely and possible, across all corners of the business.

The Hidden Risks of Spreadsheet-Based Liquidity Planning

It’s not you, it’s your Excel.

Most mid-sized finance teams still manage liquidity in Excel. And while spreadsheets might work for a single-entity forecast, they quickly fall apart in more complex environments, especially when you’re managing 5+ entities, multiple currencies, and shifting supplier or customer terms.

Here’s what typically goes wrong:

Data is fragmented

Liquidity-relevant data, open receivables, payables, payroll, and investment schedules are scattered across ERP systems, emails, and local Excel files. Consolidating it takes time, and by the time it’s ready, the numbers are outdated.

Scenario planning is nearly impossible

If you need to simulate the impact of a 10% drop in sales or a delay in key supplier deliveries, using spreadsheets can be a headache. Meaning duplicating models, chasing new inputs from operations, and hoping formulas don’t break along the way.

Read more: Scenario Planning: How to Prepare Your Business for Uncertainty

No single version of the truth

Different departments submit plans in their own formats. Working as a controller can mean that you spend days aligning numbers, rechecking formulas, and responding to ad-hoc requests from management. Confidence in the plan drops.

Manual updates cause constant delays

When one department changes its assumptions, it takes hours to reflect those changes across liquidity plans. This delays decisions, especially when the treasury needs to act fast on financing or payment priorities.

Many mid-sized and enterprise companies miss out on working capital opportunities simply because they lack real-time visibility during critical decision moments. For example, imagine a CFO preparing to approve a large equipment purchase, but the team can’t quickly model the liquidity impact across subsidiaries. Without a consolidated view of cash positions, the decision gets delayed.

This isn’t hypothetical. As HSBC notes, companies that lack real-time treasury data are slower to act on investment or supplier decisions, putting themselves at a disadvantage when agility is required. Real-time liquidity data is becoming essential for smarter, faster financial decision-making.

Traditional liquidity planning is slow, and in many cases, unreliable when it matters most.

What Modern Liquidity Planning Looks Like in Practice

According to KPMG, many companies still manage liquidity using Excel and disconnected systems. This approach causes delays, errors, and prevents group-level visibility into cash positions across entities and functions.

Imagine a company, for example, a regional manufacturing group with entities in three countries. Each finance team submits its liquidity forecast independently in Excel. One month, a key supplier shortens payment terms. Treasury doesn’t catch the change in time, and the group misses a 1.5 percent early payment discount on a €12 million capex order. That’s €180,000 lost, not because of a lack of funds, but due to poor visibility and disconnected processes.

PwC emphasizes that, in today’s volatile environment, companies with integrated, forward-looking liquidity planning are in a far better position to make informed financial decisions quickly.

So what should modern liquidity planning look like?

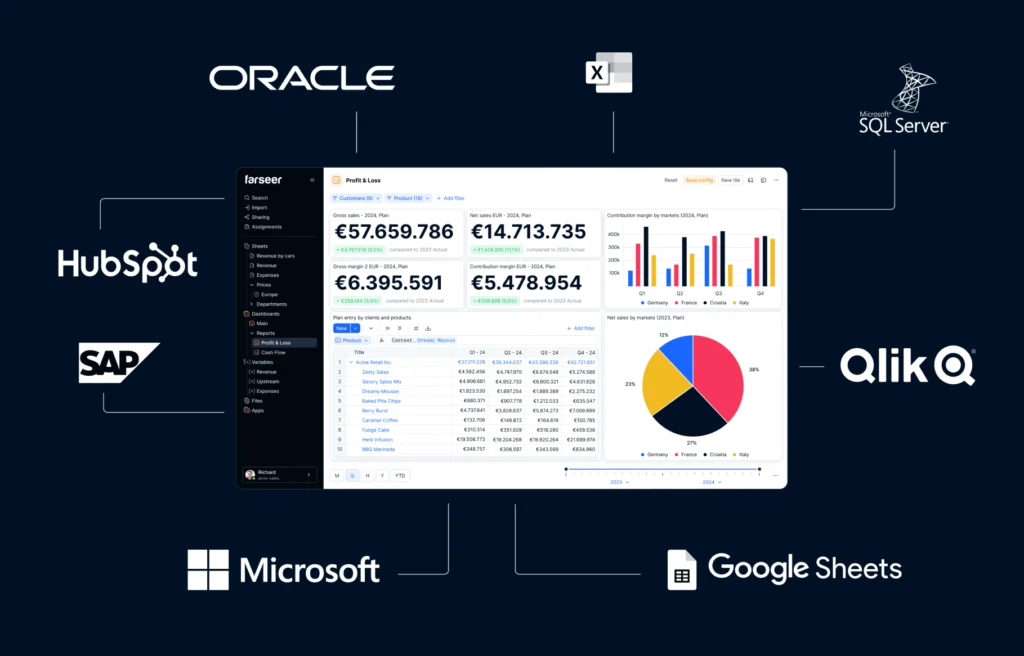

Integrated to Core Systems, Not Separate from Them

Modern liquidity planning starts with integration. Data flows automatically from ERP, HR, procurement, and finance systems. This removes the need to chase numbers and eliminates errors caused by versioning issues.

Planning Is Continuous, Not a Month-End Task

Modern planning is continuous, with actuals and forecasts updated in near real-time. This allows finance teams to make informed decisions any day of the month. By switching to weekly liquidity updates tied to rolling forecasts, companies can time short-term financing more precisely across regions.

Built to Handle Uncertainty

Today’s tools allow finance teams to simulate the impact of real-world changes, from demand fluctuations to currency shifts. Scenario planning is something teams can run in minutes. For example, a business is able to model how a 15% drop in Q4 tenders would affect their credit line usage, giving them time to renegotiate payment terms in advance.

Everyone Works from the Same Numbers

A centralized planning model ensures that all stakeholders, across departments and countries, use the same logic, drivers, and assumptions. This way they avoid the alignment issues that come with locally managed spreadsheets.

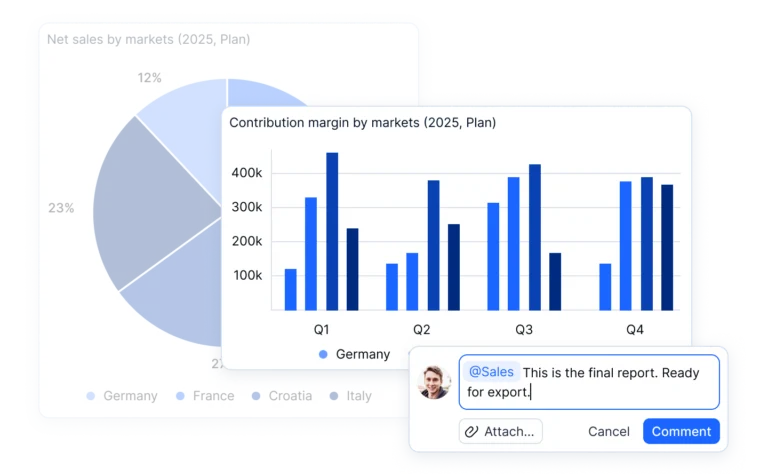

Liquidity Insights Are Clear and Actionable

Modern tools provide a visual overview of liquidity by entity, week, and inflow/outflow category. This allows decision-makers to quickly prioritize vendor payments, optimize internal funding, or delay non-essential investments. Enabling multi-entity packaging firms to monitor upcoming shortfalls by region and reallocate cash in time.

This level of control is already being implemented by teams using modern FP&A platforms like Farseer. Many start with a single business unit or region, building a foundation that can be scaled across the group.

How to Start Improving Liquidity Planning

Don’t start with a complete transformation at once, incremental improvements lead to real impact when done in the right order:

Centralize your existing data

Before automating everything, prepare the ground: bring together bank balances, payment schedules, and cash inflows into a single model. This alone will improve visibility and reduce blind spots across entities.

Automate repetitive tasks

Start syncing actuals from your ERP, linking AP/AR positions, and replacing Excel files with live data feeds. This creates a real-time view that drives faster, more confident decisions.

Introduce scenario planning early

Begin with basic, everyday cases: delayed customer payments, reduced sales, or unexpected investments. Build the habit of continuous testing how each scenario impacts liquidity. This is how teams shift from reactive to proactive.

Modern liquidity planning isn’t about replacing everything. It’s about regaining control. The faster you move away from spreadsheets, the faster your finance team can act with clarity and confidence.

Đurđica Polimac is a former marketer turned product manager, passionate about building impactful SaaS products and fostering connections through compelling content.